TSX Notice of Approval for Amendments to TSX's Policy on Normal

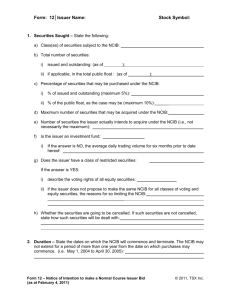

advertisement