q2 2014 report

advertisement

i n t e r i m

r e p o r t

Ff o

Or

R tThHeE t h

Sr

I Xe eMm

Oo

NnTtHhSs EeN

Ed

D AJPUrLi l

Y 2266t h,, 2

2 00 1144

nD

de

MESSAGE TO SHAREHOLDERS

Dear shareholders,

Sales for the second quarter ended July 26, 2014 decreased 9.7% to $68.3 million from $75.7 million for the second quarter ended July 27,

2013, resulting primarily from a decrease of 8.6% in comparable store sales. On a year-to-date basis, sales decreased 8.3% to $121.6

million as compared with $132.6 million last year. Comparable store sales decreased 7.2% for the first six months as compared to last year.

Sales were negatively impacted for the first six months of 2014 by reduced store traffic and increased promotional activity.

Net loss for the second quarter amounted to $3.0 million or $(0.10) per share (diluted) compared to a net earnings of $1.1 million or $0.04

per share (diluted) the previous year. Results for the second quarter were negatively impacted by increased promotional activity resulting in a

decline in the gross margin to 64.2% from 66.9% for the same period last year. In addition, $800,000 of the net loss is attributed to the

unrecognized tax benefit of non-capital losses of $2.8 million for Canadian income tax purposes generated in the quarter, for which a full

valuation allowance has been taken against the related deferred tax asset. Despite lower sales in the second quarter, gross margin increased to 64.2% when compared to 60.7% for the first quarter of 2014. As a

result, the Company returned to a positive adjusted EBITDA of $2.9 million in the second quarter. Efforts to reduce inventories have resulted

in a 6% decline over last year. Finally, we remain focused on cost control initiatives which yielded savings of $1.8 million for the three months

ended July 26, 2014.

For the first five weeks of the third quarter (up to August 30, 2014), total retail sales decreased 10.7% and comparable store sales decreased

9.4% compared to the same period last year.

I wish to thank our employees, customers, suppliers and our shareholders for their continued support.

(signed)

Jane Silverstone Segal, B.A.LLL

Chairman of the Board and Chief Executive Officer

September 5, 2014

Management’s Discussion & Analysis

Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with the unaudited interim condensed consolidated financial

statements for the six months ended July 26, 2014 and the audited consolidated financial statements and MD&A for the year ended January

25, 2014. The risks and uncertainties faced by Le Château Inc. (the “Company”) are substantially the same as those outlined in the

Company’s Annual Information Form and in the annual MD&A contained in the Annual Report for the year ended January 25, 2014. The

MD&A has been prepared as at September 5, 2014.

Results of Operations

Sales for the second quarter ended July 26, 2014 decreased 9.7% to $68.3 million from $75.7 million for the second quarter ended July 27,

2013, resulting primarily from a decrease of 8.6% in comparable store sales (see supplementary measures below). On a year-to-date basis,

sales decreased 8.3% to $121.6 million as compared with $132.6 million last year. Comparable store sales decreased 7.2% for the first six

months as compared to last year. Sales were negatively impacted for the first six months of 2014 by reduced store traffic and increased

promotional activity.

Earnings before interest, income taxes, depreciation, amortization, write-off and/or impairment of property and equipment and intangible

assets (“Adjusted EBITDA”) (see supplementary measures below) for the second quarter amounted to $2.9 million, compared to $7.9 million

last year. The decrease of $5.0 million in adjusted EBITDA for the second quarter was primarily attributable to the decrease of $6.8 million in

gross margin dollars, offset by a decrease in selling, general and administrative expenses of $1.8 million. The Company’s gross margin for

the second quarter of 2014 decreased to 64.2% from 66.9% in 2013, due to increased promotional activity.

Loss before interest, income taxes, depreciation, amortization, write-off and/or impairment of property and equipment and intangible assets

for the first six months ended July 26, 2014 amounted to $6.4 million, compared to earnings before interest, income taxes, depreciation,

amortization, write-off and/or impairment of property and equipment and intangible assets of $3.1 million last year. The decrease of $9.5

million in adjusted EBITDA for the first six months was primarily attributable to a decline of $11.6 million in gross margin dollars, offset by a

decrease in selling, general and administrative expenses of $2.1 million. The reduction in gross margin dollars was the result of the decrease

in the Company’s gross margin percentage to 62.7% from 66.3%, due to increased promotional activity.

Depreciation and amortization for the second quarter amounted to $4.6 million compared to $4.8 million last year. Write-off and impairment

of property and equipment relating to store closures, store renovations and underperforming stores, amounted to $533,000 in the second

quarter of 2014 (2013 – $753,000). For the first six months ended July 26, 2014, depreciation and amortization decreased to $9.2 million

from $9.6 million in 2013, due to the reduced investments in non-financial assets over the past year. On a year-to-date basis, write-off and

impairment of property and equipment amounted to $713,000 (2013 – $1.6 million).

Finance costs for the second quarter increased to $726,000 from $670,000 in 2013 and for the first six months ended July 26, 2014, finance

costs increased to $1.4 million from $1.36 million the previous year. The increases in finance costs for both periods were due to the

additional bank borrowings during the current year.

Net loss for the second quarter amounted to $3.0 million or $(0.10) per share (diluted) compared to net earnings of $1.1 million or $0.04 per

share (diluted) the previous year, mainly as a result of the decrease in the gross margin as mentioned above. In addition, $800,000 of the net

loss is attributed to the unrecognized tax benefit of non-capital losses of $2.8 million for Canadian income tax purposes generated in the

second quarter, for which a full valuation allowance has been taken against the related deferred tax asset.

For the six-month period ended July 26, 2014, the net loss amounted to $16.0 million or $(0.57) per share (diluted) compared to a net loss of

$7.1 million or $(0.26) per share (diluted) the previous year, mainly as a result of the decrease in the gross margin as mentioned above. In

addition, $2.9 million of the increase in the net loss is attributed to the unrecognized tax benefit of non-capital losses of $10.8 million for

Canadian income tax purposes generated in the six-month period ended July 26, 2014, for which a full valuation allowance has been taken

against the related deferred tax asset.

During the first six months of 2014, the Company opened one store, closed two stores and renovated five existing locations. As at July 26,

2014, the Company operated 227 stores (including 43 fashion outlet stores) compared to 233 stores (including 46 fashion outlet stores) as at

July 27, 2013. Total square footage for the Le Château network as at July 26, 2014 amounted to 1,237,000 square feet, compared to

1,267,000 square feet as at July 27, 2013.

The e-commerce business launched at the end of 2010. While the contribution from online sales remains a small percentage of overall sales,

the e-commerce platform continues to gain traction and is expanding customer reach. Included in comparable store sales for the three and

six-month periods ended July 26, 2014, are online sales which increased 7% and 24%, respectively, compared to the same period last year.

Page 1

Management’s Discussion & Analysis

Liquidity and Capital Resources

Cash flow from operating activities amounted to $11.4 million for the second quarter ended July 26, 2014, compared with $7.3 million for the

same period last year. The increase of $4.1 million in cash flow from operating activities for the second quarter of 2014 was mainly the result

of: (a) the $4.7 million of income taxes refunded, (b) the additional $3.9 million provided by non-cash working capital items, offset by (c) the

higher net loss of $4.0 million, and (d) a decrease of $408,000 in depreciation, amortization, write-off and net impairment of property and

equipment.

On a year-to-date basis, cash flow used for operating activities amounted to $5.2 million, compared with $8.4 million last year. The decrease

of $3.2 million in cash flow used for operating activities during the first six months of 2014 was mainly the result of: (a) the $5.5 million of

income taxes refunded, (b) the decrease of $6.6 million in non-cash working capital requirements, offset by (c) the higher net loss of $8.9

million, and (d) a decrease of $1.3 million in depreciation, amortization, write-off and net impairment of property and equipment.

The Company’s bank indebtedness, including the current portion, net of cash, amounted to $40.0 million at the end of the second quarter,

compared with $28.2 million as at July 27, 2013 and $29.3 million as at January 25, 2014.

On June 5, 2014, the Company renewed its asset based credit facility for a three-year term ending on June 5, 2017 with an increased limit of

$80.0 million. The revolving credit facility is collateralized by the Company’s cash, cash equivalents, marketable securities, credit card

accounts receivable and inventories, as defined in the agreement. The facility consists of revolving credit loans, which include both a swing

line loan facility limited to $15.0 million and a letter of credit facility limited to $15.0 million. The available borrowings bear interest at a rate

based on the Canadian prime rate, plus an applicable margin ranging from 0.50% to 1.00%, or a banker’s acceptance rate, plus an

applicable margin ranging from 1.75% to 2.25%. The Company is required to pay a standby fee ranging from 0.25% to 0.375% on the

unused portion of the revolving credit. The Credit Agreement requires the Company to comply with certain covenants, including restrictions

with respect to the payment of dividends and the purchase of the Company’s shares under certain circumstances. As at July 26, 2014, the

Company had drawn $43.0 million (2013 - $30.0 million) under this credit facility and had outstanding standby letters of credit totaling

$700,000 (2013 - $700,000) which reduced the availability under this credit facility. Financing costs related to obtaining the above facility

have been deferred and netted against the amounts drawn under the facility, and are being amortized over the term of the facility.

In addition, as at July 26, 2014, the Company had an import line of credit of $25.0 million which included a $1.0 million loan facility. The

import line was for letters of credit which guaranteed the payment of purchases from foreign suppliers. Amounts drawn under these facilities

were payable on demand, bearing interest at rates based on the bank’s prime rate plus 0.50% for loans in Canadian and U.S. dollars.

Furthermore, the terms of the banking agreement required the Company to meet certain non-financial covenants. As at July 26, 2014, the

Company had outstanding letters of credit totaling $5.7 million (2013 - $9.8 million) and no other amounts drawn under this facility (2013 $175,000).

As of September 1, 2014, the Company no longer has a separate $25.0 million import line of credit and all letters of credit opened will be

secured under the $80.0 million asset based credit facility.

Aside from the letters of credit outstanding, the Company did not have any other off-balance sheet financing arrangements as at July 26,

2014.

Capital expenditures for the second quarter amounted to $1.5 million, compared to $1.1 million for the same period last year. Capital

expenditures for the first six months of 2014 amounted to $6.6 million, compared to $4.3 million for the same period last year and are

primarily related to the opening of one new store, the renovation and/or expansion of certain existing stores and investments in information

technology. Capital expenditures were financed with the Company’s credit facility as well as the $5.0 million long-term debt financing

obtained during the first quarter of 2014.

Financial Position

Working capital stood at $83.4 million at the end of the second quarter of 2014, compared to $81.0 million as at July 27, 2013 and $74.9

million as at January 25, 2014.

Long-term debt, including the current portion, amounted to $11.7 million as at July 26, 2014, compared with $15.8 million as at January 25,

2014. The decrease in long-term debt is attributable to the repayments of $4.1 million during the first six months of 2014. As at July 26, 2014,

the long-term debt to equity ratio decreased to 0.10:1 from 0.13:1 as at January 25, 2014.

On March 3, 2014, the Company borrowed $5.0 million from a company that is directly controlled by the Chairman and Chief Executive

Officer and director of the Company. On June 18, 2014, the $5.0 million loan was converted into 2,617,801 Class A subordinate voting

shares at $1.91 per share. The loan was unsecured and carried an annual interest of 5.5%, payable monthly, with capital repayment payable

at maturity on February 28, 2018.

Page 2

Management’s Discussion & Analysis

Inventory

Total inventories as at July 26, 2014 amounted to $123.0 million compared to $131.2 million as at July 27, 2013 and $124.9 million as at

January 25, 2014. Total finished goods inventory at the end of the second quarter decreased by 4.7% compared to July 27, 2013 and by

0.3% compared to January 25, 2014.

As part of the Company’s inventory management plan, the Company continues to use 43 outlets (389,000 square feet) in its network to sell

prior season discounted merchandise. On-line selling of these goods was enabled in the first quarter of 2012 through an on-line outlet

division.

Outstanding Share Data

As at September 5, 2014, there are 25,403,762 Class A subordinate voting shares and 4,560,000 Class B voting shares outstanding.

Furthermore, there are 2,829,000 stock options outstanding with exercise prices ranging from $1.44 to $13.25, of which 1,027,500 are

exercisable. During the second quarter ended July 26, 2014, the Company granted 10,000 options to purchase Class A subordinate voting

shares at an exercise price of $1.91. On June 18, 2014, a $5.0 million loan payable to a company that is directly controlled by the Chairman and Chief Executive Officer and

director of the Company was converted into 2,617,801 Class A subordinate voting shares at $1.91 per share.

Critical Accounting Policies and Estimates

Critical Accounting Estimates:

The preparation of financial statements requires the Company to estimate the effect of various matters that are inherently uncertain as of the

date of the financial statements. Each of these required estimates varies in regard to the level of judgment involved and its potential impact

on the Company’s reported financial results. Estimates are deemed critical when a different estimate could have reasonably been used or

where changes in the estimates are reasonably likely to occur from period to period, and would materially impact the Company’s financial

position, changes in financial position or results of operations. The Company’s significant accounting policies are discussed in notes 3 and 5

of the audited consolidated financial statements for the year ended January 25, 2014; critical estimates inherent in these accounting policies

are discussed in the following paragraphs.

Inventory valuation

The Company records a write-down to reflect management’s best estimate of the net realizable value of inventory which includes

assumptions and estimates for future sell-through of units, selling prices, as well as disposal costs, where appropriate, based on historical

experience. Management continually reviews the carrying value of its inventory, to assess whether the write-down is adequate, based on

current economic conditions and an assessment of sales trends.

Impairment of non-financial assets

Non-financial assets are reviewed for impairment if events or changes in circumstances indicate that the carrying amount may not be

recoverable. A review for impairment is conducted by comparing the carrying amount of the cash generating unit’s (“CGU”) assets with their

respective recoverable amounts based on value in use. Value in use is determined based on management’s best estimate of expected future

cash flows, which includes estimates of growth rates, from use over the remaining lease term and discounted using a pre-tax weighted

average cost of capital.

Management is required to make significant judgments in determining if individual commercial premises in which it carries out its activities

are individual CGUs, or if these units should be aggregated at a district or regional level to form a CGU. The significant judgments applied by

management in determining if stores should be aggregated in a given geographic area to form a CGU include the determination of expected

customer behaviour and whether customers could interchangeably shop in any of the stores in a given area and whether management views

the cash flows of the stores in the group as inter-dependant.

Deferred revenue

The Company measures the gift card liability and breakage income by estimating the value of gift cards that are not expected to be

redeemed by customers, based on historical redemption patterns.

Provisions

When a provision for onerous contracts is recorded, the provision is determined based on management’s best estimate of the present value

of the lower of the expected cost of terminating the contract and the expected net cost of operating under the contract. Assumptions and

estimates are made in relation to discount rates, the expected cost to terminate a contract and the related timing of those costs.

Page 3

Management’s Discussion & Analysis

Income Taxes

From time to time, the Company is subject to audits related to tax risks, and uncertainties exist with respect to the interpretation of tax

regulations, changes in tax laws, and the amount and timing of future taxable income. Differences arising between the actual results and the

assumptions made, or future changes to such assumptions, could necessitate future adjustments to taxable income and income tax expense

already recorded. The Company establishes provisions if required, based on reasonable estimates, for possible consequences of audits by

the tax authorities. The amount of such provisions is based on various factors, such as experience of previous tax audits and differing

interpretations of tax regulations by the entity and the responsible tax authority, which may arise on a wide variety of issues.

Stock-based compensation

The Company measures the cost of equity-settled transactions with employees by reference to the fair value of the equity instruments at the

date on which they are granted. Estimating fair value for share-based payments requires determining the most appropriate valuation model

for a grant of equity instruments, which is dependent on the terms and conditions of the grant. This also requires determining the most

appropriate inputs to the valuation model including the assumptions with respect to the expected life of the option, volatility and dividend

yield.

Accounting Standards Implemented in 2014:

There were no new accounting standards implemented during the six months ended July 26, 2014.

New Standards Not Yet Effective:

IFRS 9, “Financial Instruments”, partially replaces the requirements of IAS 39, “Financial Instruments: Recognition and Measurement”. This

standard is the first step in the project to replace IAS 39. The IASB intends to expand IFRS 9 to add new requirements for the classification

and measurement of financial liabilities, derecognition of financial instruments, impairment and hedge accounting to become a complete

replacement of IAS 39. These changes are applicable for annual periods beginning on or after January 1, 2015, with earlier application

permitted. The Company has not yet assessed the future impact of this new standard on its consolidated financial statements.

Supplementary Measures

In addition to discussing earnings measures in accordance with IFRS, this MD&A provides adjusted EBITDA as a supplementary earnings

measure, which is defined as earnings (loss) before interest, income taxes, depreciation, amortization, write-off and/or impairment of

property and equipment and intangible assets. Adjusted EBITDA is provided to assist readers in determining the ability of the Company to

generate cash from operations and to cover financial charges. It is also widely used for valuation purposes for public companies in our

industry.

The following table reconciles adjusted EBITDA to loss before income tax recovery disclosed in the unaudited interim condensed

consolidated statements of loss for the three and six-month periods ended July 26, 2014 and July 27, 2013:

(in thousands of Canadian dollars)

Earnings (loss) before income taxes

Depreciation and amortization

Write-off and net impairment of property and

equipment and intangible assets

Finance costs

Finance income

Adjusted EBITDA

$

$

For the three months ended

July 26, 2014

July 27, 2013

(2,970)

$

1,707

4,609

4,797

533

726

(8)

2,890

$

753

670

(5)

7,922

For the six months ended

July 26, 2014

July 27, 2013

$

(17,731)

$

(9,410)

9,200

9,569

$

713

1,413

(11)

(6,416)

$

1,594

1,360

(8)

3,105

The Company also discloses comparable store sales which are defined as sales generated by stores that have been open for at least one

year. The following table reconciles comparable store sales to total sales disclosed in the unaudited interim condensed consolidated

statements of loss for the three and six-month periods ended July 26, 2014 and July 27, 2013:

(in thousands of Canadian dollars)

Total sales

Non-comparable store sales

Comparable store sales

$

$

For the three months ended

July 26, 2014

July 27, 2013

68,304

$

75,680

(821)

(1,882)

67,483

$

73,798

For the six months ended

July 26, 2014

July 27, 2013

121,609

132,562

$

$

(2,881)

(4,611)

118,728

127,951

$

$

The above measures do not have a standardized meaning prescribed by IFRS and may not be comparable to similar measures presented

by other companies.

Page 4

Management’s Discussion & Analysis

Summary of Quarterly Results

The table below presents selected financial data for the eight most recently reported quarters. This unaudited quarterly information has been

prepared under IFRS. The operating results for any quarter are not necessarily indicative of the results to be expected for any future period.

(In thousands of Canadian dollars, except per share amounts)

Second quarter ended July 26, 2014

First quarter ended April 26, 2014

Fourth quarter ended January 25, 2014

Third quarter ended October 26, 2013

Second quarter ended July 27, 2013

First quarter ended April 27, 2013

Fourth quarter ended January 26, 2013

Third quarter ended October 27, 2012

$

Sales

68,304

53,305

76,918

65,360

75,680

56,882

80,800

63,736

Earnings (loss)

before

income taxes

$

(2,970)

(14,761)

(5,012)

(7,286)

1,707

(11,117)

409

(5,565)

Net

earnings (loss)

$

(2,970)

(13,045)

(3,860)

(5,016)

1,077

(8,187)

158

(3,625)

Earnings (loss) per share

Basic

Diluted

$

(0.10) $

(0.10)

(0.48)

(0.48)

(0.15)

(0.15)

(0.18)

(0.18)

0.04

0.04

(0.30)

(0.30)

0.01

0.01

(0.14)

(0.14)

Retail sales are traditionally higher in the fourth quarter due to the holiday season. In addition, fourth quarter earnings results are usually

reduced by post holiday sale promotions.

Controls and Procedures

Disclosure Controls and Procedures

The Chief Executive Officer (“CEO”) and the Chief Financial Officer (“CFO”) have designed disclosure controls and procedures (“DC&P”), or

have caused them to be designed under their supervision, to provide reasonable assurance that material information relating to the

Company has been made known to them and has been properly disclosed in the annual and quarterly regulatory filings.

Internal Controls over Financial Reporting

The CEO and CFO have designed internal controls over financial reporting (“ICFR”), or have caused them to be designed under their

supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the financial statements for

external purposes in accordance with IFRS. The CEO and CFO have evaluated whether there were changes to its ICFR during the three and

six-month periods ended July 26, 2014 that have materially affected, or are reasonably likely to materially affect, its ICFR. No such changes

were identified through their evaluation.

Forward-looking Statements

This “Management’s Discussion and Analysis” may contain forward-looking statements relating to the Company and/or the environment in

which it operates that are based on the Company's expectations, estimates and forecasts. These statements are not guarantees of future

performance and involve risks and uncertainties that are difficult to predict and/or are beyond the Company's control. A number of factors

may cause actual outcomes and results to differ materially from those expressed. These factors also include those set forth in other public

filings of the Company. Therefore, readers should not place undue reliance on these forward-looking statements. In addition, these forwardlooking statements speak only as of the date made and the Company disavows any intention or obligation to update or revise any such

statements as a result of any event, circumstance or otherwise, except to the extent required under applicable securities law.

Factors which could cause actual results or events to differ materially from current expectations include, among other things: the ability of the

Company to successfully implement its business initiatives and whether such business initiatives will yield the expected benefits; competitive

conditions in the businesses in which the Company participates; changes in consumer spending; general economic conditions and normal

business uncertainty; seasonality and weather patterns; changes in the Company’s relationship with its suppliers; lease renewals;

information technology security and loss of customer data; fluctuations in foreign currency exchange rates; interest rate fluctuations; liquidity

risk; and changes in laws, rules and regulations applicable to the Company. The foregoing list of risk factors is not exhaustive and other

factors could also adversely affect our results.

Page 5

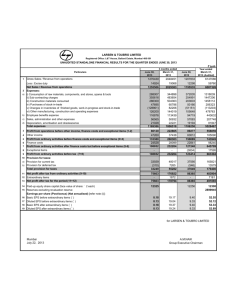

FINANCIAL HIGHLIGHTS

(Unaudited)

(In units except where otherwise stated)

Working capital ($'000)

Current ratio

Quick ratio

Long-term debt to equity ratio

Capital expenditures ($'000)

Number of stores at end of quarter

Total number of square feet ('000)

Book value per share

July 26, 2014

83,362

2.74

0.17

0.10

$

6,636

227

1,237

$

3.80

$

$

$

$

July 27, 2013

80,986

2.32

0.18

0.15

4,345

233

1,267

4.87

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands of Canadian dollars)

ASSETS

Current assets

Cash

Accounts receivable (note 3)

Income taxes refundable

Derivative financial instruments

Inventories (notes 3 and 4)

Prepaid expenses

Total current assets

Property and equipment (note 5)

Intangible assets (note 6)

As at

July 26, 2014

$

$

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Current portion of bank indebtedness (note 3)

Trade and other payables (note 7)

Deferred revenue

Current portion of provisions (note 8)

Derivative financial instruments

Current portion of long-term debt

Total current liabilities

Bank indebtedness (note 3)

Long-term debt

Provisions (note 8)

Deferred income taxes

Deferred lease credits

Total liabilities

$

Shareholders' equity

Share capital (note 9)

Contributed surplus

Retained earnings

Accumulated other comprehensive income (loss)

Total shareholders' equity

$

2,468

1,691

1,319

122,996

2,671

131,145

66,851

3,557

201,553

22,052

16,723

3,135

332

372

5,169

47,783

20,400

6,543

481

12,373

87,580

47,967

4,140

62,238

(372)

113,973

201,553

As at

July 27, 2013

$

$

$

$

1,507

1,638

5,715

4

131,199

2,460

142,523

76,716

4,453

223,692

29,752

20,353

3,041

246

8,145

61,537

11,712

474

2,239

14,678

90,640

42,876

3,044

87,129

3

133,052

223,692

As at

January 25, 2014

$

$

$

$

1,446

1,476

6,663

418

124,878

2,292

137,173

69,870

3,815

210,858

30,767

19,553

3,712

265

7,987

62,284

7,843

391

1,829

13,412

85,759

42,960

3,581

78,253

305

125,099

210,858

See accompanying notes

Page 6

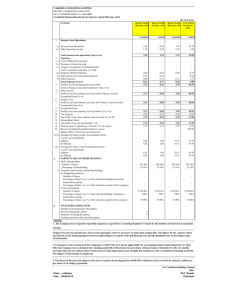

CONSOLIDATED STATEMENTS OF EARNINGS (LOSS)

(Unaudited)

(In thousands of Canadian dollars, except per share information)

Sales (note 11)

Cost of sales and expenses

Cost of sales (note 4)

Selling (note 5)

General and administrative (notes 5 and 6)

Results from operating activities

Finance costs

Finance income

Earnings (loss) before income taxes

Income tax expense (recovery)

Net earnings (loss)

Net earnings (loss) per share (note 10)

Basic

Diluted

For the six months ended

July 26, 2014

July 27, 2013

$

121,609

$

132,562

For the three months ended

July 26, 2014

July 27, 2013

$

68,304

$

75,680

24,453

37,469

8,634

70,556

25,036

39,408

8,864

73,308

45,406

74,656

17,876

137,938

44,716

78,012

17,892

140,620

(2,252)

726

(8)

(2,970)

2,372

670

(5)

1,707

630

1,077

(16,329)

1,413

(11)

(17,731)

(1,716)

(16,015)

(8,058)

1,360

(8)

(9,410)

(2,300)

(7,110)

$

(2,970)

$

$

(0.10)

(0.10)

$

Weighted average number of shares outstanding ('000)

28,524

0.04

0.04

$

$

(0.57)

(0.57)

27,256

$

$

(0.26)

(0.26)

27,933

27,249

See accompanying notes

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Unaudited)

(In thousands of Canadian dollars)

Net earnings (loss)

Other comprehensive income (loss) to be reclassified to profit

or loss in subsequent periods

Change in fair value of forward exchange contracts

Income tax expense

For the three months ended

July 26, 2014

July 27, 2013

$

(2,970)

$

1,077

Realized forward exchange contracts reclassified

to net earnings (loss)

Income tax recovery (expense)

Total other comprehensive income (loss)

Comprehensive income (loss)

$

For the six months ended

July 26, 2014

July 27, 2013

$

(16,015)

$

(7,110)

(360)

(8)

(368)

4

(1)

3

(388)

(388)

1

1

16

16

(352)

(3,322)

3

(1)

2

5

1,082

(402)

113

(289)

(677)

(16,692)

(212)

59

(153)

(152)

(7,262)

$

$

$

See accompanying notes

Page 7

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(Unaudited)

(In thousands of Canadian dollars)

SHARE CAPITAL

Balance, beginning of period

Issuance of subordinate voting shares upon conversion

of long-term debt (notes 9 and 13)

Issuance of subordinate voting shares upon exercise of options

Reclassification from contributed surplus due to exercise of share options

Balance, end of period

CONTRIBUTED SURPLUS

Balance, beginning of period

Stock-based compensation expense

Exercise of share options

Balance, end of period

RETAINED EARNINGS

Balance, beginning of period

Net earnings (loss)

Balance, end of period

ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

Balance, beginning of period

Other comprehensive income (loss) for the period

Balance, end of period

Total shareholders’ equity

For the three months ended

July 26, 2014

July 27, 2013

For the six months ended

July 26, 2014

July 27, 2013

$

42,962

$

42,960

$

5,000

3

2

47,967

$

5,000

5

2

47,967

$

$

$

$

$

3,871

271

(2)

4,140

65,208

(2,970)

62,238

$

42,740

$

125

11

42,876

$

$

$

$

$

$

(20)

(352)

(372)

$

113,973

2,784

271

(11)

3,044

86,052

1,077

87,129

$

$

$

$

$

$

(2)

5

3

$

133,052

3,581

561

(2)

4,140

78,253

(16,015)

62,238

$

42,740

$

125

11

42,876

$

2,664

391

(11)

3,044

$

$

$

94,239

(7,110)

87,129

$

$

305

(677)

(372)

$

155

(152)

3

$

113,973

$

133,052

See accompanying notes

Page 8

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands of Canadian dollars)

OPERATING ACTIVITIES

Net earnings (loss)

Adjustments to determine net cash from operating activities

Depreciation and amortization (notes 5 and 6)

Write-off and impairment of property and equipment (note 5)

Amortization of deferred lease credits

Deferred lease credits

Stock-based compensation

Provisions

Finance costs

Interest paid

Income tax expense (recovery)

For the three months ended

July 26, 2014

July 27, 2013

$

(2,970)

$

1,077

For the six months ended

July 26, 2014

July 27, 2013

$

(16,015)

$

(7,110)

Net change in non-cash working capital items related to operations

Income taxes refunded

Cash flows related to operating activities

4,609

533

(589)

260

271

144

726

(686)

2,298

4,425

4,650

11,373

4,797

753

(841)

39

271

16

670

(658)

630

6,754

527

7,281

9,200

713

(1,173)

134

561

157

1,413

(1,261)

(1,716)

(7,987)

(2,735)

5,548

(5,174)

9,569

1,594

(1,273)

39

391

(38)

1,360

(1,228)

(2,300)

1,004

(9,375)

(8,371)

FINANCING ACTIVITIES

Increase (decrease) in bank indebtedness

Proceeds of long-term debt

Repayment of long-term debt

Issue of capital stock upon exercise of options

Cash flows related to financing activities

(7,662)

(2,065)

3

(9,724)

(5,677)

(1,980)

125

(7,532)

11,945

5,000

(4,118)

5

12,832

16,592

(4,277)

125

12,440

INVESTING ACTIVITIES

Additions to property and equipment and

intangible assets (notes 5 and 6)

Cash flows related to investing activities

(1,515)

(1,515)

(1,097)

(1,097)

(6,636)

(6,636)

(4,345)

(4,345)

134

2,334

2,468

(1,348)

2,855

1,507

1,022

1,446

2,468

(276)

1,783

1,507

Increase (decrease) in cash

Cash, beginning of period

Cash, end of period

$

$

$

$

See accompanying notes

Page 9

Notes to the Interim Condensed Consolidated Financial Statements

(Unaudited –Tabular figures in thousands of Canadian dollars, except share information)

1. Corporate information

The unaudited condensed interim consolidated financial statements of Le Château Inc. (the “Company”) for the three and six-month periods

ended July 26, 2014 were authorized for issue on September 5, 2014 in accordance with a resolution of the Board of Directors. The

Company is incorporated and domiciled in Canada and its shares are publicly traded. The registered office is located in Montreal, Quebec,

Canada. The Company’s principal business activity is the retail of fashion apparel, accessories and footwear aimed at style-conscious

women and men.

2. Basis of preparation

The unaudited interim condensed consolidated financial statements for the three and six-month periods ended July 26, 2014 have been

prepared in accordance with IAS 34 “Interim Financial Reporting”. The same accounting policies were followed in the preparation of these

unaudited interim condensed consolidated financial statements as those used in the preparation of the most recent audited annual

consolidated financial statements for the year ended January 25, 2014. These interim condensed consolidated financial statements for the

three and six-month periods ended July 26, 2014 should be read together with the audited annual consolidated financial statements for the

year ended January 25, 2014 prepared in accordance with International Financial Reporting Standards (“IFRS”).

New Accounting Standards Implemented

There were no new accounting standards implemented during the six months ended July 26, 2014.

Basis of consolidation

The unaudited interim condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiary.

The unaudited interim financial statements of the subsidiary are prepared for the same reporting period as the parent company, using

consistent accounting policies. All intercompany transactions, balances and unrealized gains or losses have been eliminated. The Company

has no interests in special purpose entities.

3. Credit facilities

On June 5, 2014, the Company renewed its asset based credit facility for a three-year term ending on June 5, 2017 with an increased limit of

$80.0 million. The revolving credit facility is collateralized by the Company’s cash, cash equivalents, marketable securities, credit card

accounts receivable and inventories, as defined in the agreement. The facility consists of revolving credit loans, which include both a swing

line loan facility limited to $15.0 million and a letter of credit facility limited to $15.0 million. The available borrowings bear interest at a rate

based on the Canadian prime rate, plus an applicable margin ranging from 0.50% to 1.00%, or a banker’s acceptance rate, plus an

applicable margin ranging from 1.75% to 2.25%. The Company is required to pay a standby fee ranging from 0.25% to 0.375% on the

unused portion of the revolving credit. The Credit Agreement requires the Company to comply with certain covenants, including restrictions

with respect to the payment of dividends and the purchase of the Company’s shares under certain circumstances. As at July 26, 2014, the

Company had drawn $43.0 million (2013 - $30.0 million) under this credit facility and had outstanding standby letters of credit totaling

$700,000 (2013 - $700,000) which reduced the availability under this credit facility. Financing costs related to obtaining the above facility

have been deferred and netted against the amounts drawn under the facility, and are being amortized over the term of the facility.

In addition, as at July 26, 2014, the Company had an import line of credit of $25.0 million which included a $1.0 million loan facility. The

import line was for letters of credit which guaranteed the payment of purchases from foreign suppliers. Amounts drawn under these facilities

were payable on demand, bearing interest at rates based on the bank’s prime rate plus 0.50% for loans in Canadian and U.S. dollars.

Furthermore, the terms of the banking agreement required the Company to meet certain non-financial covenants. As at July 26, 2014, the

Company had outstanding letters of credit totaling $5.7 million (2013 - $9.8 million) and no other amounts drawn under this facility (2013 $175,000).

As of September 1, 2014, the Company no longer has a separate $25.0 million import line of credit and all letters of credit opened will be

secured under the $80.0 million asset based credit facility.

4. Inventories

Raw materials

Work-in-process

Finished goods

Finished goods in transit

July 26, 2014

$

7,401

2,394

107,160

6,041

$

122,996

July 27, 2013

$

8,211

3,288

112,457

7,243

$

131,199

January 25, 2014

$

8,181

2,782

107,523

6,392

$

124,878

Page 10

Notes to the Interim Condensed Consolidated Financial Statements

The cost of inventory recognized as an expense and included in cost of sales for the three and six-month periods ended July 26, 2014 was

$24.4 million and $45.4 million, respectively (2013 – $25.0 million and $44.7 million). For the three and six-month periods ended July 26,

2014, the Company recorded $1.6 million of write-downs as a result of net realizable value being lower than cost (2013 – $1.8 million) and

$831,000 of reversals of inventory write-downs recognized in prior periods (2013 – $1.4 million).

5. Property and equipment

Depreciation for the three and six-month periods ended July 26, 2014 and July 27, 2013 is reported in the consolidated statements of

earnings (loss) as follows:

Selling expenses

General and administrative expenses

For the three months ended

July 26, 2014

July 27, 2013

$

3,423

$

3,596

733

753

$

4,156

$

4,349

For the six months ended

July 26, 2014

July 27, 2013

$

6,856

$

7,159

1,456

1,516

$

8,312

$

8,675

Additions to property and equipment for the three and six-month periods ended July 26, 2014 amounted to $1.2 million and $6.0 million

respectively (2013 – $677,000 and $3.7 million).

Write-off of property and equipment for the three and six-month periods ended July 26, 2014 amounted to $7,000 and $187,000, respectively

(2013 – $342,000 and $742,000). This property and equipment was primarily related to leasehold improvements and furniture and fixtures,

which are no longer in use as a result of store renovations and closures.

An assessment of impairment indicators was performed which caused the Company to review the recoverable amount of the property and

equipment for certain cash generating units (“CGUs”) with an indication of impairment, consisting primarily of under-performing stores.

Impairment losses for each of the three and six-month periods ended July 26, 2014 amounted to $526,000, respectively (2013 – $411,000

and $852,000, respectively). These losses, related to store leasehold improvements and furniture and fixtures, were determined by

comparing the carrying amount of the CGU’s assets with their respective recoverable amounts based on value in use and is included in

selling expenses. Value in use was determined based on management’s best estimate of expected future cash flows from use over the

remaining lease term, and was then discounted using a pre-tax weighted average cost of capital of 19.4% (12.5% after-tax). No impairment

losses recognized in prior periods were reversed.

6. Intangible assets

Additions to intangible assets for the three and six-month periods ended July 26, 2014 amounted to $329,000 and $630,000 (2013 –

$420,000 and $675,000). Amortization for the three and six-month periods ended July 26, 2014 amounted to $453,000 and $888,000,

respectively (2013 – $448,000 and $894,000) and is reported in the consolidated statements of earnings (loss) under general and

administrative expenses. No impairment of intangible assets was recorded during the three and six-month periods (2013 – NIL).

7. Trade and other payables

Trade payables

Non-trade payables due to related parties

Other non-trade payables

Accruals related to compensation and employee benefits

July 26, 2014

$

8,493

23

3,161

5,046

$

16,723

July 27, 2013

$

11,831

23

3,502

4,997

$

20,353

January 25, 2014

$

10,290

23

3,986

5,254

$

19,553

8. Provisions

Balance, January 25, 2014

Arising during the period

Amortization

Balance, July 26, 2014

Less: current portion

$

656

300

(143)

813

(332)

481

Page 11

Notes to the Interim Condensed Consolidated Financial Statements

Provisions for onerous contracts have been recognized in respect of store leases where the unavoidable costs of meeting the obligations

under the lease agreements exceed the economic benefits expected to be received from the contract. The provision was determined based

on the present value of the lower of the expected cost of terminating the contract and the expected net cost of operating under the contract.

9. Share capital

a)

Issued and outstanding

July 26, 2014

Class A subordinate voting shares

Balance, beginning of period

Issuance of subordinate voting shares upon conversion of long-term debt

(note 13)

Issuance of subordinate voting shares upon exercise of options

Reclassification from contributed surplus due to exercise of share options

Balance, end of period

Class B voting shares

January 25, 2014

Number of

shares

$

Number of

shares

$

22,782,461

42,558

22,682,961

42,338

2,617,801

5,000

-

-

3,500

25,403,762

5

2

47,565

99,500

22,782,461

159

61

42,558

4,560,000

29,963,762

402

47,967

4,560,000

27,342,461

402

42,960

All issued shares are fully paid.

b)

Stock option plan

The status of the Company’s stock option plan is summarized as follows:

July 26, 2014

Outstanding at beginning of period

Granted

Exercised

Expired

Forfeited

Outstanding at end of period

Options exercisable at end of period

Options

3,126,200

10,000

(3,500)

(169,200)

(104,500)

2,859,000

1,047,500

Weighted

Average

Exercise price

$

4.01

1.91

1.44

9.40

2.80

$

3.74

$

4.41

July 27, 2013

Options

2,255,700

1,026,000

(75,500)

(18,000)

3,188,200

611,900

Weighted

Average

Exercise price

$

3.63

4.59

1.65

1.74

$

4.00

$

6.15

10. Earnings per share

The number of shares used in the earnings per share calculation is as follows:

Weighted average number of shares outstanding - basic

Dilutive effect of stock options

Weighted average number of shares outstanding - diluted

For the three months ended

July 26, 2014

July 27, 2013

28,523,641

27,255,812

265,420

684,318

28,789,061

27,940,130

For the six months ended

July 26, 2014

July 27, 2013

27,933,226

27,249,387

358,969

668,261

27,917,648

28,292,195

Because the Company reported a net loss for the three and six-month periods ended July 26, 2014, the weighted average number of shares

used for basic and diluted loss per share is the same, as the effect of stock options would reduce the loss per share, and therefore be antidilutive. As at July 27, 2013, a total of 1,403,700 stock options were excluded from the calculation of diluted earnings per share as these

were deemed to be anti-dilutive.

Page 12

Notes to the Interim Condensed Consolidated Financial Statements

11. Segmented information

The Company operates in a single business segment which is the retail of apparel, accessories and footwear aimed at fashion-conscious

women and men. The Company’s assets are located in Canada.

For the three months ended

July 26, 2014

July 27, 2013

Sales by division

Ladies' Clothing

Men's Clothing

Footwear

Accessories

$

37,765

12,407

8,613

9,519

68,304

$

$

42,334

13,893

8,751

10,702

75,680

$

For the six months ended

July 26, 2014

July 27, 2013

$

$

69,710

20,587

14,998

16,314

121,609

$

76,209

23,121

14,900

18,332

132,562

$

12. Financial instruments

Fair values

July 26, 2014

Carrying

value

Financial assets

Derivative financial instruments

Financial liabilities

Derivative financial instruments

Long-term debt

January 25, 2014

Fair

value

Carrying

value

-

-

372

11,712

$ 12,084

372

11,695

$ 12,067

$

418

15,830

$ 15,830

Fair

value

$

418

15,789

$ 15,789

The Company has determined the estimated fair values of its financial instruments based on appropriate valuation methodologies; however,

considerable judgment is required to develop these estimates. The estimated fair value amounts can be materially affected by the use of

different assumptions or methodologies. The methods and assumptions used to estimate the fair value of financial instruments are described

below:

The fair values of derivative financial instruments have been determined by reference to quoted market prices of instruments with

similar characteristics (Level 2).

The estimated fair value of long-term debt was determined by discounting expected cash flows at rates currently offered to the

Company for similar debt (Level 2).

There were no significant transfers between Level 1 and Level 2 of the fair value hierarchy during the periods presented.

Financial instrument risk management

There has been no change with respect to the Company’s overall risk exposure during the three and six-month periods ended July 26, 2014.

Disclosures relating to exposure to risks, in particular credit risk, liquidity risk, foreign exchange risk and interest rate risk are provided below.

Credit risk

Credit risk is the risk of an unexpected loss if a customer or counterparty to a financial instrument fails to meet its contractual obligations. The

Company’s financial instruments that are exposed to concentrations of credit risk are primarily cash and forward exchange contracts. The

Company limits its exposure to credit risk with respect to cash by investing available cash with major Canadian chartered banks. The

Company only enters into forward exchange contracts with Canadian chartered banks to minimize credit risk.

The Company’s cash is not subject to any external restrictions. The Company has an investment policy that monitors the safety and

preservation of principal and investments, which limits the amount invested by issuer.

Page 13

Notes to the Interim Condensed Consolidated Financial Statements

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they become due. The Company’s approach to

managing liquidity risk is to ensure, to the extent possible, that it will always have sufficient liquidity to meet liabilities when due. The

Company’s liquidity follows a seasonal pattern based on the timing of inventory purchases and capital expenditures. As at July 26, 2014, the

Company had $2.5 million in cash. In addition, as outlined in note 3, the Company had a committed asset based credit facility of $80.0 million

of which $43.0 million was drawn as at July 26, 2014, as well as an import line of credit of $25.0 million, which includes a $1.0 million loan

facility. The Company expects to finance its store renovation program through cash flows from operations and long-term debt as well as its

asset based credit facility. The Company expects that its trade and other payables will be discharged within 90 days and its long-term debt

discharged as contractually agreed and as disclosed elsewhere in these interim condensed consolidated financial statements or as disclosed

in its annual consolidated financial statements.

Market risk – foreign exchange risk

The Company’s foreign exchange risk is primarily limited to currency fluctuations between the Canadian and U.S. dollar. In order to protect

itself from the risk of losses should the value of the Canadian dollar decline compared to the foreign currency, the Company uses forward

contracts to fix the exchange rate of a substantial portion of its expected U.S. dollar requirements. The contracts are matched with

anticipated foreign currency purchases.

Their nominal and contract values as at July 26, 2014 are as follows:

Average contractual

exchange rate

Purchase contracts

U.S. dollar

1.1030

Nominal foreign

currency value

(000's)

Contract value

$

(000's)

18,905

20,853

The range of maturity of these contracts is from July 28, 2014 to December 22, 2014. As at July 26, 2014, the fair value of these contracts

resulted in an unrealized foreign exchange loss of $372,000 (2013 – unrealized foreign exchange gain of $4,000), all of which is expected to

be reclassified to earnings within the next 12 months.

Market risk – interest rate risk

Financial instruments that potentially subject the Company to cash flow interest rate risk include financial assets and liabilities with variable

interest rates and consist of cash and bank indebtedness. As at July 26, 2014, cash consisted of cash on hand and balances with banks.

Financial assets and financial liabilities that bear interest at fixed rates are subject to fair value interest rate risk. The Company’s long-term

debt is the only financial liability bearing a fixed interest rate. It is recorded at amortized cost.

13. Related party transactions

In addition to compensation earned by key management during the three and six-month periods ended July 26, 2014, the following are

related party transactions that have occurred.

Companies that are directly or indirectly controlled by a director sublease real estate from the Company. Total amounts earned under the

sublease during the three and six-month periods ended July 26, 2014 amounted to $68,000 and $135,000, respectively (July 27, 2013

$70,000 and $155,000).

During the year ended January 28, 2012, the Company borrowed $10.0 million from a company that is directly controlled by a director of the

Company. The loan amount outstanding as at July 26, 2014 was $5.0 million and bears interest at an annual rate of 5.5%, payable monthly,

with capital repayment payable at maturity on January 31, 2016. For the three and six-month periods ended July 26, 2014, the Company

recorded interest expense of $68,000 and $137,000, respectively (July 27, 2013 - $85,000 and $179,000).

On March 3, 2014, the Company borrowed $5.0 million from a company that is directly controlled by the Chairman and Chief Executive

Officer and director of the Company. On June 18, 2014, the $5.0 million loan was converted into 2,617,801 Class A subordinate voting

shares at $1.91 per share. For the three and six-month periods ended July 26, 2014, the Company recorded interest expense of $36,000

and $81,000, respectively. The loan was unsecured and carried an annual interest of 5.5%, payable monthly, with capital repayment payable

at maturity on February 28, 2018.

Page 14

Notes to the Interim Condensed Consolidated Financial Statements

Amounts payable to related parties as at July 26, 2014 totalled $23,000 (January 25, 2014 – $23,000).

14. Income taxes

The Company has non-capital losses of $10.8 million for Canadian income tax purposes generated in the six-month period ended July 26,

2014, expiring in 2035, for which a full valuation allowance has been taken against the related deferred tax asset. Accordingly, the tax

benefits of these losses have not been recognized in the unaudited interim condensed consolidated financial statements.

From time to time, the Company is subject to tax audits. While the Company believes that its filing positions are appropriate and supportable,

periodically, certain matters are challenged by tax authorities. On April 3, 2014, the Company received a draft assessment with respect to an

ongoing audit by a taxation authority. In July 2014, a final assessment of $5,000 was issued with respect to this audit.

15. Comparative figures

Certain comparative figures have been reclassified to conform to the presentation adopted in the current period.

Page 15