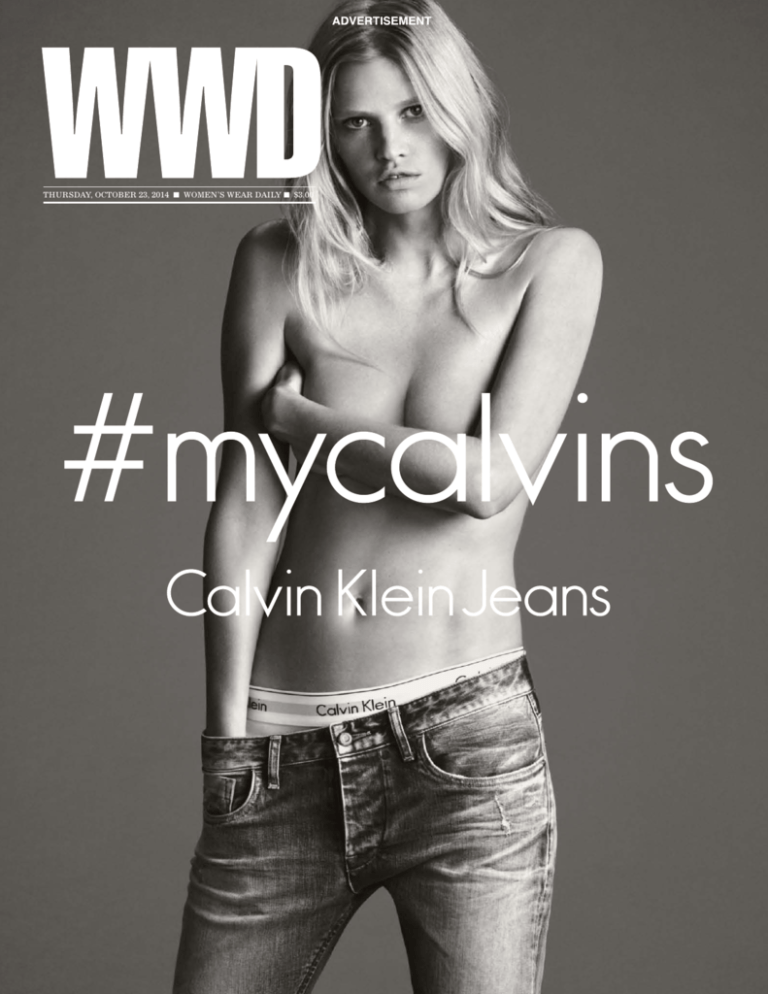

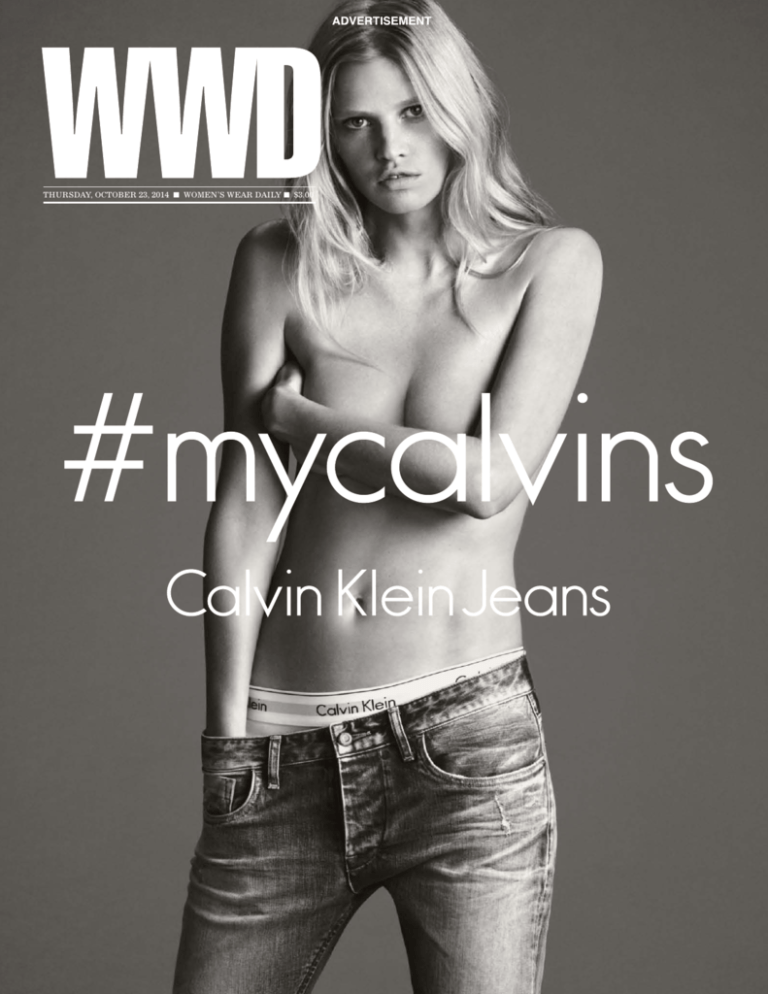

THURSDAY, OCTOBER 23, 2014 ■ WOMEN’S WEAR DAILY ■ $3.00

BRIDGET

FOLEY’S

DIARY

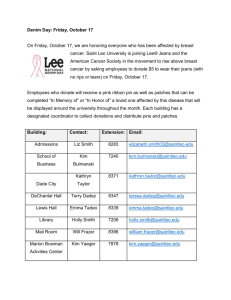

WHAT’S NEXT IN DENIM

MODELS: LINDSEY BYARD/REDIRECT AND MAX VON ISSER/FUSION; HAIR BY MARCEL DAGENAIS/LVA ARTISTS USING ORIBE HAIR CARE; MAKEUP BY JAVIER ROMERO USING MAKE UP FOR EVER

FROM ASIA TO AMERICA, THE THINGS TO

LOOK OUT FOR IN THE JEANS WORLD. SECTION II

HE’S BACK

JOSEPH ABBOUD AT

LAST GETS TO DO A

COLLECTION UNDER HIS

OWN NAME AGAIN.

MW, PAGE 13

NIKE’S $7 BILLION GOAL

IN WOMEN’S. PAGE 12

WWD

THURSDAY, OCTOBER 23, 2014 ■ $3.00 ■ WOMEN’S WEAR DAILY

Edie

Rocks

Picture a modern-day Edie Sedgwick

— what would she wear? The

flirtatious bombshell pushed the

fashion envelope with rock-star

appeal that attracted cameras and

boys alike. Here, Delpozo’s cotton

poplin top and Azede Jean-Pierre’s

silk cotton pants. Marc Jacobs

shoes; Louis Vuitton earring; Lady

Grey earring; Faith Connexion

bracelet; Iceberg belt.

On him: Sandro’s leather jacket,

Burberry London’s cotton shirt

and A Gold E’s cotton jeans.

Saint Laurent shoes. For more,

see pages 6 and 7.

PHOTO BY ISA WIPFLI;

WOMEN’S STYLED BY MAYTE ALLENDE;

MEN’S STYLED BY ALEX BADIA

BERRY BUYS BRAND

NEW CEO CORNELL SETS STRATEGY

Fashion Key in Target Revamp Halle’s Little Nothings:

By SHARON EDELSON

BRIAN CORNELL is challenging Target’s status quo.

Target’s first chairman and

chief executive officer from

outside the company’s ranks

— Cornell was ceo of Pepsico

America and prior to that ceo of

Sam’s Club — is shaking things

up and focusing on the key categories of fashion, home, baby

and kids and wellness, while

refining its strategy on food.

He’s also investing in online

and digital capabilities, an

area where retail experts saw

Target as lagging behind competitor Wal-Mart Stores Inc.,

which operates a lab in Silicon

Valley and has acquired more

than a dozen small tech companies in the last two years.

Cornell recognizes the fact

that Target has lost some of

its merchandising mojo — the

creativity, style and edge that

earned it the nickname Tahrjay in the early Nineties. He

said Target’s image has shifted more toward the low-price

proposition of its longtime

brand promise, “Expect More.

Pay Less,” than the part of the

message that addresses innovation and creativity.

“How do we inform the

brand and get the balance back

to ‘Expect More, Pay Less,’” he

said in an exclusive interview.

Asked whether Target is

doing anything differently in

terms of its designer partnerships, which have become the

hallmark of retailers from

H&M to Macy’s, Cornell said,

“Our whole focus is on design

and style. We love to hear new

ideas. We’re very pleased that

what we’ve done [in terms of

collaborations] still works.

We have a collaboration with

Joseph Altuzarra and we have

apparel based on the movie

‘Annie.’ The Toms partnerships

are blowing up on social media.

Toms is our largest partnership

to date. It’s so well positioned

for Target, which is a company

that’s been giving back throughout its history.” Toms donates a

pair of shoes to a child in need

for every pair purchased.

Cornell is redefining the profile of the Target “guest.” “We still

have a ‘cool factor’ shopper, but

we’re recognizing that more and

more there is a growing Hispanic

audience,” he said. “We recognize that the guest has changed.

They’re very connected and love

to shop, but the demographics

have changed. Localization and

personalization are important.”

CityTarget, an urban format

with 80,000 to 100,000 square

feet of space, has opened in

SEE PAGE 10

Actress’ New Scandale

By ROSEMARY FEITELBERG

HALLE BERRY’S latest venture

may read like an all-too-obvious

Hollywood pitch — Academy

Award-winning beauty invests

in 80-year-old Parisian luxury

lingerie label called Scandale

that will launch in Target.

The double entendre is not

lost on the thrice-married actress, whose curvaceous physique

all too often falls prey to the paparazzi. “If you’re in on the joke,

you’re in on the joke. If you’re

not, I don’t think that you’re offended by it in any way,” Berry

said during a recent interview at

The London hotel in New York.

But this is not a let’s-seehow-it-goes type business deal

for the actress, whose endorsement deals to date have intentionally been select beauty ones.

Berry deflected the suggestion

she is part of a new paradigm

of celebrity investors. “People

have been doing it — Ashton

Kutcher, Bethenny Frankel with

Skinnygirl, Gwen Stefani with

L.A.M.B. — just not everybody

has the desire to go into business

in this way. You have to really

want to do it. It’s time-consuming.

You have to work hard at it. Along

with the career you already have,

it’s another job, if you will, that

you’re tackling. Not everybody

has the desire to do that, but I’m

certainly not the first.”

Not to mention Jessica Alba’s

two-year-old The Honest Co.,

which is eyeing an initial public offering with a valuation at

just under $1 billion, according

to Dow Jones VentureWire. By

introducing a mass version of

the label that textiles designer

Robert Perrier started in 1932,

Berry also joins a roster of VIP

lingerie designers, including

Heidi Klum, who just partnered

SEE PAGE 4

2 WWD THURSDAY, OCTOBER 23, 2014

in 1999. He joined Luxottica in May 2005 as head

By LUISA ZARGANI

of its industrial engineering division and then became operations director for Asia. Over the followMILAN — Luxottica Group SpA hopes to put its ing three-and-a-half years, he lived in China and

management turmoil behind it, at last naming a was responsible for doubling the size of the Asian

new co-chief executive of markets to help steer the manufacturing arm, made up of 7,000 employees.

Vian returned to Italy as group chief operations ofeyewear giant.

Leonardo Del Vecchio, chairman of the group, ficer while he also managed the North American

on Wednesday named Procter & Gamble executive lab network and the Oakley factory in California. In

Adil Mehboob-Khan to the post. Independent direc- 2013, he was given the additional responsibility for

tor Marco Mangiagalli was tapped as a member of Tecnol’s Brazilian site.

Luxottica has seen some turmoil since ceo Andrea

the human resources committee, succeeding Roger

Guerra left the company in September. As reported,

Abravanel, who resigned last week.

Mehboob-Khan’s role will be formally effective last week Del Vecchio, who continues to own a majority of the firm through his

Oct. 29, when the board will meet

holding Delfin Sarl, assumed the

again to approve and release

role of interim ceo until a pair of

its quarterly financial results.

co-ceos could be appointed. He

During that meeting, Massimo

took on the role after the deparVian is expected to be appointed

ture of Enrico Cavatorta, who

interim ceo for the group with all

was appointed ceo of corporate

executive responsibilities until

functions and interim ceo of

Mehboob-Khan joins Luxottica

markets only last month.

in early January. Vian will then

Luxottica released the

assume his role as co-ceo of opmanagement news at the end

erations and product.

of trading here. The group’s

Mehboob-Khan was born

shares on Wednesday closed

in London, his father from

up 2.47 percent at 38.13 euros,

Pakistan and his mother

or $48.70 at current exchange

Italian-Hungarian, and he grew

rate. Shares have been reup in Rome before graduatcovering from a 9.5 percent

ing in engineering at London

tumble following the news of

University. In 1987 he began his

Cavatorta’s abrupt departure.

career at Procter & Gamble.

The governance shake-up at

Since 2011, he has been presiLuxottica took the industry by

dent of Wella, acquired by

Adil Mehboob-Khan

surprise, after years of stability

Procter & Gamble in 2004.

and international growth. Last

Previously, in 2009, he became

vice president in charge of all the European retail month, Luxottica reshaped its management structure based on a co-ceo model, with Del Vecchio rebeauty businesses for the group.

At Procter & Gamble, Mehboob-Khan will be turning to take on a more active role. Guerra left

succeeded by Patrice Louvet as president of the the firm after 10 years, and was to be succeeded by

P&G Salon Professional division. Louvet, a 22-year two executives, one focused on the markets and the

P&G veteran, will also assume leadership of P&G’s other dedicated to corporate functions — a manageGlobal Prestige division since the current president, ment model that left analysts skeptical.

The eyewear maker produces under license

Joanne Crewes, is due to retire in December, according to a P&G spokeswoman. Louvet has been presi- for names including the Giorgio Armani Group,

Bulgari, Burberry, Chanel, Coach, Prada and

dent of the company’s global shave-care category.

Vian was born in Verona in 1973 and earned Versace, and also has a number of owned brands,

a degree in management engineering at the such as Ray-Ban, Oakley and Persol.

University of Padua, and then moved to London

— WITH CONTRIBUTIONS FROM PETE BORN

Halloween’s Online Beauty Rush

For instance, on YouTube, searches related to

By RACHEL STRUGATZ

dry-skin makeup peak in January, while orange lipstick tops out in March through June, purple eye

BEAUTY BRANDS wanting to scare up some business shadow in April, waterproof mascara in the summer,

should look to what the vloggers are doing on YouTube. white makeup in October, red lipstick in October

Halloween is prime time for beauty vloggers, through December and gold and glitter eye shadow

who take the opportunity to showcase their most in December.

Green cited L’Oréal’s Destination Beauty as sucelaborate looks and rack up some of their biggest

numbers, according to data set to be released today cessfully tapping into this trend. The brand published content about dry skin in the New Year — at

by the video platform’s parent company Google.

The most-watched makeup tutorial on YouTube the exact time users’ interest in the topic piqued.

was Michelle Phan’s “Barbie Transformation Maybelline, Aéropostale, Burberry, Chanel and

Benefit Cosmetics are

Tutorial,” which has garothers that have been

nered 56 million views

thoughtful in the execusince its original publish

tion of beauty content

date about five years ago.

— from Burberry highPhan takes the top

lighting nail polish colthree spots. Her “Lady

ors from the runway to

Gaga Bad Romance Look”

Chanel “How-To” posts

and “Lady Gaga Poker

that coincide with the

Face Tutorial,” received

launch of every new

47 million and 34 million

makeup palette.

views, respectively.

Overall, videos with

“If you look at her

“makeup tutorial” in the

channel now, [Phan’s]

title have been watched

taken advantage of the

on YouTube more than

seasonality [of her con2.4 billion times.

tent],” said Lisa Green,

Google’s research

head of industry, luxury

also found people are

and apparel at Google.

increasingly accessing

“She has all these

Michelle Phan’s Barbie Transformation Tutorial has

beauty content from a

Halloween videos up that

garnered more than 56 million views, becoming the

mobile device. Upwards

aren’t even new. She is remost-watched makeup tutorial on YouTube of all time.

of half of all beauty

surfacing content because

searches on Google and YouTube come from a

she knows what people are looking for.”

From 2012 to 2013, views of Halloween make- mobile device, with product information and reup content increased more than four fold, with views serving as the two primary types of searches.

Halloween videos comprising 57 percent of season- Mobile searches related to “prom makeup” jumped

85 percent from 2013 to 2014.

al makeup tutorial views as of August.

“When it comes to makeup, mobile is even more

Green’s key takeaway is that beauty-content

searches on Google and YouTube are largely sea- important. It’s so rare that you’re putting on your

sonal — and brands can tap into this, tailoring their makeup with your laptop open — but you have your

phone,” Green said.

search and video strategy.

THE BRIEFING BOX

IN TODAY’S WWD

On the grounds at Frieze

art fair in London. For

more, see WWD.com.

PHOTO BY MARCUS DAWES

Mehboob-Khan Joins Luxottica

WWD.COM

Brian Cornell, Target’s first chairman and chief executive

officer from outside company ranks, is shaking things up and

making fashion, among other categories, a key focus. PAGE 1

Halle Berry is investing in 80-year-old Parisian luxury lingerie

label Scandale, which will make its debut in Target. PAGE 1

Designers and retailers may have withstood a typhoon

during Tokyo’s six-day fashion week, but economic

headwinds are still gusting. PAGE 8

The Association of Magazine Media has provided some new

insight on consumer demand for fashion and beauty magazines

for the month of September. PAGE 10

The Nov. 7 opening of Burberry’s first Rodeo Drive flagship

in Beverly Hills will precede its receiving the 22nd Rodeo Drive

Walk of Style Award on Nov. 19. PAGE 12

Ending one of the longest-running sagas in men’s fashion,

Joseph Abboud is finally able to create collections under his

own name again. PAGE MW13

Man of the Week: Brad Pitt, the star of “Fury,” seems to

be channeling “Boogie Nights” with his Seventies-porn-star

interpretation of a red-carpet tuxedo. PAGE MW14

Sébastien Jondeau has recently added fashion model to

his main duties as Karl Lagerfeld’s longtime bodyguard and

personal assistant. PAGE MW14

Los Angeles-based sneaker brand L.A. Gear will relaunch in

the spring and the first style will be will be part of the “Originals”

collection designed by hip-hop artist Tyga. PAGE MW15

Civil aviation lawyer Wan Li is among a growing number

of Chinese who are seeking professional help to dress and

look better. PAGE MW15

ON WWD.COM

THEY ARE WEARING: The 12th edition of Frieze London drew in

an eclectic crowd of arty attendees. For more, see WWD.com.

FOLLOW US ON SOCIAL MEDIA

@ WWD.com/social

TO E-MAIL REPORTERS AND EDITORS AT WWD, THE ADDRESS IS

FIRSTNAME_LASTNAME@FAIRCHILDFASHION.COM, USING THE INDIVIDUAL’S NAME.

WWD IS A REGISTERED TRADEMARK OF FAIRCHILD PUBLISHING, LLC.

COPYRIGHT ©2014 FAIRCHILD PUBLISHING, LLC. ALL RIGHTS RESERVED. PRINTED IN THE U.S.A.

VOLUME 208, NO. 85. THURSDAY, OCTOBER 23, 2014. WWD (ISSN 0149-5380) is published daily (except Saturdays,

Sundays and holidays, with one additional issue in March, April, May, June, August, October, November and December, and

two additional issues in February and September) by Fairchild Media, LLC, which is a division of Penske Business Media, LLC.

PRINCIPAL OFFICE: 11175 Santa Monica Blvd., 9th Fl, Los Angeles, CA 90025. Periodicals postage paid at Los Angeles, CA,

and at additional mailing offices. Canada Post: return undeliverable Canadian addresses to P.O. Box 503, RPO West

Beaver Cre, Rich-Hill, ON L4B 4R6. POSTMASTER: SEND ADDRESS CHANGES TO WOMEN’S WEAR DAILY, P.O. Box 6356,

Harlan, IA, 51593. FOR SUBSCRIPTIONS, ADDRESS CHANGES, ADJUSTMENTS, OR BACK ISSUE INQUIRIES: Please write

to WWD, P.O. Box 6356, Harlan, IA, 51593, call 866-401-7801, or e-mail customer service at wwdPrint@cdsfulfillment.com.

Please include both new and old addresses as printed on most recent label. For New York Hand Delivery Service address

changes or inquiries, please contact Mitchell’s NY at 1-800-662-2275, option 7. Subscribers: If the Post Office alerts us

that your magazine is undeliverable, we have no further obligation unless we receive a corrected address within one year.

If during your subscription term or up to one year after the magazine becomes undeliverable, you are ever dissatisfied with your

subscription, let us know. You will receive a full refund on all unmailed issues. First copy of new subscription will be mailed within

four weeks after receipt of order. Address all editorial, business and production correspondence to WOMEN’S WEAR DAILY,

750 Third Avenue, New York, NY 10017. For permissions requests, please call 212-630-5656 or fax request to 212-630-5883.

For reprints, please e-mail FFM_Reprints@pmc.com or call Wright’s Media, 877-652-5295. For reuse permissions,

please e-mail FFM_Contentlicensing@pmc.com or call 800-897-8666. Visit us online at www.wwd.com. To subscribe to

other Fairchild Media, LLC magazines on the World Wide Web, visit www.wwd.com/subscriptions. WOMEN’S WEAR DAILY IS NOT

RESPONSIBLE FOR THE RETURN OR LOSS OF, OR FOR DAMAGE OR ANY OTHER INJURY TO, UNSOLICITED MANUSCRIPTS,

UNSOLICITED ARTWORK (INCLUDING, BUT NOT LIMITED TO, DRAWINGS, PHOTOGRAPHS AND TRANSPARENCIES),

OR ANY OTHER UNSOLICITED MATERIALS. THOSE SUBMITTING MANUSCRIPTS, PHOTOGRAPHS, ARTWORK, OR OTHER

MATERIALS FOR CONSIDERATION SHOULD NOT SEND ORIGINALS, UNLESS SPECIFICALLY REQUESTED TO DO SO BY

WOMEN’S WEAR DAILY IN WRITING. MANUSCRIPTS, PHOTOGRAPHS AND OTHER MATERIALS SUBMITTED MUST BE

ACCOMPANIED BY A SELF-ADDRESSED STAMPED ENVELOPE.

4 WWD THURSDAY, OCTOBER 23, 2014

WWD.COM

Halle Berry Muses Off Set on Scandale

her own style as “pretty simple.” In a black

blouse and torn jeans, the “Extant” star,

who had just returned from a God’s Love

We Deliver visit with Kors before the interview, said, “I try not to ever overdo it. You

WWD.com/

won’t see me overjeweled or overdressed.

market-news.

That’s really not my style.”

Berry’s business manager of 25 years,

Jeff Wolman, gave her the most solid advice that has served her well. “He is probably the most honest man I have ever known

and he is solely the reason I still have a lot

of the money I have ever earned in life,

because he taught me how to manage my

money,” she said. “He told me, ‘If someone

is not adding value, they should not be on

the payroll.’ While that seems like a simple

statement, sometimes it’s really hard when

you’ve known someone for a long time and

they’ve worked for you for a long time. It’s

hard to look at a situation with your business mind and not your heart.”

Having partnered with Kors for the

United Nations’ World Food Programme,

Berry insisted philanthropy is not just

for the affluent. “I just hope that through

Michael or me talking that people will

start to help. I tend to think a lot of people

really help. But when you really start to

break it down, you realize that a lot of people don’t help in the ways that they could

help. A lot of people think, ‘Well, I’m not

superwealthy — I can’t afford to give a lot

of money,” she said. “I took my daughter to

Nicaragua and she was so moved by it that

when she came home she set up a lemonade stand and raised $300 in an afternoon.

That inspired me to think, ‘It doesn’t matter who you are. You can be six years old,

and raise $300 to make a difference.’”

Of Kors, she said, “He’s one of those

guys who is really putting his money

where his mouth is and putting his

money into something that is really

meaningful.…I personally don’t know any

secrets [about him.] So I would have to say

you would be surprised to know that he

really is that guy who he appears to be.”

As for any moral responsibility tied to

fame, Berry said, “It’s a very individual

choice. There’s no right and there’s no

wrong. Some people might give in a quiet

way. They might make contributions financially. They might give of their time and

you don’t know what they do. That doesn’t

mean that it is any less honorable than

the people who do it more out in the open.

If we can use our voices from time to time

to raise that awareness, then I personally

feel that’s an important thing that I should

do because I have that power to do that.”

Once her daughter ’s zombie

Halloween costume is good to go, Berry

will be winging it to New Orleans for her

— HALLE BERRY

Moviefone-sounding role as “a mother

who will stop at nothing” to rescue her

cated to these patients and felt they had to roam in Europe. “When you’re with a son in the Lorenzo di Bonaventura and

been totally and completely mistreated local [in Paris] you kind of get to enjoy the Erik Howsam-produced thriller “Kidnap.”

In the meantime, Berry hasn’t lost

and that the country kind of forgot about city in a different way. Of course, we love

them, especially when they came back the food, the wine, the culture — the fash- any sleep about the potential for others

from the Vietnam War. She was committed ion is different there. We have a place in to chalk up her Scandale pursuit to her

St. Germain so I love to roam around and beauty, a subject she only addressed when

to helping change their lives.”

In turn, Berry, a mother of two, helped discover the artists. I love the freedom asked. “I honestly have suffered that my

champion the antipaparazzi bill that be- that I have when I’m there. It’s very dif- whole career. That’s not even something I

came a California law last year. Her pro- ferent than when I’m tooling around here. think about quite honestly when I decide

duction company 606 Films is named for There’s just a freeness [in] the way that I to do something. I kind of get lumped in

that box no matter what I do. I find myself

that piece of legislation. “It’s gotten bet- am able to move around in the city.”

Partial to Helmut Lang, Chloé, Isabel struggling out of that, struggling to prove

ter for my children under the 606 pact,”

said Berry, adding that she is more at ease Marant and Michael Kors, Berry described myself in a different way. I used to think

that at some point, everybody is going to get over

that, but they never seem

to. So I don’t really think

about that any more. I

just do. I believe in this

brand. I love lingerie and

I think this is something

that North American

women will really be excited about and happy to

have. So that’s where I

come from. I really can’t

control what people are

going to think. I learned

a long time ago to stop

From left: Veronica Timbers, Wesley Snipes and Halle Berry in 1991’s “Jungle Fever”; 1998’s “Bulworth”; 2002’s “Die Another Day”; 2003’s “X-Men 2”; 2012’s “Dark Tide.”

worrying about that.”

{Continued from page one}

’’

’’

I understand that women want to feel sexy and

beautiful. They want to have undergarments

that are very functional, but to still feel

beautiful when we take our clothes off.

“JUNGLE “FEVER” © UNIVERSAL PICTURES/COURTESY EVERETT COLLECTION; “BULWORTH” © 20TH CENTURY FOX FILM CORP. /COURTESY EVERETT COLLECTION; “DIE ANOTHER DAY” © MGM/COURTESY EVERETT COLLECTION;

“X-MEN 2” © 20TH CENTURY FOX FILM CORP./COURTESY EVERETT COLLECTION; “DARK TIDE” © LIONSGATE/COURTESY EVERETT COLLECTION

FOR SLIDESHOW ON

HALLE BERRY, SEE

PHOTO BY JOHN AQUINO

with Bendon on a new label that will replace Elle Macpherson’s Intimates brand.

Berry and her business partner Erik Ryd,

founder of the intimates-driven Hop Lun,

own Scandale 50-50, and Berry has reimagined it for the North American market.

Tooling around the side streets of St.

Germain while visiting her now-husband

Olivier Martinez in Paris, Berry discovered Scandale, researched its heritage, learned she could acquire it and

signed up to revamp Scandale. Ladurée

in Manhattan’s SoHo was her location

of choice for this morning’s unveiling of

the bound 10-piece Scandale Paris collection, which launches at Target on

Monday and is decidedly more modest

than what she wore in “Swordfish” or even

“The Flintstones.” Intrigued by vintage

Scandale ads by such famed illustrators as

René Gruau, “I thought this would be the

perfect way to bring that Parisian glamour and sophistication that I feel about all

things Parisian to America,” she said.

“I’ve been doing this for 25 years. I have

been offered many, many times to endorse

a product and a big fat check came along

with it. But I didn’t feel that that was in

line with who I was. There have been some

very bizarre things — let’s put it that way,”

she said, declining to elaborate.

“For many years, I’ve endorsed the

brands of others like Revlon. I sort of partnered with Coty and started making my

own fragrances. But those aren’t my own

companies. I decided for my own evolution

as a woman and an entrepreneur, it’s time

for me to step out and really be part owner

of something that I believed in and not

just lend my name to a brand,” she said. “I

understand that women want to feel sexy

and beautiful. They want to have undergarments that are very functional, but to still

feel beautiful when we take our clothes off.

That’s really important and that’s a way to

make women feel sexy and validated — all

the ways we as women need to feel. And I

love lingerie. It’s always been important in

my life. This is a very important endeavor

that feels very in line with who I am.”

Berry, whose first name is a wink to

Halle’s Department Stores in her hometown of Cleveland, once punched the

clock in retail. “My first job was selling

cookies at a place called The Cookie

Company in Cleveland. I was about 16.

Hated it. I knew that 9-to-5 selling cookies would not be for me,” she said with

a laugh. “Later I worked at Higbee’s

Department Store. I liked that better

than selling cookies, but I knew that was

not what I would be doing with my life.”

Even before she wheeled it out of

Ohio at the age of 17, Berry grasped what

it took for her mother to provide. “I was

raised by a single mother. All I saw her

do was work her ass off to raise two kids

to give us every opportunity to succeed

in life — from the sort of school she sent

us to, to the social environment that she

allowed us to grow up in, to her ability

to teach us that our world is bigger than

our backyard,” she said. “She was a registered nurse on a psychiatric ward in a V.A.

hospital for 35 years. So imagine. A lot of

stories came home from work. She was

committed to it. Every time she had a bad

experience she never quit. She was dedi-

6 WWD THURSDAY, OCTOBER 23, 2014

Sally LaPointe’s cashmere

and wool top with

feathers and Paule Ka’s

cotton shorts. Giuseppe

Zanotti shoes; Louis

Vuitton earring (left); Lady

Grey earring (right). On

him: Costume National’s

wool suit and Caruso’s

cashmere turtleneck.

Saint Laurent shoes.

E

H

T

G

O

A

D

SH

e for

groov aphic

s

e

i

t

ix

gr

the S

sses,

ed up ils on dre titude.

n

e

h

g

a

at

et

tou

are d

k-star

ners

Desig with hardw idedly roc

c

g

sprin s and a de

e

r

u

t

x

te

LI;

WIPF

Y ISA BADIA;

B

S

O

X

PHOT D BY ALE LLENDE

EA

YLE

'S ST BY MAYT

N

E

M

ED

STYL

EN'S

WOM

fashion-news.

▼

Azede JeanPierre’s cotton

bra and Maki

Oh’s polyester

skirt. Paco

Rabanne shoes.

On him: Dior

Homme’s wool

turtleneck and

Topman’s cotton

jeans. Saint

Laurent shoes.

Paule Ka’s

triacetate and

polyester dress

and cotton

tank. Anthony

Vaccarello by

Versus Versace

shoes. On him:

Marc Jacobs’

wool coat,

Topman’s wool

sweater, Ovadia

& Sons’ cotton

shirt and A Gold

E’s cotton jeans.

Faith

Connexion’s

leather

jacket and

AllSaints’

cotton

jeans.

MODELS: LINDSEY BYARD/REDIRECT AND MAX VON ISSER/FUSION; HAIR BY MARCEL DAGENAIS/LVA ARTISTS USING ORIBE HAIR CARE; MAKEUP BY JAVIER ROMERO USING MAKE UP FOR EVER; PHOTO ASSISTANT: LEVI MANDEL; FASHION ASSISTANTS: MILTON DIXON AND MERCEDES PLS BASS

WWD.com/

Burberry

London’s

cashmere

coat, Paul

Smith’s cotton

shirt and BLK

DNM’s cotton

jeans. Saint

Laurent belt.

▼

▼

FOR MORE IMAGES, SEE

▼

WWD THURSDAY, OCTOBER 23, 2014 7

WWD.COM

8

WWD THURSDAY, OCTOBER 23, 2014

Tokyo Collections

Spring 2015

IT WOULDN’T BE TOKYO FASHION WEEK WITHOUT A HEAVY DOSE OF QUIRK — BUT FOR SPRING, THERE WERE ALSO PUNK

AND STREETWEAR LOOKS, AS WELL AS COLORFUL TAILORED SUITS.

Onitsuka Tiger by Andrea Pompilio:

The fashion-weary audience

waited nearly an hour for the

start of Andrea Pompilio’s

collection for sneaker brand

Onitsuka Tiger, which closed

the Tokyo season. Thankfully

he delivered an energetic

show that put a fresh spin

on sportswear and produced

some edgy clothes. Stripes

resembling industrial tape and

bold color-blocked accents gave

flair to jackets, sweats, pants

and tank tops. The guys rocked

a few looks in camo, such as

a parka and matching shorts.

The ladies sported feather

headpieces as they strutted

in ruffled skirts and dresses

including a couple floor-grazing

numbers. As for shoes, there

were sneakers, both high-tops

and low, with skin-bearing

cutouts and a variation that

laced up the calf, giving the

sportif a gladiator spin.

Onitsuka Tiger by

Andrea Pompilio

Mr. Gentleman

Facetasm

— AMANDA KAISER

Mr. Gentleman: Designed by

Takeshi Osumi and Yuichi

Yoshii, Mr. Gentlemen delivers

bold color with a cool factor.

For spring, the designers

worked a resort-friendly mood

with notice-me suits — jackets

over shorts or long pants in

vibrant emerald and coral. A

more literal interpretation of

the theme came in a jacket

embroidered with an image of a

Mediterranean seaside hamlet.

The collection also featured

sporty twists on tailoring, such as

hoods or mesh pockets on shirts.

While such looks might not

appeal to the investment banker

set, young Japanese guys are

generally more open to colorful

clothes and brash patterns

than a lot of other men. Still,

even they might steer clear

of the leathers, particularly a

sleeveless jacket and shorts in

lavender — tough for even the

ubercool to pull off.

— A.K.

Toga Virilis

Taro Horiuchi: Taro Horiuchi

said he’d been dreaming about

the universe and the future

this season. More specifically,

he looked to the UFO-themed

work of Belgian artist Henri

Van Herwegen, who goes by the

name of Panamarenko.

Horiuchi sought to

incorporate futuristic shapes

and fabrics into his lineup.

While he did so only vaguely,

he delivered an appealing

collection. Texture played a

key role in a high-shine green

dress and a white perforated

fabric used for a blouse and

pencil skirt as well as a dress

with kimono-sleeves. Other

strong looks included a short

pin-striped shirtdress and long

nubby sweaters draped over

dresses and skirts.

— A.K.

Toga Virilis: For spring, Toga

Virilis’ Yasuko Furuta headed

west — the American West.

For the poorly lit presentation,

she stationed her models on

low platforms of red dirt that

recalled desert sands. Some

of the pieces — bandana-print

shirts and bolo ties — spoke

FOR MORE SPRING

COVERAGE, SEE

WWD.com/

runway.

to the theme literally. Other

items like a long, blue, doublebreasted coat and embroidered

workman’s jackets were less

obvious. Furuta employed a

mix of hard and soft textures,

layering a thin knit cardigan

over a leather motorcycle

jacket in one instance. A red

windbreaker with a blue snapon bottom panel and a sweat

suit with mesh sleeves seemed

slightly out of place, but overall

it was a solid collection of

wearable yet distinctive pieces.

— KELLY WETHERILLE

Phire Wire: Phire Wire, whose

designer goes by the single

moniker Kiri, had a dark,

sinister feel. A follow spotlight

that took the place of stationary

overhead lighting called to

mind a searchlight.

The dramatic setup proved

anticlimactic given the lineup

of standard sporty fare.

Textural detailing — a tonal

print on a T-shirt, tuxedo

stripes on sweatpants —

attempted to elevate the items

beyond their basics core. So,

apparently, did images of flying

fish on the group of random

T-shirts that closed the show.

But compared with some of

the more directional men’s

collections of the week, this one

fell a bit flat.

— K.W.

Facetasm: Hiromichi Ochiai’s

Facetasm show was one of the

most highly anticipated of the

week. Ochiai delivered with

his street-ready mix of what

he called: “dress-up and dressdown.” He thus fused elements

of the two, adorning the backs

of men’s T-shirts and tanks

with feathers, and adding a

fluttering overlay of chiffon to

one sleeve of otherwise sporty

women’s blouson jackets.

Some standout looks riffed on

high-polish fare. Reincarnations

of tuxedo shirts included a

men’s poncho version and one

with a 3-D panel for women.

Pin-striped suiting fabric turned

youthful on a tulle-trimmed

pencil skirt and a men’s jacket

with crisscrossing satin panels

over the lapels .

— K.W.

WWD THURSDAY, OCTOBER 23, 2014 9

WWD.COM

Taro Horiuchi

Tokyo Gets More Salable

By AMANDA KAISER

Sretsis

TOKYO — Designers and retailers may have withstood a

typhoon during this city’s sixday fashion week, but economic

headwinds are still gusting.

Uncertainties about Japan’s

macroeconomic landscape, especially plans for a second sales

tax increase, are looming.

From a creative standpoint,

foreign buyers, some of whom

received free trips from the

Japanese government to attend

the shows and presentations,

were upbeat about the fashion

they saw as tending toward a

more accessible than extreme

aesthetic.

’’

Phire Wire

So many of the

trends that you

have seen done

on the runways in

Milan and Paris

actually have

evolved and are

also here. So it’s

not like it’s from

outer space or

not relevant.

’’

— NICK WOOSTER

Key women’s wear trends for

spring included a heavy emphasis on sporty fabrics and athletic

wear, lace, tie-dye applications,

plaid and pleated skirts. The

men’s wear similarly focused

on sporty fare — including baseball/varsity jackets, a carryover

trend from last season — as well

as colorful suits, motorcycle

jackets and leather pants.

“The Japan designers did a

very good job with [real-world

sensibility] and a true creativity and they are very open

and attentive to advice,” said

Géraldine Florin, partnerships

senior buyer for fashion and accessories at Galeries Lafayette.

Fashion week organizers said

international buyer registrations rose to 221. That compares

with 212 buyers in March and

192 in October. The countries

with the biggest number of registrations were China and the

U.S. with 50 and 35 respectively.

And while buyers were generally positive in their feedback,

those accolades still do not necessarily translate into significant

commercial sales. Some Japanese

merchants said they liked what

they saw but they are also balancing their budgets to accommodate

talents from other countries, such

as the U.S. and the U.K.

Aya Ota, a women’s buyer for

Isetan’s Shinjuku store said she

was impressed with the work

of Sretsis, Facetasm and men’s

brand Toga Virilis. At the same

time, she warned that she might

trim her budget for Japanese

designers for the spring season

as she is favoring British brands

at the moment. Perhaps more

importantly, she expressed caution about Japanese shoppers’

increasingly selective mind-set.

“After the fall of Lehman

Brothers and the March 11

earthquake, it’s not cool to be

so interested in fashion anymore,” she said. “Young people

are using their money for other

things besides clothes. They

won’t buy something just to buy

it; it has to be very good, something they’ll use for a long time,

or something they really like.”

Similarly, Motofumi Kogi,

men’s fashion director of United

Arrows & Sons, voiced positive

feedback about brands like Mr.

Gentleman, Toga Virilis and

Phenomenon, but said he is also

juggling the geographic makeup

of his spring budget.

Kogi said he’s seeing a lot of

strong “luxury street” brands

coming out of Los Angeles at

the moment, so he may allocate

more of his budget to those labels. That doesn’t necessarily

tinued to decline from April to

August. However, luxury goods

performed better compared to

regular apparel,” said Yukino

Kawabata, a research analyst

with Euromonitor. “There are

certainly those that think

the government should postpone the second tax hike in

October of 2015 as it would

double the tax rate from 5

percent to 10 percent in a period of just 18 months.”

While Japan’s economy remains a significant question

mark for designers here — and

many of them do the bulk of

their business in their home

market — a relatively weak

yen works in their favor when

it comes to export appeal. Still,

as Florin pointed out, Japanese

designers need to understand

the needs of international retailers. For one, western stores

need a wider range of sizes beyond the two or three sizes that

Japanese brands often produce.

Nick Wooster, a consultant who formerly worked for

Neiman Marcus and Atrium, visited Tokyo for a second straight

season as a guest of show organizers. He said he has seen

an evolution in the quality of

the brands and shows since

March. Citing standouts such as

Factotum, Yoshio Kubo, Kidill,

99%IS- and Onitsuka Tiger x

Andrea Pompilio, he said he was

impressed with the men’s tailoring and attention to distinctive

shapes and bright colors.

“So many of the trends

that you have seen done

on the runways in

Milan and Paris actually have evolved

SPRING 2015

and are also here.

So it’s not like it’s

from outer space

or not relevant,”

COLLECTIONS

he said.

As in past seasons, fashion week

organizers invited a

handful of international

buyers to come to Tokyo on free

trips to check out local brands.

Guests this season included

Galeries Lafayette’s Florin,

Jennifer Mankins, owner of Bird

in Brooklyn and Herman Shah,

director of operations and a buyer

mean that his budget for Tokyo for Singapore-based Front Row.

Mankins said she plans to

brands will decrease but it probpick up a few new Japanese

ably won’t increase, he said.

While Japan’s economy per- brands for her store includformed relatively well over the ing World Basic, Nicholson &

tail end of last year and the first Nicholson and Still by Hand. She

part of 2014, it took a tumble in also enjoyed the playful patterns

the second quarter. It contract- and prints at the Ne-net show.

“Every collection is beautied an annualized 7.1 percent

over the April-to-June period. fully produced and the textiles

April’s sales tax hike — the rate are gorgeous,” said the retailer.

grew from 5 percent to 8 per- “It’s eye-opening to come here

cent — put more of damper on for work...to really dive in and

consumer sentiment than origi- meet the smaller designers.”

Shah said he still hasn’t denally anticipated. The country

is now waiting to see whether cided if he will pick up any

Japan Prime Minister Shinzo Japanese designers this season

Abe will proceed with plans to but might be ordering more acpush through a second sales tax cessories. While he said he appreciates the quality level and

increase to 10 percent next year.

“The tax hike is also pos- design expertise of Tokyo deing a threat to the apparel and signers, he offered measured

luxury goods market in Japan. feedback of the week.

“Tokyo as always has been

The majority of Japanese consumers feel discouraged from evolving. This season is no differpurchasing apparel due to the ent,” said Shah. “But the brands

tax hike and followed by rising I saw this season are playing it

price. According to the Japan safe I feel, I guess to be more acDepartment Stores Association, cepted internationally.”

consumers’ spending on ap— WITH CONTRIBUTIONS

parel at department stores conFROM KELLY WETHERILLE

TOKYO

10 WWD THURSDAY, OCTOBER 23, 2014

WWD.COM

Cornell Shakes Up Target Strategy

{Continued from page one}

locations such as downtown Chicago.

The first TargetExpress opened in July

near the University of Minnesota campus in Minneapolis. At 20,000 square feet,

the store offers 15 percent of the products in a SuperTarget store. While the

ceo did not reveal plans to open more

TargetExpresses, he hinted that it’s a

possibility because “people are moving

back to cities. We need to understand

how to meet the needs of urban shoppers.

We also recognize that we have families.

We’re rolling out CityTarget and looking at

rolling out Express, which is in the very

early days and has been successful.”

P-Fresh, Target’s multiyear initiative

begun in 2008, expanded the grocery

departments in most stores, resulting

in an increase of 50 percent to 200 percent more space for food. But it’s unclear

how successful P-Fresh has been in driving repeat business. Target entered the

food arena under then-chairman and ceo

Robert Ulrich, who saw the new category

as a major game changer for the retailer

and a chance for it to close the revenue

gap with the behemoth of Wal-Mart.

Cornell is revamping that strategy.

“As we think about the role of food, we

need to step back,” he admitted. “We’ve

made it really clear we’re going to double

down on style and design and invest in apparel and home. Baby and kids are critically

important and wellness is a big growth area.”

Target’s Merona and Mossimo brands

are billion-dollar businesses, but it’s

been several years since the retailer introduced a new apparel label. “We have a

very extensive product design and development team of over 600 people,” Cornell

said. “How do we unleash them with the

right guest in mind? We have some great

internal designers.” Will Target develop

another women’s apparel label along the

lines of Isaac Mizrahi for Target, which

was discontinued after the designer

joined the Liz Claiborne brand in 2008?

“We’ll come back with one of those,”

Cornell vowed. “What is the next new

proprietary brand to keep the collections

fresh and serve other guests? Home and

apparel is where we can [leverage] that.”

Cornell has some serious challenges

to overcome. Target’s financial results

have been uneven since last year’s fourth

quarter, when the retailer posted a loss

due to the massive data breach at holiday that potentially impacted millions of

shoppers. Second-quarter net earnings

dropped nearly 62 percent to $234 mil-

MEMO PAD

FIGURING OUT THE NUMBERS: The

Association of Magazine Media has

provided some new insight on consumer

demand for fashion and beauty

magazines during the all-important

month of September.

The MPA ranked the women’s

magazines Vogue, Elle, Harper’s Bazaar,

Allure, Teen Vogue, Lucky, Glamour,

Marie Claire, Seventeen and InStyle,

and while the numbers might need a

statistics degree to decipher, it found

that Glamour had the largest brand

audience with 19 million for the month.

That brand audience number, which

is dubbed MPA’s “total 360” number,

comprises readers of a title’s print

and digital editions, as well as unique

visitors to its video channel and to its

Web site via computer and mobile. The

data, which is culled from third-party

providers GfK MRI, Ipsos, ComScore,

Nielsen Online and SocialFlow, is

the MPA’s new way of providing what

it claims is the “true” insight into

consumer demand for magazines.

Returning to the September numbers,

the MPA said that year over year, Glamour

grew just 8 percent, while Harper’s

Bazaar logged the biggest improvement

lion or 37 cents a share on sales of $17.4

billion from $17.1 billion, a 1.7 percent

increase over 2013’s second quarter.

Target cut its guidance for adjusted

third-quarter earnings per share to between 40 cents and 50 cents a share.

Analysts are expecting earnings of 65 cents

a share. For fiscal 2014, Target cut guidance

to between $3.10 and $3.30 a share from a

previous forecast of $3.60 to $3.90 a share.

A key problem is Canada, where the

business continues to falter. Canadian

segment sales rose 63.1 percent to $449

million from $275 million in the 2013

second quarter, partly due to new store

openings, but comps declined 11.4 percent in the second quarter. Target has

changed its management in Canada in an

attempt to get the business on track.

All of these problems led to pressure on Cornell’s predecessor, Gregg

Steinhafel to step down in May. Cornell

joined as ceo in August.

Now, he’s facing his first holiday season at the helm of the discounter — one

that’s expected to be more competitive

than ever across all segments of retail.

Target and Wal-Mart themselves are

deploying new technology, investing in

low prices and trying to one-up each

other with exclusives.

Cornell on Wednesday unveiled a multipronged holiday initiative with new enhanced digital tools such as a holiday wishlist app and said the retailer will offer for

the first time free holiday shipping on most

purchases made on target.com. However,

some analysts warned that free shipping

could negatively impact gross margins.

“We estimate that this free shipping offer

could translate to 230 basis points of gross

margin impact and 4 cents to 6 cents in

earnings per share, although the company noted this offer is already included in

guidance and therefore likely funded with

expense reductions in other areas,” said

Matt Nemer, a retail analyst at Wells Fargo.

Target is upping the offering of items

for sale online to 65,000 from 60,000. The

retailer has a price-match guarantee

and will be loading Cartwheel, its digital

savings app, with daily deals. IPod and

Android apps have been relaunched for

the holidays with new enhancements

such as interactive store maps and

streamlined checkout with Apple pay on

the iPhone app.

Wal-Mart last week lowered its fullyear forecast, citing a tough economy,

and putting a cloud over holiday sales.

But the retailer isn’t surrendering

with a 44 percent increase in brand

audience to six million. The MPA didn’t

add Cosmopolitan magazine to its top

10 list, as it likely views it as more of a

generalist read, but that glossy turned

in the highest total 360 number among

women’s magazines with 29.5 million.

(Of MPA member magazines, the highest

overall 360 number went to a non-fashion

publication, People, with 75.1 million).

Among the top 10, Vogue came in

second with a total 360 number of

16 million, followed by InStyle (12.4

million), Seventeen (11 million), Allure

(10.2 million), Elle (9.8 million), Bazaar

(six million), Teen Vogue (5.8 million),

Marie Claire (5.5 million) and Lucky (3.5

million). In men’s magazines, GQ earned

an audience of 13.7 million, while

Esquire pulled in 8.3 million and Details

attracted 1.6 million. On the bright side,

Details improved its total 360 number by

16 percent, according to the MPA, which

noted that InStyle only improved on its

figure by 2 percent.

The MPA introduced its total 360

metric in late September when it

revealed that it would cease reporting

monthly advertising-page figures, as

those numbers tell just one element of a

magazine’s health, namely the print story.

For those still interested in print

and ad pages, Vogue pulled the highest

total page count in September with 631,

Christmas. With its financially pinched

shoppers in mind, Wal-Mart is offering

a holiday layaway plan with no opening

fee. A portion of its Web site is devoted

to a clearance: “Huge savings on the hottest items” and a “savings center” feature

that suggests other low-priced items that

might interest a consumer.

Wal-Mart polled hundreds of children

to find their favorite toys and will cover

them on SavingsCatcher, its digital pricecomparison tool. The Bentonville-based

mass merchant plans to deliver its holiday message through its new “holiday

hub,” a production studio that will produce thousands of ads and other forms

of content for everything from broadcast

television to Vine under the direction of

a former Saatchi & Saatchi executive.

Target is offering free shipping

for the holiday season.

Target recently launched two new

apps and promises more in 2015. A new

Target Healthful app manages prescriptions and an updated gift registry has

new features and capabilities for life

events such as wedding, baby and college.

“As we go forward, it’s really all about

mobile,” Cornell told WWD, adding that

digital will be the first point of entry for

the majority of customers in the not-toodistant future. “It’s such a mobile experience. It’s where they purchase, it’s in

their hand. I’ve seen shoppers steering

their cart with one hand and using their

other hand to hold a phone. There’s an art

to it. They’re using Cartwheel to find savings. It’s a GPS, a navigator for the store.

“Shoppers recognize they have more

options now,” he added. “Amazon has

changed everybody’s expectations. Our

staff has got to supply solutions. We can

although that was a 4.5 percent dip from

last year. InStyle and Elle nabbed 485

and 465 pages, respectively, with Bazaar

nipping at their heels with 444 pages.

Glamour, MPA’s total 360 winner, had

215 pages, down 4 percent, and Cosmo

grabbed 188 pages for a 9.1 increase.

GQ’s pages were flat at 203, while Details

had a 10 percent decline in pages to 132.

Esquire’s pages fell 12.3 percent to 109.

— ALEXANDRA STEIGRAD

BUCK STOPS HERE: When people talk

about a “dearth” of talent in fashion and

retailing, it appears to be a misnomer. If

Harvard Business Review is any standard,

this sector is alive and well when it comes

to the world’s best-performing chief

executive officers. The November issue

lists the world’s top ceo’s, and 14 of them

hail from the fashion and retailing world.

The ceo’s were judged on such hard data

as total shareholder return and market

capitalization, as well as long-term results.

Number one on the list is Jeffrey

Bezos, ceo of Amazon, whose sales keep

growing even though it routinely reports

losses. Amazon continues to bet on the

future and move into completely new

industries, according to HBR. David

Simon, ceo of Simon Property Group,

came in at number four, while Tadashi

Yanai, ceo of Fast Retailing, whose

properties include Uniqlo, Theory and

direct you to a new app or a digital solution. Our physical stores are quickly

becoming solution centers for the guest.

We’re shipping from stores now. You can

come in, shop, and decide you want to

pick up next week or have something

delivered. We’re beginning to think of

stores as distribution facilities. There’s

much more flexible fulfillment.”

With a new social command center at

headquarters, Target is becoming more

proactive in terms of social media “to stay

in touch with what’s happening and what’s

streaming,” Cornell said. “We built a center

where we can see data from all of our platforms [Facebook, Twitter and Instagram].

Retailers are content generators. We amplify guest content and make it very visible.

Guests love it when we use their content.

The guests get more posts than our posts.

It has an authenticity and attraction. We

do it across platforms and monitor their

comments closely. When a friend says, ‘You

have to go to Target,’ it has [far more influence than anything we could say.]”

There are further signs that Target

is pushing hard to recapture its buzz.

The company said it will partner for

Christmas with Story, a Manhattan store

known for its themed installations and the

editorial lens it brings to retailing. Story

visited Target headquarters to select holiday products from the retailer’s design

partnerships to its everyday collections.

The Target collaboration will open at the

store on West 19th St. on Nov. 5. Kathee

Tesija, chief merchandising and supply

chain officer at Target, said that Story will

be “a testing ground for us to continue to

understand how merchandising and product curation influences our guests.”

Across the board, there is change in

the air at Target — beginning in the chairman’s office. Cornell is far more open and

forthcoming that his predecessors, which

was evident from Day One when he held

a town hall-style meeting for thousands of

employees. It’s all part of Target’s recognition that its methods of the past are no

longer enough.

“Retail is really shifting,” Cornell said.

“We used to be so campaign-focused. In

July, it was back to school, but the customer [didn’t want to buy back-to-school

until August]. I want to engage with the

Target guest and make sure I understand

and the team understands their expectations of us. My vote shouldn’t be driving

our decisions when we have an opportunity to get so much feedback from guests.

They vote with their wallets.”

J Brand, took the number 11 spot. Pablo

Isla Álvarez de Tejera, ceo of Inditex, which

owns Zara, was listed as number 14.

Michael Balmuth, ceo of Ross Stores,

came in at number 25, while Carol

Meyrowitz, ceo of TJX, came in at number

51. Meyrowitz is not only one of two

women who made the top 100, but she

also came in at number 10 on the list

of performers with the highest total

compensation. She earned $20.7 million,

according to compensation analysis firm

Equilar. (Heading up that separate list

was Disney’s Robert Iger, who earned

$34.3 million, followed by David Zaslav,

ceo of Discovery Communications, who

earned $33.3 million).

Of the top 100 ceo’s, Nick Hayek Jr., ceo

of Swatch, came in at number 52, while

Blake Nordstrom, ceo of Nordstrom tied,

for number 54 (with Howard Schultz, ceo of

Starbucks). Also making the top 100 were

Terry J. Lundgren, ceo of Macy’s, who tied

for number 66. Athleticwear firms also

made a strong showing. Herbert Haines,

ceo of Adidas, took the number 73 spot,

while Mark Parker, ceo of Nike, sprinted

in at number 76. Fabrizio Freda, ceo of

Estée Lauder, earned the number 81

spot, while Eric Wiseman, ceo of VF Corp.,

came in at number 84. Further down the

list was Michael Kowalski, ceo of Tiffany &

Co., who came in at number 92.

— LISA LOCKWOOD

WE’RE HIRING.

(YES, YOU READ THIS CORRECTLY)

–

WWD Deputy Fashion Editor

–

WWD Beauty Sales Director

–

WWD Beijing-Shanghai or Hong Kong Reporter

–

WWD Sales Coordinator LA

–

WWD Street Style Reporter/Editor

–

WWD Sales Integrated Marketing & Research Specialist

–

WWD Eye Reporter NY

–

WWD Digital Sales Account Executive

–

WWD Eye Reporter NY/LA

–

WWD Creative Specialist, Advertising Sales

–

WWD Accessories Reporter/Editor

–

Summits Attendee Sales Manager

–

WWD Brazil Beauty & Fashion Reporter

–

Summits & Events Sponsorship Sales Director

–

WWD Silicon Valley-San Francisco Reporter

(Fashion-Tech-Commerce)

–

Brand Strategy & Social Media Director

Summits & Events Experience Director

WWD Activewear Swimwear Reporter

–

–

Summits & Events Marketing Director

WWD Men’s Wear Reporter/Editor

–

–

Event Creative Director

WWD West Coast Fashion Editor

–

–

Summits & Event Manager

WWD Copy Editor

–

–

Designer InfoGraphic Designer Specialist

WWD Wearable Tech Reporter

–

–

Sales Marketing Designer

Financial Analyst

–

–

Summits & Events Lead Designer

FN Business Reporter

–

–

Summits Art & Design Director

FN Athletic Reporter

–

–

Assistant Manager, Consumer Marketing

FN Europe Editor

–

–

Director Corporate Sales, Consumer Marketing

FN Admin/Edit Assistant

–

–

–

FN Sales Coordinator

Fairchild Media is growing. We’re looking for talent across our organization. If interested, contact:

FairchildJobs@pmc.com

Indicate the job you are applying for in the subject line or you will not be considered.

12 WWD THURSDAY, OCTOBER 23, 2014

WWD.COM

FASHION SCOOPS

Mark Parker

BURBERRY TAKES RODEO DRIVE: The Nov. 7 opening of Burberry’s

first Rodeo Drive flagship will precede its receiving the 22nd

Rodeo Drive Walk of Style Award on Nov. 19, which was

revealed today by the city of Beverly Hills and the Rodeo

Drive Committee. The award, inaugurated in 2003, has been

presented to Giorgio Armani, Tom Ford, Gianni and Donatella

Versace, photographer Mario Testino, the houses of Missoni and

Ferragamo, costume designer Edith Head, and editor Diana

Vreeland, among others. Burberry, founded in 1856, plans to

celebrate its Beverly Hills store with a big bash in April. Los

Angeles locals and tourists have already

FOR MORE

glimpsed the soon-to-be-finished threeSCOOPS, SEE

story store, on the corner of Rodeo

Drive and Dayton Way. — MARCY MEDINA

WWD.com.

Nike’s Women’s Day

THERE WAS a whole lot going

on at opening day of Nike’s twoday Women’s Summit at Spring

Studios, not all of it terribly wellorganized, but the takeaway could

not have been more clear: Nike

loves the ladies, and it plans to

marshal that love into a 40 percent

increase in business by 2017.

Bridget Foley’s That’s a cool $2 billion on top of

the current $5 billion worldwide.

Diary

Another takeaway was that,

while Nike may be brilliant when

it comes to performance research and development,

its fashion show proclivities swing a little cheesy.

(Not to mention counterproductive. One part of

the show occurred on a runway lined with rows

of wispy, desert-looking fauna between which the

athletes and models walked, partially obscuring the

merch, particularly the sneakers.)

But who are we to argue with five billion bucks?

Or a female digital community of

65 million as well as two apps, the

Nike by

Nike+ Training Club App and the

Pedro

Nike+ Running App, that have

Lourenço

been downloaded 16 million and

nine million times, respectively?

In his remarks to open the

show, chief executive officer

Mark Parker spoke about the

intense degree to which women

are shaping the fitness world and

noted that today, they hold more

gym memberships than men. In

a brief postshow interview, he

elaborated on that explosion. “It’s

a cultural shift,” he said. “It’s a

convergence of a number of things

— the awareness of health and

fitness and the importance, not

just of health, but of the emotional

[aspect],” he said. “And there’s a

social element to it.”

About that $2 billion projection,

one area primed for growth

is Nike’s already explosive

e-commerce: 70 percent growth

overall in the last quarter with

purchases by women up in the

triple digits. “The whole digital

e-commerce experience is getting

so much better,” Parker noted.

“The style guide helps. There’s

fewer clicks to get through — a lot

of those basic improvements are happening. But

it does come down to the product, how good is the

product, how easy are you making [the experience],

how compelling is the presentation.”

As Parker noted, fitness is integrated into the

cultural fabric. So are other aspects of Nike’s

reality, including its relationship with the NFL,

whose uniforms it provides.

Given Nike’s focus on women, does the brand

have a seat at the league’s table when it comes

to developing a domestic violence policy? “I

PHOTOS BY GEORGE CHINSEE

CRUZ GOES STREET: Victor Cruz is turning his

wouldn’t say a seat at the table,” Parker said.

“But we have made our position known. We’re an

important partner, so we think it’s important to

make our position known. I think they, by their

own admission, they have trailed the play, so to

speak. I think they’ve learned a lot. I’ve spoken

to Commissioner [Roger] Goodell. I think he’s

learned a lot himself, personally, but also the whole

organization. Domestic violence and child abuse is

something that is not tolerable.”

Yet Parker stressed that despite the horror

stories, he believes in the affirmative power of

sports. “We take the cases of athletes in these

situations case by case,” he said. “I’m a firm

believer that athletes and sports are an incredible

source of inspiration for people around the world.”

Back to the event itself, the runway show featured

two parts; one had 27 athletes from around the world

including Nike stalwart Joan Benoit Samuelson,

Russian skater Adelina Sotnikova and Chinese

tennis player Li Na, who all wore gear that could

best be described as basic. That

was followed by a showing of

Nike’s new collaboration with

young Brazilian designer Pedro

Lourenço. Lourenço showed a

collection of black and beige that

was appealing, if low key. If the

line takes off, it could be quite a

boon to his minuscule ready-towear business. But what attracted

him to the partnership was the

chance to take advantage of Nike

technology. “It’s really important

not just for the business side,

but more for me as a designer

to experiment with technology,

which is something in my line that

is very important to me. With Nike

I had the possibility to use all of

their tools to develop technology

on clothes. I think that’s the next

big step in fashion.”

Other collections, some of a

feistier visual ilk, were shown

off the runway in various

“rotations,” although finding

them took more effort than that

warranted by the promise of a

few pairs of vibrant tights.

Amy Montagne, vice president

and general manager of Global

Nike Womens, counted among

key areas of development

performance tights, sports bras and shoes, including

Flyknit sneakers, which look fabulous. “This is a

versatile training shoe. It’s the lightest weight, but

superstrong and supportive.” One mélange knit in

a delightful pastel called to mind Chanel’s much

meatier tweed sneakers. But Nike will never be

about beauty — or any fashion trend — for its own

sake. “We will always, first and foremost, start from

the athlete, innovation and performance,” Montagne

said. “That is what inspires us.” And the promise of

all those extra billions doesn’t hurt.

eye to Japan — at least as far as the new

Kith collaboration with Japanese clothing brand Ones Stroke

is concerned. The injured wide receiver from the New York

Giants fronted the new look book campaign for the downtown

streetwear store’s Kith for Ones Stroke Genesis Collection.

“Victor has always been fashion forward,” said Kith’s

founder Ronnie Fieg. “Not only has he supported Kith for

a very long time, he is also one of my closest friends — a

brother. I felt that there would be no one better to help me

deliver this collection to the world than him.”

It will be the first time that the Japanese label will be sold

Stateside. Ones Stroke is popular in Japan and best known

for its denim workwear. The collaboration with Kith will run

in 40 different pieces, from Japanese selvedge denim pants

to reimagined robes in light denim and buffalo plaid. Prices

will range from $250 to $450 and the line will be introduced

at the new Kith shop on Saturday.

“I feel that the U.S. has always appreciated Japanese

style and culture, but it is hard for us to integrate it into our

wardrobe,” said Fieg. “Either the price tag is too high or the

sizing is too skewed. So with this project, I focused on delivering

Japanese sensibilities with an American fashion twist.”

It will mark the first time Kith has ventured into denim

bottoms. The brand — which expanded from footwear to

apparel — has previously offered tapered sweatpants. — DAVID YI

HANG TEN: A decade

has passed since Karl

Lagerfeld did a oneoff collaboration for

H&M — and the fashion

industry has never been

the same. “Inexpensive

is not ‘cheap’ anymore,

that’s why the luxury

industry has to make an

even bigger effort. I think

all that is very healthy,”

Lagerfeld muses in

The commemorative H&M book.

“The First Ten Years,”

a commemorative book H&M is releasing Nov. 6 in tandem

with its latest holiday tie-up, Alexander Wang for H&M.

Available in about 250 stores, it’s priced at 9.90 euros,

or $11.50 at current exchange, with 25 percent of proceeds

going to UNICEF.

H&M dug out unseen imagery and solicited

contributions from each of its participating designers,

including Donatella Versace, Alber Elbaz and Roberto Cavalli.

The Swedish retailer is also mounting a retrospective

exhibition of its annual collaborations at its Fifth Avenue

flagship in New York from Oct. 27.

Said Lagerfeld: “I never expected it to make such a splash.”

— MILES SOCHA

SKIN-TIGHT: Fashion and art have never been as closely

intertwined as at Paris’ Silencio on Tuesday night. Two

chairs, a pair of thigh-high boots custom-made by Francesco

Russo and bare skin — lots of it — were the main ingredients

of a performance staged by Turner Prize-winning artist

Douglas Gordon. The elusive nightclub-cum-theater designed

by director David Lynch proved the ideal venue for the brazen

if slightly obscure cabaretlike act based on an improvised

interaction between Gordon, who wore said boots with a

black shirt (and nothing else), and his female counterpart.

“It’s not about fashion any more,” explained Russo, who

had personally sewn matching gloves onto the black-andnude stiletto boots, which, when worn with the provocative

footwear, put the protagonists in even more compromising

positions, giving full view of Gordon’s private parts. Don’t

bother asking what the exact message was.

“Art is about the artist posing the questions and the person

who watches giving the answers,” was Russo’s explanation.

OK. But it struck a chord with collectors, who had

arrived in Paris ahead of FIAC, the city’s annual art fair

starting Thursday.

“In a sense, it’s like a tailor-made sculpture; each piece is

unique,” said the shoe designer, as he took measurements of

the impromptu buyers’ feet and hands while the performance

unfurled further. “I just wish I could get two instead of only

one boot,” said a young connoisseur, vowing to cherish the

boot-cum-glove as part of her private art collection.

— PAULINA SZMYDKE

Men’s Week

WWD THURSDAY, OCTOBER 23, 2014

13

Joseph Abboud Redux

by JEAN E. PALMIERI

JOSEPH ABBOUD is Joseph Abboud again.

Ending one of the longest-running sagas in

men’s fashion, the designer is finally able to

create collections under his own name again

and is launching an upscale line with Men’s

Wearhouse, where he is chief creative director.

Tonight, the Men’s Wearhouse, which

bought the Joseph Abboud brand just over a

year ago, will host an exclusive preview of the

Joseph Abboud Limited Edition Collection,

a new higher-priced lifestyle assortment of

suits, sport coats, slacks, dress and casual

shirts, knitwear, outerwear and accessories

that will be sold exclusively on a new Joseph

Abboud Web site. The merchandise will retail

for around 30 percent to 40 percent more than

the Joseph Abboud product currently sold in

Men’s Wearhouse and Moores stores in the

U.S. and Canada, with suits retailing for about

$695 versus $495 at Men’s Wearhouse.

The meat of the collection, which will be

more than 200 pieces strong, will be suits

and sport coats that are being manufactured

at the company’s factory in New Bedford,

Mass. The suits are signed and numbered

and are being touted as “a modern tribute to

the heritage of classic men’s wear, with a sophisticated color palette, luxurious weaves

and vintage fabrics.”

Abboud said the Limited Edition collection is a way to “exercise my creative

juices.” There were “no limits” on the piece

goods, styles or design details he could use,

so he was able to produce what he believes

is the “true essence of the Joseph Abboud

brand” — albeit a brand that has had many

essences over the last 14 years, ever since he

lost control of his name in 2000.

The new line was built as a collection

and the clothes “blend rather than match,”

he said. Key pieces will include sepia-toned

sport coats, mushroomy chalk stripes, herringbone suits and vested suits in “rich,

textured fabrics. There are not a lot of

flat finishes.” In its sensibility and fabric

choices, the line is reminiscent of the original Abboud collection that the designer

launched in 1987. He said with a chuckle:

“Fast-forward 25 years and I’m back on

track. It’s been an amazing journey.”

The Boston-born Abboud started his

fashion career working at the Louis Boston

retail store and after cutting his teeth at

Ralph Lauren, launched his own brand. He

sold his name and trademark in 2000 for $65

million and the brand went through several iterations and owners — with Abboud

angling to get his name back every step of

the way — before Men’s Wearhouse bought

it for $97.5 million last August. At the end

of 2012, Abboud, who filled in the gap years

with stints at several labels including Hickey

Freeman, joined Men’s Wearhouse at a time

PHOTOS BY GEORGE CHINSEE

Joseph

Abboud

Looks from the

Limited Edition

Collection.

when the men’s wear retailer was in the

midst of its own drama as it shortly after

ousted its founder and chief spokesman

George Zimmer in an acrimonious battle.

Since purchasing the Abboud brand, the

label has grown to represent 13 percent of

Men’s Wearhouse’s overall sales, which are

about $2.5 billion. And the tailored clothing

has yet to roll out to all stores. “We anticipate

this will be a $200 million business for us by

the end of this year,” Doug Ewert, chief executive officer, told WWD. And the margins are

strong. “We’re value-pricing this product, so

it’s not being promoted and the margins are

stronger,” Ewert told analysts last month.

Ewert, naturally, pooh-poohed the prevailing wisdom at the time that Men’s

Wearhouse had overpaid for the brand.

“Clearly that’s not true,” he said — although

the numbers will ultimately prove whether

he’s right or wrong.

The ceo believes the numbers will be on

his side, and that the Abboud brand can grow

to between $300 million and $400 million

within the next couple of years. “It’s really

resonating with the customer and attracting

a new customer,” he said. “And it’s selling

just as well in Canada as in the U.S. It also

gets us into the custom clothing business.”

Ewert said the Joseph Abboud custom offering is still rolling out but is selling well,

and will be marketed more aggressively

next year. “It’s a really high-quality garment,

made in the U.S. that can be delivered in

three weeks,” he said. Prices for a custom

suit, also manufactured in Massachusetts

and available only at Men’s Wearhouse

stores, start at $595.

Ewert said the factory has been running

at capacity for months and the workforce has

been grown by 50 percent since the acquisition. And he believes it

can expand further as

demand for the product grows.

Although

he

doesn’t expect

the

Limited

Edition offering

to significantly

add to the label’s

bottom line, Men’s

Wearhouse views

it as a “halo” for the

brand as a whole.

“We anticipate it will

do business, but we’re

not giving guidance on

how much,” he said — a

comment that implies it

won’t be immediately significant to the company’s

overall sales. “But it will provide a halo approach to the

product. It’s modern, classic

styling in luxurious fabrics

that showcases the craftsmanship and exclusivity of the

brand. And it will help position

Joseph as the leading modern

men’s wear authority.”