CHAPTER 1

advertisement

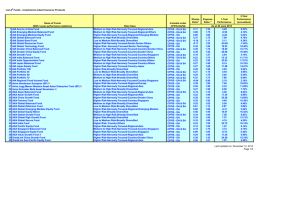

CHAPTER 1 INTRODUCTION 1.1 Research Motivation GE has been famous for two things – its global operations and diversified businesses. With such characteristics, GE has become one of most typical multinational conglomerates. I feel strongly interested in how GE finances such tremendous operations and how the company can make it work well. In recent years, a lot of Taiwanese companies are also trying to globalize their operations and diversifying their businesses. The study on how GE’s mechanism works should be valuable for the Taiwanese companies which are growing rapidly and globally. 4 1.2 Research Objectives Diversification and globalization have been become sort of popular trends for many companies, including many big-scale companies in Taiwan. However, how to properly manage their resources for these two directions is always a critical issue for these companies. General Electric, one of the world’s most admired companies, happens to be a very good example of a diversified and globalized organization. With operations in over 100 countries all over the world and in 11 very little related businesses, GE’s capability to leverage its resources to drive growth is remarkable. There should be a lot of things that can be learned, especially for those Taiwanese giants who want to be the top-tier players in the world. Therefore, the main objective for this study is to take a deep look at how GE sets up its strategy for business portfolio management and how the company leverages its financial resources to reach its goal for business growth. Furthermore, we also compare the major financial performance of GE with a benchmark company and find out the explanation of the difference and link it to their different approaches for business development. Ultimately, we will come up with the conclusion concerning what factors a globally diversified company has to really look into to achieve outstanding and sustainable growth, such as GE does. The suggestion for the direction for further studies in the future is also proposed. 5 1.3 Methodology 1.3.1 Review and Analysis on Secondary Sources Secondary sources, including journal articles, internet, books, industrial reports magazines, and companies’ public and internal information, etc., have been extensively reviewed and analyzed, especially in the preliminary stage of this study. 1.3.2 Competitive Forces Analysis Michael Porter’s model of competitive forces analysis has been used to analyze GE to see the position where the company stands in terms of competitive elements. GE’s competitive advantages will be analyzed as well. The analysis is based on the internal views of some GE senior managers, the company’s internal data and information, as well as published data and information. Competitive forces analysis generally is a very useful tool for us to look at the company before any further financial analysis is conducted. We prove such usefulness in this study. 1.3.3 Case Study – Using GE as an Example GE is used as the example for this study given that it is considered as one of the best role model of globally diversified businesses in the world. GE has 11 business units, from engineering plastics to consumer financial services. The composition of its business 6 portfolio is enormously complicated. In addition, as one of the world’s most globalized companies, GE is a very good example to be used for discussion on validity of some theories involving globalization in previous studies. Another important reason for me to choose GE for this study is that I have easy access to the internal information of the company and the company senior executives. Besides all the objective data and figures, it is also important to grab a deep understanding of the company’s underlying business philosophy and strategy. That, in fact, provides me with a more profound view of how a globally diversified firm works out its synergy, develops the business strategy and formulates execution plans. The conclusion drawn from the study will be, therefore, much more powerful than the works done by an average outsider. 1.3.4 Comparative Financial Analysis of GE with the Benchmarked Company It is hard to conclude the performance of the targeted company (i.e. GE) without comparing several key indicators, especially financially related ones, with the benchmarked company. The benchmarked company should have similar characteristics to GE’s. It should be the one which also has diversified businesses and high global exposure. In this sense, 3M has been chosen to be the benchmark. 1.3.5 Interview with GE’s Senior Executives 7 In order to catch the internally high level view of GE on the company’s idea of growing its businesses in various fields worldwide, interviews with several senior GE executives have been conducted. The interviewees all hold important positions at the company in sales, marketing, finance and operation fields. They are proactively involved in the formulation of the company’s strategy and execution plans. Their view can fairly reflect the top managements’ view on how GE can leverage its resources to boost its sustainable long-term growth and to meet commitments and obligations to its shareholders and debt holders. 8 1.4 Conceptual Structure The objective of this study is to look into how globally diversified companies leverage their financial resources and set their financial strategies properly to drive sustainable business growth. Based on this objective, the related data and information have been collected, reviewed and analyzed. Related conclusions and suggestions have been drawn as well. This paper is structured as the following chapters: Chapter 1 defines research direction and objectives – the motivation, methodology, the area covered by this research and the structure of the research has also been touched base here. Chapter 2 includes the reviews, comparison and analysis of the available literature related to the filed covered by this research. In this chapter, the papers pertaining to different theories of diversified businesses as well as global companies have been extensively reviewed. The importance of research objectives proposed by this study is further accentuated after reviewing previous literatures. Chapter 3 focuses on the analysis of General Electric Company, which is used as a case in this study. In this chapter, the compositions of GE as well as its main business philosophy and strategy are introduced. Furthermore, Porter’s model of competitive forces will be used to analyze GE’s competitive advantages and disadvantages. The analysis in this chapter provides a solid foundation for further comparatively financial 9 analysis of GE and its benchmarked company as well as the more detail discussion in the later chapters. In addition, Chapter 3 also contains the comparative financial analysis of GE with its benchmarked company, 3M. The performance of two companies will be compared and analyzed from various angles, such as short-term liquidity, cash flows, capital structure, and returns on invested capital. The correlation of such performance difference and the strategy these two companies undertook will be extensively discussed and preliminary explanation will be developed. Moreover, the characteristics of GE, a typical example of a far more conglomerate with both industrial and financial businesses, will be linked with its different financial indicators and results from 3M’s. The later part of the chapter also covers GE’s valuation based on various scenarios. It is attempted to understand the significance of AAA rating for GE in terms of the company’s values. How such significance is correlated with GE’s strategy in globalization will also be covered. The chapter will end with some results from interviews with senior executives of the company to further address the philosophy for such strategy setting and what mechanisms GE constructs to address integrity in order to ensure minimum concern regarding corporate governance. Chapter 4 contains main conclusions from the study and some suggestions for the company to move forward. Some recommendations for the directions for the research in related areas in the future are also addressed. 10 1.5 Limitations The major limitation for this study is that the results derived from this case study is company-specific and industry-specific. It does not necessarily apply to other companies with diversified structures and global presence. Furthermore, some of the findings from the interview cannot be used as a theory or a model that is applicable to all situations. There is no statistical approach behind to test the hypothesis from qualitative observation. Most of the financial numbers for doing the financial analysis in this study is from the company’s annual reports and public information. There is limited access to the company’s more confidential information and raw financial data. 11