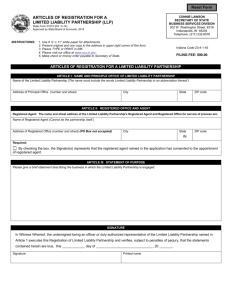

THE LIMITED LIABILITY PARTNERSHIP BILL, 2008

advertisement