ADVANCED FINANCIAL ACCOUNTING AND REPORTING

advertisement

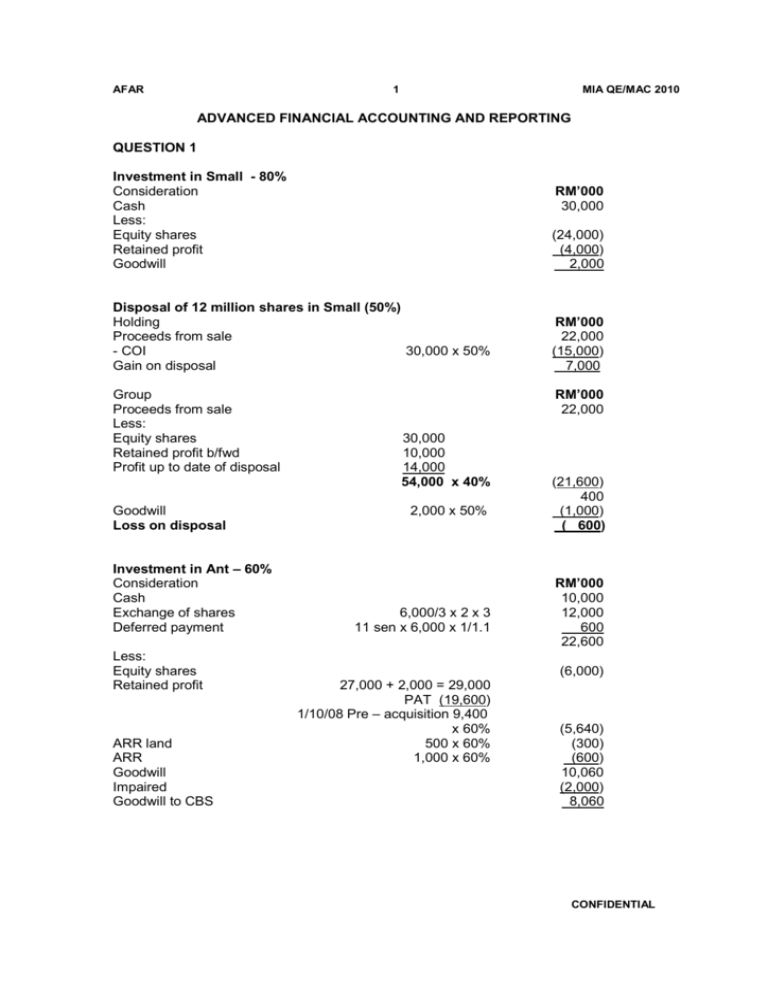

AFAR 1 MIA QE/MAC 2010 ADVANCED FINANCIAL ACCOUNTING AND REPORTING QUESTION 1 Investment in Small - 80% Consideration Cash Less: Equity shares Retained profit Goodwill (24,000) (4,000) 2,000 Disposal of 12 million shares in Small (50%) Holding Proceeds from sale - COI 30,000 x 50% Gain on disposal RM’000 22,000 (15,000) 7,000 Group Proceeds from sale Less: Equity shares Retained profit b/fwd Profit up to date of disposal Goodwill Loss on disposal Investment in Ant – 60% Consideration Cash Exchange of shares Deferred payment Less: Equity shares Retained profit ARR land ARR Goodwill Impaired Goodwill to CBS RM’000 30,000 RM’000 22,000 30,000 10,000 14,000 54,000 x 40% 2,000 x 50% 6,000/3 x 2 x 3 11 sen x 6,000 x 1/1.1 (21,600) 400 (1,000) ( 600) RM’000 10,000 12,000 600 22,600 (6,000) 27,000 + 2,000 = 29,000 PAT (19,600) 1/10/08 Pre – acquisition 9,400 x 60% 500 x 60% 1,000 x 60% (5,640) (300) (600) 10,060 (2,000) 8,060 CONFIDENTIAL AFAR 2 MIA QE/MAC 2010 Retained earnings – Ant Balance b/d Pre-acquisation profit Under- provision depreciation MI Post acquisition – CIS 27,000 – 200 x 40% RM’000 27,000 ( 5,640) ( 200) (10,720) 10,440 Retained earnings – High RM’000 22,000 10,440 1,200 13,200 7,000 (400) (2,000) (60) (1,000) 50,380 Balance b/d Add: From Ant Dividends receivable from Ant Share of associate’s profit Gain on disposal Less:URP Goodwill impaired – Ant Interest on deferred consideration Final dividend To CBS Investment in associate – 40% COI Share of post acquisition profit To CBS 38,000 – 5,000 x 40% RM’000 15,000 13,200 28,200 Minority interest – 40% Equity Retained profit ARR land ARR plant ARR subsequent revaluation To CBS 500 x 40% 1,000 x 40% 1,000 x 40% RM’000 4,000 10,720 200 400 400 15,720 Consolidated income statement for the year ended 30 September 2009 Revenue COS GP Less Operating expenses PBT Share of profit of associate Tax Profit for the year 120,000 + 52,000 x6/12 + 34,800 – 6,000 72,000 + 18,000 x 6/12 + 9,000 – 6,000 + URP 400 Loss on disposal 4,900 + 4,400 x 6/12 + 5,000 + depreciation 200 + goodwill 2,000 + interest 60 28,000 x 6/12 x 40% 6,000 + 1,600 x 6/12 + 1,200 RM’000 174,800 (84,400) 90,400 ( 600) 89,800 (14,360) 75,440 5,600 81,040 ( 8,000) 73,040 CONFIDENTIAL AFAR 3 Attributable to: MI Small 28,000 x 6/12 x 20% Ant 19,600 – 200 x 40% Equity holders of parent MIA QE/MAC 2010 RM’000 2,800 7,760 62,480 73,040 Consolidated statement of changes in equity for the year ended 30 September 2009 RM’000 Retained profit b/fwd High (15,100) Small 10,000 – 5,000 x 80% 4,000 (11,100) Profit for the year 62,480 Dividends – H (1,000) Retained profit c/fwd 50,380 Consolidated balance sheet as at 30 September 2009 Non current assets Goodwill Investment in associate Current assets RM’000 81,300 67,000 + 12,000 + ARR 1,000 + 500 + 1,000 - 200 (depreciation) 8,060 28,200 31,000 + 39,500 – URP 400 – 2,000 + 1,000 69,100 186,660 Total assets Equity Share premium ARR CIS MI Current liabilities 50,000 + 4,000 8,000 + 20,000 24,000 + 14,500 – dividends payable 2,000 – 1,000 + 1,000 Dividend due to MI Deferred payment Total equity and liabilities 54,000 28,000 600 50,380 15,720 36,500 800 660 186,660 (Total : 25 marks) QUESTION 2 a. Recalculate profit for the year : Profit as per draft accounts Investment Property surplus Depreciation – Investment property Depreciation – Plant Change in accounting policy Government grant amortised Sales not recognised Cost of sales not recognised Adjusted profit for the year RM’000 11,000 2,000 (3,100) (4,406) (1,800) 750 (1,000) 800 4,244 (8 marks) CONFIDENTIAL AFAR 4 MIA QE/MAC 2010 b. Statement of changes in equity Balance as at 1 October 2008 PYA Adjusted profit Profit for the year ARR Share capital RM’000 160,000 Share ARR premium RM’000 RM’000 20,000 16,000 Retained profits RM’000 21,000 1,500 22,500 4,244 160,000 20,000 5,100 21,100 Total RM’000 217,000 1,500 4,244 5,100 26,744 227,844 (5 marks) c. Balance sheet as at 30 September 2009 RM’000 Non- current asset Investment property P/M Motor vehicle Equipment 40,000 – 1,800 Current assets Inventory A/R Bank 35,000 + 800 20,000 -1,000 15,000 + 4,000 Equity and reserves Ordinary shares ARR Retained profits Share premium Non- current liabilities Deferred tax Government grant Provision for environment Current liabilities Accounts payable Government grant 75,000-4406 64,000 70,594 15,000 38,200 35,800 19,000 19,000 263,094 160,000 21,100 26,744 20,000 15,000 2,250 5,000 12,000 1,000 263,094 Workings 1.) At date of change: 60,000 – 62,000 = increase 2,000 Depreciation for 6 months :- 62,000/10 years x 6/12 = 3,100 Carrying value at year end: 62,000 – 3,100 = 58,900 FV 64,000 CONFIDENTIAL AFAR 5 ARR surplus MIA QE/MAC 2010 5,100 2.) RM’000 22,000 ( 2,000) 20,000 3,000 500 23,500 Base cost Less: trade discount Modifications Transport Initial cost Depreciation 23,500/4 x 9/12 Government grant Amortised 4,000 /4 x 9/12 4,000 -750 -1,000 3) = 4,406 = 20,000 x 20% = 4,000 split between current = 750 , current liability 1,000 non current liability = 2,250 Change in accounting policy old policy 30,000/8,000 x 2,000 = 7,500 30,000/8,000 x 800 = 3,000 new policy 30,000 x 20% = 6,000 24,000 x 20% = 4,800 4 ) Sale and return 1,000/ 125 x 25 = 200 profit Cost 800 (12 marks) (Total : 25 marks) QUESTION 3 A. Memorandum to the Board of Directors of AutoMart Valuation of showroom as at 31 December 2009 and impairment implications in accordance to FRS 136. FRS 136 has concluded that an entity should recognize an impairment loss only when the recoverable amount of an asset is less than its carrying amount. The recoverable amount of an asset is the higher of fair value less cost to sell and value in use. The value in use should be measured based on the present value of estimated future cash flows from the asset. In this case, the carrying value of the showroom at 1 January 2010 is RM 7,500,000. This is calculated as below : Cost Accumulated depreciation [RM10,000,000/40 years * 10] (Asset has been in used for 10 years from 2000 – 2009) Carrying value at 31 December 2009 RM10,000,000 (RM2,500,000) RM7,500,000 As at 31 December 2009, the fair value less cost to sell of the showroom is RM5,000,000 less RM200,000 = RM4,800,000. CONFIDENTIAL AFAR 6 MIA QE/MAC 2010 Value in use computation : Assumption 1 : The showroom is rented for RM500,000 for 10 years and is subsequently sold. The value in use is the present value of the estimated future cash flows of RM500,000 for the next 10 years and the net selling proceeds at the end of 10 years ie. RM500,000 + (RM500,000 * 5.7590) + (3,000,000 * 0.3855) = RM4,536,000. As the value in use is lower than the fair value less cost to sell, the recoverable amount under this assumption is the fair value less cost to sell value ie. RM4,800,000. Impairment loss is RM2,700,000 (RM7,500,000 – RM4,800,000) Assumption 2 : If AutoMart commence using the showroom for its own operations at the end of the 10-year period, this raises further the question of permanent impairment as the future cash flows is uncertain. There is a possibility that the showroom’s value would exceed the rental value if it were to be used again in operations. In any case, FRS 136 do provide for the write back of impairment in accordance with paragraph 114 subject to paragraph 117. (13 marks) B. Prior period errors are omissions from, and misstatements in, the entity’s financial statements for one or more prior periods arising from a failure to use, or misuse of, reliable information that : - was available when the financial statements for those periods were authorized for issue; and could reasonably be expected to have been obtained and taken into account in the preparation and presentation of those financial statements. Such errors include the effects of mathematical mistakes, mistakes in applying accounting policies, oversight or misinterpretations of facts, and fraud. Entity Quintan shall correct the prior period error retrospectively in the first set of financial statements authorized for issue after their discovery by i) ii) C. restating the comparative amounts for the prior period(s) presented which the error occurred; or if the error occurred before the earliest prior period presented, restating the opening balances of assets, liabilities and equity for the earliest prior period presented. (6 marks) An estimate may need revision if changes occur in the circumstances on which the estimate was based or as a result of new information or more experience. By CONFIDENTIAL AFAR 7 MIA QE/MAC 2010 its nature, the revision of an estimate does not relate to prior periods and is not the correction of error. The effect of a change in an accounting estimate shall be recognized prospectively by including it in the profit or loss in the period of change and future periods. (6 marks) (Total : 25 marks) QUESTION 4 A.a. (i) Aye RM INR loan to Bee INR4,600,000/2.2 INR4,600,000/1.7 Gain 2,090,909.09 (2,705,882.35) 614,973.26 (1.5 marks) INR loan to Cee INR2,000,000/2 INR2,000,000/1.7 Gain 1,000,000.00 (1,176,470.59) 176,470.59 (1.5 marks) Net gain 791,443.85 (ii) Bee No transactions in foreign currency Recognised in IS (1 mark) (2 marks) (iii) Cee Rupiah RM trading balance Carried at RM250,000 × 2,400 Gain INR loan from Aye INR2,000,000 × 1,500 INR2,000,000 × 1,750 Loss Net loss 625 million (600 million) 25 million (1.5 marks) 3,000 million (3,500 million) (500 million) (1.5 marks) (475 million) Recognised in IS (1 mark) (10 marks) CONFIDENTIAL AFAR 8 MIA QE/MAC 2010 A. b. Since the loan is long-term and repayment is not foreseeable, the loan is considered as part of the net investment in Bee (3 marks). The exchange difference of RM614,973.26 (gain) should be classified as equity in the CFS. (1 mark) until the disposal of the net investment (1 mark). (5 marks) B This issue is one of the timing of when revenue should be recognised in the income statement. This can be a complex issue which involves identifying the transfer of significant risks, reliable measurement, the probability of receiving economic benefits, relevant accounting standards and legislation and generally accepted practice. Applying the general guidance in FRS 118 Revenue, the previous policy, applied before cancellation insurance was made a condition of booking, seemed appropriate. The appendix to FRS 118 specifically refers to payments in advance of the ‘delivery’ of goods and says that revenue should be recognised when the goods are delivered. Interpreting this for P’s transaction would seem to confirm the appropriateness of its previous policy. The directors of P wish to change the timing of recognition of sales because of the change in circumstances relating to the compulsory cancellation insurance. Even if this does justify revising the timing of the recognition of revenue, it is not a change of accounting policy. (Note: circumstances where it becomes necessary to change an accounting policy? Where it is required by a new or revised accounting standard, interpretation or applicable legislation or where the change would result in financial statements giving a more reliable and relevant representation of the entity’s transactions and events.) An issue to consider is whether compulsory cancellation insurance represents a substantial change to the risks that P experiences. An analysis of past experience of losses caused by uninsured cancellations may help to assess this, but even if the past losses were material, it is unlikely that this would override the general guidance in the appendix to FRS 118 relating to payments made in advance of delivery. It seems the main motivation for the proposed change is to improve the profit for the year ended 31 December 2009 so that it compares more favourably with that of the previous period. (10 marks) (Total: 25 marks) CONFIDENTIAL