TEACHING MATERIAL OF THE MODULE ADVANCED ACCOUNTING

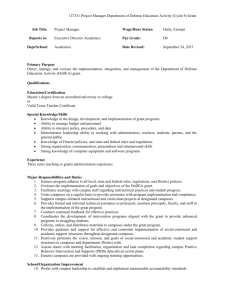

advertisement