Solutions Centre's Role in Strengthening BC Credit Unions

advertisement

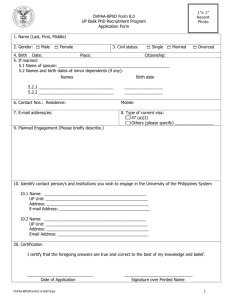

Solutions Centre’s Role in Strengthening BC Credit Unions December 15, 2011 Royal Roads University Doris Good Kasia Chudleigh Julian Pattison Sam Malik Rolf Lyster Word Count: 5222 Table of Contents Introduction .................................................................................................................................1 Executive Summary....................................................................................................................2 Competitive Landscape..............................................................................................................3 The Value Chain ..........................................................................................................................4 What You Told Us .......................................................................................................................5 Pick Your Poison ........................................................................................................................6 1. Go It Alone ..............................................................................................................................6 2. Acquire Smaller Credit Unions ................................................................................................7 3. Be Acquired and Assimilate ....................................................................................................7 4. Merge Into One Entity but Maintain Existing Storefront ..........................................................8 5. À la Carte Shared Services.....................................................................................................8 6. Comprehensive Shared Services............................................................................................9 Recommended Approach ........................................................................................................10 A Good Start… Now What?......................................................................................................11 Build Trust Among Members.....................................................................................................11 Lead by Example ...............................................................................................................12 Open Dialogue...................................................................................................................13 Group Dynamics ................................................................................................................13 Build Sense of Group Identity ...................................................................................................14 Build Sense of Group Efficacy ..................................................................................................15 Achieving Buy-In................................................................................................................16 Sharing Information ...........................................................................................................17 Continuous Improvement...................................................................................................18 Call To Action............................................................................................................................19 Appendices................................................................................................................................20 Appendix 1: Porter’s Five Forces Model ...................................................................................20 Appendix 2: Strategic Group Map .............................................................................................21 Appendix 3: SWOT Model.........................................................................................................22 Appendix 4: Summary of CEO Responses to Survey Questions..............................................23 Appendix 5: Borman Model.......................................................................................................24 Borman identified and defined eight principal dimensions in alignment and shared service performance: .............................................................................................................................24 1. Environmental conditions – the context within which the organization operates, ..............24 2. Organizational resources – the tangible and intangible assets available to the organisation,..............................................................................................................................24 3. History – the past choices and developments that influence the current organisation, .....24 4. Strategy – the long term goals of an organisation, ............................................................24 5. Structure – the operational design chosen by an organisation to deliver on its strategy,..24 6. Management processes – how activities are directed and controlled, ..............................24 7. Individual skills – the competencies required for employees to fulfill their roles,...............24 8. Technology – the organisation’s underlying approach, or philosophy, towards the use of information technology. .............................................................................................................24 Appendix 6: SMART Model.......................................................................................................25 Appendix 7: Building the Emotional Intelligence of Groups ......................................................26 Bibliography ..............................................................................................................................27 Endnotes....................................................................................................................................31 1 Introduction Why listen to us? We are not in the credit union industry. Moreover, our collective experience in studying your specific business is measured in weeks as compared to decades for you. Undoubtedly your bookshelves are adorned with industry reports and expert whitepapers espousing the recipe for a prosperous future. What could we possibly offer that is of value? “A fresh pair of eyes brings a new perspective to a situation.”1 In fact, as a team we represent multiple viewpoints. While we strive to underpin our rationale with broad business fundamentals we also instinctively view situations from our own personal perspective. We are more than business practitioners: we are customers, parents, and members from a variety of communities. Furthermore, we offer a unique aspect as we stand on terrain outside the credit union industry. 2 Executive Summary Small and mid-size credit unions lack economies of scale putting them at a competitive disadvantage. Banks and some large credit unions are exploiting this weakness which has resulted in a great deal of consolidation. If the existing trends continue, credit unions will continue to shrink in numbers and perhaps relevance. All but the largest credit unions must collaborate if they are to maintain a semblance of their autonomy. Shared services are a proven technique to enhance the competitiveness of the credit union business model. This technique offers a continuum of approaches with selective participation at one end of the scale and full collaboration at the other. The benefits of shared services increase with the degree of collaboration. Full collaboration requires relinquishing some independence in exchange for a vote in a democratic interdependent consortium. Comprehensive collaboration requires alignment and trust among participants. Effective communication and open dialogue will be crucial in developing trust among member CEOs. The Solutions Centre is ideally positioned to facilitate this process, however they cannot be all things to all credit unions. Through the visioning process it will become evident which credit unions have similar needs and compatible views on a path forward. The group that emerges through this process will be a more tightly aligned group better capable of cooperating in the shared services model needed to deliver required benefits. Collaboration is not a static process – it requires buy-in from all stakeholders, sharing of information, and continuous improvement. By sharing knowledge across member credit unions, transparency as well as mutual experiential learning will be enhanced. The Solutions Centre has an important role to play in leading the challenging exercise of establishing and accomplishing common goals. A comprehensive shared services approach does not follow the path of least resistance, but high impact programs rarely do. 3 Competitive Landscape The market is a battlefield given the constant rate competition for buyer (mortgage) and supplier (capital) patronage. The increased costs of technology, compliance, and personnel have put a squeeze on firms that lack scale.2 Given the price-sensitive market, the industry is attractive to firms with an overall low-cost leadership strategy and those who can afford to aggressively promote their brand identity. Appendices 1 – 3 detail the models used to assess the competitive environment. According to Stabilization Central Credit Union, the forecast trend for BC credit unions (CUs) is declining membership and shrinking margins.3 Moreover, banks and some large CUs are leveraging their competitive advantages of scale, reach, and brand power to exploit the weaknesses of small CUs. The competitive environment has reached a strategic inflection point (see Figure 1) where firms must make a fundamental change in business strategy: “nothing less is sufficient.”4 Figure 1: The Inflection Point Curve Financial cooperatives are people-based and rely on member participation to differentiate themselves from investor-owned firms and to develop and support their competitive advantage. However, they are also economic entities and are thus subject to the realities of the economic 4 environment – realities that at times may directly conflict with the cooperative culture and philosophy.5 It is recognized that democracy and business efficiency can never be separated and treated as independent of each other. As stated by Laidlaw, “a system of cooperatives, or any single cooperative, that tries to exist on a foundation of business efficiency alone is not only denying or neglecting a base principle of its operation, but it is also writing its own death warrant.”6 To be successful, financial cooperatives such as the CUs must not only be champions of business efficiency but must also be champions of democracy and member involvement.7 The Value Chain A company’s various internal activities combine to form a value chain. As shown in Figure 2, a generic value chain consists of primary activities and support activities. The primary activities are foremost in creating value for customers. In classical business speak, CUs are experiencing a situation where rivals are performing value chain activities more cheaply. The primary activities of deposit-taking and lending do not appear especially problematic from a cost perspective. However, support activities and certain primary functions are more costly than competitors. This has not gone unnoticed by the industry. Benchmarking has illustrated this problem by using the operating efficiency ratio to demonstrate cost structure disparities. Figure 2: Generic Value Chain 5 For a company to compete successfully, its value chain costs must be in line with those of close rivals.8 While some industries can compensate for internal cost disadvantages by reducing primary supplier costs or raising prices in the forward portion of the chain, this is not a viable choice for CUs. Deposit interest rates (supplier costs) and mortgage rates (prices) are both market-driven, so the CUs must directly address the cost disadvantages within their value chains. Generally speaking, a company should not perform any value chain activity that can be performed more efficiently by others. Moreover, if these activities are not vital to the firm’s core competencies there is minimal hazard in delegating them to others. By being selective in value chain activities, a company can concentrate its energy and resources on the core activities that support its strategy. What You Told Us To gain insights from the Solutions Centre (SC) members, a short survey was circulated among CEOs. It is important to note that the questions were not exclusively aimed at symptoms caused by a problem; they were also anticipatory in nature focussed on a desired future state. The research questions were as follows: 1. Fast-forward 15 years. Without limiting yourself to the present challenges, what is your ideal future state in terms of working together with the credit unions in British Columbia? 2. What are the roadblocks you see in reaching that future state? A shared services model for non-member-facing activities emerged as the predominant vision with 61% of CEOs citing this future state. This strategy was described in one of two ways: a single Credit Union Service Organization (CUSO) entity providing all non-core services, or a number of CU coalitions and collaborations with multiple service providers. Competing as one CU brand was mentioned by 22% of CEOs. Integration of technology was viewed as a narrower shared services approach by 17% of CEOs. Principal barriers to a cooperative future state for CUs are fear and lack of trust; this concern was expressed by 39% of respondents. A lack of commitment was considered problematic by 6 28% and a loss of control and ideology was each voiced by 17% of CEOs. A summary of responses to each survey question can be found in Appendix 4. Pick Your Poison Challenges have not gone unnoticed. Financial cooperatives such as the BC CUs face critical business decisions due to the competitive landscape. The CU industry has taken steps to improve efficiency and introduce new revenue streams. The forces for change are now so pressing that many smaller CUs are placing a top priority on long-term transition strategies. Several business models have provided business leaders a degree of control over unpredictable market forces. For example, SC currently operates with an à la carte shared services model whereas some larger credit unions host all services in-house. Business models are time and context specific, in that they come in and out of favour, depending on market conditions.9 Much research has examined the relationship between organizational design including its business models and performance. Differing institutional arrangements, policy priorities and organizational cultures dictate the need for tailored, rather than off the shelf, shared services business model solutions.10 In today’s CU environment efficiency is not only desirable but also required for survival.11 Six business models have emerged in response to competitive pressures: 1. Go It Alone Relying on organic growth alone is a risky proposition. Consolidation has been widespread with the number of CUs in BC decreasing from 111 to 44 over the past 20 years. As shown in Figure 3, some CEO-members of SC believe the trend in BC is likely to continue. Only in the most optimistic scenario will the trend change; this requires a more aligned approach by BC CUs. 7 Figure 3: Credit Union Growth in BC 2. Acquire Smaller Credit Unions Many smaller Canadian CUs have been acquired over the past 20 years; this same trend has occurred in other jurisdictions as well. In the US, where CUs have a superior operating efficiency, this trend is forecasted to continue with 21% expecting to be acquired in a merger.12 The consolidation of Canadian CUs is also expected to continue, as larger firms will be more competitive.13 3. Be Acquired and Assimilate Net interest margin is no longer a reliable source of income for CUs; many small CUs are heavily dependent on this single source of revenue. Compounding this problem are high operating expense ratios. “Unless those credit unions find a way to increase income and reduce operating expenses, they are in the midst of a slow motion self-liquidation.”14 Typically a weaker CU will be acquired by a stronger firm long before it becomes insolvent, in part due to reputation risks for the other system members.15 8 4. Merge Into One Entity but Maintain Existing Storefront First West Credit Union has pioneered a multi-brand merger model.16 Integration of financial assets, membership, and operations still occurs but it differs from options 2 and 3 in that acquired CUs continue to operate under their own brand.17 A downside to this approach is loss of board control: in place of a board for each brand, a regional council acts as ambassadors on behalf of the First West board of directors. First West hopes to expand its operating model by having other CUs join over time. 5. À la Carte Shared Services An alternative to mergers and acquisitions is collaboration among CUs. In response to the present global economic situation, organizations are increasingly looking to realise the benefits of a shared services business model. This could include cost savings from lower head count and increased corporate value resulting from efficiency, effectiveness, and economies of scale.18 The shared services model concentrates selected business functions into a new semi-autonomous business unit with a management structure designed to promote collaboration, efficiency, value generation, costs savings, and improved service for internal customers.19 The current shared services business model was strategically chosen by SC and its members to build on organizational strengths and develop opportunities for future growth and success. The member CUs were faced with a variety of alternatives with the most distinct being the threat of mergers and acquisitions. As a result, these CUs found that SC’s proposal was of most benefit to their present situation and that it aligned with their future strategic planning. This model was economically timely and specific to the needs of the involved players. This allowed SC and its members to join forces and realize the strengths and benefits of their joint efforts. 9 6. Comprehensive Shared Services As opposed to the à la carte model, comprehensive shared services consolidates a large number of business functions into a centralized business unit. Further, all members are required to fully participate in all initiatives. One of the most successful alliances among small groups of CUs are the Credit Union Service Organizations (CUSOs) in the US. The 10 largest US CUs have lowered their operating expense ratios to a level that is comparable to the largest Canadian chartered banks.20 This highly successful shared services business model should encourage Canadian CUs to consider stronger alliances as an alternative to mergers, in order to solve their economies of scale problems. Research from the BC Institute for Co-operative Studies suggests that although CUSOs are almost exclusively an American phenomenon and are based on a response to regulatory restrictions, the concept should still work under the circumstances of the Canadian CUs.21 Australian and British public services and financial cooperatives further demonstrate and support the notion that an appropriate shared services business model has a high potential to enhance the efficiency and effectiveness of a business.22 Research also suggests that approximately 50% of Fortune 500 companies have established some form of shared services operation to realize the benefits of this business model.23 In addition to the benefits of shared services business models, numerous companies are focused on elevating these benefits to a higher level by combining shared services with a Lean business model, as described later in this document. 10 Recommended Approach To ensure a comprehensive assessment based on the various information sources and environmental factors, the aforementioned options were evaluated using the Borman and SMART models – more detail can be found in Appendices 5 and 6. It is clear that CUs must move from being independent to become interdependent. There are currently pockets of collaboration but it is not the prevailing theme in BC; efforts are often fragmented leading to suboptimal outcomes. Members must be willing to relinquish some control by trusting and working with others in a more aligned collaborative model.24 A comprehensive shared services model (#6) is recommended for BC CUs to be viable. This model need not be limited to back office functions; SC and the member CEOs must determine which services should be aligned. This will require visionary leadership by SC as members will be required to fully participate in all initiatives; although some existing members may choose to opt out of SC, it is important to note that SC cannot be all things to all credit unions and that alignment of members is more important than large numbers. SC has stated that its approach is “crawl-walk-run” – this has served it well during its initial growth stage. The following is a recommended strategy that in the short term moves SC to a “walk” mode and in the long term to a “run” mode. The Master Services Agreement established in June 2010 is a significant accomplishment. It has enabled SC to grab the “low hanging fruit,” one of which was to negotiate substantial savings on Enterprise Resource Management software due to sufficient volumes. Congratulations are in order and it is recommended that SC celebrate this success with the members and communicate this to all non-participating CUs.25 The following section leverages these successes to guide a strong group of committed members into a vision for the future. 11 A Good Start… Now What? SC is positioned to leverage its strong foundation and lead the organization from “crawl” into “walk” mode. It was identified that “although being better and stronger as a united force than as individual CUs is often discussed, it is seldom demonstrated at levels that will ensure viability of many of SC’s members into the future.” Based on the CEO survey, there is clearly desire for collaboration as a group. However, the pathway must first be cleared of significant boulders that stand in the way of alignment. At the root of these obstacles is the necessity for a change in mindset.26 Member CUs do not wish to have a joint strategy on product, channels, or pricing, however it is recommended that SC lead a process to develop a strategy for competition with banks and collaboration in all business areas. In other words, SC should offer leadership in purpose-finding as opposed to problem-solving;27 this means leading the member CUs to find their own solutions. In doing so, SC must embrace the concept that “people will work harder for ideas that they believe in, and not surprisingly, most of these ideas are their own.”28 To fully engage the CEOs, SC must involve them in determining their approach to collaboration and setting an aligned course for the future. Three conditions are essential to this group’s effectiveness: “trust among members, a sense of group identity, and a sense of group efficacy.”29 The following will explore these three conditions and offer recommendations for implementation. Build Trust Among Members The CEO survey responses indicate several barriers to collaboration. Individuals fear loss of autonomy and control, and there is limited trust or desire to work together. It is not surprising that SC has had difficulties convincing people to collaborate, as individuals can be leery of team situations due to past negative experiences. The group cannot succeed by ignoring these barriers: if left unaddressed, SC will not be able to move forward effectively. Effective teams and better knowledge sharing result from trust-based relationships,30 and the barriers listed above can be addressed through a trust-building process. According to MerriamWebster, trust is defined as “assured reliance on the character, ability, strength, or truth of someone or something.”31 12 Teams that are built upon trust: • allow members to take risks within a safe environment; • determine common objectives, directions, and priorities; • capitalize on the strengths of their members; • admit their weaknesses and mistakes, asking for help when necessary; • avoid bureaucracy and minimize politics; and • hold all members to the same standards.32 These characteristics are certainly desirable to SC; however, much work is necessary in order to build trust. SC must lead by example, promote open dialogue, and cultivate positive group dynamics. Lead by Example To engender trust, the member CEOs must first be able to trust in SC’s leadership; they must respect the processes for decision-making and have confidence that the group has the capability to achieve its goals. The proposed SC stance that members must fully participate serves as a clear indication of organizational direction; this will increase the perception of competence and thus create trust. SC leadership must continue to lead by example, building on strengths in the following areas: • Transparent Communication: It is important that everyone receive the same version of information in a timely manner through an interactive central resource. • Encouraging Feedback: Transparent communication is a two-way dialogue – members must believe that their concerns will be heard and addressed appropriately. • Authenticity and Realism: It is important that members view leadership as authentic and grounded in reality. If any mistakes have occurred in the past, this is a good time to admit those mistakes while focusing on the future. • Predictability and Integrity: In the first year, members will pay particular attention to the success or failure of the new SC model. Failure to keep promises will result in loss of trust.33 It is important to not promise more than can be delivered, and it is important to deliver on what was promised or explain the reasons for postponement.34 13 Ultimately, these trust-building actions by SC leadership will model the behaviour required by the CEOs and their staff and contribute to greater alignment among the entire group. Open Dialogue Effective communication and open dialogue will be crucial in developing trust among the group of SC members. Face-to-face meetings are very effective when discussing sensitive subjects or transferring large amounts of information;35 as part of membership in the SC group, CEOs should attend two face-to-face meetings a year with hosting responsibilities rotated among the member CUs. Level of communication has a strong effect on trust, as lack of communication can create doubt and suspicion.36 A communication plan must be created in order to allow for frequent and open communication between meetings; this can occur through a central information source as detailed later in this report. SC leadership must pay particular attention to the format of these gatherings. CEOs and SC leadership should sit in a circle formation to remove the semblance of hierarchy. Each CEO must be able to speak without fear of retribution; SC leadership must frame the discussions as visioning for the future versus focusing on past conflicts. At the first meeting of the new group, it is suggested that CEOs speak of their hopes and dreams for the group, as well as the particular fears they bring to the table. Everyone must have a chance to speak, and everyone must be given an equal voice. Group Dynamics In order to be an effective team, group members must place a large amount of trust in each other. For this reason, it is important to create norms and standards – these are the accepted rules and behaviours within the group. All members must agree to abide by these rules for smooth functioning of the team. To ensure that individuals feel included, SC leadership must facilitate a supportive climate through the building of “emotional intelligence.”37 Human beings have a basic need for respect, and they must feel valued for their personalities and skills. Each individual brings different perspectives, different hopes and fears, and different experiences to the table. They will wonder where they fit in the social structure of the group, and will act differently according to what 14 makes them feel comfortable. Individuals and groups can develop emotional intelligence through a model by Druskat and Wolff – for further information, see Appendix 7. An important step to building trust is finding the common ground between members – a shared purpose can be found through facilitated discussion. This works because people usually trust those who seem similar to themselves.38 The CUs are similar insomuch as they all must increase their membership and improve their efficiency ratio in order to compete with the chartered banks. Their interests will likely be in alignment, which means they can benefit from each other’s contributions and are more likely to trust one another.39 Finally, formal meetings must be supplemented by opportunities for informal connection. The group should think about a residential event where people stay together overnight: “this gives the group an opportunity to socialize as well as work together, an essential ingredient in the trust-building process.”40 Build Sense of Group Identity There is concern that limiting SC to combined efforts in processing and administration will not bring SC members to the next level – from “crawling” to “walking.” In order to survive, the participating CUs must have a vision of how they wish to maintain differentiation, compete with banks, and share a common strategy; this will make them stronger together. The stated vision of SCCU as set out in the Master Service Agreement Terms of Reference is: “We work in partnership with credit unions that have joined together to provide proactive, customized solutions and valuable information so as to strengthen our business practices, with a focus on self-sufficiency and sound financial management.” After efforts at the inaugural meeting of SC, the following vision was developed: “The vision of the founding members of the Solutions Centre is to provide cost effective solutions for credit unions to enhance and strengthen their business practices and operations.” 15 In the SCCU vision there appears to be an incompatibility in that CUs have “joined” but wish to retain “self-sufficiency.” The vision for SC focuses only on providing solutions, not working together as a united force; this is consistent with the survey where many express fear and lack of trust. SC must create a sense of urgency, remove fear, and create trust41 which will clear the pathway to collaboration and success. Therefore, SC and its participating members must come together to create a new vision and mission statement that better aligns them as a united force. Well-conceived visions are distinctive and specific to a particular organization. They create a visual image of where the group wishes to be at a point in time in the future – “where are we going?” It should communicate the organization’s philosophy and that which differentiates it from its competitors; this could be built on the founding principles of CUs which are “caring, cooperative, and community.” The vision should also be inspirational, as this will help to steer the energies of the members; for example, Henry Ford’s vision of “a car in every garage” had power because it captured the imagination. A strong vision statement should illuminate the organization’s path and provide a reference point that creates consistency in all efforts of the members.42 Whereas the vision statement expresses the future goals, the mission statement describes the present purpose – “who are we, what do we do, and why we are here?” To build a mission statement, the members should come together and establish organizational values. Values are the beliefs, traits, and behavioural norms that the group will agree to display while carrying out the vision. When like-minded people share similar values, motivations, and aspirations, this creates a connectedness and commitment of group members; further, this focuses efforts towards changing the mindset from one of fear and self-sufficiency to one of openness and collective collaboration.43 SC should undertake an exercise to reach a shared understanding of values and goals; the Cultural Values Assessment44 is an excellent tool for this purpose. Build Sense of Group Efficacy Having developed trust and a sense of group identity, SC members must also build a sense of group efficacy – “the belief that the team can perform well and that group members are more effective working together than apart.”45 This requires frequent communication between the SC, member CEOs, and CU employees; the following section describes the use of Lean Management to involve employees at all organizational levels. 16 Lean Management is a globally-recognized business approach that creates value for customers and minimizes waste through use of fewer resources.46 The Lean term was invented by a team of researchers who explored how Toyota successfully increased its sales and market share. The Lean strategy is becoming critical in almost every industry, since competition is increasing and organizations are focusing on reducing cost without compromising quality. SC and its members can achieve significant benefits by employing Lean Management in their businesses. CUs are competing with each other as well as banks, which makes it more complex and challenging to succeed. After reviewing the values and mission statements of the current SC members, it can be inferred that most of the CUs have similarities. In leveraging these similarities through collaboration and alignment of shared services and products, CUs can more effectively share information, increase operational efficiency, and significantly decrease overall costs. Achieving Buy-In In order that SC members achieve their shared goals, they must ensure that all stakeholders are on board with the initiatives. This can be accomplished through Lean’s strategic policy deployment or hoshin planning (Figure 4). “A hoshin is a strategy to achieve a higher-level goal.” 47 Hoshin planning focuses on the core problems and big boulders; participating CEOs must determine these barriers in consultation with their staff. In order to reach their destination, they must first address the big boulders through hoshin planning, then concentrate on the small stones as part of the operational plan. Alignment and flexibility are the fundamental requirements in this process. 48 Figure 4: Hoshin Planning 49 17 To build consensus and receive feedback on organizational direction, CEOs can use nemawashi50 and catchball. 51 Nemawashi means "to prepare a tree for transplanting” and denotes the process of consensus building that creates alignment. Catchball is a strategy where CEOs can “throw” out an idea and their staff will “catch” it, make comments, and “throw” it back; this creates an environment where feedback and creative ideas will transcend the organizational hierarchy. Sharing Information Fear, lack of trust, and loss of power are core issues among the CU CEOs; these can be addressed through open sharing of information. The sharing of knowledge will foster trust and decrease suspicion. Lean Management suggests that knowledge can be shared across the company through “mutual, experiential learning” or yokoten.52 This concept will allow members to share their personal experiences and prevent them from repeating mistakes already made by other members. The concept of the Visual Management Triangle suggests that SC members must “see together, know together, and act together;”53 although the CUs reinforce their brands individually, they strengthen the philosophy of products, services, and markets jointly. SC will manage the identification of shared objectives and knowledge areas, and will lead the exercise of mutual action towards accomplishment of common goals. In the distributed CU environment information is best shared through a central interactive resource. One such tool is Microsoft SharePoint, a web-based platform that can be used as a central location for sharing, storing, updating, and managing information. Several corporate and government agencies are using this platform, including the City of Calgary (www.calgary.ca) and TAQA Global (www.taqa.ae). Once set up, SharePoint is simple and provides good security. Considering IT support requirements and keeping the cost at a minimum, the viable option for SC is to consider the Microsoft Office 365 offer of $60 per user per year. In this option, the server is hosted by Microsoft and SC need not worry about adding IT resources to its team. SC may require a part-time consultant for initial setup and management of the content, and will also need to arrange preliminary training for the users. Once users are familiar with the system, the content can be managed by SC and CU employees themselves. 18 Continuous Improvement Collaboration is not a static process – it requires continuous improvement. The Lean Management term is kaizen, which is derived from the word “kai” which means to “take apart” and “zen” which means to “make good.”54 CUs can become stronger together through a mindset of continuous improvement – “every day a little up.”55 One tool for continuous improvement is Lean’s PDCA, which stands for “Plan, Do, Check, and Adjust.”56 • “Plan” recommends that SC partner with CU CEOs through hoshin planning. • “Do” directs SC and CUs to develop and implement a plan for change. • “Check” prompts them both to verify the results through web-based tools. • “Adjust” encourages SC and CUs to adopt and update the necessary standards, solve problems, and share learning.57 It is recommended that SC and the CUs run through the PDCA cycle regularly for continuous process improvement. PDCA can also be used as a framework for implementation of future recommendations, including those suggested by other teams within the MBA cohort. Through achieving buy-in, sharing information, and developing a culture of continuous improvement, SC members will create alignment and efficiencies. 19 Call To Action Many BC credit unions are operating independently with an unsustainable business model. Moreover, duplication of efforts, inconsistencies in service delivery, and lack of brand equity are factors that are undermining growth potential. This has not gone unnoticed among credit union CEOs and Stabilization Central Credit Union. As a proactive move, the Solutions Centre was launched to leverage scale and scope particularly with small to mid-size credit unions. The espoused strategy of “crawl-walk-run” has yielded early returns. Big problems require commensurately big solutions. The Solutions Centre must strengthen its role in order to transition from crawl to walk and run. This evolution will enable more cohesive and pronounced action. The Solutions Centre cannot be all things to all credit unions; it must concentrate on an aligned group of CEOs that share similar issues and a sense of urgency. With the visioning assistance of these CEOs, the Solutions Centre can focus its efforts to guide the credit unions to success. Appendices Appendix 1: Porter’s Five Forces Model Appendix 2: Strategic Group Map Appendix 3: SWOT Model Strengths Weaknesses Opportunities Threats Dedication of staff and volunteers – superior service from staff. Competition of other Restrictive Legislation Younger demographics Credit Unions – need to and regulatory pressures (30-50 and younger) unify and align Trust of the members. Aging membership resulting in depressed loan demands Credit Union unification Chartered banks and alignment to create competition strength in numbers Unique Business model Deficient in attracting (cooperative) – members new members, younger Small business lending are owners. members Non-banking lending institutions - New Entrants into market such as Shoppers Drug Mart, Canadian Tire etc. All money on deposit and money invested in nonAttraction/retention of Other untapped markets equity shares with a BC qualified board members credit union is 100% guaranteed. Marginal squeeze, low interest rate reality creating compressed margins. Flexible terms and conditions make the range of products more accessible than the chartered banks. Slower economic growth The BC credit union system is the largest network of financial institutions in the province, 45 independent credit unions. Available in 42 BC communities where no other banking outlet. Employee attraction/retention and staff development programs Regulator’s expectations Appendix 4: Summary of CEO Responses to Survey Questions 1. Fast-forward 15 years. Without limiting yourself to the present challenges, what is your ideal future state in terms of working together with the credit unions in British Columbia? CEO's Total Respondents Percentage All non-core operations provided by one shared services provider or a series of providers 11 18 61% Competing as one credit union brand 4 18 22% Integrated technology 3 18 17% Shared liquidity and capital 2 18 11% Franchise model 1 18 6% CEO's Total Respondents Percentage Fear and/or lack of trust 7 18 39% Lack of commitment 5 18 28% Loss of control 3 18 17% Ideology 3 18 17% Inability to standardize non-core processes 2 18 11% Regulatory environment 2 18 11% Need bigger scale; i.e. multi-province 1 18 6% Loss of jobs in community 1 18 6% Over-reliance on growth 1 18 6% No roadblocks to mergers 1 18 6% Future state 2. What are the roadblocks you see in reaching that future state? Roadblocks Appendix 5: Borman Model Borman identified and defined eight principal dimensions in alignment and shared service performance: 1. Environmental conditions – the context within which the organization operates, 2. Organizational resources – the tangible and intangible assets available to the organisation, 3. History – the past choices and developments that influence the current organisation, 4. Strategy – the long term goals of an organisation, 5. Structure – the operational design chosen by an organisation to deliver on its strategy, 6. Management processes – how activities are directed and controlled, 7. Individual skills – the competencies required for employees to fulfill their roles, 8. Technology – the organisation’s underlying approach, or philosophy, towards the use of information technology. Appendix 6: SMART Model SMART Model: Competitive Analysis Strategic Alternatives Go it Alone Acquire smaller credit unions Be Acquired and Assimilate Merge Entities but Maintain Brand À la carte Shared Services Comprehensive Shared Services Small Tier Credit Unions Mid Tier Credit Unions Top Tier Credit Unions Appendix 7: Building the Emotional Intelligence of Groups Individual Group Cross-Boundary Norms That Create Awareness of Emotions Interpersonal Understanding 1. Take time away from group tasks to get to know one another. 2. Have a "check in" at the beginning of the meeting - that is, ask how everyone is doing. 3. Assume that undesirable behaviour takes place for a reason. Find out what that reason is. Ask questions and listen. Avoid negative attributions. 4. Tell your teammates what you're thinking and how you're feeling. Team Self-Evaluation 1. Schedule time to examine team effectiveness. 2. Create measurable task and process objectives and then measure them. 3. Acknowledge and discuss group moods. 4. Communicate your sense of what is transpiring in the team. 5. Allow members to call a "process check." (For instance, a team member might say, "Process check: is this the most effective use of our time right now?") Perspective Taking 1. Ask whether everyone agrees with a decision. 2. Ask quiet members what they think. 3. Question decisions that come too quickly. 4. Appoint a devil's advocate. Seeking Feedback 1. Ask your "customers" how you are doing. 2. Post your work and invite comments. 3. Benchmark your processes. Organizational Understanding 1. Find out the concerns and needs of others in the organization. 2. Consider who can influence the team's ability to accomplish its goals. 3. Discuss the culture and politics in the organization. 4. Ask whether proposed team actions are congruent with the organization's culture and politics. Norms That Help Regulate Emotions Confronting 1. Set ground rules and use them to point out errant behaviour. 2. Call members on errant behaviour. 3. Create playful devices for pointing out such behaviour. These often emerge from the group spontaneously. Reinforce them. Caring 1. Support members: volunteer to help them if they need it, be flexible, and provide emotional support. 2. Validate members' contributions. Let members know they are valued. 3. Protect members from attack. 4. Respect individuality and differences in perspectives. Listen. 3. Never be derogatory or demeaning. Creating Resources for Working with Emotion 1. Make time to discuss difficult issues, and address the emotions that surround them. 2. Find creative, shorthand ways to acknowledge and express the emotion in the group. 3. Create fun ways to acknowledge and relieve stress and tension. 4. Express acceptance of members' emotions. Building External Relationships 1. Create opportunities for networking and interaction. 2. Ask about the needs of other teams. 3. Provide support for other teams. 4. Invite others to team meetings if they might have a stake in what you are doing. Creating an Affirmative Environment 1. Reinforce that the team can meet a challenge. Be optimistic. For example, say things like, "We can get through this" or "Nothing will stop us" 2. Focus on what you can control. 3. Remind members of the group's important and positive mission. 4. Remind the group how it solved a similar problem before. 5. Focus on problem solving, not blaming. Solving Problems Proactively 1. Anticipate problems and address them before they happen. 2. Take the initiative to understand and get what you need to be effective. 3. Do it yourself if others aren't responding. Rely on yourself, not others. Source: Vanessa Urch Druskat and Steven B. Wolff, "Building the Emotional Intelligence of Groups," Harvard Business Review 79, no. 3 (2001): 80-90. Bibliography Barrett Values Centre. "Cultural Values Assessment." Accessed December 9, 2011. http://www.valuescentre.com/products__services/?sec=cultural_values_assessment_(cva). Bergeron, Bryan P. Essentials of Shared Services, Vol. 13. Hoboken, NJ: John Wiley and Sons, 2003. Blumenfeld, Matt. "Outsourcing: Letting CUs Focus on their Core.” Credit Union Journal 13, no. 39 (September 2009): 14. Borman, Mark. "The Design and Success of Shared Services Centres." 2006. http://is2.lse.ac.uk/asp/aspecis/20080190.pdf. Bridges, William, and Susan Mitchell. “Leading Transition: A New Model for Change.” Leader to Leader 16 (2000). Business Source Premier. "Merger Alternative: CUs, Others Press to Expand CUSOs.” Credit Union Journal 12, no. 27 (July 2008): 33. Christensen, Karen. "Integrity: Without it Nothing Works." Rotman: The Magazine of the Rotman School of Management (Fall 2009): 16-20. Cohen, Donald J., and Prusak Laurence. "In Good Company: How Social Capital Makes Organizations Work." Ubiquity 2001 (January 2001): 3-es. Credit Union Central of Canada. "Credit Union Environmental Scan: Fall 2011. Volume 26." 2011. Credit Union National Association. "Teamwork a Competitive Advantage." Credit Union Magazine 71, no. 4 (April 2005): 16. DBRS. "Rating Canadian Provincial Credit Union Centrals, Credit Unions and Desjardins Group and Related Entities." April 2011. http://www.dbrs.com/research/238927/rating-canadianprovincial-credit-union-centrals-credit-unions-and-desjardins-group.pdf. Dennis, Pascal. Lean Production Simplified: A Plain-Language Guide to the World's Most Powerful Production System, 2nd Edition. New York, NY: Productivity Press, 2007. Dennis, Pascal. The Remedy: Bringing Lean Thinking Out of the Factory to Transform the Entire Organization. Hoboken, NJ: John Wiley and Sons, 2010. Druskat, Vanessa Urch, and Steven B. Wolff. "Building the Emotional Intelligence of Groups." Harvard Business Review 79, no. 3 (March 2001): 80-90. Envision Financial. "First West Credit Union 2010 Annual Report." 2011. http://www.envisionfinancial.ca/SharedContent/AnnualReports/2010/2011FWAnnualReport.pdf. Grove, Andrew S. "Academy of Management, Annual Meeting." 1998. http://www.intel.com/pressroom/archive/speeches/ag080998.htm. Hudson, Michael. “Aligning Culture and Strategy for a Competitive Advantage.” March 8, 2011. http://cuesskybox.typepad.com/skybox/2011/03/aligning-culture-and-strategy-for-competitiveadvantage.html. NHS Institute for Innovation and Improvement. "Fresh Eyes – Seek Out and Use the Wisdom of Others." 2008. http://www.institute.nhs.uk/quality_and_service_improvement_tools/quality_and_service_improv ement_tools/creativity_tools_-_seek_out_and_use_the_wisdom_of_others_(fresh_eyes).html. Jusko, Jill. "Lean Confusion." Industry Week 259, no. 9 (2010): 32-33. Kock, Ned F. Business Process Improvement through E-Collaboration: Knowledge Sharing through the use of Virtual Groups. Hershey, PA: Idea Group Publishing, 2005. Kotter, John P. “Leading Change: Why Transformation Efforts Fail.” Harvard Business Review 85, no. 1 (2007): 96-103. Lank, Elizabeth. Collaborative Advantage: How Organizations Win by Working Together. New York, NY: Palgrave Macmillan, 2006. Leshchyshen, Bob. "Analysis of Canada’s Largest Credit Unions Financial Results." July 2010. http://www.canadiancreditunion.ca/files/report-2009.pdf. Magretta, J. "Why Business Models Matter." Harvard Business Review 80, no. 5 (2002): 86-92. McKillop, D. G. "Financial Cooperatives: Structure, Conduct and Performance." Annals of Public and Cooperative Economics 76, no. 3 (2005): 301-305. Messick, Guy. "The Collaborative Strategy.” Credit Union Management 33, no. 10 (October 2010): 14-17. Merriam-Webster. "Trust." Accessed December 8, 2011. http://www.merriamwebster.com/dictionary/trust. Millar, James B. The Corporate Coach. New York, NY: St. Martin’s Press, 1993. Quinn, Ryan W., and Robert E. Quinn. Lift: Becoming a Positive Force in any Situation. San Francisco, CA: Berrett-Koehler Publishers Inc., 2009. Senge, Peter M. The Fifth Discipline. New York, NY: Doubleday Business, 1990. Spoehr, John, Anne Burger, and Dr. Steven Barrett. "The Shared Services Experience; Report 2: Lessons from Australia." May 2007. http://www.european-servicesstrategy.org.uk/news/2007/shared-services-britain/psa-shared-services-australia.pdf. Tapping, Don. The Simply Lean Pocket Guide. MCS Media, Inc., 2008. http://library.books24x7.com/toc.aspx?bookid=25014. The Co-operative Learning Centre. “On building alliances: Credit Union Service Organizations.” March 1, 2005. http://www.learningcentre.coop/resource/building-alliances-credit-union-serviceorganizations. Thompson, Arthur A. Jr., A.J. Strickland III, and John E. Gamble. Crafting and Executing Strategy: The Quest for Competitive Advantage, 17th Edition. New York, NY: McGraw-Hill/Irwin, 2010. Turkman, Inci and Zane L. Berge. "Preserving Trust while Downsizing." In The 2011 Pfeiffer Annual: Training. Hoboken, NJ: John Wiley and Sons, 2010. 185-192. Endnotes 1 "Fresh Eyes – Seek Out and Use the Wisdom of Others," NHS Institute for Innovation and Improvement, 2008, http://www.institute.nhs.uk/quality_and_service_improvement_tools/quality_and_service_improvement_to ols/creativity_tools_-_seek_out_and_use_the_wisdom_of_others_(fresh_eyes).html. 2 Guy Messick, "The Collaborative Strategy,” Credit Union Management 33, no. 10 (October 2010): 14. 3 "Rating Canadian Provincial Credit Union Centrals, Credit Unions and Desjardins Group and Related Entities," DBRS, April 2011, http://www.dbrs.com/research/238927/rating-canadian-provincial-creditunion-centrals-credit-unions-and-desjardins-group.pdf. 4 "Academy of Management, Annual Meeting," Andrew S. Grove, 1998, http://www.intel.com/pressroom/archive/speeches/ag080998.htm. 5 D.G. McKillop, "Financial Cooperatives: Structure, Conduct and Performance," Annals of Public and Cooperative Economics 76, no. 3 (2005): 301-305. 6 Ibid. 7 Ibid. 8 Arthur A. Thompson, Jr., A.J. Strickland III, and John E. Gamble, Crafting and Executing Strategy: The Quest for Competitive Advantage, 17th Edition (New York, NY: McGraw-Hill/Irwin, 2010), 116. 9 Bryan P. Bergeron, Essentials of Shared Services, Vol. 13 (Hoboken, NJ: John Wiley and Sons, 2003). 10 J. Magretta, "Why Business Models Matter," Harvard Business Review 80, no. 5 (2002). 11 Matt Blumenfeld, "Outsourcing: Letting CUs Focus on their Core,” Credit Union Journal 13, no. 39 (September 2009): 14. 12 Business Source Premier, “Merger Alternative: CUs, Others Press to Expand CUSOs,” Credit Union Journal 12, no. 27 (July 2008): 33. 13 "Analysis of Canada’s Largest Credit Unions Financial Results," Bob Leshchyshen, July 2010, http://www.canadiancreditunion.ca/files/report-2009.pdf. 14 Messick, "The Collaborative Strategy,” 14. 15 "Rating Canadian Provincial Credit Union Centrals, Credit Unions and Desjardins Group and Related Entities," 9. 16 Credit Union Central of Canada, "Credit Union Environmental Scan: Fall 2011. Volume 26," 2011. 17 "First West Credit Union 2010 Annual Report," Envision Financial, 2011, http://www.envisionfinancial.ca/SharedContent/AnnualReports/2010/2011FWAnnualReport.pdf. 18 Bergeron, Essentials of Shared Services. 19 "The Design and Success of Shared Services Centres," Mark Borman, 2006, http://is2.lse.ac.uk/asp/aspecis/20080190.pdf. 20 "Analysis of Canada’s Largest Credit Unions Financial Results.” 21 “On building alliances: Credit Union Service Organizations,” The Co-operative Learning Centre, March 1, 2005, http://www.learningcentre.coop/resource/building-alliances-credit-union-service-organizations. 22 "The Shared Services Experience; Report 2: Lessons from Australia," John Spoehr, Anne Burger, and Dr. Steven Barrett, May 2007, http://www.european-services-strategy.org.uk/news/2007/shared-servicesbritain/psa-shared-services-australia.pdf. 23 “The Design and Success of Shared Services Centres.” 24 Messick, "The Collaborative Strategy,” 17. 25 William Bridges and Susan Mitchell. “Leading Transition: A New Model for Change.” Leader to Leader 16 (2000). 26 Peter M. Senge, The Fifth Discipline, (New York, NY: Doubleday Business, 1990). 27 Ryan W. Quinn and Robert E. Quinn, Lift: Becoming a Positive Force in any Situation, (San Francisco, CA: Berrett-Koehler Publishers Inc., 2009). 28 James B. Millar, The Corporate Coach, (New York, NY: St. Martin’s Press, 1993). 29 Vanessa Urch Druskat and Steven B. Wolff, "Building the Emotional Intelligence of Groups," Harvard Business Review 79, no. 3 (March 2001): 82. 30 Donald J. Cohen and Prusak Laurence, "In Good Company: How Social Capital Makes Organizations Work," Ubiquity 2001 (January 2001): 3-es. 31 Merriam-Webster, "Trust," http://www.merriam-webster.com/dictionary/trust, accessed December 7, 2011. 32 Credit Union National Association, "Teamwork a Competitive Advantage," Credit Union Magazine 71, no. 4 (April 2005): 16. 33 Karen Christensen, "Integrity: Without it Nothing Works," Rotman: The Magazine of the Rotman School of Management (Fall 2009): 16. 34 Inci Turkman and Zane L. Berge, "Preserving Trust While Downsizing," in The 2011 Pfeiffer Annual: Training (Hoboken, NJ: John Wiley and Sons, 2010), 190. 35 Ned F. Kock, Business Process Improvement through E-Collaboration: Knowledge Sharing through the use of Virtual Groups (Hershey, PA: Idea Group Publishing, 2005). 36 Turkman and Berge, "Preserving Trust while Downsizing," 191. 37 Druskat and Wolff, "Building the Emotional Intelligence of Groups," 81. 38 Turkman and Berge, "Preserving Trust while Downsizing," 190. 39 Ibid. 40 Elizabeth Lank, Collaborative Advantage: How Organizations Win by Working Together, (New York, NY: Palgrave Macmillan, 2006): 61. 41 John P. Kotter, “Leading Change: Why Transformation Efforts Fail,” Harvard Business Review 85, no. 1 (2007): 99. 42 Thompson, Strickland, and Gamble, Crafting and Executing Strategy. 43 “Aligning Culture and Strategy for a Competitive Advantage,” Michael Hudson, March 8, 2011, http://cuesskybox.typepad.com/skybox/2011/03/aligning-culture-and-strategy-for-competitiveadvantage.html. 44 "Cultural Values Assessment," Barrett Values Centre, accessed December 9, 2011, http://www.valuescentre.com/products__services/?sec=cultural_values_assessment_(cva). 45 Druskat and Wolff, "Building the Emotional Intelligence of Groups," 83. 46 Jill Jusko, "Lean Confusion," Industry Week 259, no. 9 (2010): 33. 47 Pascal Dennis, Lean Production Simplified: A Plain-Language Guide to the World's Most Powerful Production System, 2nd Edition, (New York, NY: Productivity Press, 2007). 48 Ibid. 49 Ibid. 50 Ibid. 51 Ibid. 52 Ibid. 53 Pascal Dennis, The Remedy: Bringing Lean Thinking Out of the Factory to Transform the Entire Organization, (Hoboken, NJ: John Wiley and Sons, 2010), 52. 54 Don Tapping, The Simply Lean Pocket Guide, (MCS Media, Inc., 2008), http://library.books24x7.com/toc.aspx?bookid=25014. 55 Dennis, The Remedy, 56. 56 Ibid., 48. 57 Ibid.