United States Securities and Exchange

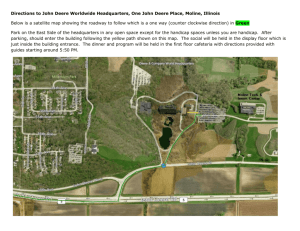

advertisement