2005 Corporate Responsibility Report

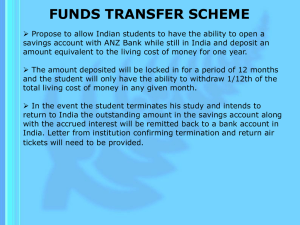

advertisement