Accountants Licensing Solution

advertisement

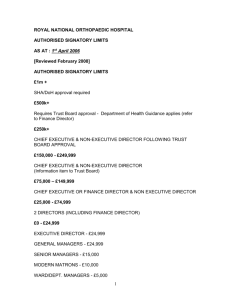

Accountants Licensing Solution: Frequently Asked Questions REGULATORY ENVIRONMENT WHAT IS CHANGING IN THE WAY SMSF ADVICE IS REGULATED? The current accountants’ licensing exemption allows accountants to provide advice on the establishment of self-managed superannuation funds (SMSF) without the need for authorisation under an Australian Financial Services Licence (AFSL). As part of the Future of Financial Advice (FoFA) reforms, introduced in 2013, the accountants’ licensing exemption will be removed on 1 July 2016. WHAT DOES THE REMOVAL OF THE ACCOUNTANTS’ LICENSING EXEMPTION MEAN IN PRACTICE? The accountants’ licensing exemption will cease on 1 July 2016 at which point accountants providing SMSF advice will need to operate under an AFSL. During the three years leading up to 1 July 2016, accountants will be faced with some important choices.. PRIOR TO 1 JULY 2013 1 JULY 2013 – 30 JUNE 2016 1 JULY 2016 ONWARDS Accountants could offer SMSF advice under the accountants’ licensing exemption Transition period •• Accountants can continue to operate under the accountants’ licensing exemption •• Accountants can determine which licensing/authorisation solution meets their requirements. End of transition period Accountants must choose between the following options with respect to SMSF advice: •• apply for a limited AFSL •• become an Authorised Representative of an existing AFSL •• refer SMSF advice to an Authorised Representative, or •• cease providing SMSF advice. WHAT ARE THE OPTIONS FOR AN ACCOUNTANT PROVIDING SMSF ADVICE UNDER THE ACCOUNTANTS’ LICENSING EXEMPTION? Accountants essentially have four options: OPTIONS PROS 1. Refer to an Authorised Representative •• No additional training or cost from becoming •• May lead to capacity issues. licensed/authorised. •• Undermines the accountant’s relationship 2. O btain a limited AFSL and appoint qualified Authorised Representatives under your limited AFSL •• Can take advantage of the waiver of the experience requirements under the licensing obligations (during the transition period leading up to 1 July 2016). CONS with the client. •• Extra administrative, cost and compliance burden of maintaining a licence. •• Ongoing liability related to financial advice provided under the AFSL. •• Advice is limited to SMSF and ‘class of financial product’ advice. •• You will be responsible for monitoring the 3. B ecome an Authorised Representative of an AFSL •• Allows accountants to continue to provide SMSF advice without additional administrative, cost and compliance burden of running their own AFSL. •• Can choose to offer holistic financial advice to clients (if appropriately authorised). •• Provides access to licensee support services. 4. Decline to provide SMSF advice Count’s solution comes under option 3 described above. © Count Financial January 2015 training and education requirements of your Authorised Representatives. •• Training and education requirements to become an Authorised Representative must be met. Only suitable if SMSFs are not important to your business/clients. WHAT DO I NEED TO DO DIFFERENTLY ONCE I AM OPERATING UNDER A LICENSED REGIME? From the time you become authorised, any accountants providing advice as an Authorised Representative of any licensee will need to meet the relevant obligations under the Corporations Act. This not only includes having the relevant training, but also the following: •• Meeting the disclosure obligations by providing your client with a Financial Services Guide and confirming anything considered financial advice in a Statement of Advice; •• Being able to demonstrate that the advice you provide is in the best interests of your client; •• Maintaining professional indemnity insurance for the financial advice you provide; •• Having a complaints handling policy in place. The good news is, by partnering with an established licensee like Count, you can take advantage of our established systems, processes and support, so you can spend more time helping your clients. OUR ACCOUNTANTS’ SOLUTION WHAT IS COUNT DOING TO HELP? Count already offers a cost effective full Authorised Representative option to accountants and are proud of our community of over 550 individual Authorised Representatives within around 300 Public Practice Accounting firms Australia-wide. We have also developed an Authorised Representative designation (an Accountant Authorised Representative) for accountants who wish to continue to provide SMSF advice to their clients but do not – at this point – wish to become a full Authorised Representative. The Accountant Authorised Representative is a more limited authorisation that provides the accountant with enough scope to continue to deliver SMSF advice in a compliant manner and minimises the upfront and ongoing training requirements by eliminating areas of advice that fall outside the scope of ‘typical’ SMSF advice. The solution also provides a pathway for the Accountant Authorised Representative to become a full Authorised Representative in the future as they identify other ways they can help their clients and grow their business. WHAT ARE THE DIFFERENCES BETWEEN THE ACCOUNTANTS’ EXEMPTION, ACCOUNTANT AUTHORISED REPRESENTATIVE AND FULL AUTHORISED REPRESENTATIVE? Count will have two designations for Authorised Representatives – full or accountant. The Accountant Authorised Representative is essentially a ‘limited authorisation’ to provide financial advice specific to SMSFs. It provides a greater scope of advice than allowed under the accountants’ licensing exemption but less than a full authorisation. The table below highlights the differences in advice that can be provided by individuals holding various authorisations/licences. ADVICE EXISTING ACCOUNTANTS’ EXEMPTION COUNT ACCOUNTANT AUTHORISED REPRESENTATIVE COUNT FULL AUTHORISED REPRESENTATIVE Establish/close an SMSF ✓ ✓ ✓ General super contributions ✓ ✓ ✓ Strategic super consolidation ✓ ✓ Strategic SMSF advice ✓ ✓ Basic deposit products inside super ✓ ✓ Strategic insurance advice (inside super) ✓ ✓ Strategic debt advice (limited recourse borrowing) ✓ Strategic investment advice (including class of product) ✓ Insurance product advice ✓ Specific investment product advice ✓ Holistic financial advice ✓ WHAT ARE THE SERVICES OFFERED TO AUTHORISED REPRESENTATIVES? All Authorised Representatives are valued members of the Count community and therefore have access to the full breadth of Count services tailored to meet the needs of your unique business. The services include: •• Professional Development days •• Compliance support •• Advice documents and templates •• Technical support •• Business development •• Marketing •• Financial planning software •• Paraplanning •• Referral arrangements •• Professional indemnity cover The only support which is not offered to the Accountant Authorised Representative is Product Research, as AARs do not provide product advice. WHAT SUPPORT WILL COUNT PROVIDE TO HELP CREATE THE WRITTEN ADVICE DOCUMENTS? All Count Authorised Representatives are able to take advantage of one of two Count supported options to create advice documents in a way which best suits their business. As an Authorised Representative of Count, you will have access to a fully supported system which you use to produce compliant documents in your own office. Alternatively, you may choose to take advantage of our team of in-house Paraplanners who can produce the documents in consultation with you on a user-pays basis. We know that your support staff are integral in your business, so we also help you by providing special training specifically for support staff. I ONLY HAVE A SMALL NUMBER OF SMSF CLIENTS; IS IT WORTHWHILE TO BECOME AUTHORISED TO GIVE ADVICE? The answer really depends on where you want to take your business. Count is active in supporting our Members to grow their businesses; if you want to develop and grow this part of your services, we will work with you on a business plan to expand your offering to clients. However, if you don’t see SMSF advice as a key part of your offering going forward, it may be that you should consider referring this work to someone who is more active in this space. We are happy to discuss the various options with you to determine which option is best for your firm. WHAT TRAINING WILL BE REQUIRED TO BECOME AN AUTHORISED REPRESENTATIVE? In order to become an Authorised Representative, you will need to undertake training in line with ASIC Regulatory Guide 146 (RG 146). For individuals who chose to become an Accountant Authorised Representative, they will be able to complete a tailored version of RG146 training prior to appointment. We have worked closely with our partners to offer a program specifically for our Accountant Authorised Representatives. UPFRONT EDUCATION REQUIREMENTS ACCOUNTANT AUTHORISED REPRESENTATIVE Generic knowledge Recognition of Prior Learning (RPL) for CA and CPA accountants FULL AUTHORISED REPRESENTATIVE ✓ Financial Planning ✓ ✓ Insurance & risk protection ✓ ✓ ✓ ✓ Super & retirement Securities & Managed Investments Not included ✓ SMSF accreditation ✓ Not included Exams 3 5 Assessments Time investment 2 4 2 × 2 day workshops 7 day face to face workshop $2,270 $3,390 Face to face study cost Once appointed, Accountant Authorised Representatives will need to complete 15 hours of ongoing continuing professional development (CPD), including attending at least one face to face Count training event, per annum. The ongoing training requirements are outlined in the table below. ONGOING EDUCATIONAL REQUIREMENTS ACCOUNTANT AUTHORISED REPRESENTATIVE FULL AUTHORISED REPRESENTATIVE CPD points 15 CPD 30 CPD CPD points allocated to specific competency areas 15 CPD 20 CPD Competency areas 7 12 Free knowledge points 0 10 WHAT OPTIONS ARE THERE FOR COMPLETING THE EDUCATION TO BECOME AUTHORISED? The training required for each individual will differ depending on whether they have existing qualifications or have completed courses previously which can be recognised and for which you can receive credit. It is also important to ensure that any training that you undertake will meet the requirements of your chosen licensee and the level of authorisation you seek. We are happy to talk to you to help you determine the most appropriate training solution for you and have an education program specifically designed for our Accountants’ Solution. I HAVE ALREADY DONE MY RG 146 TRAINING, DO I NEED TO DO IT AGAIN? If you have already completed RG 146 training, you are probably well on your way to having enough training to become an Authorised Representative. As each course is different, we need to assess that the course that you previously completed covers all of the requirements for the level of authorisation that you would like to obtain from us. WHAT ONGOING TRAINING OPPORTUNITIES WILL BE AVAILABLE THROUGH COUNT? We provide two one-day Professional Development events held in each capital city each year, as well as workshops, webinars and online training. Our training covers all areas of our Members’ businesses including technical, strategy, compliance, practice management, marketing, business development and software and is tailored to meet the needs and requirements of the different businesses within our Membership. The entire Count network is invited to attend a three-day Annual Conference annually. This event is available, and has content tailored to, Count Authorised Representatives, Accountants and support staff and as our premier training event attracts a range of high quality guest speakers. Our 2014 event was attended by over 850 delegates. WHEN WILL ACCOUNTANTS BE ABLE TO JOIN COUNT? Any accountants wanting to join Count as an Authorised Representative can do so as soon as they have met the initial on‑boarding requirements. Don’t wait to act. As Authorised Representatives will be required to complete some training before becoming authorised, we recommend making a start sooner rather than later! CAN I HAVE A MIX OF FULL AUTHORISED REPRESENTATIVES AND ACCOUNTANT AUTHORISED REPRESENTATIVES IN MY FIRM? Yes, our Accountants’ Solution is designed for maximum flexibility enabling firms to choose the types and levels of authorisation that are right for their business. ABOUT COUNT Australian Financial Services Licence (AFSL): An Australian financial service licence granted under s913B of the Corporations Act. HOW IS COUNT DIFFERENT TO OTHER LICENSEES? Authorised Representative: A person authorised in accordance with section 916A or 916B of the Corporations Act to provide a financial service or financial services on behalf of the licensee. Count is Australia’s largest network of accountant-based professional advisers with a 30 year history of helping accounting firms grow their business, by enhancing their client offering to include financial advice. Count offers the opportunity to join a network of like-minded accounting professionals. We currently partner with over 550 individual Authorised Representatives within around 300 Member Firms Australia wide. We understand the opportunities and challenges faced by accounting firms introducing financial advice to their business offer to the first time. That’s why we offer end-to-end support and have a team of professionals and a suite of resources specifically focused on supporting new Member firms. We also support accountants via our advocacy efforts and support for requirements that are specific to accountants providing financial advice; for example, we have been active in discussions with the Joint Accounting Bodies regarding how to integrate APES 230 into our advice process and documents. GLOSSARY Accountants’ Licensing Exemption: The existing exemption under regulation 7.1.29A of the Corporations Regulations 2001 (Corporations Regulations) which allows recognised accountants to give advice about self-managed superannuation funds (SMSFs) without holding an AFS licence. Class of Financial Product Advice: Class of product advice is defined as financial product advice about a class of products, but does not include a recommendation about a specific product in the class. For example, you could provide advice about term deposit products, but could not make a specific recommendation as to which term deposit product the client should invest in ie a specific product with a specific product provider. Limited Australian Financial Services Licence: A limited AFS licence available from ASIC from 1 July 2013. The authorities are limited to SMSFs, a client’s existing superannuation holdings in certain circumstances, and ‘class of product’ advice. A limited AFS licensee can also be authorised to arrange to deal in an interest in an SMSF. A limited AFS licensee does not need to lodge an auditor’s report annually – instead they can lodge an annual compliance certificate. RG 146: Australian Securities and Investments Commission Regulatory Guide 146 – Licensing: Training of Financial Product Advisers. This guide sets out minimum training standards that apply to Authorised Representatives and how they can meet these training standards. APES 230: The Accounting Professional and Ethical Standards Board standard that applies to accountants providing Financial Planning Services to their clients. FIND OUT MORE 1300 732 266 SOLUTIONS@COUNT.COM.AU COUNT.COM.AU Important Information This information has been prepared by Count Financial Limited ABN 19 001 974 625, AFSL 227232, (Count) a wholly-owned, non-guaranteed subsidiary of Commonwealth Bank of Australia ABN 48 123 123 124. ‘Count’ and Count Wealth Accountants® are trading names of Count. Count is a Professional Partner of the Financial Planning Association ofAustralia Limited. While care has been taken in the preparation of this document, no liability is accepted by Count, its related entities, agents and employees for any loss arising from reliance on this document. 20966/0115