ACCOUNTING 342

Chapter 15 Homework

Solutions

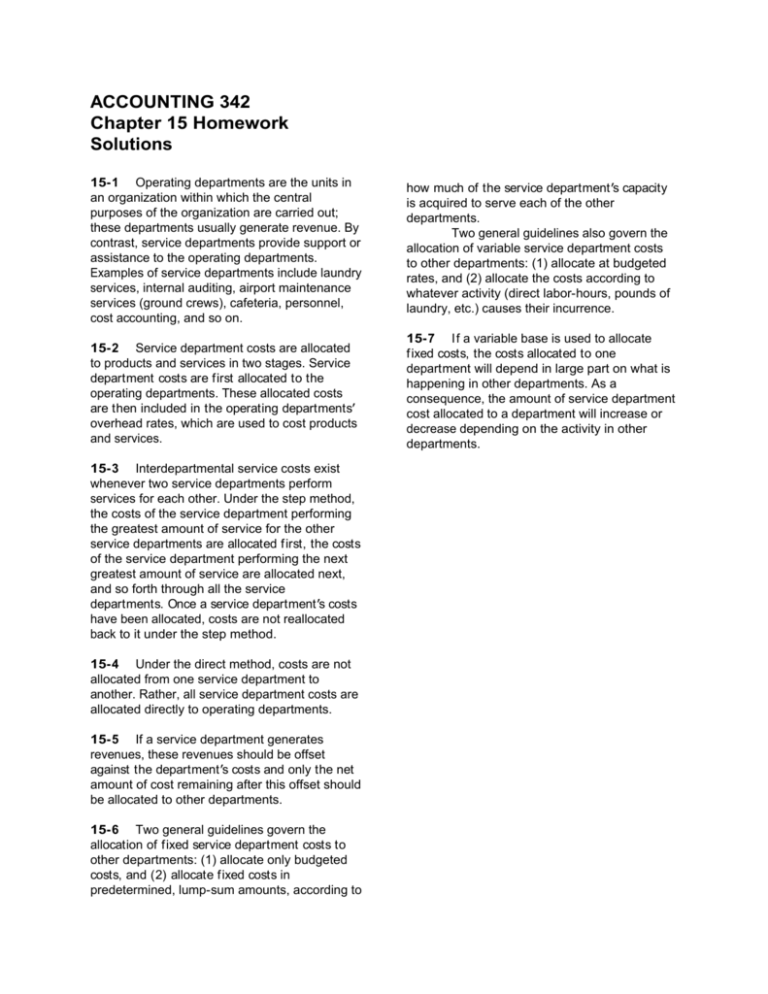

15-1 Operating departments are the units in

an organization within which the central

purposes of the organization are carried out;

these departments usually generate revenue. By

contrast, service departments provide support or

assistance to the operating departments.

Examples of service departments include laundry

services, internal auditing, airport maintenance

services (ground crews), cafeteria, personnel,

cost accounting, and so on.

how much of the service department s capacity

is acquired to serve each of the other

departments.

Two general guidelines also govern the

allocation of variable service department costs

to other departments: (1) allocate at budgeted

rates, and (2) allocate the costs according to

whatever activity (direct labor-hours, pounds of

laundry, etc.) causes their incurrence.

15-2 Service department costs are allocated

to products and services in two stages. Service

department costs are first allocated to the

operating departments. These allocated costs

are then included in the operating departments

overhead rates, which are used to cost products

and services.

15-7 If a variable base is used to allocate

fixed costs, the costs allocated to one

department will depend in large part on what is

happening in other departments. As a

consequence, the amount of service department

cost allocated to a department will increase or

decrease depending on the activity in other

departments.

15-3 Interdepartmental service costs exist

whenever two service departments perform

services for each other. Under the step method,

the costs of the service department performing

the greatest amount of service for the other

service departments are allocated first, the costs

of the service department performing the next

greatest amount of service are allocated next,

and so forth through all the service

departments. Once a service department s costs

have been allocated, costs are not reallocated

back to it under the step method.

15-4 Under the direct method, costs are not

allocated from one service department to

another. Rather, all service department costs are

allocated directly to operating departments.

15-5 If a service department generates

revenues, these revenues should be offset

against the department s costs and only the net

amount of cost remaining after this offset should

be allocated to other departments.

15-6 Two general guidelines govern the

allocation of fixed service department costs to

other departments: (1) allocate only budgeted

costs, and (2) allocate fixed costs in

predetermined, lump-sum amounts, according to

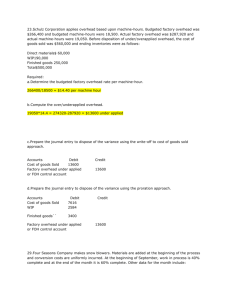

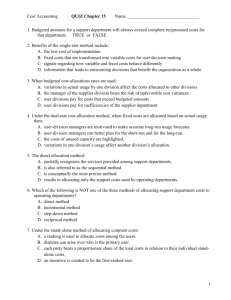

Problem 15- 10

1.

(Thousands of ¥)

Factory

Administration

Custodial

Services Personnel

Maintenance

Machining Assembly

Step method

Operating department costs ......

¥376,300

Costs to be allocated ................ ¥270,000 ¥ 68,760 ¥ 28,840 ¥ 45,200

Allocations:

Factory Administration

@ ¥1,800 per labor-hour ..... (270,000)

5,400

9,000

39,600

54,000

Custodial Services

@ ¥720 per square foot. ......

(74,160)

2,160

7,200

50,400

Personnel

@ ¥320,000 per employee ...

(40,000)

8,000

12,800

Maintenance

@ ¥1,250 per machinehour...................................

(100,000)

87,500

Total overhead after

allocations............................. ¥

0 ¥

0 ¥

0 ¥

0 ¥581,000

Divide by machine-hours

(thousands) ..........................

70

Divide by direct labor-hours

(thousands) ..........................

Overhead rate..........................

¥ 8,300

¥175,900

162,000

14,400

19,200

12,500

¥384,000

80

¥ 4,800

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 15

2

Problem 15- 10 (continued)

2.

(Thousands of ¥)

Factory

Administration

Direct method

Operating department costs ......

Costs to be allocated ................ ¥270,000

Allocations:

Factory Administration

(1/4, 3/4) ........................... (270,000)

Custodial Services (7/9, 2/9)...

Personnel (2/5, 3/5)...............

Maintenance (7/8, 1/8) ..........

Total overhead after

allocations............................. ¥

0

Divide by machine-hours

(thousands) ..........................

Divide by direct labor-hours

(thousands) ..........................

Overhead rate..........................

Custodial

Services Personnel

¥68,760

¥28,840

Maintenance

Machining Assembly

(28,840)

(45,200)

0

¥

0

¥175,900

67,500

53,480

11,536

39,550

202,500

15,280

17,304

5,650

¥548,366

¥416,634

¥45,200

(68,760)

¥

¥376,300

¥

0

70

¥ 7,834 ¥

80

5,208

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 15

3

Problem 15- 10 (continued)

3. Plantwide rate

Overhead rate=

=

Total overhead cost

Total direct labor-hours

¥965,000,000

= ¥9,650 per DLH

100,000 DLHs

4. The amount of overhead cost assigned to the job would be:

Step method:

Machining Department: ¥8,300 per machine-hour ×

190 machine-hours................................................. ¥1,577,000

Assembly Department: ¥4,800 per direct labor-hour

× 75 direct labor-hours ...........................................

360,000

Total overhead cost ..................................................... ¥1,937,000

Direct method:

Machining Department: ¥7,834 per machine-hour ×

190 machine-hours................................................. ¥1,488,460

Assembly department: ¥5,208 per direct labor-hour ×

75 direct labor-hours ..............................................

390,600

Total overhead cost ..................................................... ¥1,879,060

Plantwide method:

¥9,650 per direct labor-hour × 100 direct labor-hours.. ¥ 965,000

The plantwide method, which is based on direct-labor hours, assigns

very little overhead cost to the job since it requires little labor time.

Assuming that Factory Administrative costs really do vary in proportion

to labor-hours, Custodial Services with square feet occupied, and so on,

the company will tend to undercost such jobs if a plantwide overhead

rate is used (and it will tend to overcost jobs requiring large amounts of

labor time). The direct method is better than the plantwide method, but

the step method will generally provide the most accurate overhead rates

of the three methods.

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 15

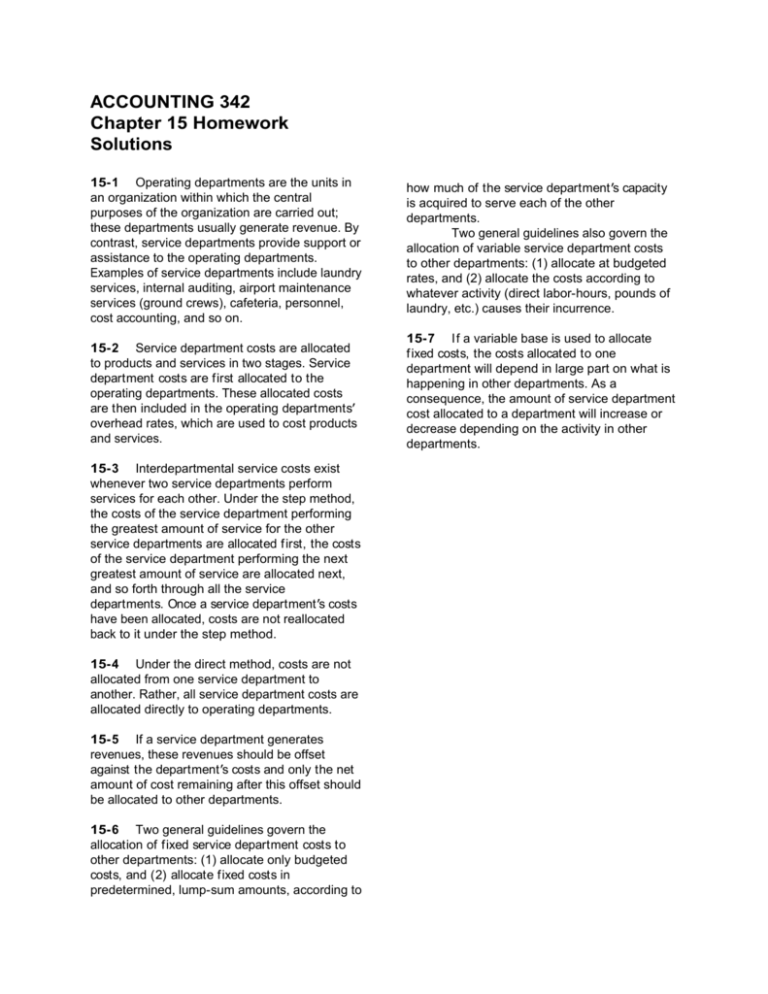

Problem 15- 11

1.

Auto

Division

Variable costs:

$3 per meal × 35,000 meals..... $105,000

$3 per meal × 20,000 meals.....

Fixed costs:

65% × $40,000.......................

26,000

35% × $40,000.......................

Total cost allocated..................... $131,000

Truck

Division

$60,000

14,000

$74,000

The variable costs are allocated by multiplying the budgeted rate per

meal by the budgeted number of meals that will be served in each

division during the month. The fixed costs are allocated in

predetermined, lump-sum amounts based on the peak-period need for

meals in each division.

2.

Auto

Division

Variable costs:

$3 per meal × 20,000 meals.....

$3 per meal × 20,000 meals.....

Fixed costs:

65% × $40,000.......................

35% × $40,000.......................

Total cost allocated.....................

Truck

Division

$60,000

$60,000

26,000

$86,000

14,000

$74,000

The variable costs are allocated according to the budgeted rate per meal

and not according to the actual rate. The fixed costs are again allocated

in predetermined, lump-sum amounts, based on budgeted fixed costs.

Any difference between budgeted and actual costs is not allocated, but

rather is treated as a spending variance of the cafeteria:

Total actual costs for the month................

Total cost allocated above ........................

Spending variance not allocated .............

Variable

$128,000

120,000

$ 8,000

Fixed

$42,000

40,000

$ 2,000

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 15

Problem 15- 11 (continued)

3. Actual variable costs..............

Actual f ixed costs..................

Total actual costs ..................

$128,000

42,000

$170,000

One-half of the cost, or $85,000, would be allocated to each division,

since an equal number of meals were served in each division during the

month.

4. This method has two major problems. First, the spending variances

should not be allocated, since this forces the inefficiencies of the service

department onto the using departments. Second, the fixed costs should

not be allocated according to month-by-month usage of services, since

this causes the allocation to one division to be affected by what happens

in another division.

5. Their strategy probably will be to underestimate their peak period

requirements in order to force a greater proportion of any allocation

onto other departments. Top management can control ploys of this type

by careful follow-up, with rewards being given to those managers who

estimate accurately, and severe penalties assessed against those

managers who underestimate their peak period requirements. For

example, departments whose managers underestimate their peak period

requirements may be denied access to the cafeteria once their estimates

have been exceeded.

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 15

Problem 15- 12

1. Yes, there is merit to the complaint. The company is using a variable

base (hours of hangar use) to allocate costs that are largely fixed. Thus,

the amount of cost that is charged to a division during a given month

will depend to a large extent on usage in other divisions. A reduction in

usage in one division can result in shifts of costs from it onto the other

divisions, even though the other divisions receive no more service.

2.

1st quarter activity ...............

2nd quarter activity ..............

Difference............................

Variable cost element =

=

Hours of Use

3,000

2,000

1,000

Total Cost

$172,000

168,000

$ 4,000

Change in cost

Change in activity

$4,000

= $4 per hour

1,000 hours

Fixed cost per quarter:

Total cost, 1st quarter................................................

Less variable cost ($4 per hour × 3,000 hours)............

Fixed cost .................................................................

$172,000

12,000

$160,000

Thus, the cost formula is $160,000 f ixed cost plus $4 per hour variable

cost.

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 15

Problem 15- 12 (continued)

3. Even though the peak-period level of activity will not be reached until

the fourth quarter, it should still be used to allocate the fixed costs of

the hangar. The reason is that peak-period requirements determine the

present level of fixed costs. The fact that the divisions do not need a

peak-period level of servicing every quarter is immaterial. If the divisions

require such servicing at certain times, then the capacity to deliver it

must be available, and it is the responsibility of the divisions to bear the

cost of that capacity.

Domestic Overseas

Freight Passenger Passenger

1st quarter allocation:

Variable cost:

$4 per hour × 900 hours ................. $ 3,600

$4 per hour × 1,800 hours...............

$4 per hour × 300 hours .................

Fixed cost:

30% × $160,000 ............................ 48,000

50% × $160,000 ............................

20% × $160,000 ............................

Total cost allocation ........................... $51,600

2nd quarter allocation:

Variable cost:

$4 per hour × 800 hours ................. $ 3,200

$4 per hour × 700 hours .................

$4 per hour × 500 hours .................

Fixed cost:

30% × $160,000 ............................ 48,000

50% × $160,000 ............................

20% × $160,000 ............................

Total cost allocation ........................... $51,200

$ 7,200

$ 1,200

80,000

$87,200

32,000

$33,200

$ 2,800

$ 2,000

80,000

$82,800

32,000

$34,000

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 15

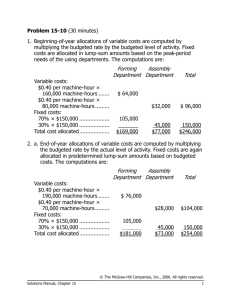

Problem 15- 14

1. Beginning-of-year allocations of variable costs are computed by

multiplying the budgeted rate by the budgeted level of activity. Fixed

costs are allocated in lump-sum amounts based on the peak-period

needs of the using departments. The computations are:

Forming

Assembly

Department Department

Variable costs:

$0.40 per machine-hour ×

160,000 machine-hours .......

$0.40 per machine-hour ×

80,000 machine-hours .........

Fixed costs:

70% × $150,000 ...................

30% × $150,000 ...................

Total cost allocated...................

Total

$ 64,000

$32,000

$ 96,000

45,000

$77,000

150,000

$246,000

105,000

$169,000

2. a. End-of-year allocations of variable costs are computed by multiplying

the budgeted rate by the actual level of activity. Fixed costs are again

allocated in predetermined lump-sum amounts based on budgeted

costs. The computations are:

Forming

Assembly

Department Department

Variable costs:

$0.40 per machine-hour ×

190,000 machine-hours .......

$0.40 per machine-hour ×

70,000 machine-hours .........

Fixed costs:

70% × $150,000 ...................

30% × $150,000 ...................

Total cost allocated...................

Total

$ 76,000

$28,000

$104,000

45,000

$73,000

150,000

$254,000

105,000

$181,000

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 15

Problem 15- 14 (continued)

b. Any difference between the budgeted and actual variable cost per

machine-hour or between the budgeted and actual total fixed cost

would not be allocated to the other departments. The amount not

allocated would be:

Actual cost incurred during the year...

Cost allocated (above) ......................

Cost not allocated (spending

variance).......................................

Variable

Fixed

Cost

Cost

Total

$110,000 $153,000 $263,000

104,000 150,000 254,000

$ 6,000 $ 3,000 $ 9,000

The costs not allocated are spending variances of the Maintenance

Department and are the responsibility of the Maintenance

Department s manager.

© The McGraw-Hill Companies, Inc., 2006. All rights reserved.

Solutions Manual, Chapter 15