0 day of J-ewa r, 2009 SECOND SUPPLEMENTAL TRUST DEED

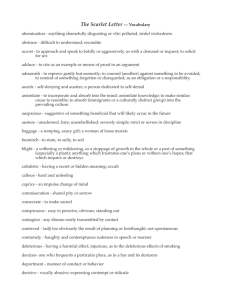

advertisement

Dated this ?0 day of J-ewa r, 2009 MEDIUM TERM NOTES PROGRAMME OF UP TO RM1 .7 BILLION SECOND SUPPLEMENTAL TRUST DEED Between RIGINAL t,,'vIA MAGESVKRYAT MURUGAYA Advocate & Solicitor Kuala Lumpur GERBANG PERDANA CIQ SDN BHD (Company No. 638136-H) (as "Issuer") MAYBAN TRUSTEES BERHAD (Company No . 5004-P) (as "Trustee") CERTIFI_EDARUE COPY Terkecuah danpgda Do Setem dibawah Seksyen R0(1) /tea Setem 1949 rnelalui Perintah Duti Seam (Pengecualian) (No . 23) 2000 [P. U (A) 241r20W] bertarikh 1 Julai 2(100 wcz Gerbang Perdana CIQ Sdn Bhd (Company No . 638136-H) Proposed MTN Programme of up to RM1 .7 Billion Nominal Value - Second Supplemental Trust Deed SECOND SUPPLEMENTAL TRUST DEED THIS SECOND SUPPLEMENTAL TRUST DEED is made on the 2009 7-O day of ~ ~ntAC(C~J Between (1) GERBANG PERDANA CIQ SDN BHD (Company No. 638136-H), a company incorporated in Malaysia and having its registered office at 9 & 10, Jalan Medan PB 3A, Pusat Bandar Bangi, 43650 Bandar Baru Bangi, Selangor Darul Ehsan and a place of business at No. 3, Jalan P.P. Narayanan (Jalan 222), 46100 Petaling Jaya, Selangor Darul Ehsan (the "Issuer") ; AND (2) MAYBAN TRUSTEES BERHAD (Company No . 5004-P), a company incorporated in Malaysia and having its registered office at 34`s Floor, Menara Maybank, 100, Jalan Tun Perak, 50050 Kuala Lumpur (the "Trustee"). WHEREAS: (A) The Issuer wishes to raise funds by way of a medium term notes programme of up to Ringgit Malaysia One Billion and Seven Hundred Million (RM1,700,000,000 .00) only (the "Programme") under which the Issuer proposes to issue from time to time zero coupon medium term notes (the "MTNs") pursuant to financing arrangements arranged by CLUB INVESTMENT BANK BERHAD (Company No. 18417-M), a company incorporated in Malaysia and having its registered office at 5`1' Floor, Bangunan CIMB, Jalan Semantan, Damansara Heights, 50490 Kuala Lumpur and includes its successors in title and assigns (the "Arranger") . (B) By virtue of an agreement dated 17 August 2004 (the "Programme Agreement" and which expression shall, where the context so admits, include the first supplemental programme agreement to the Programme Agreement dated 3 December 2007 and any supplemental agreements which may at any time and from time to time thereafter be entered into between the parties thereto for the variation, amendment or substitution of any of the terms and conditions contained therein) and made between (i) the Issuer; (ii) CIMB INVESTMENT BANK BERHAD (Company No. 18417-M) (as Facility Agent, Arranger, Monitoring Agent, Issue Agent and Calculation Agent); and (iii) CEN4B INVESTMENT BANK BERHAD (Company No. 18417-M) and ALLIANCE INVESTMENT BANK BERHAD (Company No. 21605-D) (as Primary Subscribers and Joint Lead Managers), the Primary Subscribers have at the request of the Issuer agreed to severally subscribe for the MTNs issued from time to time by the Issuer upon the terms and subject to the conditions therein contained . (C) By virtue of a trust deed dated 17 August 2004 ("Trust Deed") and made between the Issuer and Trustee, the Trustee has agreed to act as trustee for the benefit of the holders of such MTNs upon the terms and subject to the conditions therein contained . (D) By virtue of a supplemental trust deed dated 3 December 2007 (`First Supplemental Trust Deed") and made between the Issuer and the Trustee and supplementing the Trust Deed, at the request of the Issuer, the Trustee has agreed to extend the Availability Period (as defined in the Trust Deed) of the Programme until 31 December 2008. ! ~J Gerbang Perdana CIQ Sdn Bhd (Company No . 638136-H) Proposed MTN Programme of up to RM1.7 Billion Nominal Value - Second Supplemental Trust Deed (E) At the request of the Issuer, the Trustee has now agreed pursuant to the consent of the Noteholder obtained on 16 December 2008 and the rating affirmation of Malaysian Rating Corporation Berhad dated 28 November 2008 to the requested additional extension of the Availability Period (as defined in the Trust Deed) of the Programme subject to the approval from the Securities Commission. (F) The Securities Commission had given its approval for the additional extension of the Availability Period via its letter dated 15 January 2009. (G) The parties hereto agree that the Trust Deed as amended by the First Supplemental Trust Deed be further varied upon the terms and subject to the conditions contained herein. NOW THIS SECOND SUPPLEMENTAL TRUST DEED WITNESSES as follows : DEFINITIONS AND INTERPRETATION 1 .1 Definitions in the Trust Deed: In this Second Supplemental Trust Deed, unless the context otherwise requires and save as specifically defined in this Second Supplemental Trust Deed, words and expressions defined in the Trust Deed as amended by the First Supplemental Trust Deed shall have the same meanings when used in this Second Supplemental Trust Deed. 1 .2 Interpretation : (a) Reference in this Second Supplemental Trust Deed to the "Trust Deed" shall, unless the context otherwise requires, be references to the Trust Deed as amended and supplemented by the First Supplemental Trust Deed and this Second Supplemental Trust Deed and words such as "herein", "hereinafter", "hereunder", "hereby" and "hereto", where they appear in the Trust Deed shall be construed accordingly. (b) Unless the context otherwise requires, words denoting the singular number only shall include the plural and vice versa . Save where otherwise indicated, references to "Clauses" and "Schedules" are to be construed as to include references to clauses of, and the schedules to, this Second Supplemental Trust Deed. THE SECOND SUPPLEMENTAL TRUST DEED 2.1 Binding Effect : This Second Supplemental Trust Deed is supplemental to the Trust Deed as amended by the First Supplemental Trust Deed and save as otherwise varied herein, the other provisions of the Trust Deed as amended by the First Supplemental Trust Deed shall continue to bind the parties and be in full force and effect. The Trust Deed as amended by the First Supplemental Trust Deed and this Second Supplemental Trust Deed shall be read and construed as one instrument. 2.2 Deeming Provision: All provisions of this Second Supplemental Trust Deed shall be deemed to be incorporated in the Trust Deed as amended by the First Supplemental Trust Deed mutatis mutandis and shall form part of the Trust Deed as amended by the First Supplemental Trust Deed. VARIATION TO THE TRUST DEED 3.1 Amendment to Clause 1 .1 Definition of "Availability Period" : The definition of "Availability Period" contained in Clause 1 .1 of the Trust Deed is hereby amended by substituting the same in its entirety with a new definition of "Availability Period" as follows : "Availability Period the period commencing from the date of first (1S) issuance of MTNs under the Programme and ending on the close of business in Kuala Lumpur on 30 September Gerbang Perdana CIQ Sdn Bhd (Company No. 638136-H) Proposed MTN Programme of up to RM1 .7 Billion Nominal Value - Second Supplemental Trust Deed 2009." STAMP DUTY 4.1 It is hereby agreed and declared that this Second Supplemental Trust Deed constitutes one of the several instruments employed in the medium term notes programme of up to Ringgit Malaysia One Billion and Seven Hundred Million (RIN11,700,000,000 .00), which issuance has been sanctioned by the Securities Commission of Malaysia and is thereby exempted from stamp duty pursuant to the provisions of the Stamp Duty (Exemption) (No . 23) Order 2000. Gerbang Perdana CIQ Sdn Bhd (Company No . 638136-H) Proposed MTN Programme of up to RM1.7 Billion Nominal Value - Second Supplemental Trust Deed IN WITNESS WHEREOF the parties hereto have hereunto affixed their respective common seals in the presence of their respective officers duly authorised the day and year first above written . THE ISSUER The Common Seal of GERBANG PERDANA CIQ SDN BHD (Company No . 638136-H) was hereunto duly affixed in accordance with its Articles of Association in the presence of : - ----------------------------------------------D'rector YB ID'ATO e YAHYA A . JALI L IC NO : 560819-01-6437) D' ctor/Secretary ALI SHAH HASHIM (IC NO : 590206-07-5001) THE TRUSTEE SIGNED by as Attorney for and on behalf of MAYBAN TRUSTEES BERHAD (Company No. 5004-P) in the presence of:- MAYBAN TRUSTEES BERHAD (Company No. 5004-P) S "U"""BAR KAUR A/P GIAN NNUH ATTORNEY 580615-10-649 ;-: UMA MAGESWARY A/P MURUGAY Advocate & Solicitor Kuala Lumpur Dated this D-0 day of J-0 YL uctC~ 2009 MEDIUM TERM NOTES PROGRAMME OF UP TO RM1.7 BILLION SECOND SUPPLEMENTAL TRUST DEED Between GERBANG PERDANA CIQ SDN BHD (Company No. 638136-H) (as "Issuer") and MAYBAN TRUSTEES BERHAD (Company No. 5004-P) (as "Trustee") Albar & Partners Advocates & Solicitors 6'h Floor Faber Imperial Court Jalan Sultan Ismail 50250 Kuala Lumpur (SZ/CSL/JAR/20070661) I r a ft r5