China Fertilizer Weekly Report Sample- November 2014

advertisement

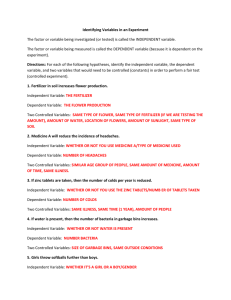

JYD CHINA FERTILIZER MARKET WEEKLY REPORT November 21, 2014 To request subscription, please email service@315.com.cn Content Fertilizer Units Operation Rate Synthetic Ammonia Price and Operation Rate Urea Price and Operation Rate Phosphate Price and Operation Rate Potassic Price and Operation Rate 1 1 2 3 4 Compound fertilizer Price and Operation Rate Sulfur Price and Operation Rate Sulphuric Acid Price and Operation Rate Forecast of China Fertilizer Market 5 6 6 7 China Fertilizer Unit Operation Rate The daily output of urea averaged at 145,600 mt in China in the week ending November 21st. Phosphatic fertilizer operation rate dropped slightly due to partial of the small plants in Central China at maintenance. The fertilizer operation rate is predicted to edge up in the following week, albeit it is to exert little impact on market supply. China Fertilizer Unit Operation Rate, 2014 Product Prilled urea Region Nov 10th-14th (%) Nov 17th-21st (%) Nov 24th -28thE (%) Total 65.53 66.23 65-68 Shandong 47.11 48.77 47-50 Henan 59.65 57.33 57-60 Anhui 84.10 85.50 83-85 MAP Total 68.64 64.05 66-66 DAP Total 74.72 74.05 75-75 Potassium chloride Total 70.00 68.00 68-68 Sulfur Total 60-65 65-70 70-75 China Synthetic Ammonia Market Major Synthetic Ammonia Operation Status According to JYD, a large majority of China major synthetic ammonia producers have started operating. Specifically, Anhui Anqing Petrochemical started its liquid ammonia unit on November 18, adding a supply of 450-500 mt per day, and Anhui Zhun Chemical started to produce on November 17, lifting daily output by 100 mt, which brought total supply in Anhui market to 7,950 mt, rising 23.26% from a week before. Hebei Tianbao Chemical put its liquid ammonia unit into production on November 18, adding 200 mt/day supply to Hebei market. Shandong Mingshui Chemical was predicted to resume production on November 24, expected to raise market supply in Shandong by 200 mt per day. China Synthetic Ammonia Plants Turnaround, 2014 Region Major Producer Operation Status Anhui Anhui Yingshang Xintai Chemical Turnaround started on Nov 21 and ended on Nov 21, cutting 7,500 mt supply Hebei Hebei Tianbao Chemical Turnaround started on Nov 3 and ended on Nov 18, cutting 3,200 mt supply Hubei Sinopec Hubei Branch Turnaround started on Nov 3 and ended on Nov 21, cutting 9,500 mt supply Shandong Shandong Mingshui Dahua Turnaround started on Nov 5 and ended on Nov 21, cutting 1,500 mt supply Data Source: JYD Information Co., Ltd. P-1 JYD CHINA FERTILIZER MARKET WEEKLY REPORT November 21, 2014 China Synthetic ammonia price changes This week, China synthetic ammonia market kept the downtrend, mainly due to increasing supply and weak demand. According to JYD, plants in regions like Anhui, Jiangsu and Hebei, which were in turnaround, had all recovered production, lifting market supply by about 1,000 mt per day. However, traders were still slow in winter restocking, with their demand for liquid ammonia declining rather than rising. The market was obviously plagued by oversupply. China liquid ammonia market moved lower in the week, barring a slight price gain in Jiangsu due to a unit turnaround at Shilian Chemical. Synthetic Ammonia Average Prices, 2014 CNY/mt Time Shandong South Shandong Hebei Henan Jiangsu Anhui Hubei Nov 10th-14th 2,475 2,446 2,269.5 2,242 2,358 2,520 2,600 Nov17th-21st 2,386.67 2,440 2,245.5 2,240 2,400 2,510 2,480 WoW (%) -3.57 -0.25 -1.06 -0.09 +1.78 -0.40 -4.61 YoY (%) -3.37 -11.88 -9.08 -7.14 -9.43 -8.06 -1.59 Time Shandong South Shandong Hebei Henan Jiangsu Anhui Hubei Nov 14th 2,475 2,440 2,272.5 2,240 2,340 2,540 2,600 Nov 21st 2,386.67 2,440 2,237.5 2,240 2,400 2,475 2,400 Change (%) -3.57 0 -1.54 0 +2.56 -2.56 -7.69 China Urea Market Major Urea Producers’ Unit Operation Status According to JYD, some coal-based urea producers had returned to normal operation after the APEC meeting, especially those large ones in Shandong. Urea supply was sufficient and overall operation rate increased. Hebei Cangzhou Chemical had stopped production due to tight natural gas supply, reducing supply by 1,700 mt per day, and had no production resumption plan. Therefore, gas-based producers’ operation rate dropped to some extent. China Key Urea Plants Turnaround, 2014 Region Major Producer Operation Status & Affected Output Northwest Inner Mongolia Talent Chemical Fertilize It has an annual urea production capacity of 520,000 mt. Unit turnaround started on Oct 25th, planned to end in late Nov. It will reduce output by 1,700 mt per day Shandong Mingshui Dahua Its granular urea units, with an annual production capacity of 400,000 mt, shut down in early Nov, predicted to cut an output by 500 mt per day. Already ignited, the units are predicted to return to normal production in the following week. Its prilled urea units remained closed. Zhejiang Juhua Production suspended on Nov 10, predicted to affect an output of 600 mt per day; Operation restarted on Nov 20, producing no more than 500 mt per day. Hebei Jinshi Chemical The units closed during the APEC meeting and resumed production successively thereafter, returning to normal production on Nov 20th. Hebei Cangzhou Dahua It has an annual urea production capacity of 500,000 mt. Unit turnaround started on Nov 20th, predicted to cut output by 1,700 mt per day Henan Xinlianxin Chemical No. 4 plant started unit turnaround on Nov 19th, to reduce output by 2,800 mt/day. Shandong North China Central China Data Source: JYD Information Co., Ltd. China Urea Price Changes China urea market showed no obvious upturn with fragile trading. Though quotations stabilized in most regions, transactions were subdued. A part of resources in North China and East China were shipped to the Northeast, while some big plants in Henan were reeling from relatively heavy inventory pressures. Nevertheless, capacity utilization slowed down at the compound fertilizer plants, offering no strong support for urea demand. China urea market is hard to improve significantly in the short term. P-2 JYD CHINA FERTILIZER MARKET WEEKLY REPORT November 21, 2014 China Urea Average Prices, 2014 Time Shandong CNY/mt Anhui Hubei Liaoning Shaanxi Sichuan Guangdong Nov 10th-14th 1,532 1,536 1,564 1,600 1,560 1,660 1,668 Nov 17th-21st 1,516 1,538 1,540 1,600 1,560 1,620 1,652 WoW (%) -1.04 +0.13 -1.53 0 0 -2.41 -0.95 YoY (%) -11.09 -7.35 -6.67 -5.88 -2.50 -2.99 -9.23 Time Shandong Anhui Hubei Liaoning Shaanxi Sichuan Guangdong Nov 14th 1,520 1,540 1,540 1,600 1,560 1,655 1,650 Nov 21st 1,515 1,530 1,540 1,600 1,560 1,620 1,660 Change (%) -0.33 -0.65 0 0 0 -2.11 +0.61 China Phosphate Market China Major Phosphatic Fertilizer Unit Operation Status This week, China MAP producers’ operation rate slightly dropped, mainly as the units at Hubei Wuhan Zhongdong, Hubei Chunxiang Chemical and Henan Xinmi Fengyuan Phosphorus Chemical were under maintenance. MAP supply declined 39,000 mt in the week, accounting for 15.14% of the country’s total production. China DAP producers’ operation rate remained flat, and supply dropped 537,000 mt in the week, taking up 16.68% of the country’s total output. China Major Phosphatic Fertilizer Plants Turnaround, 2014 Region Major Producer Operation Status & Affected Output Southwest Yuntian Chemical With a DAP production capacity of 2.82 million mt per annum, the plant is producing at only 80% of capacity, reducing output by 1,500 mt per day. Hubei Yihua Its MAP units started transformation from the end of 2013. Only one powder production line is operational, and the granular facilities are running at 30% of capacity, cutting supply by 970 mt per day. Hubei Wuhan Zhongdong With a MAP production capacity of 350,000 mt per annum, its units shut down in late Oct and is planned to resume in mid-Dec, to reduce supply by 700 mt per day. Hubei Chunxiang Chemical With a MAP production capacity of 150,000 mt per annum, its units started maintenance on Nov 15 and is planned to resume at the end of the month, to reduce supply by 300 mt per day. Henan Xinmi Fengyuan Phosphorus Chemical With a MAP production capacity of 100,000 mt per annum, its units halted production on Oct 25, with resumption date unknown, and it is to reduce supply by 200 mt per day. Shandong Mingrui Chemical With a MAP production capacity of 100,000 mt per annum, its units started maintenance on Nov 8 and was planned to resume production on Nov 20, to reduce supply by 200 mt per day. Central China East China Data Source: JYD Information Co., Ltd. China Phosphatic Fertilizer Price Changes In China MAP market, winter restocking merely concentrated in a small scope of regions like the Northeast and Northwest, and demand from end users was in a lull season. However, capacity utilization at MAP plants in Hubei was rallying. Under sufficient supply and dull demand, MAP prices, hard to gain further, are predicted to stabilize. P-3 JYD CHINA FERTILIZER MARKET WEEKLY REPORT November 21, 2014 China MAP Average Prices, 2014 CNY/mt Time Yunnan (N+P: 58%) Guizhou (N+P: 60%) Hubei (N+P: 55%) East China (N+P: 55%) Nov 10th-14th 1,900-2,000 2,000 2,100 2,150-2,200 Nov 17th-21st 1,900-2,000 2,050 2,100 2,150-2,200 WoW (%) 0 +50 0 0 YoY (%) +18.18 +17.14 +16.67 +15.96 In China DAP market, neither domestic demand nor export volume has seen a large increase despite desirable policies next year. Furthermore, DAP exporting, used to concentrate in only several months, now can occur at any time of the year under the integration of custom tariff. Prices thus tend to stabilize on lack of support from concentrated demand. The outlook for China DAP market remains blurry in 2015 due to overcapacity, in spite of incentives. Under faltering winter storage activities, market prices for urea and potassic fertilizer will be flagging, and compound fertilizer prices are likely to maintain autumn’s low levels. Therefore, there are still concerns about whether DAP prices could keep at the current high levels throughout the winter. China DAP Average Prices,2014 CNY/mt Time Yunnan Guizhou Hubei East China North China Northwest Northeast Nov 10th-14th 2,650 2,600 2,650 2,800 2,800 2,850 3,000 Nov 17th-21st 2,600 2,600 2,650 2,800 2,800 2,850 3,000 WoW (%) -1.89 0 0 0 0 0 0 YoY (%) +17.78 +15.38 +17.78 +19.15 +21.74 +14 +17.65 Time Yunnan Guizhou Hubei East China North China Northwest Northeast 14th Nov 2,650 2,600 2,700 2,800 2,800 2,850 3,000 21st Nov 2,600 2,600 2,650 2,800 2,800 2,850 3,000 Change -50 0 -50 0 0 0 0 Data Source: JYD Information Co., Ltd. China Potassic Fertilizer Market China Major Potassic Fertilizer Unit Operation Status China potassic fertilizer plants kept stable production. Yanhu Potassic Fertilizer maintained a daily output of 10,000 mt, shipping two cargoes per day, while Zangge Potassic Fertilizer produced 3,000 mt per day, delivering two cargoes every three days. China Major Potassic Fertilizer Turnaround, 2014 Region Major Producer Operation Status & Affected Output Northwest Golmud Zangge Potassic Fertilizer With one unit under maintenance, output declined to 3,000 mt per day from 4,000 mt per day Data Source: JYD Information Co., Ltd. China potassic fertilizer price changes This week, China potassium chloride market was under narrow fluctuations amid sluggish demand, and more traders were heard to make concessions in selling. The coming potassium chloride market is predicted to keep stable under unit maintenance at stated-owned plants and unclear outlook for big contract negotiations. China potassium chloride (KCl) Average prices, 2014 Time CNY/mt China-made KCl Crystals Russia-made KCl Crystals Russia-made KCl Crystals K2O: 60% Northeast Ports Nov10th-14th 2,080 2,050 2,200 Nov17th-21st 2,080 1,990 2,180 WoW (%) 0 -2.9 -0.9 YoY (%) +2.5 -2.9 -1.8 Data Source: JYD Information Co., Ltd. P-4 JYD CHINA FERTILIZER MARKET WEEKLY REPORT November 21, 2014 China potassium sulfate market remained flat overall this week. Potassium sulfate prices are likely to vibrate downwards in the near future, owing to low operation rate of compound fertilizer units and rapid expansion in potassium sulfate production capacity. China Potash Average Prices, 2014 CNY/mt Luobupo Potash Foshan Qingshang Chuanhua Qingshang Shijiazhuang Hehe delivered to station K2O: 50% K2O: 50% K2O: 50% Nov 10th-14th 3,600 3,600 3,600 3,550 Nov 17th-21st 3,600 3,600 3,600 3,550 WoW (%) 0 0 0 0 YoY (%) +19.2 +12.5 +14.2 +10.9 Time China Compound Fertilizer Market China Major Compound Fertilizer Plants Operation Status China Major Compound Fertilizer Turnaround, 2014 Producer Operation Status Hubei E’Zhong Chemical Operation rate recovered to 80%. Hubei Xiangyun Chemical Tower unit restarted on Nov 15, with other units’ restarting date unknown. Jiangsu Huachang Chemical Units shut down on Nov 13 and restarted on Nov19, now running at 30-40% capacity. Shandong Hongri Akang Operation rate was 50% after units restarting production. Jiangsu Zhongdong Fertilizer Operation rate was 50%. Wuxi Taipingyang Chemical Units ran at low capacity due to weakening demand. Anhui Hong Sifang Operation rate was 70%. Henan Xinlianxin Chemical Some units were under maintenance, and average operation rate was 30-40%. Hebei Shuanglian Compound Fertilizer Two units were under operation. Sichuan Xindu Compound Fertilizer Operation rate rose to 70-80%. Anhui Zhongyuan Chemical Units started maintenance, recovering date unknown. Shandong Gufengyuan Fertilizer A temporary turnaround was arranged. Chia Tai Group Units started maintenance, recovering date unknown. Jiangsu Xinyi Hengyuan Fertilizer Units shut down on Oct 24, with production resumption date unknown. Shandong Shengdeyuan Fertilizer Units shut down in early Nov, planned to restart in late Nov. Jiangsu Luling Chemical Industry Units shut down, with recovering date unknown. Henan Junma Chemical Industry Units ran at low operation rate. Wuxi Baoli Fertilizer Operation rate was 50%. China Compound Fertilizer Price Changes China Compound Fertilizer Average Prices, 2014 CNY/mt Time Shandong Hebei Jiangsu Hubei Anhui Nov 10th-14th 2,250 2,250 1,760 2,200 1,850 Nov 17th-21st 2,200 2,200 1,730 2,150 1,800 WoW (%) -2.2 0 -1.7 -2.3 -2.7 YoY (%) +2.3 0 0 +4.8 0 Time Shandong Hebei Jiangsu Hubei Anhui 2014-11-14 2,200-2,300 2,150-2,250 1,750-1,780 2,150-2,250 1,800-1,900 2014-11-21 2,150-2,250 2,150-2,250 1,700-1,750 2,150-2,250 1,800-1,850 Change (%) -50 0 - (30-50) 0 -50 Remark: Jiangsu and Anhui: Cl: 45%; N: 15%; P: 15%; K: 15%; Shandong, Hebei and Hubei: S: 45%; N: 15%; P: 15%; K: 15%; Data Source: JYD Information Co., Ltd. P-5 JYD CHINA FERTILIZER MARKET WEEKLY REPORT November 21, 2014 This week, some compound fertilizer producers issued pricing policies for winter restocking. They mostly set fixed prices for compound fertilizer (S: 45%) at CNY2,150-2,250/mt, with some pricing low at CNY2,100/CNY. However, traders were not active in payment, dragged by an unsteady feedstock market. China compound fertilizer market is predicted to show narrow volatility in the following week, and market players are suggested to watch closely on large producers’ pricing policy for stock replenishment in winter. China Sulfur Market Weekly Report China Main Sulfur Units Operation Status Although sulfur companies in North China have restored to work, Puguang Gas Field, in short of Fuling shale gas, has lowered its operation rate, under the vast impact of which, the average domestic sulfur unit operation rate still maintained at a low level. China Main Sulfur Units Turnaround, 2014 Region Company Abnormal Operation Status & Loss East China Gaoqiao Petrochemical Sulfur units halted production early September, planned to operate late November, with an estimated loss of about 12,500mt during the overhaul. Southeast Beihai Petrochemical Sulfur units halted production till middle November for overhaul, with an estimated loss of about 10,500mt and maintained a small supply. China Sulfur Price Change Domestic sulfur market goes through ups and downs. On the one hand, sulfur price transacted at a lower price and there’s a noticeable decine in new orders in November as chemical fertilizer producers in Hubei Province made bulk purchase in the middle of October. On the other hand, general quotation rises from domestic and overseas market will sustain a future transaction price rise. China Sulfur Price Change, 201 CNY/mt Date North China East China Central China South China Southwest Last Week Average 1,100-1,150 1,150-1,180 1,130-1,180 1,150-1,180 1,160-1,220 This Week Average 1,120-1,150 1,150-1,160 1,130-1,180 1,160-1,200 1,200-1,220 WoW (%) +0.9 -1.69 0 +1.69 +1.7 YoY (%) +21.7 +21.21 +30.5 +35.17 +49.12 Date North China East China Central China South China Southwest Nov 14th, 2014 1,100-1,150 1,180-1,190 1,120-1,180 1,150-1,180 1,130-1,220 th Nov 21 , 2014 1,150-1,160 1,150-1,180 1,130-1,180 1,170-1,200 1,200-1,220 Date North China East China Central China South China Southwest Weekly Price Change +50 +120 +30 +50 +30 China Sulphuric Acid Market Weekly Report China Main Sulfuric Acid Units Operation Status Recently, domestic sulfuric acid units maintained an operation rate of about 70%, which eased the imbalance of supply and demand. As units now undertaken overhaul return to work later on, supply in some regions may see an obvious rise. The market trend is up to the downstream sulfur demand. China Main Sulfur Units Turnaround, 2014 Region Company Abnormal Operation Status & Loss North China Shandong Humon Smelting Production halt for overhaul since Oct 20th, planned to restart late November; lose 3,000mt/d. North China TanshanBaoshun Old unit (250,000 mt/yr) undertaken production halt for overhaul early October, restart time pending, lose 600 mt/d. South China YunfuGuangye Pyrite One unit undertaken overhaul, planned to restart on Nov 28th Data Source: JYD Information Co., Ltd. P-6 JYD CHINA FERTILIZER MARKET WEEKLY REPORT November 21, 2014 China Sulfuric Acid Price Change This week, domestic sulfuric acid market went on in the direction as predicted, with regional adjustment of about CNY20/ mt. As of now, 98% of domestic sulfuric acid prices at CNY283/mt, almost unchanged from last month, up by about 57.5% year on year. The current sulfur feedstock market is strong, will probably lead to a sulfuric acid price rise in a long term, but influence from the downstream chemical fertilizer and chemical engineering markets is still negative. Traders from both upstream and downstream all are reluctant to transact, only purchase on demand. The sulfuric acid market will maintain a stable level in a short term, JYD suggests traders to follow the market trend. China Sulfur Average Price Change, 2014 CNY/mt Region Grade Weekly Average WOW (%) YOY (%) Hebei 98% Smelting acid 280-330 0 +10 Henan 98% Smelting acid 280-300 0 +27.27 Shandong 98% Smelting acid 320-360 -3.03 +73.68 Jiangsu 98%Sulphuric acid 310-350 +3.33 +130.7 Anhui 98%Sulphuric acid 330-370 0 +175 Hubei 98% Smelting acid 310-320 0 +200 Gansu 98% Smelting acid 90-120 +3.22 +28.57 Forecast of China Fertilizer Market This week, the domestic chemical fertilizer market remained weak, with mild price decline in nitrogen fertilizer, phosphatic fertilizer and potassic fertilizer. According to JYD, next week, the nitrogenous fertilizer price will see a slight rebound. Forecast on China Fertilizer Prices, Dec 1st-5th 2014 CNY/mt Product Price F (Nov 17th-21st) Actual Price (Nov 17th-21st) Price F (Nov24th-28th) Prilled Urea 1,450-1,650 1,460-1,670 1,500-1,680 Synthesis ammonia 2,150-2,550 2,200-2,470 2,200-2,520 MAP 2,050-2,200 2,050-2,200 2,050-2,200 DAP 2,600-2,700 2,600-2,700 2,600-2,700 Russia-made KCl Crystals 2,180-2,220 2,180-2,200 2,180-2,200 Product Price F (Nov 17th-21st) Actual Price (Nov 17th-21st) Price F (Nov24th-28th) Potash 50% 3,500-3,600 3,450-3,550 3,500-3,550 CI-NPK(15:15:15) 1,750-1,850 1,700-1,850 1,700-1,850 S- CI-NPK(15:15:15) 2,100-2,300 2,100-2,250 2,100-2,250 Sulphur 1,150-1,200 1,150-1,200 1,150-1,200 Sulfuric acid 300-360 310-360 310-360 Remark: CI-NPK(15:15:15)refers to chlorine compound fertilizer (N: 15%; P: 15%; K: 15%); S- CI-NPK(15:15:15)refers to sulfur compound fertilizer (N: 15%; P: 15%; K: 15%) Data Source: JYD Information Co., Ltd. Focus of China phosphatic fertilizer market 1. Market players should pay attention to whether the corporate value added tax will recover next year. Given a recovery, it will drive up phosphatic fertilizer plants’ production cost. 2. Market players should keep a watchful eye on winter restocking policies and sales in the compound fertilizer market. Focus of China potassic fertilizer market 1. Focus should be put on downstream compound fertilizer producers’ procurement in winter. 2. Market participants are suggested to watch closely on negotiations over big import contracts in 2015. 3. As it gets cold, attention should be paid to domestic potassic fertilizer producers’ unit closures and future shipments. P-7 JYD CHINA FERTILIZER MARKET WEEKLY REPORT November 21, 2014 Focus of China compound fertilizer market 1. Value added tax policies for fertilizer in 2015 are worthy of notice. 2. Focus should be put on various downstream enterprises’ winter restocking policies and new pricing mechanism. 3. It is important to know about market trends for upstream urea, MAP and potassic fertilizer. 4. Compound fertilizer plants’ unit operation rate is also noteworthy. Focus of China sulfur/sulfuric acid markets 1. Sinopec Puguang Gas Field, China’s key sulfur producer, has no inventories, which firmly bolsters the sulfur market. 2. Sulfur inventories at China’s various ports dropped further by 350,000 mt on a yearly basis in the week ending Nov 21, lending sustaining strong support to the sulfur market. 3. Ammonium phosphate plants, which shut down previously, have successively resumed production, as winter restocking kicks off all comprehensively. End users’ demand for sulfur looks to rally. 4. Taiwan Formosa Plastics Corporation’s and Indian Reliance’s selling prices for sulfur tick higher overall, leading to a price inversion between foreign quotes and port stock prices. Traders are unwilling to sell at current prices in anticipation of a price growth. P-8