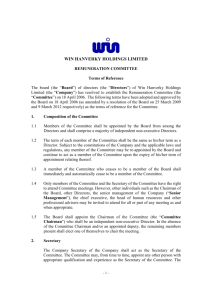

Corporate GovernanCe report

advertisement