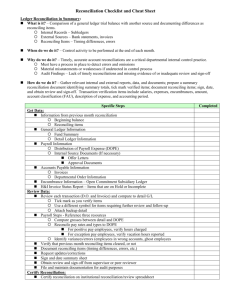

Ledger Review Checklist and Cheat Sheet

advertisement

Ledger Review Checklist and Cheat Sheet Ledger Review in Summary: What is it? – Evaluation of information to determine validity of charges and credits. Review for currency, accuracy, completeness and compliance Document significant differences for corrective action or follow-up – Timing differences, errors, noncompliances Use a risk-based approach to concentrate effort on high risk areas and transactions When do we do it? – Key control activity to be performed after the end of each month. Why do we do it? – Timely account reviews are critical departmental internal control responsibilities. Must have a process in place to detect significant errors and omissions Last line of defense for accurate reporting – Lack of reviews could result in material misstatements in financial reporting/billing Potential audit findings – Lack of timely account review and missing evidence of review and sign-off fails test of key control How do we do it? – Gather relevant internal and external reports, data, and documents; use a risk-based approach to review; prepare a summary GL Review document that identifies summary totals and follow-up items; sign, date, and obtain review and sign-off from separate manager/peer reviewer. Transaction verification items include but are not limited to: salaries, expenses, encumbrances, amounts, account and sub-account classification, description of expense, unallowable costs and accounting/reporting period. Specific Steps Get Data: Information from previous month GL review - Ending balances - Corrective action and follow-up items General Ledger Information - Fund Summary - Detail General Ledger Payroll Information - Payroll Distribution - Internal source documents (If necessary and based on risk) Offer letters or other supporting documentation Approval documents Accounts Payable Information (If necessary and based on risk) - Invoices - Departmental order information/authorization Encumbrance Information – Open Commitment Subsidiary Ledger H&I Invoice Status Report – Items that are on Hold or Incomplete Review Data: Compare budget to actual expenses and document whether expenses are according to plan Review expense items based on risk (materiality, unusual items, unexpected activity/items, etc.) - Document as you verify items - Identify items requiring further review and follow-up - Keep backup with GL review or reference location Verify Payroll Distribution totals to General Ledger totals – Compare summary totals to identify differences Verify Payroll Distribution detailed items based on risk (materiality, new employees, unusual activity) - Review employee names and pay details for unusual activity or unexpected items/types of pay Rates, hours, percentage time, salary changes for unusual activity or unexpected items/types of pay Employee names for unknown/potential ghost employees or employees in wrong accounts - Identify items requiring further review and follow-up - Keep backup with GL review or reference location Verify that previous month follow-up items cleared and errors were corrected, or not Document new follow-up items in summary to carry forward (timing differences, errors, etc.) Request of updates/corrections or document status (timing difference, waiting for journal, etc.) Sign and date summary sheet (can be electronic) Obtain review and sign off from supervisor or peer reviewer (can be electronic) File and maintain documentation for audit purposes Updated 10/08/2014, SAI Completed