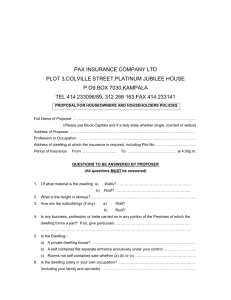

General Dwelling Protector - SGI CANADA Policy Booklet

advertisement