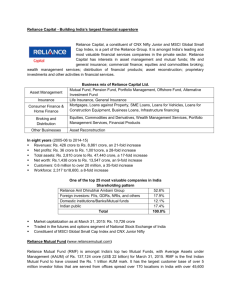

Invest. Innovate. Inspire. For a new India.

advertisement