Cruise shipping strategiC plan

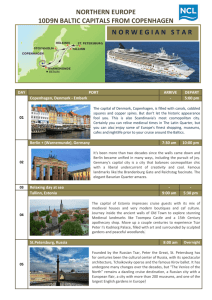

advertisement

WESTERN AUSTRALIAN Cruise Shipping Strategic Plan 2012 – 2020 NOVEMBER 2012 MESSAGE FROM THE HON DR KIM HAMES MLA, MINISTER FOR TOURISM Western Australian Cruise Shipping Strategic Plan 2012-2020 I am pleased to present the Western Australian Cruise Shipping Strategic Plan 2012-2020. Cruise shipping is an important part of the State’s tourism industry. It not only attracts visitors to Western Australia, it also showcases our extraordinary regions and makes a significant contribution to the economy. In 2011-12, the sector generated $185.7 million in expenditure, which is a significant growth of 150 per cent compared to the previous year. The State Government aims to double I would like to congratulate the Cruise the value of tourism in Western Australia WA Committee and its Chair, Professor from $6 billion in 2010 to $12 billion Ross Dowling OAM, for taking the lead by 2020. Cruise ship visits will play an role in implementing this strategy with important role in achieving this goal. support from the State Government. The Cruise WA Committee has developed I look forward to seeing the results of the the Western Australian Cruise Shipping Strategic Plan in years to come. Strategic Plan 2012-2020, to ensure the State’s cruise port destinations deliver quality experiences for passengers as well as maximise the economic benefits of cruise shipping to Western Australia. The plan also provides the State Government and industry with a clear direction on the initiatives required to make Western Australia a desirable and capable cruise destination. Dr Kim Hames MLA DEPUTY PREMIER MINISTER FOR TOURISM Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 3 Cruise Western australia committee introduction professor ross dowling oam, chair Cruise shipping is an important part of the Western Australian tourism industry which is experiencing incredible levels of growth. The WA cruise shipping industry recorded a total of 102 cruise ship visit days in 2011-12, which was a significant increase from 68 visits in the previous year. These visits generated $185.7 million in expenditure, which was a great outcome for Western Australia. The Cruise Western Australia Committee We look forward to working in has developed the Western Australian collaboration with the State Government Cruise Shipping Strategic Plan 2012-2020 and relevant stakeholders to make Western to ensure to maximise the economic Australia a desirable cruise shipping benefits of cruise shipping to WA. destination that delivers on its promise of The purpose of the strategic plan is to provide world-class cruise destinations, for cruise visitors. unique and extraordinary tourism experiences and deliver high value benefits for cruise passengers and local communities. This will be achieved by marketing the State as a world-class cruise destination, enhancing the individual cruise destinations, providing necessary infrastructure and services as well as building industry capacity. Fremantle 4 providing extraordinary holiday experiences Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 Professor Ross Dowling OAM CHAIR CRUISE WESTERN AUSTRALIA COMMITTEE Table of Contents Overview OF THE CRUISE SHIPPING SECTOR 6 Global Cruise Shipping Context 6 Cruise Shipping in Australia 9 Cruise Shipping in Western Australia 11 Developing the strategic plan 12 SWOT Analysis 12 Key Business Areas 13 Cruise Destinations - Current and Future Status 14 Strategic Direction 16 Critical Success Factors 18 IMPLEMENTATION 20 Implementation Plan 20 Targets and Indicators of Success 27 Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 5 Overview of the Cruise Shipping Sector Where are we now? Global Cruise Shipping context The global cruise shipping industry is continuing to develop rapidly. Since 1980, the average annual percentage growth rate for cruise lines worldwide has been more than 7.5%. In 2008, cruising in established markets such as the USA and UK increased by 5% and 12% respectively while over the same period Australia’s growth reached 26%.1 The global cruise capacity, in terms of the number of berths, recorded a compound annual growth rate of 7.24% during 2005-2010. For the year POTENTIAL BENEFITS FOR WESTERN AUSTRALIA: Continued passenger growth ended December 31, 2010, the berth capacity was registered at 423,913, Increased focus on “baby boomers”, an increase of 8.3% against that of family and multi- generational travel 391,304 in 2009. The cruise industry worldwide carried The continued emergence of mega liners around 18.80 million passengers in 2010, which increased to 20.23 million Significant growth in the number in 2011, an increase of 7.6%. It is of Asian passengers anticipated that between 2011 and 2015, the cruise industry compound annual growth rate will average 3.81% and by 2015 is expected to reach 23.49 million passengers.2 Repeat cruisers make up half of passenger worldwide manifests, and these passengers are continuously More ships home based in Australia An increase in circumnavigation itineraries around Australia Significant investment in cruise port facilities in emerging markets such as Asia. searching for new destinations. The saturation of traditional cruise destinations and increasing sophistication among cruise passengers will inevitably see the emergence of Asia, Australia and the South Pacific as serious cruise markets. 20.23M passengers were carried by the cruise industry worldwide in 2011. 1 6 “A Summary of Consultation with Western Australia’s Cruise Shipping Sector” Tourism WA, July 2011 2 “Global Cruise Market Report: 2012 Edition - June 2012” Koncept Analytics 2011-12 Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 Exmouth Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 7 Map - AUSTRALIA & SOUTH EAST ASIA Malaysia Penang Kuala Lumpur Port Klang Singapore Singapore Jakarta Papua New Guinea Indonesia Port Moresby Bali (Benoa) Christmas Island Darwin Northern Teritory Broome Indian Ocean Port Hedland Exmouth N Western Australia Australia Brisbane Geraldton South Australia Fremantle/Perth Bunbury Augusta Queensland New South Wales Esperance Albany Adelaide Sydney Canberra Victoria Melbourne Tasmania DISTANCES BETWEEN PORTS Hobart Esperance to Albany Geraldton to Exmouth 224 nautical miles 11 hours 520 nautical miles 1 day 2 hours Albany to Bunbury Exmouth to Port Hedland 266 nautical miles 13 hours 337 nautical miles 17 hours Bunbury to Fremantle Port Hedland to Broome 100 nautical miles 5 hours 253 nautical miles 13 hours Fremantle to Geraldton Broome to Christmas Island 213 nautical miles 10 hours 1063 nautical miles 2 days 5 hours 8 Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 Cruise Shipping in Australia The Australian cruise market has shown a significant increase in the number of cruise passengers over recent years. Even during the global recession, the Australian market experienced significant growth. In fact, the Australian cruise market is one of the fastest growing cruise markets worldwide.3 The key factors contributing to the growth of the Australian cruise industry include: holiday option 29.6% Increased product diversification of ship visits in Australia. Increasing consumer awareness of cruise holidays as a value for money Increase in the number of cruise cruise holiday offerings appealing to a broader range of audience An increasing choice of cruise The Australian cruise shipping industry itineraries provided by various recorded significant growth of 29.6% cruise companies to popular in the number of cruise ships visits in tourism regions 2011-12, with strong growth in both international transit ships and ships that An increase in the number of cruise based themselves in Australia for part of ships operating from Australia. the year. The strong growth is primarily attributed to the growth in port visits recorded by Sydney (34.9%), Brisbane (36.5%), Melbourne (55.6%), Fremantle (37.9%) and Geraldton (325%); jointly accounting for nearly two thirds of the total increase in the total number of port visits during 2011-12.4 “Global Cruise Market Report: 2012 Edition - June 2012” Koncept Analytics 2011-12 “Economic Impact Assessment of the Cruise Shipping Industry in Australia, 2011-12” CDU August, 2012 3 4 PORT HEDLAND Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 9 Cruise Shipping in Australia CONTINUED The Australian cruise industry is projected to reach one million cruise passengers by the year 2020, registering an average growth rate of over 5% during the coming years.5 the projected global industry growth The majority of Australian cruise rate for the period. This estimate is itineraries currently comprise smaller based on ongoing domestic influences vessels, with ships based in Australia of robust household incomes, tourism An increase in total passenger days and New Zealand operating itineraries to preferences and scope for further at port destinations in relatively close proximity cruise market penetration (based on such as to regional Australia and New international comparisons). The Australian cruise industry is projected to touch the mark of one million cruise passengers by the year 2020, thereby registering a growth rate of over 5% during the coming Australian economic impact was years , which is significantly more than $2.43 billion 6 seasonal deployment such as Voyager of the Seas to Asia and Australia is an indicator of the future growth in the Australian cruise sector. It is anticipated that an increasing number of mega liners will incorporate 736 cruise ship visits to Australia (from 573 in 2009 –10) An increase in passenger spend from $302.9 million to $443.1 million Zealand and neighbouring islands. The relocation of larger mega liners on Cruise Down Under research7 on the impact of cruising in australia 2011-12: 102 Cruise ship visit days in 2011-12. Australia into their world cruise An increase in crew expenditure from $43.5 million to 60.3 million Total crew days at port up from 237,386 to 324,660 Total port-related expenditure increased year on year from $440.6 million to $733.2 million itineraries with strong demand predicted for South East Asian cruise circuits that incorporate Northern Australia. “Global Cruise Market Report: 2012 Edition - June 2012” Koncept Analytics 2011-12 “Global Cruise Market Report: 2012 Edition - June 2012” Koncept Analytics 2011-12 7 “Economic Impact Assessment of the Cruise Shipping Industry in Australia, 2011-12, Final Report” CDU August, 2011 5 6 GERALDTON 10 Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 Cruise Shipping in Western Australia Western Australia has experienced significant industry growth with expenditure increasing from $22 million in 2004-5 to $185.7 million in 2011-12, with average growth over the period of 35% annually.9 In 2011-12, the industry in Western Australia recorded a significant increase in the number of base port visits, the majority of which were based out of Fremantle. The industry generated approximately $185.7 million of expenditure, which resulted in an additional $87.8 million in Value Added , 10 representing an increase exceeding 150% when compared with 2010-11. A major The most significant region within Bunbury recorded $0.6 million in Western Australia in terms of cruise total expenditure from the industry shipping impacts was Perth serviced in 2011-12, providing the stimulus by the Port of Fremantle. In 2011- for $0.2 million in wages income, 12, the cruise shipping industry 3 FTEs and Value Added of $0.3 generated approximately $160.6 million to the regional economy. million of expenditure within These figures were well below Perth, up significantly from $65.3 2010-11 and what is expected in million in 2010-11. This stimulus 2013/14. generated additional wages income of approximately $44.5 million and 554 FTEs. The industry contributed approximately $75.8 million to Perth’s Value Added, a significant economic contribution. contributor to growth was expenditure Broome recorded $6.5 million in from the Athena and Sun Princess being total expenditure from the industry based out of Fremantle for numerous trips. in 2011-12, providing the stimulus The Western Australian cruise shipping for $1.8 million in wages income, industry recorded a total of 102 cruise ship visit days in 2011-12, a significant increase from 68 visits in 2010-11. The majority of ports (except Bunbury and Albany) recorded an increase, with Fremantle and Geraldton recording the largest increase in 2011-12 (when compared with 2010-11). Overall, the total passengers aboard the ships visiting Western Australia increased from 67,586 in 2010-11 to 158,691 in 2011-12, or a 235% increase. $185.7 m 30 FTEs and Value Added of $3.1 million to the regional economy. These results were well above the Albany recorded $2.1 million in total expenditure from the industry in 2011-12, providing the stimulus for $0.6 million in wages income, 10 FTEs and Value Added of $1.0 million to the regional economy. Esperance recorded $0.6 million in total expenditure from the industry in 2011-12, providing the stimulus for $0.2 million in wages income, 3 FTEs and Value Added of $0.3 million to the regional economy. 2010-11 figures. As at 2012, Western Australia offers Port Hedland recorded $0.8 million in eight cruise port destinations as total expenditure from the industry in identified above. A marina facility is due 2011-12, providing the stimulus for to open in Augusta (gateway to the $0.2 million in wages income, 4 FTEs Margaret River Wine Region) in 2013 and Value Added of $0.4 million to providing a ninth cruise destination the regional economy.11 opportunity for the State. Exmouth and Geraldton recorded The Cruise Western Australia Committee $14.4 million in total expenditure (CWAC) has recently been established from the industry in 2011-12, a to guide the implementation of the WA result significantly above the 2010- Cruise Shipping Strategic Plan. 11 contribution. The value of the cruise shipping sector in Western Australia for 2011-12 “Expenditure” is direct and indirect expenditure by cruise industry crew, operators and passengers “Economic Impact Assessment of the Cruise Shipping Industry in Australia, 2011-12” CDU August, 2012 10 “Value Added” is the total contribution of the industry to the economy including the total consumption, investment and government expenditure, plus exports of goods and services, minus imports of goods and services due to the industry. 11 “Economic Impact Assessment of the Cruise Shipping Industry in Australia, 2011-12” CDU August, 2012 8 9 Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 11 DEVELOPING THE STRATEGIC PLAN The State Government Strategy for Tourism in Western Australia 2020 identifies a key goal for Tourism WA, other government agencies (State and Local) and the broader tourism industry to achieve by 2020: To double the value of tourism in Western Australia – from $6 billion in 2010 to $12 billion by 2020. Western Australian Cruise Industry SWOT analysis Strengths Weaknesses Diverse locations and unique Tourism product is underdeveloped experiences and inadequate to support cruise Capacity at Fremantle to ship visitation at some regional accommodate mega liners destinations Mediterranean climate in the Insufficient regional marine south and tropical climate in the infrastructure to adequately service north has the capacity to support large cruise vessels ships all year round Extensive range of quality land and Cruise shipping has been identified in water based activities and cultural the Strategy as a key initiative that will experiences to satisfy the needs of contribute to this goal. the international cruise passenger In 2011-12 Tourism Western Australia Viewed by cruise passengers as a conducted extensive consultation to safe and exotic destination ascertain the strengths, weaknesses, Research conducted in opportunities and threats for the 2011 – 12 identified Broome as industry and the key business areas a key destination influencing where efforts of Government and consumers’ cruise itinerary choice industry should be focused in order to The Kimberley, Ningaloo and realise the potential of cruise shipping South West regions are profiled for the State. tourism destinations at the State Seasonal weather conditions impact current cruising itineraries Increasing number of Western Australian cruise destinations competing for the same market Cruise lines lack the general awareness of Western Australia’s regional destinations in terms of facilities and capabilities. and Federal level. Opportunities Closest western destination to Strong global competition to South East Asia, the world’s fastest attract cruise lines to destinations growing tourism source market impacts Western Australia’s ability Improved co-operation and to grow market share co-ordination within Western Increasing fuel costs impact Australia’s Cruise sector upon Western Australia’s appeal Capitalise on Western Australia’s as a cruise destination due to ability to deliver quality indigenous remoteness experiences to cruise ship passengers Competition from other industry Expand and enhance destination sectors for resources and product for shore excursions and investment. pre and post touring options Leverage projected increase in home berthed ships in Australia as ships are relocated to SE Asia/ Australian waters Increasing number of “baby boomers” coming into retirement. 12 Threats Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 KEY BUSINESS AREAS The following four key business areas have been identified in consultation with stakeholders: A. D estination awareness & marketing B. Port infrastructure & policy $12b Forge relationships within the cruise Identify the priority gaps (particularly industry and initiate marketing in relation to marine and terrestrial activities to increase cruise port infrastructure and amenities) ship visitation, length of stay and and implement necessary activities Goal to double the value of to improve capacity to facilitate tourism in Western Australia - growth within the cruise sector. from $6 billion in 2010 to expenditure. $12 billion by 2020 D. L andside destination development C. S trengthen industry capacity & ownership Facilitate a cooperative Visitor servicing infrastructure and Statewide approach to realise the development of new shore excursion State’s cruise industry growth options (including indigenous through identification of lead experiences content) and pre and agencies and tourism organisations post cruise touring activities to to provide leadership and build generate additional visitor nights/ capacity (such as TCWA, FACET, spend. These four business areas RDCs, RTOs, and Port Authorities). form the basis of the Western Australia cruise shipping industry priorities and are reflected in the Strategic Goals incorporated into the Strategic Plan. ALBANY Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 13 CRUISE Destinations - Current and Future Status During stakeholder consultation and through cruise passenger research several key Western Australian cruise destinations have been identified as having the greatest influence on the future of cruise shipping in the State. The Strategic Plan must guide decision The tiering of ports is based on the making and choices regarding these following key criteria: destinations, and do so in a way that effectively considers: Global and local passenger and cruise line preferences State tourism priorities Infrastructure and capability development requirements and Destination awareness and marketing Port infrastructure and policy Industry capacity and ownership Landside destination experiences and amenities funding. Cruise destinations have been The forward vision is that by 2020 categorised into tiers to reflect their Western Australia will offer two current status and projected future turnaround ports (Fremantle and status based on their ability to impact Broome) and seven well established strategically on the growth of the sector. transit ports. Tier 1 CRUISE DESTINATIONS are turn-around ports that score highly in the four criteria above. That is, they have a high level of port infrastructure to support visitation from large cruise ships, a high level of destination awareness among the cruise industry, a high degree of industry capacity and port infrastructure to support turn around visits, a high level of tourism destination infrastructure to support cruise ship visitation such as attractions, accommodation, activities, access and amenities, and the destination is an international air gateway. Tier 2 CRUISE DESTINATIONS score on average a medium rating across the four criteria. Therefore they may have a high degree of port infrastructure to support visitation from cruise ships but lack the tourism destination infrastructure , industry capacity or destination awareness among the cruise industry. Alternatively, the destinations may have a high level of destination awareness and industry capacity but lack the port infrastructure to rate highly across all four criteria. Tier 3 CRUISE DESTINATIONS score on average a low rating across the four criteria. For example, while the port offers a medium level of infrastructure, the destination marketing and awareness is low, industry capacity is low and the tourism destination infrastructure cannot service the market adequately. 14 Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 CRUISE Destinations - Current and Future Status CONTINUED In the following table each port is assessed as high (H), medium (M) or low (L) against the four strategic business areas. CURRENT STATUS OF KEY CRUISE DESTINATIONS Destination awareness and marketing Port infrastructure and policy Industry capacity and ownership Landside Destination Development Tier Ranking Fremantle H H H H 1 Broome H M M M 2 Bunbury M M H M 2 Albany M M M M 2 Esperance M L M L 2 Geraldton M L M L 2 Exmouth M L L L 3 Port Hedland L M L L 3 Augusta* L L L** M 3 Port * Due to open tender facility by October 2013 ** Non-operational as at 2012 therefore no experience in servicing cruise ship arrivals The following table shows each cruise destinations assessed 2012 Tier Status, and its planned Tier Status during the Strategy timeframe at 2016 and 2020. Year 2012 Tier 1 Fremantle Tier 2 Tier 3 Albany Augusta Broome Exmouth Bunbury Port Hedland Esperance Geraldton 2016 Fremantle Albany Augusta Broome Exmouth Bunbury Port Hedland Esperance Geraldton 2020 Broome Albany Fremantle Augusta Bunbury Esperance Exmouth Geraldton Port Hedland Cruise Shipping Strategic Plan | 2012 - 2020 Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 15 STRATEGIC DIRECTION The purpose of this Strategic Plan is to bring together Western Australia’s cruise shipping industry stakeholders and influencers around a common understanding and direction for the development of a sustainable, co-ordinated and achievable future for the sector. The Western Australian Cruise Shipping Strategic Plan enables priorities to be: Agreed and implemented The Strategy is designed to engage stakeholders by ensuring the Plan: Is achievable and addresses main local and State priorities to align Integrated with State and local with overarching State and National business plans tourism plans to 2020 Monitored and updated as Is owned and understood by required. industry and other key stakeholders so it will be implemented It is important that this Strategic Plan also integrates with other tourism and industry plans and initiatives as there are multiple industry stakeholders that influence and are influenced by this Strategy. Identifies strategic risks and critical success factors Enables local stakeholders to be involved in choices between and within priorities. MISSION To contribute significantly to the economic growth of tourism and the State, by providing world class cruise destinations and extraordinary tourism experiences that deliver high value benefits for the cruise industry, cruise passengers and local communities. ALBANY 16 Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 The Strategic Goals indicate the four priorities identified to achieve the industry’s planned growth and development targets for 2020. Four of these goals are aligned to the four priority business areas identified from Tourism Western Australia’s consultations with industry in 2011-12, and integrate with State and National tourism and other related plans and strategies. The final priority aims to ensure sustainability of the cruise industry in Western Australia. The goals with their objectives are detailed to the right. 1999 Goals Goal 1 Position and market Western Australia as a world class cruise destination Business Area 1: Destination Marketing and Awareness 1 Promote Western Australia as a world class cruise destination Goal 2 Enhance Western Australia’s individual cruise destinations Business Area 2: Landside Destination Development 1 Enhance visitor servicing infrastructure in destinations to meet the needs of the cruise sector 2 Expand the shore excursion touring options and experiences to exceed visitor expectations 3 Develop pre and post cruise / stay options in turnaround port destinations 4 Promote the delivery of quality tourism product servicing the cruise market Goal 3 Provide efficient and safe port facilities and services that meet the needs of the cruise sector Business Area 3: Port Infrastructure and Policy 1 Develop and enhance maritime facilities to meet the needs of current and future cruise ship specifications 2 Provide safe and welcoming port facilities to meet passenger requirements Goal 4 Build and Foster Industry Partnerships Business Area 4a: Strengthen Industry Capacity and Ownership 1 Establish and develop industry relationships to showcase Western Australia to cruise shipping industry decision-makers 2 Develop and implement stakeholder communication and engagement strategy 3 Provide and support industry education, training and development programs 4 Advocacy for the industry and the Strategy Business Area 4b: Ensure Industry Sustainability 1 Conduct market research to validate and inform implementation of the Strategic Plan 2 Secure sustainable funding, investment and support Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 17 Critical Success Factors In developing the Strategic Plan four critical success factors have been identified. These factors influence and enable the strategic goals, and contribute to successful implementation of the Plan and achievement of its priorities. Critical Success Factors 1 Integrating with other industry, State, National and International tourism supply and demand strategies The Strategy must complement and co-ordinate with other plans to ensure that funding and resources are best utilised across all sectors to address multiple priorities and achieve the 2020 goals 2 Actively supporting key stakeholders for the industry and the Strategic Plan (including Tourism WA, CWAC, CDU, cruise lines, Port Authorities, ITOs, LGAs and local suppliers) The Strategy covers a large geographic area in an industry with diverse local assets and needs. A co-ordinated approach to gain active local and broad support for the Plan is vital. 3 CWAC successfully leading this Strategy and representing the WA cruise shipping sector CWAC will provide the necessary leadership, co-ordination and monitoring of the Strategy. It is critical that it adequately represents and advocates for and with industry and is supported internally and externally in fulfilling this role. 4 Tourism WA sponsoring and taking an active partnership role with CWAC for this Strategy implementation through to 2020 Tourism WA has provided the impetus to formalise this industry Strategy. It is important that it commits to an active role until 2014, but maintains a core role as the industry grows and develops. Measures to achieve and monitor these critical success factors have been incorporated into the KPIs and monitoring of this Strategic Plan. STRATEGIC RISKS Risk analysis of this Strategy identifies the critical role of the CWAC in ensuring the successful growth and development of the Western Australian cruise industry; specifically in the following areas: Leading industry and stakeholders throughout the development and implementation of the Strategy Ensuring that stakeholders work together so that cruise shipping demand and supply strategies and initiatives are co-ordinated and consistent with the Strategy, and individual port and industry priorities are balanced 18 Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 ESPERANCE Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 19 ImplementATION Successful implementation of the Strategic Plan relies on appropriate prioritisation and integration, correct risk analysis, and stakeholder engagement and support. The Strategic Plan aspires to grow and The goals reflect the four business develop the cruise shipping industry areas identified through stakeholder in Western Australia to incorporate consultation and define actions that opportunities from global and local are prioritised as high, medium or cruise shipping growth, to anticipate low in terms of their priority ranking and deal with challenges and risks, and for implementation. to integrate with the State and Federal Governments’ tourism strategies to achieve the goal of doubling the value of tourism by 2020. A glossary of key terms and acronyms used in the Strategic Plan is included as Appendix One. IMPLEMENTATION PLAN Business Area 1: Destination Awareness and Marketing Goal 1: Position and market Western Australia as a world class cruise destination Objective 1: Promote Western Australia as a world class cruise destination Strategies Develop and implement a dedicated and co-ordinated strategy to position and market Western Australia as an attractive cruising destination aligned to the “Experience Extraordinary Western Australia” brand, as well as Cruise Down Under and Tourism Australia marketing programs at a National level Actions Research and establish a dedicated marketing strategy that considers all forms of marketing activities (digital, social, traditional, trade event, PR, familiarisations) Work with neighbouring countries and jurisdictions to position Western Australia within the Asian cruise zone Implementation, monitoring and review of the marketing strategy Regular reporting of outcomes and achievements BUNBURY Photo courtesy of Troy Mayne 20 Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 Partners Marketing strategy to identify the roles and responsibilities of all stakeholders Priority HIGH Business Area 2: Landside Destination Development Goal 2: Enhance Western Australia’s individual cruise destinations Objective 1: Enhance visitor servicing infrastructure in destinations to meet the needs of the cruise sector Strategies Develop partnerships with industry stakeholders to ensure a collaborative approach to visitor servicing Actions CWAC and LCCs to ensure that industry / stakeholder partnership opportunities are fully explored and implemented Partners CWAC Priority HIGH VCs LCCs Utilise cruise passenger research to identify enhancements and improvements at cruise destinations (Land side) Analyse research to identify opportunities and constraints at cruise destinations relating to: Hygiene factors (shade, water, seating) Transport provision Retail – including opening hours Food and Beverage Welcome activities/services CWAC MEDIUM TWA CDU ATEC LGAs VCs LCCs Visitor information and signage Establish and implement visitor infrastructure development plans at cruise destinations (Land side) Opportunities for cross-agency communication and partnering Conduct infrastructure audit at destinations Establish an action plan identifying and costing infrastructure requirements Secure resources for implementation of the plan CWAC MEDIUM TWA LGA VCs LCCs Objective 2: Expand the shore excursion touring options and experiences to exceed visitor expectations Strategies Develop shore excursions that support destination positioning Actions Conduct an audit of existing shore touring product to identify gaps Work with currently uncontracted product, or work to establish new product, including indigenous/cultural experiences Investigate current ground transport infrastructure issues at destinations (with identified challenges) and identify options to remedy these challenges Partners CWAC Priority HIGH TWA RTOs VCs WAITOC ATEC LCCs Promote the new/enhanced product offering to travel intermediaries, aiming to expand shore activity choices, encourage repeat visitation and ensure better customer experiences in destinations Work with tour operators to educate industry on standard cruise commission structures/terms Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 21 IMPLEMENTATION PLAN CONTINUED Goal 2: Enhance Western Australia’s individual cruise destinations Objective 3: Develop pre and post cruise / stay options in turnaround port destinations Strategies Encourage increased length of stay by expanding pre/post cruise stay in Western Australia in turnaround ports (Fremantle currently) Actions Work with travel intermediaries to encourage packaging pre/post cruise stay and travel options in Western Australia Partners CWAC Priority MEDIUM TWA ATEC Work with cruise lines and inbound tour operators to develop opportunities to promote tailored packages for crew CDU RTOs LCC Objective 4: Promote delivery of quality tourism product servicing the cruise market Strategies Promote tourism quality through industry accreditation programs and best practice templates for all stakeholders Actions Develop and implement an industry guidelines and development kit for all stakeholders, especially suppliers Implement an industry-driven accreditation process BROOME 22 Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 Partners CWAC TCWA Priority MEDIUM Business Area 3: Port Infrastructure and Policy Goal 3: Provide efficient and safe port facilities and services that meet the needs of the cruise sector Objective 1: Develop and enhance maritime facilities to meet the needs of current and likely future cruise ship specifications Strategies Port - Marine Identify port facility status and marine infrastructure development requirements to service the cruise shipping market Actions Research and report on port marine facilities – status, infrastructure development needs (immediate, medium and long term - refer to current and planned tier status on page 15) Partners State and Federal Governments Priority HIGH Port Authorities Prioritise port marine infrastructure requirements and ensure integration into State and regional infrastructure plans Secure resources to implement priority marine infrastructure needs Port - Terrestrial Build capacity of port (terrestrial) facilities to enhance visitor experiences at embarkation and disembarkation (i.e. shade areas, walkways, etc) Identify the gaps and enhancement requirements of port terrestrial facilities Prioritise port terrestrial facilities requirements and ensure integration into State and regional infrastructure plans Secure resources to implement priority needs Local, State and Federal Governments HIGH LCCs Visitor Centres Port Authorities Investigate alternative forms of infrastructure funding Objective 2: Provide safe and welcoming port facilities to meet passenger requirements Strategies Coordinate passengers and port operations in a safe and efficient manner Actions Partners Improve people and activity management DOT Enhance effective transport, processing and servicing operations Port Authorities Priority LOW LGAs Develop ship scheduling guidelines Continually improve port systems and processes that impact on ships and passenger experiences Streamline systems, activities and processes DOT Improve customer service Port Authorities Plan passenger facilities to maintain passenger comfort and streamline processing Consult widely on the design of cruise facilities to meet the requirements of key stakeholders Create a secure passenger terminal and port area Incorporate best practice security arrangements LOW LGAs DOT LOW Port Authorities LGAs DOT LOW Port Authorities LGAs Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 23 IMPLEMENTATION PLAN CONTINUED Business Area 4: Strengthen Industry Capacity and Ownership Goal 4A: Build and Foster Industry Partnerships Objective 1: Establish and develop industry relationships to showcase Western Australia to cruise shipping industry decision-makers Strategies Establish a peak cruise shipping industry body for Western Australia Actions Establish an effective and efficient Cruise WA Committee (CWAC) Foster the development of LCCs in port destinations CWAC to become interface with National bodies including Cruise Down Under, Tourism Australia, ATEC, RET (e.g. Access Working Group under National Long Term Tourism Strategy) CWAC to communicate regularly with National bodies Partners Priority TWA and industry stakeholders MEDIUM CWAC MEDIUM TWA Ensure that Tourism WA maintains membership to Cruise Down Under (CDU) Integrate cruise shipping plans and strategies with other State, National and International tourism strategies Bid to host CDU Conference 2014 CWAC to become the interface for regional cruise destinations Identify, engage and establish relationships with industry decision-makers and influencers CWAC MEDIUM LCCs Develop and implement a calendar of engagement with identified stakeholders Objective 2: Develop and implement stakeholder communication and engagement strategy Strategies Actions Partners Priority Implement key issues and communications plan Agree and implement with CWAC on purpose, scope, context and content of communications plan CWAC HIGH Identify and survey key industry stakeholders to better understand their interests, expectations, needs and concerns Design and implement stakeholder survey CWAC MEDIUM Report findings and main recommendations TWA Monitor and evaluate the communications and engagement plan Survey and consult with stakeholders and incorporate feedback into plan improvements 24 ATEC Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 CWAC LOW Business Area 4: Strengthen Industry Capacity and Ownership Goal 4A: Build and Foster Industry Partnerships Objective 3: Provide and support industry education, training and development programs Strategies Facilitate industry training and development Actions Work with industry bodies (e.g. TCWA, ATEC) and all levels of government to build capacity and capability within the industry Deliver industry-specific training (e.g. cruise ready workshops, tour guide training) Partners CWAC Priority HIGH TWA TCWA ATEC Deliver development programs, including insights and industry intelligence Engage with local communities to educate on the expectations of cruise consumers during shore visits Identify and work with local stakeholders (e.g. LGA, CCI) to educate cruise destination communities, particularly retail and hospitality, as to the needs of the cruise consumer during shore visits CWAC HIGH TWA LCCs VCs Objective 4: Advocacy for the industry and the Strategy Strategies Encourage support for implementing the Western Australian Cruise Shipping Strategic Plan Actions Engage key industry stakeholders to commit to supporting the Western Australian Cruise Shipping Strategic Plan Partners Priority CWAC HIGH CWAC HIGH CWAC to be the united voice and advocate working towards raising the profile of the cruise industry in Western Australia Develop a prioritised and staged Western Australian cruise shipping industry infrastructure development and marketing budget Engage industry decision-makers and influencers, including all levels of government, to secure suitable and sustainable infrastructure funding TWA DOT DLG RDL DOP Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 25 IMPLEMENTATION PLAN CONTINUED Business Area 4: Strengthen Industry Capacity and Ownership Goal 4.B Ensure Industry Sustainability Objective 1: Conduct research to validate and inform a sustainable Strategy Strategies Actions Implement Cruising WA Health Check to monitor performance against target indicators Develop indicators and reporting methodology Undertake research activities to provide reliable intelligence to inform a sustainable Strategy: Develop ongoing market research program to monitor economic contribution of the cruising industry and implement research programs (when required) to research project specific requirements (e.g. customer satisfaction) Research the economic value of cruise shipping for Western Australia Research to inform marketing activities Research on destination satisfaction to inform infrastructure, servicing and experience requirements. Partners Priority CWAC HIGH CWAC MEDIUM Undertake industry health checks TWA TRA CDU Partner CDU and TRA (where possible and appropriate) on research programs Regularly engage cruise industry to proactively identify issues and trends, and ensure that cruise line profiles are kept updated Objective 2: Secure sustainable funding, investment and support Strategies Secure appropriate level of funding to: Implement marketing activities Implement port/destination infrastructure needs Support industry training and education Support governance structure 26 Actions Engage industry decision-makers and influencers, including all levels of government, to secure suitable and sustainable infrastructure funding Government to consider recurrent funding for marketing of the State as a cruise destination Apply for CDU Cruise Research Funding Facilitate individual discussions with funders and investors Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 Partners State and Federal Governments Priority HIGH Targets and Indicators of Success The Cruise WA Committee will review the initiatives identified in the Western Australian Cruise Shipping Strategic Plan annually to ensure the Plan remains current, relevant and makes a significant contribution to the State Government Strategy for Tourism in Western Australia 2020 goal to double the value of tourism to the State’s economy. In line with this Statewide goal, this Strategic Plan seeks to increase the value of the cruise shipping sector from $185.7 million in 2011-12 to $274.4 million in 2020, using an average annualised growth rate of 5%, based on the national average projected industry growth to 2020.12 The table to the right outlines the 2013-14 measures and targets for each strategic business area. 1. Destination awareness and marketing 2013-14 Measures 2013-14 targets Increase the number of cruise line 1 additional cruise company (from companies visiting Western Australia 2011/12 base) Increase the number of cruise ship visits 5% increase on 2011/12 to Western Australia Lead or participate in trade marketing 3 significant activities events/road shows/activities 2. Landside Destination Development 2013-14 Measures Increase or update Western Australia 2013-14 targets 5% increase on 2011/12 shore excursion product featuring in cruise itineraries/brochures Undertake Passenger Survey research Next passenger research survey to be every second year completed in 2013/14 3. Port Infrastructure and Policy 2013-14 Measures Investigate Western Australian port 2013-14 targets Broome 2013/14 infrastructure requirements to service the cruise sector 4. Strengthen industry capacity and ownership $274.4M The WA Crusie Shipping Strategic Plan 2012-2020 seeks to increase the value of the cruise shipping sector from $185.7 million in 2011-12 to $274.4 million in 2020. 2013-14 Measures 2013-14 targets Deliver cruise ready educational programs Delivered in all 9 ports in Western Australian cruise ports Secure State membership of Cruise Down Ongoing membership to CDU secured Under Establish a co-ordinated approach to Local Cruise Committees established to cruise ship arrivals manage all visits “Global Cruise Market Report: 2012 Edition - June 2012” Koncept Analytics 2011-12 12 Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 27 Appendix One: Glossary of terms and acronyms ATEC Australian Tourism Export Council CCI Chamber of Commerce and Industry CDU Cruise Down Under CWAC Cruise Western Australia Committee DLG State Department of Local Government DOP State Department of Planning DOT State Department of Transport FACET Forum Advocating Cultural and Eco Tourism Inc. FIT Free and Independent Traveller GH Ground Handler HP Home Port ICCA International Cruise Council Australasia ITO Inbound Tourism Operator LCC Local Cruise Committee LGA Local Government Authority NLTSS National Long Term Tourism Strategy PA Port Agent RDC Regional Development Commissions RDL State Department of Regional Development and Lands RTO Regional Tourism Organisation STO State Tourism Organisation TCWA Tourism Council Western Australia TRA Tourism Research Australia TP Transit Port TWA Tourism Western Australia VC Visitor Centres WAITOC Western Australian Indigenous Tourism Operators Council 28 Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 PERTH Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 29 Appendix Two: Major Cruise Shipping Industry Stakeholders in Western Australia The major stakeholders of the Western Australia cruise shipping industry include: Cruise Shipping Passengers and potential passengers Major Cruise Lines currently operating in Australia and potential new cruise lines Cruise Down Under as the Australian peak cruise industry association charged with growing and developing the Australian Pacific region as the world’s leading cruise destination providing economic, social and environmental benefits Shipping Agents that handle the operational aspects for cruise lines while cruise ships are in port Inbound Tour Operators (Ground Handlers) who develop and operate shore excursions in Australia and generate revenue for cruise lines from the sale of shore excursions Regional Development Commissions and Other State Government Agencies which can provide local support and may assist with infrastructure assessments and local co-ordination Port Authorities that provide marine infrastructure and manage the arrival and departure of cruise vessels Port Facility and Service Providers including shops and transport or tour providers Local, Regional, State and National Tourism Authorities to assist and support industry in implementing this Strategy Local Government Authorities across the State which play a vital role in facilitating numerous on ground services and amenities to assist in providing cruise passengers with a comfortable and enjoyable visitor experience PORT HEDLAND 30 Western Australian Cruise Shipping Strategic Plan | 2012 - 2020 Tourism Western Australia Level 9 2 Mill Street PERTH WA 6000 GPO Box X2261 PERTH WA 6847 Tel: 08 9262 1700 Prepared by Our Community Pty Ltd Fax: 08 9262 1702 August 2012. cruiseshipping@westernaustralia.com westernaustralia.com Dolphin Cover Image: Troy Mayne tourism.wa.gov.au ISSN 1834-2418 For an electronic copy of this document or further information on the Western Australian Cruise Shipping Strategic Plan 2012-2020 please visit: www.tourism.wa.gov.au