Deere & Company - University of Oregon Investment Group

advertisement

!

May 30, 2012

IME

Deere & Company

Ticker: DE

Recommendation: Hold

Current Price: $75.78

Implied Price: $83.94

Investment Thesis

!Key Statistics

!52 Week Price Range

50-Day Moving Average

!

!

$61.05-$88.55

$75.14

Estimated Beta

1.84

Dividend Yield

N/A

Market Capitalization

3-Year Revenue CAGR

$34.1 billion

!

!

By 2050, there will be 20 billion increases in global population. It indicates

the expected stronger food demand, which transfers to the demand for John

Deere’s agricultural equipment.

John Deere increasingly invests in their global expansion, 7 new product

factories will be added in the next few years to add capacities to respond

strong demand. Along with other effective strategies like product transition

will help Deere remain competitive in the global market.

Due to achieving continuous record quarters of sales and profits, John

Deere’s operation and management are proven to be effective and expected

to have promising growth in the next several years.

50.10%

Deere & Company

Trading Statistics

Diluted Shares Outstanding

402 million

Average Volume (3-Month)

3.77 million

Institutional Ownership

Insider Ownership

Five-Year Stock Chart

65.10%

6.18%

EV/EBITDA

9.08x

Margins and Ratios

Gross Margin

35.97%

EBITDA Margin

14.67%

Net Margin

7.89%

Debt to Enterprise Value

Current Ratio

51.13%

4.52x

Covering Analysts: Grace Gong

Gong

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

1

University of Oregon Investment Group!

!

University of Oregon Investment Group

May 30, 2012

Business Overview

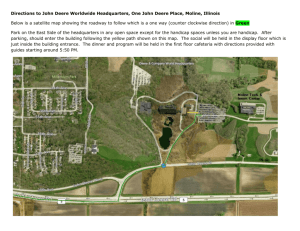

A blacksmith and inventor – John Deere founded Deere & Company in 1837,

while the Present Company was incorporated under laws of Delaware in 1958.

In 1848, the company, which is still a growing plow business at that time, moves

to Moline, Illinois. The headquarters has stayed there since then because Moline

offers waterpower and transportation advantages. The history of the company

consists of people, places and products that reflect their core values – integrity,

quality, commitment and innovation.

Since 1837, John Deere has been experiencing many changes, which also come

with opportunities:

!

!

!

!

!

!

!

!

In 1863, the company made the first Deere implement adapted for

riding – Hawkeye Riding Cultivator.

In 1912, the modern Deere & Company emerges and its shares started

to be listed in New York Stock Exchange.

During 1984 - 2000, Deere acquired Farm Plan Corporation, an

agribusiness financier; Funk Manufacturing Company, maker of

powertrain components; SABO, a European maker of lawn mowers;

Homelite, a leading producer of handheld outdoor power equipment;

and Timberjack, a world-leading producer of forestry equipment.

In 2001, a record number of products are introduced to strengthen

Deere's global competitive position. John Deere Landscapes is formed

through acquisitions of McGinnis Farms and Century Rain Aid.

In 2005, John Deere invests in wind energy projects in the rural United

States and establishes a new wind energy business unit managed by

John Deere Credit.

In 2007, Deere & Company completes its acquisition of LESCO, Inc., a

leading supplier of lawn care, landscape, golf course and pest control

products. John Deere is chosen by Ethisphere magazine for its list of

the World's 100 Most Ethical Companies.

In 2010, Research and development expense tops $1 billion for the first

time. Deere is the first company to ship construction machines with

above 175-horsepower engines certified to meet rigorous U.S. Interim

Tier 4 emissions standards.

In 2011, Deere is listed among the 50 most-admired companies by

Fortune magazine and ranked as one of the 100 best global brands by a

leading brand-consulting firm. The company acquired the remaining

61% ownership interest in A& I Products, Inc.

Deere & Company (the Company) and its subsidiaries (collectively called John

Deere) operate in three major business segments – the agriculture and turf

segment, the construction and forestry segment and financial services segment.

The first two segments sometimes are grouped as “equipment operations”,

whose products and services are marketed primarily through independent retail

dealer networks and major retail outlets. In addition, the last segment is referred

as “financial services operations”.

The Agriculture and Turf Segment (A&T: 70%)

!"#$%&'(')'*&%"&+',%-./0%'1-%/

This segment manufactures and distributes a full line of farm and turf equipment

and related service parts including large, medium and utility tractors, loaders,

seeding and application equipment, hay and forage equipment, turf and utility

equipment, integrated agricultural management system technology, precision

agricultural irrigation equipment and supplies, landscape and nursery products,

and other outdoor power products.

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 2

University of Oregon Investment Group

May 30, 2012

The major tractors include:

! 5 Series Tractors (epitome of the word “utility”)

! 6 Series Tractors (efficiency and comfort)

! 7000 Large-Frame Series Tractors

! 8R/8RT Series Tractors

! 9000 Series Tractors

The Construction and Forestry Segment (C&F: 21%):

This segment primarily manufactures and distributes a broad range of machines

and service parts used in construction, earthmoving, material handling and

timber harvesting. Examples include various loaders, excavators, motor graders,

articulated dump trucks, log harvesters and related attachments.

The Financial Services Segment (FS: 8%):

!"#$%&'2'304+/%$./"04'1-%/

This segment’s main duty is to finance sales and leases by John Deere dealers of

new and used agriculture and turf equipment and construction and forestry

equipment. Additionally, it also provides wholesale financing to dealers of the

foregoing equipment and operating loans, finances retail revolving charge

accounts and offers crop risk mitigation products and extended equipment

warranties.

Other Revenues (1%)

Finally, there is small part of the revenues, which primarily include the

equipment operations’ revenues for finance and interest income.

Strategic Positioning

!"#$%&'5'!0%&+/%6'1-%/'7'5589':0-;&%

John Deere welcomes its 175th anniversary after the “Year of Exceptional

Achievement” 1. The company has been famous for its outstanding performance

since it was founded in 1837. In 2011, Deere reported income of $2.8 billion and

the net sales and revenues of $32.0 billion, which surpassed previous high by a

wide margin – a 50% increase and a 23% increase, respectively. In addition, all

the business segments reported a sharp growth in profit in relation to 2010.

Besides delivering record financial results, the company has maintained

conservative capital expenditures, encouraged innovation, strengthened their

commitment to responsible corporate citizenship, and continues to be a wellrespected employer.

Engineering and Research

John Deere has invested heavily in engineering and research to improve the

quality and performance of its products, to develop new products, and to comply

with government regulations for operating in a global market. Such expenditures

were $1,226 million in 2011, $1.052 million in 2010 and $977 million in 2009,

which were 4.2%, 4.5% and 4.7% of net sales, respectively.

Manufacturing

In the United States and Canada, the equipment operations own and operate 19

factory locations and lease and operate 4 locations, which contain roughly 27.1

million square feet of floor space. Fifteen of those factories are mainly used for

producing A&T equipment and three are devoted to C&F equipment.

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

1

John Deere 2011 Annual Report

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 3

University of Oregon Investment Group

May 30, 2012

Outside the U.S. and Canada, the company’s equipment operations own or lease

and operate equipment factories and assemblies throughout the world including:

! A&T equipment factories in Brazil, China, France, Germany, India,

Israel, Mexico, the Netherlands, Russia and Spain;

! A C&F assembly operation in Russia, and equipment factories in Brazil

and China.

Patents and Trademarks

John Deere owns a large number of patents, trade secrets, licenses and

trademarks related to the company’s products and services that are expected to

grow to further the competitive position. Patents are generally important but not

regarded as a deciding factor to any of its businesses. However, certain John

Deere trademarks including the “John Deere” mark, the leaping deer logo, the

“Nothing Runs like a Deere” slogan and green and yellow equipment colors

considered an integral part of John Deere’s business. Their loss could have a

material adverse influence on John Deere.

Marketing

In the United States and Canada, the equipment operations distribute equipment

and service parts through two A&T equipment sales and administration offices

in Olathe, Kansas and Cary, North Carolina and one sales branch in Grimsby,

Ontario; and one construction, earthmoving, material handling forestry

equipment sales and administration office in Moline, Illinois. In addition,

equipment operations operate a centralized parts distribution warehouse with 8

regional parts depot and distribution centers. Through these U.S. and Canadian

facilities, John Deere markets products to 2,496 dealer locations for both A&T

and C&F equipment – mostly independent owned. Certain lawn and garden

product lines are sold through The Home Depot and Lowe’s.

Outside the U.S. and Canada, John Deere A&T equipment is sold to distributors

and dealers for resale in over 100 countries

.

! Sales and administrative offices in Argentina, Australia, Brazil, China,

France, Germany, India, Italy, Mexico, Poland, Russia, Singapore,

South Africa, Spain, Sweden, Switzerland, Turkey, Ukraine and the

United Kingdom

! Centralized parts distribution warehouses in Brazil, Germany and

Russia

! Regional parts depots and distribution centers in Argentina, Australia,

China, India, Mexico, South Africa, Sweden, and the United Kingdom.

By consistently encouraging innovations, keeping product quality and taking

advantages of its global presence and brand effect, John Deere “remains wellpositioned to capitalize on growth economy and, long term, to benefit from

broad economic trends that hold great promise for the future”2.

Business Growth Strategies

John Deere has been poised for growth and future success, which determines its

main business growth strategies – global expansion, continuing emphasis on

U.S. and Canada markets and new product development.

Global Expansion

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

2

John Deere 2011 Annual Report

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 4

University of Oregon Investment Group

May 30, 2012

John Deere, especially its A&T segment, seeks to increase their market share in

the emerging and high potential international markets. In addition, C&F segment

has joint ventures with companies in its target markets including Bell Equipment

Limited in North, Central and South America; Hitachi Construction Machinery

Co. in Asia, Xuzhou Bohui Science & Technology Development CO. ltd in

China and Ashok Leyland Limited in India.

Furthermore, in 2011, Deere announced to build seven factories in markets that

are important to its growth. Three of those new facilities for construction,

equipment, engines and large farm machinery are located in China. One for the

manufacture of farm tractors is in India as well as one for seeding, tillage and

application equipment will be built in Russia. Besides building new facilities,

the Equipment Operation’s manufacturing strategy also includes increasing

levels of technology and automation, and the flexibility to add more capacities

and accommodate the product design changes required to meet market

conditions.3

Achieve growth in U.S. and Canada

In 2011, U.S. and Canadian region accounted for 60% of the total revenue, 70%

of total profit and over half the spending on capital programs. The main strategy

to continue the success in this region is to investing in U.S. manufacturing base.

In 2011, the facilities in Davenport, Des Moines and Waterloo were upgraded.

In addition the company added about 2,500 employees to its U.S. workforce.

New Product Development

Another essential part of John Deere’s growth plans is expanding the product

range and entering attractive portions of the market4. In 2011, John Deere has

introduced a record number of products such as premium combines and its

largest-ever self-propelled sprayers, which mostly feature improvements in

power, comfort and performance. Those new products also aim to reduce

emissions to customer requirements for power and efficiency. As a result, John

Deere has receive many technology-related honors in 2011 including five silver

metals presented at Europe’s largest farm equipment show and a gold medal

earned at an international competition in France. Additionally, the John Deere

7280R was named tractor of the year by European farm-magazine editors.

Influential factors to John Deere’s Growth

For A&T segment, seasonality and general agricultural economy greatly affect

the sales of equipment. For example, due to seasonality, the demand of turf and

utility equipment in the second and third quarter is usually higher that in the rest

of the year. Therefore, the company has set their production and shipment

schedules corresponding to this seasonal pattern. In addition, when farmers have

more income and costs associated with farming are lower, the demand will be

higher and it benefits the cost reduction of producing the equipment. As a result,

the company can generate more sales.

For C&F segment, the prevailing levels of residential, commercial and public

construction and condition of the forest products influences the sales

significantly, because they determines the demand for the equipment produced

under this segment. Additionally, the other factors include the general economic

conditions, certain commodity like pulp and paper prices affecting the sales as

well.

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

3

4

John Deere 2011 10-K

John Deere 2011 Annual Report

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 5

University of Oregon Investment Group

May 30, 2012

Furthermore, for overall Equipment Operation Sales, currency exchange rates

respected to U.S. dollars and interest rates can have material influence on the

sales due to the increasing portion of sales in the international markets.

Industry

Overview

John Deere’s A&T segment is in tractors & agricultural machinery

manufacturing industry. Firms in this industry manufacture agricultural

machinery and equipment and powered home lawn and garden equipment. The

main agricultural equipment includes tractors, harvesting and seeding

machinery, and other machinery. 5 In order to be successful in this industry,

companies are required to meet emission standards, invest in research and

development of new products, have effective quality control, maintain

guaranteed supply of key inputs and quickly adopt new technology.

In addition, C&F segment operates in construction machinery manufacturing

industry. Firms in this industry make construction machinery and equipment for

use in residential, non-residential, highway, street and other infrastructure

construction. 6 To have outstanding performance in this industry, companies

have to obtain the latest available technology and techniques, establish export

markets, increase both quantity and quality of the products and maintain a multiskilled and flexible workforce.

Macro factors

The major demand determinants for the tractors & agricultural machinery

manufacturing industry include farm income, direct government payments,

commodity prices, crop yields, replacement demand and seasonality. For

example, when the farm income is high, farmers will increase their investments

in machinery to generate more income. Alternatively, the availability of credit

can also affect the demand in this aspect, because farmers will buy more

machines if they can borrow money easily. In addition, the ages and operating

costs of the old equipment affect the demand. For instance, if the equipment is

out-of-date and costs a lot to operate, farmers will intent to replace it by new

equipment, which will increase the demand. Furthermore, seasonality is another

important factor causing the fluctuation in demand during the year. Thus, setting

appropriate production and shipping schedule is essential to meet the seasonal

demand for agricultural equipment sales.

Secondly, the factors that influence the demand in construction machinery

manufacturing industry are mainly interest rates, government spending on new

infrastructure and repairs, business profitability and household disposable

incomes. Particularly, the first two factors have higher influences on the demand

for heavy construction equipment, since it is basically used for larger projects

like big infrastructure construction and repairs. On the other hand, the last two

factors have greater impact on the demand for light construction machinery,

since those machines are basically used in the household construction and

relatively smaller projects.

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

5

6

IBIS World

IBIS World

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 6

University of Oregon Investment Group

May 30, 2012

Competition

For A&T segment, the biggest competitor is CNH Global NV, which has 11.6%

market share in tractors and agricultural machinery manufacturing industry in

U.S. comparing to Deere & Company’s 46.2% market share. John Deere keeps

its leading position in this industry by possessing solid customer base due to the

long history, diversity in product lines (both machines and data management

systems), advance in technology (telematics system) and strength in producing

large size agricultural equipment (tractors over 100 horsepower).

On the other hand, CNH Global NV, located in IL as well, is the world’s

second-largest manufacturer of agricultural equipment, which makes it the direct

competitor with A&T operating segment of John Deere. CNH has the strength in

significant global presence and put heavy investments on research and

development, which can help it stand out but not comparing to Deere &

Company. Other indirect competitors include AGCO Corporation (3.9% market

share), Lindsay Manufacturing Company (!1% market share) and Alamo Group

Inc. (!1% market share), which mostly have their own focus but lack of global

presence and large capital.

For C&F segment, Deere’s (7.2% market share) major competitor is Caterpillar

Inc., who owns 35.3% market share in construction machinery manufacturing

industry in United States. Caterpillar’s large company size and outstanding

strategic planning that react to the changes in business environment has helped

the company lead the whole industry. For example, by seeing the potential high

growth in the emerging market like China, Caterpillar has stepped ahead of

other competitors to get in the market and possesses the market share by

providing a wide range of services. Unlike Caterpillar, Deere entered the global

market by partnering with other firms to increase manufacturing efficiency

particularly licensing and supply agreements with domestic companies in the

target markets. Additionally, the other competitors include Komatsu Ltd. (4.7%

market share), Terex Corporation (3.2%) and CNH Global NV (2.6%) and

Doosan Corporation (3.2%), which have the lack of global presence and

resistivity to recessions as Caterpillar and Deere do.

Management and Employee Relations

*-<$&='>?'@==&4

A-<&+'B?'!"&=;

Samuel R. Allen – Chairman and CEO since February 2010

After joining John Deere in 1975, Allen had been working in positions of

increasing responsibility in the Consumer Products Division, Worldwide

Construction & Forestry Division, John Deere Power System, and the

Worldwide Agricultural division including managing operations in Latin

America, China & East Asia and Australia. Additionally, Allen is also the

Chairman of Council on Competitiveness as of January 2010 and was appointed

to Whirlpool Corporation’s board of director’s in June 2010.

James M. Field – Senior VP and CFO since June 2009

Mr. Field is responsible for advising the CEO and division presidents on major

financial and strategic growth issues, and for managing Deere & Company’s

worldwide financial and planning functions. In addition, he is also in charge of

business planning and development, investor communications, and enterprise

information technology. Before joining in Deere, he was working at Deloitte &

Touche as a CPA. Now he is a member of Illinois CPA society and the

American Institute of CPA.

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 7

University of Oregon Investment Group

!%-4.&+'C?'D<&%+04

May 30, 2012

Frances B. Emerson – VP, Corporate Communications and Global Brand

Management

Frances B. Emerson is responsible for a broad range of external internal, and

brand management communications activities, as well as community relations

and philanthropy. Before coming to Deere, she served as associate instructor of

business and technical communications at the University of Arizona and

associate instructor in University of Utah. Furthermore, she is the author of

college textbook Technical Writing, published by Houghton Mifflin. Moreover,

she completed the advanced program for Directors offered by the Harvard

School of Business.

Management Guidance

After having the record year 2011, John Deere’s management has strong

confidence in the future growth of their equipment operations due to recovering

global economy, increasing farm income, stronger governmental supports

outsides U.S. and Canada, increasing commodity prices. In order to effectively

respond the strong demand for both A&T and C&F equipment in the next few

years, the company has strategically expanded their global presence by opening

new factories to add capacities, developing new products and modifying existing

product mix by increasing product variety. However, there are also costs

associated with expansion and product development including but not limit to

higher R&D expenses, SG&A expenses, capital expenditures and unfavorable

currency translation. In addition, due to the higher raw material cost and engineemission requirements, there will be more costs associated with production and

capital expenditures incurred at least in the recent years.

Specifically, the management estimates that the net sales will go up by 15%

including 4-point price realization and 3-point unfavorable currency translation,

which remains the same with the previous forecast. In addition, they projected

net sales to increase by 15% in second quarter of 2012 compared to that of 2011,

which the actual increase in 13%. Furthermore, as the management announced,

John Deere will expand globally with mainly focuses on large-size tractors and

develop combines to meet higher quality and emission requirements. In the

recent annual industrial conference, John Deere’s CFO mentioned that they

became the No.2 in combines business and No. 3 in tractor business in China,

which shows their success in global expansion execution. On the other hand, as

they predicted, the SG&A expense, R&D expense and material costs and freight

increased by 5%, 18% and $185 million dollars in the second quarter of 2012

compared to the same quarter of 2011. Therefore, though the company attempts

to be optimistic about their future growth, their estimates are relatively

reasonable.

As a result, John Deere is expected to have promising future growth because of

strong demand, additional capacities and increasing global expansion with the

considerable costs associated with generating higher revenues in the recent years

Recent News

Deere Posts Record Second-Quarter Earnings of $1.056 billion7

May 16, 2012

! Earnings per share rise 23% on 12% increase in net sales and revenues.

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

7

John Deere Website

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 8

University of Oregon Investment Group

May 30, 2012

!

!

Healthy global farm conditions performance, support positive outlook.

Full-year earnings forecast boosted to $3,350 billion

John Deere’s chairman and CEO said, “John Deere is well on its way to a year

of outstanding performance after reporting an eight consecutive quarter of

recording earnings. Out results are a reflection of positive conditions in a global

farm economy, which is continuing show impressive strength and endurance.

Deere is gaining new customers throughout the world, who are responding with

great enthusiasm to our innovative lines of equipment.”

Deere Plans to Expand Manufacturing Capacity for Large Tractors8

March 1, 2012

Deere & Company announced that it would invest $70 million to expand the

manufacturing capacity n its Waterloo, Iowa operations, where the company

builds large farm tractors that are used around the world.

David Everitt, the president of the Worldwide Agricultural & Turf Equipment

division, said, “Through this initiative, we will increase our manufacturing

flexibility and speed. The market demand John Deere has experienced for large

agricultural equipment has remained strong several years. We believe the time is

right to invest in our facilities to meet future demand for the large John Deere

tractors that help our customers meet the world’s growing demand for food.”

John Deere: Priced And Positioned for Success9

May 23, 2012

The demand for building and farming equipment has contributed to the success

of Deere. Deere and Caterpillar, who are consistently working to create the most

innovative products for consumers, dominate the industry. However, Deere has

done an exceptional job at creating an integrated company that is able to provide

equipment solutions for many types of customers. In addition, the extensive

investments in new products and additional global capacity put Deere in a sound

position to respond to a rising global need for food, shelter and infrastructure in

the years ahead.

Catalysts

Upside

!

!

!

Increasing global food demand driven by rapid population growth (20

billion global population in 2050) directly contributes to higher demand

for agricultural equipment.

Successes and continuing investments in global expansion primarily in

emerging markets, new product development and product variation to

maintain competitive position.

Recovering farm economy reflected by stronger farmers’ confidence

Downside

!

!

!

Fluctuations in farm commodity prices affecting farmer’s income

Uncertainty in general economic conditions influencing customers’

purchasing power of the company’s equipment

Governmental monetary, imports and industrial related policies

Comparable Analysis

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

8

9

John Deere Website

Seeking Alpha

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 9

University of Oregon Investment Group

May 30, 2012

The comparable companies are first selected from the major player in the

industry of John Deere’s each operating segment. Those who share the similar

risk factors, operating segments and growth rate.

Caterpillar Inc. (CAT 40%)

Caterpillar Inc. is an Illinois-based multinational manufacturer of construction

and mining equipment, diesel and natural gas engines and diesel-electric

locomotives. The company was established in 1925, which now operates in 180

countries and employs 121,513 people globally. The reported segments include

Construction Industries (32.4% of total revenue), Resource Industries (26.9% of

total revenue), Power Systems (35.9% of total revenue) and Financial Product

Segment (4.8% of total revenue). Caterpillar maintains a strategy of ongoing

expansion into emerging markets in South America and Asia particularly in

China where Caterpillar plans to launch lower-pried equipment.

In addition, Caterpillar’s business is highly sensitive to global economic

conditions and economic conditions in the industries and markets they serve,

changes in governmental monetary or fiscal policies and commodity or

component price increases.

CNH Global NV (CNH 40%)

Italy’s Fiat Group owns 90% of CNH Global NV, the world’s second-largest

manufacturer of agricultural equipment and third largest maker of construction

equipment. It was founded in 1999 through the merger of New Holland NV and

Case Corporation with current headquarters in Burr Ridge, IL. The company has

about 30,000 employees and produces attachments and loaders for tractors,

commercial and residential mowers, harvesters, hay bales, planting and seeding

equipment, sprayers, tillage equipment and tractors, which is sold through

12,000 dealers and distributors in 160 countries.

Furthermore, the company has very similar operating segments as John Deere

including Agricultural Equipment Segment (73.9% of total revenue),

Construction Equipment Segment (20.2% of total revenue) and Financial

Service Segment (8.5% of total revenue). The risks related to its business consist

of global economic condition, risks associated with global expansion like

currency transaction risks, and changes in the price of certain parts or

commodities.

Terex Corp. (TEX 20%)

Terex Corporation manufactures capital goods machinery products worldwide.

The company was founded in 1925 and based in Westport, Connecticut. There

are five reported segments – AWP (Aerial Work Platforms 26.9% of total

revenue), Construction (23.1% of total revenue), Cranes (30.7% of total

revenue), MHPS (Material Handling and Port Solutions 9.5% of total revenue),

MP (Material Processing segment 10.5% of total revenue) and Corporate and

Other/Eliminations (-0.7% of total revenue).

Terex operates a diverse portfolio of capital goods machinery businesses that

serve numerous end-user applications and geographic markets. Mergers and

acquisitions have played an important role in the industry of our company and

will evaluate new opportunities that can enhance their business portfolio.

Discounted Cash Flow Analysis

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 10

University of Oregon Investment Group

May 30, 2012

In this discounted cash flow analysis, each line item is projected by the

percentage of revenue.

Beta

The betas for John Deere and its comparable companies are regressed against

S&P 500 weekly for 1 year, monthly for 3 years and monthly for 5 years. The

final beta is the average of the 3 betas got for Deere and 3-year Hamada, 5-year

Hamada, 3-year Vasicek and 5-year Vasicek, which is reasonable and a little

lower than the comparable companies’ betas.

Revenue Model

There are mainly four parts of the revenue model – three operating segments

discussed below and Other Revenues. The estimates are based on the

management guidance, discussion in conference calls and changes in the macro

environment and risk factors.

Agricultural and Turf

The sales revenues of the full line of farm and turf equipment worldwide

primarily through independent retail dealer networks and major retail outlets are

included in this segment.

Construction and Forestry

The sales revenue of the broad range of machines and service parts used in

construction, earthmoving, material handling and timber harvesting mainly

through retail dealers networks and major retail outlets are included in this

segment.

Financial Services

The line mainly includes the income or loss by financing sales and leases by

John Deere dealers of new and used equipment, and of wholesale financing.

Other Revenues

This part includes primarily the equipment operations’ revenues for finance and

interest income and other income net of certain intercompany eliminations.

Other income mainly includes revenues from services, insurance premium and

fee earned and investment income.

Capital Expenditure

In 2012, Deere’s capital expenditure will mainly relate to Tier 4 emission

requirements, the modernization and restructuring of key manufacturing

facilities, the construction of new manufacturing facilities, and the development

of new products. Future levels of capital expenditures are expected remain at

least the same level for the next 5 years due to the new facilities needed for

global expansion, additional capacities to meet stronger demand, investments in

new products to maintain the leading position in each industry.

Cost of Sales

The costs are associated with the cost to manufacturing the equipment such as

raw material, labor, overhead, shipping and handling costs and impairments.

Since the price of raw materials is expected to increase by the management, cost

of sales increases roughly at the same rate as the revenue.

Inventories

According to the conference calls, the management announces that Deere is in

the middle of product transition, which they are making more combines. As a

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 11

University of Oregon Investment Group

May 30, 2012

result, their inventory level went down in the recent periods. Since they have not

finished this transition process, their inventories in the next 2-3 years will

increase really slowly. However, after that their inventories will increase at a

normal pace due to additional capacities and completion of product transition.

Research and Development Expense

Expenses related to R&D include but not limited to spending in support of new

products including designing and producing products. R&D expenses are

expected to increase in the recent future because of the necessity to meet more

stringent emission requirement and to design different products fitting each

region.

Selling, Administrative and General Expense

SG&A expenses include but not limited to the incentive compensation expenses,

postretirement benefit costs, foreign currency translation and marketing

expenses. Those expenses are projected to be higher due to the greater efforts

needed to capture international market share and unfavorable currency

translation.

Depreciation and Amortization Expense

The depreciation expenses of property and equipment, capitalized software and

other intangible assets based on straight-line depreciation method are included in

this part. However, expenditures for maintenance, repairs and minor renewals

are generally expensed as incurred and not depreciable. Those expenses are

expected to be higher due to management guidance.

Interest Expense

The interest expense is projected by the amortization schedule of long-term debt,

which shows a large portion including all outstanding midterm notes, as about

75.3% of the total debt, will be paid off before 2019. In addition, the

management states that the interest expense is expected to decrease due to lower

average borrowing rates, partially offset by higher average borrowings.

Other Operating Expense

Other operating expenses mainly include depreciation of equipment on

operating leases, cost of services and insurance claims and expenses. This

expense increased in 2011 due to the write-down of wind energy assets

classified as held for sale in 2010. Those expenses are projected to remain the

same level in the future.

Tax Rate

The U.S. federal income tax rate is 35% and the company’s tax rate is projected

to be lower because of R&D tax credit and tax rate on foreign activities.

Recommendation

Recommendation

Comparable Analysis (50%)

$

DCF Analysis (50%)

$

Current Price

$

Implied Price

$

Under (Over) Valued

$

82.86

85.02

75.14

83.94

7.80

Due to the increasing global food demand and recovering farm economy, John

Deere has promising opportunities of future growth. Based on the discounted

cash flow analysis, which management guidance and various macro

environmental factors are taken into consideration, the price of John Deere is

undervalued by 13.15%. In addition, the comparable companies all have similar

operational segments, are affected by similar risk factors and seek for global

expansion, which make the comparable analysis useful for the overall analysis.

As a result, by weighting discounted cash flow analysis and comparable analysis

50% and 50%, the implied price of $83.94 undervalued by $7.80 is a reliable

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 12

University of Oregon Investment Group

May 30, 2012

estimate of Deere’s future position. However, since the company still faces

potential negative impact of uncertainty in general economic condition,

unfavorable currency translation and higher costs associated with global

expansion, new product development and product modification to meet the

emission requirements, Hold for Svigals’ portfolio is regarded as a wise choice.

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 13

University of Oregon Investment Group

May 30, 2012

Appendix 1 – Comparables Analysis

Comparables Analysis

($ in millions)

Stock Characteristics

Current Price

50 Day Moving Average

200 Day Moving Average

Beta

Size

Short-Term Debt

Long-Term Debt

Cash and Cash Equivalent

Non-Controlling Interest

Preferred Stock

Diluted Basic Shares

Market Capitalization

Enterprise Value

Profitability Margins

Gross Margin

EBIT Margin

EBITDA Margin

Net Margin

Credit Metrics

Interest Expense

Debt/EV

Leverage Ratio

Interest Coverage Ratio

Operating Results

Revenue

Gross Profit

EBIT

EBITDA

Net Income

Valuation

EV/Revenue

EV/Gross Profit

EV/EBIT

EV/EBITDA

EV/Net Income

DE

CNH

CAT

Deere & Company CNH Global N.V.

40.00%

$75.14

$39.76

79.96

43.07

77.52

41.36

1.84

2.69

TEX

Caterpillar Inc.

40.00%

$89.94

100.43

102.19

1.93

Terex Corp.

20.00%

$16.93

21.72

19.90

3.33

8,484.00

8,626.00

950.00

0.00

0.00

239.72

9,531.11

25,691.11

10,762.00

25,191.00

2,864.00

25.00

0.00

652.34

58,671.28

91,785.28

243.30

2,365.20

973.20

1.10

0.00

110.40

1,869.07

3,505.47

34.29%

15.61%

18.49%

8.63%

25.95%

10.40%

12.53%

5.28%

31.70%

13.47%

17.61%

8.37%

17.87%

3.69%

5.66%

0.80%

$772.00

0.67

6.52

3.25

$749.00

0.51

4.64

8.06

$772.00

0.67

6.83

3.25

$1,249.00

0.39

3.23

8.90

$132.40

0.74

6.52

3.02

$34,682.36

10,339.02

4,288.12

5,531.16

2,549.30

$20,002.00

5,191.00

2,081.00

2,506.00

1,056.00

$32,659.80

11,197.70

5,099.60

6,038.80

2,819.10

$20,002.00

5,191.00

2,081.00

2,506.00

1,056.00

$63,170.00

20,025.00

8,509.00

11,122.00

5,289.00

$7,067.80

1,263.10

260.60

399.80

56.50

1.19x

4.37x

11.94x

9.16x

29.08x

1.28x

4.58x

12.35x

8.77x

24.33x

1.68x

4.90x

10.76x

9.08x

19.46x

1.28x

4.95x

12.35x

10.25x

24.33x

1.45x

4.58x

10.79x

8.25x

17.35x

0.50x

2.78x

13.45x

8.77x

62.04x

Max

$89.94

100.43

102.19

3.33

Min

$16.93

21.72

19.90

1.84

Weight Avg.

$55.27

61.74

61.40

2.51

Median

$39.76

43.07

41.36

2.69

11,120.20

25,191.00

3,388.30

25.00

0.00

652.34

58,671.28

91,785.28

243.30

2,365.20

950.00

0.00

0.00

110.40

1,869.07

3,505.47

7,747.06

13,999.84

1,720.24

10.22

0.00

378.90

27,654.77

47,691.65

8,484.00

8,626.00

973.20

1.10

0.00

239.72

9,531.11

25,691.11

11,120.20

16,924.00

3,388.30

1.50

0.00

401.83

30,193.51

54,850.91

34.29%

15.61%

18.49%

8.63%

17.87%

3.69%

5.66%

0.80%

26.64%

10.29%

13.19%

5.62%

25.95%

10.40%

12.53%

5.28%

$1,249.00

0.74

6.83

8.90

$132.40

0.39

3.23

3.02

$834.88

0.57

5.33

5.46

$63,170.00

20,025.00

8,509.00

11,122.00

5,289.00

$7,067.80

1,263.10

260.60

399.80

56.50

1.68x

4.95x

13.45x

10.25x

62.04x

0.50x

2.78x

10.76x

8.25x

17.35x

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 14

University of Oregon Investment Group

May 30, 2012

Appendix 2 – Discounted Cash Flows Analysis

Discounted Cash Flow Analysis

($ in millions)

Total Revenue

% YoY Growth

Cost of Sales

% Revenue

Gross Profit

Gross Margin

Selling, Administrative and General

% Revenue

Depreciation and Amortization

% Revenue

Research and Development

% Revenue

Other Operating Expense

% Revenue

Earnings Before Interest & Taxes

% Revenue

Interest Expense

% Revenue

Earnings Before Taxes

% Revenue

Less Taxes (Benefits)

Tax Rate

Net Income

Net Margin

Add Back: Depreciation and Amortization

Add Back: Interest Expense*(1-Tax Rate)

Operating Cash Flow

% Revenue

Current Assets

% Revenue

Current Liabilities

% Revenue

Net Working Capital

% Revenue

Change in Working Capital

Capital Expenditures (PP&E)

% Revenue

Acquisitions

% Revenue

Unlevered Free Cash Flow

Discounted Free Cash Flow

Q1

Q2

Q3

Q4

2008A

2009A

2010A

2011A

01/31/2012A 04/30/2012E 07/31/2012E 10/31/2012E

2012E

2013E

2014E

2015E

2016E

2017E

2018E

2019E

2020E

2021E

28438

23112

26005

32013

6767

10009

9940

9234

35950

38815

41774

44690

47703

50845

54143

56780

58951

60719

-18.73%

12.51%

23.10%

-21.43%

47.92%

-0.70%

-7.10%

12.30%

7.97%

7.62%

6.98%

6.74%

6.59%

6.49%

4.87%

3.82%

3.00%

18744

15352

16484

21005

4333

6674

6878

6297

23916

25773

27738

29540

31341

33354

35464

37134

38554

39710

65.91%

66.42%

63.39%

65.61%

64.03%

66.68%

69.20%

68.20%

66.53%

66.40%

66.40%

66.10%

65.70%

65.60%

65.50%

65.40%

65.40%

65.40%

$9,694

$7,761

$9,521

$11,008

$2,434

$3,335

$3,061

$3,121

$12,033

$13,042

$14,036

$15,150

$16,362

$17,491

$18,679

$19,646

$20,397

$21,009

34.09%

33.58%

36.61%

34.39%

35.97%

33.32%

30.80%

33.80%

33.47%

33.60%

33.60%

33.90%

34.30%

34.40%

34.50%

34.60%

34.60%

34.60%

2960

2781

2987

3169

709

870

755

720

4116

3834

4217

4639

5103

5614

6175

6177

6140

6134

10.41%

12.03%

11.49%

9.90%

10.48%

8.69%

7.60%

7.80%

11.45%

9.88%

10.09%

10.38%

10.70%

11.04%

11.40%

10.88%

10.42%

10.10%

831

873

915

915

243

246

229

203

883

850

830

815

820

1068

1191

1306

1303

1214

2.92%

3.78%

3.52%

2.86%

2.87%

2.46%

2.30%

2.20%

2.46%

2.19%

1.99%

1.82%

1.72%

2.10%

2.20%

2.30%

2.21%

2.00%

943

977

1052

1226

313

352

348

342

1354

1456

1546

1609

1670

1729

1787

1817

1827

1822

3.32%

4.23%

4.05%

3.83%

4.62%

3.52%

3.50%

3.70%

3.77%

3.75%

3.70%

3.60%

3.50%

3.40%

3.30%

3.20%

3.10%

3.00%

698

718

748

716

177

255

276

224

932

815

1199

1292

1364

1444

1527

1584

1627

1548

2.45%

3.11%

2.88%

2.24%

2.61%

2.55%

2.78%

2.43%

2.59%

2.10%

2.87%

2.89%

2.86%

2.84%

2.82%

2.79%

2.76%

2.55%

$4,262

$2,412

$3,819

$4,982

$992

$1,611

$1,453

$1,632

$4,747

$6,087

$6,244

$6,796

$7,405

$7,636

$8,000

$8,762

$9,500

$10,291

14.99%

10.43%

14.68%

15.56%

14.67%

16.10%

14.62%

17.67%

13.21%

15.68%

14.95%

15.21%

15.52%

15.02%

14.78%

15.43%

16.11%

16.95%

1137

1042

811

759

192

158

128

88

564

609

606

644

677

717

720

698

719

735

4.00%

4.51%

3.12%

2.37%

2.84%

1.58%

1.29%

.95%

1.57%

1.57%

1.45%

1.44%

1.42%

1.41%

1.33%

1.23%

1.22%

1.21%

3125

1369

3007

4223

800

1453

1325

1544

4183

5477

5639

6152

6728

6919

7280

8063

8780

9556

10.99%

5.92%

11.56%

13.19%

11.83%

14.52%

13.33%

16.72%

11.64%

14.11%

13.50%

13.77%

14.10%

13.61%

13.45%

14.20%

14.89%

15.74%

1111

460

1162

1424

266

485

459

526

1431

1904

1888

1984

2234

2296

2417

2685

2915

3153

35.56%

33.60%

38.63%

33.71%

33.26%

33.34%

34.60%

34.05%

34.21%

34.77%

33.49%

32.25%

33.20%

33.18%

33.20%

33.30%

33.20%

33.00%

$2,014

$909

$1,846

$2,799

$534

$969

$867

$1,018

$2,752

$3,573

$3,750

$4,168

$4,494

$4,623

$4,863

$5,378

$5,865

$6,402

7.08%

3.93%

7.10%

8.74%

7.89%

9.68%

8.72%

11.03%

7.66%

9.20%

8.98%

9.33%

9.42%

9.09%

8.98%

9.47%

9.95%

10.54%

831

873

915

915

243

246

229

203

883

850

830

815

820

1,068

1,191

1,306

1,303

1,214

733

692

498

503

128

105

84

58

371

398

403

436

452

479

481

466

480

492

3,577

2,475

3,258

4,217

906

1,320

1,179

1,279

4,007

4,820

4,983

5,419

5,767

6,170

6,535

7,150

7,649

8,109

12.58%

10.71%

12.53%

13.17%

13.38%

13.19%

11.86%

13.85%

11.15%

12.42%

11.93%

12.13%

12.09%

12.14%

12.07%

12.59%

12.97%

13.36%

24,648

24,280

28,720

30,565

32,085

34,357

34,221

35,649

35,649

37,515

39,810

41,964

44,173

46,218

48,404

50,080

51,051

52,461

86.67%

105.05%

110.44%

95.48%

474.17%

343.26%

344.29%

386.07%

99.16%

96.65%

95.30%

93.90%

92.60%

90.90%

89.40%

88.20%

86.60%

86.40%

6,735

5,594

6,830

8,091

7,083

8,961

8,676

7,952

7,952

8,605

9,232

10,015

10,647

11,394

12,085

13,008

13,187

13,534

23.68%

24.20%

26.26%

25.27%

104.68%

89.53%

87.28%

86.12%

22.12%

22.17%

22.10%

22.41%

22.32%

22.41%

22.32%

22.91%

22.37%

22.29%

$17,913

$18,687

$21,890

$22,474

$25,002

$25,396

$25,545

$27,697

$27,697

$28,909

$30,578

$31,949

$33,526

$34,824

$36,319

$37,072

$37,864

$38,927

62.99%

80.85%

84.18%

70.20%

N/A

N/A

N/A

N/A

77.04%

74.48%

73.20%

71.49%

70.28%

68.49%

67.08%

65.29%

64.23%

64.11%

$773

$3,204

$584

$2,528

$395

$149

$2,151

$0

$1,213

$1,669

$1,371

$1,577

$1,298

$1,495

$753

$792

$1,063

349

322

319

537

269

155

127

99

650

740

802

894

840

830

815

800

790

780

1.23%

1.39%

1.23%

1.68%

3.98%

1.55%

1.28%

1.07%

1.81%

1.91%

1.92%

2.00%

1.76%

1.63%

1.51%

1.41%

1.34%

1.28%

252.30

49.80

45.50

61

0

0

0

0

0

0

0

0

0

0

0

0

0

0

.89%

.22%

.17%

.19%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

- $ 1,329.59 $ (309.82) $

3,036 $

(1,891) $

771 $

903 $

(971) $

3,357 $

2,868 $

2,512 $

3,155 $

3,350 $

4,043 $

4,224 $

5,597 $

6,066 $

6,266

$

751 $

857 $

(899) $

710 $

2,394 $

1,891 $

2,142 $

2,051 $

2,233 $

2,105 $

2,515 $

2,459 $

2,290

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 15

University of Oregon Investment Group

May 30, 2012

Appendix 3 – Revenue Model

Revenue Model

($ in millions)

Agriculture and turf net sales

% Growth

% Revenue

Construction and forestry net sales

% Growth

% Revenue

Financial services revenues

% Growth

% Revenue

Other revenues

% Growth

% Revenue

Total Revenue

% Growth

$

$

$

$

$

2008A

20,985

27.54%

73.79%

4,818

-4.31%

16.94%

2,190

4.58%

7.70%

445

-10.82%

1.56%

28,438

18.09%

$

$

$

$

$

2009A

18,122

-13.64%

78.41%

2,634

-45.33%

11.40%

2,028

-7.40%

8.77%

328

-26.29%

1.42%

23,112

-18.73%

$

$

$

$

$

2010A

19,868

9.63%

76.40%

3,705

40.66%

14.25%

2,074

2.27%

7.98%

358

9.15%

1.38%

26,004

12.51%

$

$

$

$

$

2011A

24,094

21.27%

75.26%

5,372

44.99%

16.78%

2,163

4.29%

6.76%

384

7.26%

1.20%

32,013

23.11%

Q1

01/31/2012A

$ 4,724

-14.96%

69.81%

$ 1,395

-4.42%

20.61%

$

548

-1.73%

8.10%

$

100

-0.32%

1.48%

$ 6,767

-21.42%

Q2

04/30/2012E

$ 7,735

63.74%

77.28%

$ 1,611

15.48%

16.10%

$ 561.15

2.40%

5.61%

$

102

2.00%

1.02%

$ 10,009

47.91%

Q3

07/31/2012E

$ 7,700

-0.45%

77.47%

$ 1,570

-2.55%

15.80%

$

570

1.50%

5.73%

$

100

-2.00%

1.01%

$ 9,940

-0.70%

Q4

10/31/2012E

$ 7,000

-9.09%

75.81%

$ 1,550

-1.27%

16.79%

$

583

2.30%

6.31%

$

101

1.20%

1.10%

$ 9,234

-7.10%

2012E

$ 27,159

12.72%

75.55%

$ 6,126

14.04%

17.04%

$ 2,261

4.55%

6.29%

$

403

4.98%

1.12%

$ 35,950

12.30%

2013E

$ 29,386

8.20%

75.71%

$ 6,643

8.44%

17.11%

$ 2,359

4.30%

6.08%

$

427

6.00%

1.10%

$ 38,815

7.97%

2014E

$ 31,737

8.00%

75.97%

$ 7,131

7.34%

17.07%

$ 2,460

4.30%

5.89%

$

446

4.40%

1.07%

$ 41,774

7.62%

2015E

$ 34,085

7.40%

76.27%

$ 7,573

6.21%

16.95%

$ 2,561

4.10%

5.73%

$

470

5.40%

1.05%

$ 44,690

6.98%

2016E

$ 36,540

7.20%

76.60%

$ 8,003

5.67%

16.78%

$ 2,663

3.97%

5.58%

$

498

6.00%

1.04%

$ 47,703

6.74%

2017E

$ 39,134

7.10%

76.97%

$ 8,427

5.30%

16.57%

$ 2,766

3.87%

5.44%

$

518

4.00%

1.02%

$ 50,845

6.59%

2018E

$ 41,952

7.20%

77.48%

$ 8,789

4.30%

16.23%

$ 2,864

3.54%

5.29%

$

539

3.90%

0.99%

$ 54,143

6.49%

2019E

$ 44,175

5.30%

77.80%

$ 9,083

3.34%

16.00%

$ 2,959

3.35%

5.21%

$

563

4.50%

0.99%

$ 56,780

4.87%

2020E

$ 45,942

4.00%

77.93%

$ 9,375

3.21%

15.90%

$ 3,052

3.12%

5.18%

$

582

3.50%

0.99%

$ 58,951

3.82%

2021E

$ 47,320

3.00%

77.93%

$ 9,656

3.00%

15.90%

$ 3,143

3.00%

5.18%

$

600

3.00%

0.99%

$ 60,719

3.00%

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 16

University of Oregon Investment Group

May 30, 2012

Appendix 4 – Working Capital Model

Working Capital Model

($ in millions)

Total Revenue

Current Assets

Receivables

Days Sales Outstanding A/R

% of Revenue

Inventories

Days Inventory Outstanding

% of Revenue

Total Current Assets

% of Revenue

Long Term Assets

Net PP&E Beginning

Capital Expenditures

Depreciation and Amortization

Net PP&E Ending

Total Current Assets & Net PP&E

% of Revenue

Current Liabilities

Payables to Unconsolidated Affiliates

Days Payable Outstanding

% of Revenue

Accounts Payable and Accrued Expenses

Days Charges Outstanding

% of Revenue

Deferred Income Taxes

% of Revenue

Total Current Liabilities

% of Revenue

Q1

Q2

Q3

Q4

2008A

2009A

2010A

2011A 01/31/2012A 04/30/2012E 07/31/2012E 10/31/2012E 2012E

2013E

2014E

2015E

2016E

2017E

2018E

2019E

2020E

2021E

$28,438.00 $23,112.00 $26,004.00 $32,013.00 $6,767.00 $10,009.15 $9,939.53 $9,233.83 $35,949.51 $38,815.01 $41,773.71 $44,690.01 $47,703.46 $50,844.90 $54,143.02 $56,780.18 $58,950.78 $60,719.30

21606.00 21882.90 24349.10 27501.60

278.07

345.59

341.77

313.56

75.98%

94.68%

93.64%

85.91%

3041.80

2397.30

4370.60

3063.00

59

57

97

53

12.49%

9.85%

17.95%

12.58%

24647.80 2428020% 2871970% 3056460%

86.67% 105.05% 110.44%

95.48%

26406.80 28957.00 29011.00 32210.76 32210.76 33769.06 35716.53 37226.78 38735.21 40269.16 42069.13 43550.40 44389.94 45600.20

359.01

260.37

268.52

320.93

327.04

317.55

312.08

304.88

296.38

289.08

283.61

280.72

274.85

274.12

390.23% 289.31% 291.87% 348.83%

89.60%

87.00%

85.50%

83.30%

81.20%

79.20%

77.70%

76.70%

75.30%

75.10%

5677.70

5400.00

5210.00

3438.00

3438.00

3745.65

4093.82

4737.14

5438.19

5948.85

6334.73

6529.72

6661.44

6861.28

121

73

70

50

52

53

54

59

63

65

65

64

63

63

83.90%

53.95%

52.42%

37.23%

9.56%

9.65%

9.80%

10.60%

11.40%

11.70%

11.70%

11.50%

11.30%

11.30%

3208450% 3435700% 3422100% 3564876% $ 35,648.76 $ 37,514.71 $ 39,810.35 $ 41,963.92 $ 44,173.40 $ 46,218.01 $ 48,403.86 $ 50,080.12 $ 51,051.37 $ 52,461.48

474.13% 343.26% 344.29% 386.07%

99.16%

96.65%

95.30%

93.90%

92.60%

90.90%

89.40%

88.20%

86.60%

86.40%

4303.8

4212.6

4111.0

4006.8

3773.4

3663.4

3635.4

3714.2

3734.2

3496.5

3120.3

2614.4

2101.6

155.00

127.00

99.00

650.00

740.00

802.06

893.80

840.00

830.00

815.00

800.00

790.00

780.00

246.23

228.61

203.14

883.46

850.00

830.00

815.00

820.00

1067.74

1191.15

1305.94

1302.81

1214.39

4532.2

4127.7

3790.7

4352.3

4303.8

4212.6

4111.0

4006.8

3773.4

3663.4

3635.4

3714.2

3734.2

3496.5

3120.3

2614.4

2101.6

1667.2

$ 29,180.00 $ 28,407.90 $ 32,510.40 $ 34,916.90 $ 36,388.30 $ 38,569.57 $ 38,331.97 $ 39,655.58 $ 39,422.12 $ 41,178.07 $ 43,445.77 $ 45,678.14 $ 47,907.62 $ 49,714.49 $ 51,524.19 $ 52,694.51 $ 53,152.95 $ 54,128.66

15.94%

17.86%

14.58%

13.60%

537.73% 385.34% 385.65% 429.46%

10.50%

9.44%

8.70%

8.31%

7.83%

6.88%

5.76%

4.60%

3.56%

2.75%

169.20

55.00

203.50

117.70

113.50

134.00

149.60

121.00

121.00

163.02

192.16

214.51

238.52

254.22

281.54

295.26

288.86

255.02

3

1

5

2

2

2

2

2

2

2

3

3

3

3

3

3

3

2

0.65%

0.21%

0.78%

0.45%

1.68%

1.34%

1.51%

1.31%

0.34%

0.42%

0.46%

0.48%

0.50%

0.50%

0.52%

0.52%

0.49%

0.42%

6393.60

5371.40

6481.70

7804.80

6816.70

8677.93

8349.20

7664.08

7664.08

8267.60

8856.03

9608.35 10208.54 10931.65 11586.61 12491.64 12674.42 13054.65

125

128

144

136

145

117

112

112

117

117

117

119

119

120

119

123

120

120

24.59%

20.66%

24.93%

30.01%

100.73%

86.70%

84.00%

83.00%

21.32%

21.30%

21.20%

21.50%

21.40%

21.50%

21.40%

22.00%

21.50%

21.50%

171.80

167.30

144.30

168.30

152.80

148.90

176.80

166.90

166.90

174.67

183.80

192.17

200.35

208.46

216.57

221.44

224.01

224.66

0.66%

0.64%

0.55%

0.65%

2.26%

1.49%

1.78%

1.81%

0.46%

0.45%

0.44%

0.43%

0.42%

0.41%

0.40%

0.39%

0.38%

0.37%

6734.60 $ 5,593.70 $ 6,829.50 $ 8,090.80 $ 7,083.00 $ 8,960.83 $ 8,675.60 $ 7,951.98 $ 7,951.98 $ 8,605.29 $ 9,231.99 $ 10,015.03 $ 10,647.41 $ 11,394.34 $ 12,084.72 $ 13,008.34 $ 13,187.29 $ 13,534.33

23.68%

24.20%

26.26%

25.27%

104.67%

89.53%

87.28%

86.12%

22.12%

22.17%

22.10%

22.41%

22.32%

22.41%

22.32%

22.91%

22.37%

22.29%

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 17

University of Oregon Investment Group

May 30, 2012

Appendix 5 – Discounted Cash Flows Analysis Assumptions

Considerations

Terminal Risk Free Rate

Terminal WACC

Avg. Industry Debt / Equity

Avg. Industry Tax Rate

Current Reinvestment Rate

Reinvestment Rate in Perpetuity

Implied Return on Capital in Perpetuity

Terminal Value as a % of Total

Implied 2013E EBITDA Multiple

Implied Terminal Year Multiple

Terminal Free Cash Flow Growth Rate

2.85%

10.87%

125.00%

30.04%

(7.48%)

9.12%

32.90%

61.2%

6.9x

7.1x

3%

Tax Rate

Risk Free Rate

Beta

Market Risk Premium

% Equity

% Debt

Cost of Debt

CAPM

WACC

Discounted

Free Cash Flow Assumptions

Implied Price

33.00% Terminal Growth Rate

2.85% Terminal Value

!"#$ PV of Terminal Value

7.00% Sum of PV Free Cash Flows

64.08% Firm Value

35.92% Total Debt

3.31% Cash & Cash Equivalents

15.72% Market Capitalization

10.87% Fully Diluted Shares

Implied Price

Current Price

Undervalued

3.00%

81,970

29,199

18,500

47,699

16,924

3,388

34,163

402

$ 85.02

$ 75.14

13.15%

Adjusted Beta

Appendix 6 –Sensitivity Analysis

85

0.55

0.65

0.75

0.85

0.95

Implied Price

Terminal Growth Rate

2.0%

2.5%

3.0%

3.5%

343.10

406.26

499.89

653.04

290.02

335.19

398.27

492.55

249.12

282.70

327.59

390.64

216.69

242.41

275.65

320.29

190.38

210.55

235.94

268.87

Undervalued/(Overvalued)

Terminal Growth Rate

4.0%

948.89

648.79

485.70

383.38

313.29

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 18

University of Oregon Investment Group

May 30, 2012

Appendix 7 – Sources

SEC Filings

John Deere Investor Relations page

John Deere Conference and Earning Calls

IBIS World

S&P Net Advantage

Factset

Yahoo! Finance

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!UOIG 19