Interaction of Demand and Supply

advertisement

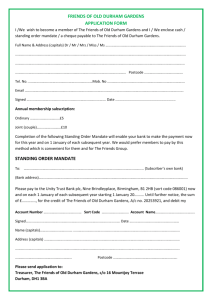

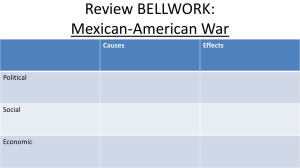

County Durham Economic Assessment: People Strand Topic Paper: Interaction of Demand and Supply Interaction of Demand and Supply Average earning have increased at a slower rate in County Durham than the regional and national averages i. Wage inflation is an indicator of the tightness of the labour market, and excessive wage growth is taken as an indicator that demand is growing at a faster than supply. Data from the Annual Survey of Hours and Earnings (ASHE) shows that wage inflation over the nine years to 2009 in County Durham was below that for Great Britain and the North East. On average, between 2000 and 2009, median annual gross pay in the County increased by 2.5% per annum compared to 3.6% in United Kingdom and 3% in the North East. ii. This is the outcome that we would have anticipated given the changes to demand and supply in County Durham. During a long period in which the country has enjoyed favourable economic conditions, demand in County Durham has failed to match the growth rates achieved elsewhere, principally due to its reliance upon a traditional manufacturing base and an under-representation of high growth sectors such as financial and professional services. The growth in demand which has been achieved has been comfortably met by an apparent increase in economic participation, at least partly achieved by moving people from benefits in to employment. County Durham employers have experienced some difficulty meeting their skills requirements iii. The National Employment and Skills Survey (NESS) is a survey of some 80,000 employers, 1,150 of which are in County Durham. It is the largest and most comprehensive survey to capture evidence of the imbalance between demand and supply, including evidence of skill shortage vacancies and skill gaps11. However, the size of the sample in County Durham means it is not possible to carry out detailed analysis at a lower spatial level or in specific sectors. iv. The survey suggests that County Durham employers have experienced some difficulty meeting their skills requirements. The rate of skills shortage vacancies (SSVs) was higher in County Durham than the regional average in two of the last three surveys and was higher than the national average in the most recent survey (which occurred in the middle of the economic downturn). v. The rate of SSVs actually increased between 2007 and 2009; a trend which is counterintuitive, as we would expect demand for skills to exceed supply at a time when the economy is growing (as experienced in the wider region and at the national level). More in depth analysis reveals that the problem is most severe for skilled trade occupations which accounted for over half of the skill shortage vacancies despite only accounting for 10% of total employment. vi. This could be caused by particularly high levels of retirement in the manufacturing sector which has an ageing workforce – this will need to be explored in more details in the full evidence report. However, overall it appears skill shortages are only a problem for certain sectors and occupations. At all other skill levels, it appears the County’s employers have been able to source the skills they require. Page i County Durham Economic Assessment: People Strand Topic Paper: Interaction of Demand and Supply Figure 1: Percentage Share of Employment and Skill Shortage Vacancies by Occupations 60% 50% Share of employment Share of SSVs 40% 30% 20% 10% 0% Source: National Employers Skills Survey The situation for skill gaps has also worsened, although this has also been a national trend vii. viii. It appears that a large proportion of the increasing number of skill gaps in County Durham have been in highly skilled occupations (especially managers). This is consistent with large increases in demand for managers and higher level skills but limited growth in the supply of high skilled people - the implication being that those people who have taken managerial jobs have been less qualified to do so than elsewhere in the country. Other than job specific skills, the skills which were most frequently found to be lacking were soft skills such as teamworking, customer handling and management skills. Most sectors appear to able to source the skills they need but there are some potential challenges specific to key sectors. These included the following: A lack of general business management skills in the manufacturing sector. This will be of growing importance as the County relies less on its cost competitiveness and more on product innovation and design Manufacturing may face additional challenges as it relies on an ageing workforce and there does not appear to be the flow of skilled young people to replace them The digital and creative sector reports a high number of skill gaps and shortages – with the most pressing need for people with level 4 qualifications. This will be of crucial importance if the sector is to continue to grow and remain competitive. Looking to the future, we expect demand for managers and professionals to continue to grow, as the activity carried out across a range of sectors will increasingly require higher level skills (due to the continuing trend for manual employment to relocate to low wage economies and be replaced by management and professional services in the UK). However, an ageing workforce will also mean demand will be very high across a range of occupations (as more and more people retire and leave the workforce). This replacement demand is likely to outweigh the effects of structural change, meaning demand for skills will still be high even in those sectors which are in decline (such as manufacturing). Page ii