at a Glance - Syariah Mandiri

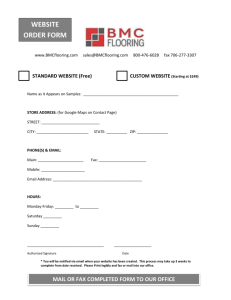

advertisement