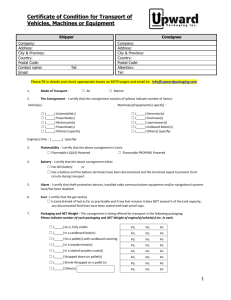

Egyptian Import/Export Regulation 770/2005

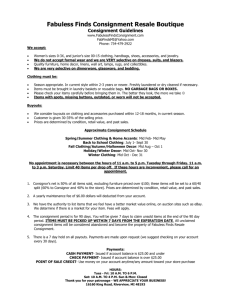

advertisement