IRC FINAL copy

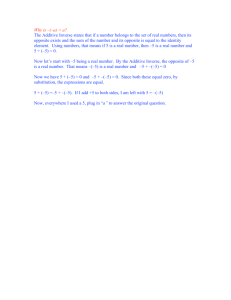

advertisement