PIERCING THE CORPORATE VEIL

advertisement

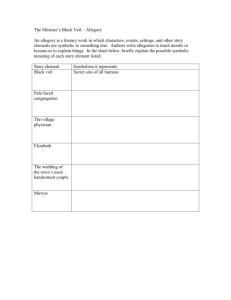

PIERCING THE CORPORATE VEIL: RAMIFICATIONS OF THE SC DECISION IN PREST v PETRODEL RESOURCES LIMITED Julian Wilson / Amy Rogers WHY PREST MATTERS •Authoritative statement of the law on piercing the veil and separate corporate personality •HC Judge had departed from basic company law principles; CA had split on Chancery/Family lines •Potentially wide ramifications for small companies, family offices, wealth management and tax structures, asset tracing and fraud actions THE FACTS •Proceedings for financial remedies following a divorce – “big money” •Valuable property assets held by Petrodel corporate structure – co/s in IoM, Nigeria & Nevis •Husband in breach of disclosure orders / evasive •Ultimate ownership unclear but husband effective owner and controller FIRST INSTANCE MOYLAN J AT FIRST INSTANCE • Veil was NOT pierced at common law •Applied test in Ben Hashem v Al Shayif •No relevant impropriety in use of co/s MOYLAN J AT FIRST INSTANCE Ben Hashem v Al Shayif • to enable to enable a court to pierce the veil of a corporation necessary to show not only control of the company by wrongdoers but also impropriety • i.e. misuse of company by wrongdoers as device or façade to conceal some wrongdoing that existed entirely outside company MOYLAN J AT FIRST INSTANCE No relevant impropriety in husband’s use of co/s • Company structure set up and used for conventional wealth protection and tax avoidance reasons. • Breach of company law as husband treated companies as money box and their assets as at his will, but not relevant impropriety MOYLAN J AT FIRST INSTANCE • But veil pierced by STATUTE •s24(1)(a) MCA 1973 •an order that a party to the marriage shall transfer to the other party … property to which the first mentioned party is entitled, either in possession or reversion MOYLAN J AT FIRST INSTANCE • Petrodel companies were separate legal entities but w/in scope of s.24 as a result of the complete nature of the husband’s control •As husband had complete control could deal as he wished with co. assets – and so was the beneficial owner and “entitled” to them for s.24 •Wife awarded a lump sum by way of an order transferring to her properties held by co/s controlled by her husband THE COURT OF APPEAL THE COURT OF APPEAL: THE MAJORITY CA HELD BY MAJORITY THAT: • s24 MCA could not be used to make an order in respect of co. property unless there were legitimate grounds to pierce the corporate veil • The principles in Salomon v Salomon applied to all jurisdictions of the English Court: legal personality had to be respected RIMER LJ • No primary findings justifying finding other than that the properties part of the assets of, and belonged beneficially to, the companies RIMER LJ • Shareholders have no interest in / entitlement to co. assets – even 100% one-man owner does not have unlimited power to procure co. to deal as he would wish with the co. assets • Even one-man company constrained by capital maintenance provisions limiting wholesale disposals – cannot lawfully procure the making of distributions save out if distributable profits and, if he does, will be unlawful & void RIMER LJ • Distinction between legal personalities, rights and liabilities of co. and shareholders as valid today as in Salomon in 1897 and applies in all proceedings, incl. matrimonial ancillary relief • Not open to Judges to lift the veil where ‘justice requires’ PATTEN LJ • s24(1)(a) does not give the Court power to disapply the established principles of legal and beneficial ownership or of company law THE COURT OF APPEAL: THE DISSENT THORPE LJ (ex-Family Division): • Would not complicate the approach that a Family Division Judge can legitimately adopt by reference to co. law authority on “lifting or piercing the corporate veil” • Simple question is whether individual entitled to property within the meaning of s24 THE COURT OF APPEAL: THE DISSENT • Co/s milked for so long as marriage lasted to fund extravagant lifestyle. Only possible b/c wholly owned and controlled by the husband and no 3rd party interests. • Invocation of company law one of husband’s array of strategies to deprive wife of assets to achieve “irresponsible and selfish ends”. If the law permits that, defeats Judge’s duty to achieve a fair result. THE SUPREME COURT THE SUPREME COURT • Court could not disregard corporate veil by using s24(1)(a) MCA 1973 • BUT on the facts, the Petrodel properties were held on resulting trust for the husband and therefore available to satisfy financial provision ordered for the wife LORD SUMPTION • Piercing the veil meant disregarding separate personality • Limited power in carefully defined circumstances and when no other remedy to ensure not disarmed when legal personality abused for the purpose of wrongdoing • “Façade” / “sham” test begs too many qns LORD SUMPTION • Concealment Principle •Evasion Principle LORD SUMPTION CONCEALMENT PRINCIPLE Interposition of co/s to conceal identity of real actors will not deter the Courts Not piercing the veil – looking behind it to discover the facts that corporate structure concealing CONCEALMENT PRINCIPLE - EXAMPLE • • Receipt of money by co. counted as receipt by shareholder if the co. received it as agent or nominee, rather than in its own right Gencor ACP Ltd v Dalby [2000] 2 BCLC 734: secret profit to director from payment to BVI co. … co. received it as director’s nominee only so director held it and liable to account for its receipt … and director’s knowledge imputed to company so company independently liable to account • Trustor [2001] 1 WLR 1177 - similar LORD SUMPTION EVASION PRINCIPLE Disregard the corporate veil where… Legal right against the person in control which existed independently of the co’s involvement Co. interposed so that separate legal personality would defeat the right or frustrate enforcement EVASION PRINCIPLE • So, where a person used the co’s separate legal personality to evade a liability that he would otherwise have had, the court could disregard the veil EVASION PRINCIPLE - EXAMPLES • Where a person bound by a non-compete covenant established and used a co. he controlled to work in competition (Gilford Motor Company v Horne [1933] Ch 935) • Where a person reneged on a contract for sale and conveyed to a creature co. to avoid an order for specific performance (Jones v Lipman [1962] 1 WLR 832) WHY THE PROPERTIES WERE THE HUSBAND’S Husband not co/s had funded purchases AND Companies used to conceal: • 3 transferred to PRL for nominal consideration • 2 transferred to PRL for substantial consideration but funded by H • 2 acquired by Vermont for substantial consideration but funded by PRL and ultimately H • PRL was oil trading company and little reason of own to buy London residential properties • So properties held by co/s on resulting trust for H SUPREME COURT – OTHER JUDGMENTS • Lord Neuberger: agreed that doctrine should be limited to evasion principle • Lady Hale/Lord Wilson: not clear that concealment or evasion analysis was robust • Lord Mance/Lord Clarke: disagreed that piercing ought necessarily to be limited in future to evasion cases THE PREST TEST • When a person is under an existing legal obligation or liability or subject to an existing legal restriction which he deliberately evades or whose enforcement he deliberately frustrates by interposing a company under his control, the court may pierce the corporate veil for the purpose, and only for the purpose, of depriving the co. or its controller of the advantage that they would otherwise have obtained by the co’s separate legal personality THE PREST TEST – ELEMENTS • Use of a company’s separate legal personality to evade a liability that the wrongdoer would otherwise have had, being a liability which arose independently of the involvement of the company • Role of company is not to conceal fact that wrongdoer is true actor but to evade the law or to frustrate its enforcement THE PREST TEST – EXAMPLES Gilford Motor Company v Horne [1933] Ch 935 Pre-existing and independent legal obligation of Horne not to compete with GMC evaded by interpositioning of company Jones v Lipman [1962] 1 WLR 832 Seller’s pre-existing obligation to perform contract for sale evaded by interpositioning of company as fictitious purchase to prevent specific performance PIERCING THE VEIL: ALTERNATIVE REMEDIES? • Resulting trust analysis • Agency analysis • Accessory liability by imputation of knowledge • s423 IA 1986: setting aside transactions to defeat creditors • Proprietary claim: co. not a BFPFVWN ALTERNATIVE REMEDIES? RESULTING TRUST • A makes voluntary payment to B or pays wholly or partly for property vested in B or A/B jointly, presumption that A did not intend to make a gift and property treated as held on trust for A Westdeutsche Landesbank, Lord Browne-Wilkinson ALTERNATIVE REMEDIES? RESULTING TRUST WARNING Family Offices and wealth managers should beware resulting trust analyses Concealment principle means assets held in names of co/s may be treated as assets of individual behind co. if: • transfer to co. funded by individual; and/or • asset unrelated to co’s business ALTERNATIVE REMEDIES? AGENCY ANALYSIS Co. is agent for wrongdoer and not true principal • Accessory liability of company by imputation • Knowledge of wrongdoer imputed to the company he controls so as to make the latter’s conduct unconscionable or tortious: • Knowing assistance/knowing receipt • Common design torts ALTERNATIVE REMEDIES? s423 s.423 Insolvency Act 1986 • Power to set aside a transaction entered into at an undervalue • Makes adequate provision for dealing with transactional impropriety: Ord v Bellhaven Pubs [1998] 2 BCLC 447 over-ruling Creasey v Breachwood Motors ALTERNATIVE REMEDIES? s423 A transaction is entered into at an undervalue if (a) Gift or no consideration terms • ... (c) Consideration less than the value of the consideration provided by himself. the court may, if satisfied that it was entered into by him for the purpose (a) of putting assets beyond the reach of a person who is making, or may at some time make, a claim against him, or (b) of otherwise prejudicing the interests of such a person in relation to the claim which he is making or may make. make such order as it thinks fit for (a) restoring the position to what it would have been if the transaction had not been entered into, and (b) protecting the interests of persons who are victims of the transaction. ALTERNATIVE REMEDIES? s423 Note width of Court’s discretion • Even a transaction designed to protect assets from the reach of future unknown creditors falls within the section: Midland Bank v Wyatt • Motive to defeat creditors may not be the dominant purpose of the transaction as opposed to a purpose of the transaction • Purpose may co-exist with the motive to secure family protection: Inland Revenue v Hashmi ALTERNATIVE REMEDIES? PROPRIETARY CLAIMS Proprietary claim against the co. because the company will not be a BFPFVWN • A beneficiary of a trust is entitled to a continuing beneficial interest not merely in the trust property but in its traceable proceeds and his interest binds everyone who takes the property or its traceable proceeds except a bona fide purchaser for value without notice of the breach of trust (BFPFVWN): Foskett v McKeown [2001] 1 AC 102 at 127 THE CMS / ULTRAFRAME PROBLEM AFTER PREST • CMS Simonet v Dolphin [2001] 2 BCLC 704: a defaulting fiduciary is liable to account for profits made by a co. to which he diverted business opportunities where there is no effective remedy against that co. b/c it is insolvent • Doubted in Ultraframe at [1565 -1576]: where the fiduciary can show that the profits were received into a co. and he has not received any benefit, then only the co. and not the individual can be held to account • Post-Prest: if co. established to evade a liability that the fiduciary would otherwise have had, veil may be pierced and fiduciary held accountable for the profits of the co. REAFFIRMATION OF CO. LAW FUNDAMENTALS • Separate entity • Separate property • Distribution only by remuneration, dividend or in a solvent winding-up • Capital maintenance affirmed • Ratification: Sumption - shareholders could never validly consent to their own appropriation of the company’s assets for purposes which were not the company’s REAFFIRMATION OF CO. LAW FUNDAMENTALS 1. A company is a legal entity distinct from its shareholders 2. It has rights and liabilities of its own which are distinct from those of its shareholders 3. Its property is its own, and not that of its shareholders • These principles apply as much to a company that is wholly owned and controlled by one man as to any other company: Salomon v A Salomon and Co Ltd [1897] AC 22 REAFFIRMATION OF CO. LAW FUNDAMENTALS • The sole owner and controller of a company does not even have an insurable interest in property of the company, although economically he is liable to suffer by its destruction: Macaura v Northern Assurance Co Ltd [1925] AC 619 “no shareholder has any right to any item of property owned by the company, for he has no legal or equitable interest therein. He is entitled to a share in the profits while the company continues to carry on business and a share in the distribution of the surplus assets when the company is wound up” CO. LAW FUNDAMENTALS: RATIFICATION The sole shareholder or the whole body of shareholders cannot validly consent to their own appropriation of the company’s assets for purposes which are not the company’s • • Belmont Finance Corpn Ltd v Williams Furniture Ltd [1979] Ch 250, 261 (Buckley LJ) • AG’s Reference (No 2 of 1982) [1984] QB 624 DPP v Gomez [1993] AC 442, 496-497 (Lord BrowneWilkinson) CO. LAW FUNDAMENTALS: CAPITAL MAINTENANCE • The statutory schemes of company and insolvency law include elaborate provisions regulating the repayment of capital to shareholders and other forms of reduction of capital, and for the recovery in an insolvency of improper dispositions of the co. assets • These schemes are essential for the protection of those dealing with a company THE END PIERCING THE CORPORATE VEIL: RAMIFICATIONS OF THE SC DECISION IN PREST v PETRODEL RESOURCES LIMITED Julian Wilson / Amy Rogers