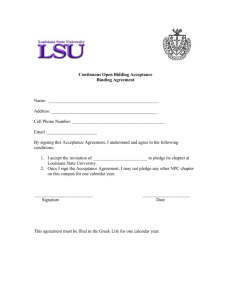

offer

advertisement