Natural Persons only - The Institute of Accounting and Commerce

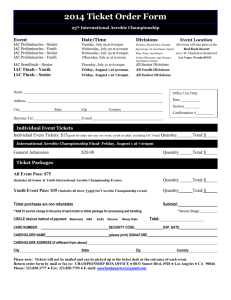

advertisement

(Form MEM0001) Membership No INSTITUTE OF ACCOUNTING & COMMERCE Application for Membership (Natural Persons only) Surname: ______________________ Ph No: CODE ( Name: _________________________ ) ____________________ (Cell) ___________________ Please tick the category of membership that you are applying for: Categories of Membership Fellow Members [] Full Members 1. Independent Accounting Professional (Reviewer) [ ] 2. Financial Accountant in Practice (Accounting Officer) [ ] 3. Financial Accountant in Commerce [ ] Associates Members 4. Technical Accountant [ ] 5. Student Members [ ] On completion, this form should be returned to the Institute at: P O Box 36477 GLOSDERRY 7702 Enquiries can be directed to: Tel: (021) 761-6211 or Fax: (021) 761-5089 / 086 637 6989 (Form MEM0001) General Information on Membership of the IAC Categories of Membership Fellows (Full member) Taking into account the applicant’s status in accounting and commerce, age and relevant business experience, the IAC Board will determine which category of membership an applicant will be admitted to. Persons, who have not been a Full member of the IAC for at least 5 years, are not eligible to apply for Fellow membership. Full Members 1. 2. 3. Independent Accounting Professional ( Reviewer) (IAP) Financial Accountant in Practice ( IAC-FAP) Financial Accountant in Commerce ( IAC-FAC) Associate Members 4. 5. Technical Accountant (IAC-TA) Students Criteria for admission as an Accounting Officer (Financial Accountant in Practice) The following persons are eligible to apply for Accounting Officer membership 1. A person who has completed an IAC diploma in Accounting, Cost and Management Accounting and Company Secretaries, or 2. A person who has completed a recognised post- matric (Grade12) qualification (SAQA rated NQF Level 6 as per the old grid, post 2009 = NQF 7 – New Grid) with the same evaluation as an IAC diploma, provided that the subjects passed are relevant to the IAC subjects, and that the qualification is recognised by the IAC. For example, the following qualifications are acceptable: The degree B.Com (Accounting) / B. Accounting Science and B. Tech degrees, obtained from South African Universities and Universities of Technology. Members of the following Institutes are also eligible for professional membership of the IAC. South African Inst. Of Professional Accountants South African Inst. Of Charted Accountants Accounting Officers of (SAIPA) (CA) (SA) CIMA, CSSA, ACCA Registered Members in good standing with these mentioned Institutes are welcome to join the IAC membership, and CAN BE EXEMPTED from the IAC entry evaluation. Please note that Members from Zimbabwe who want to register as a Member with the IAC in South Africa will have to ensure that in addition to the normal criteria they pass: - Company Law Tax (South African Legislation) (South African Legislation) 2 (Form MEM0001) 3. Accounting Officers for Close Corporations (FULL MEMBER) An Accounting Officer is defined in section 60 of the Close Corporations Act No.69 of 1984. To be registered as an accounting officer for close corporations, an applicant must, in addition to his/her academic qualification(s), also meet the following criteria: Core Subjects (per the Regulations to the Close Corporations Act) 3.1 To have majored in Financial Accounting (i), (ii) & (iii) 3.2 To have passed Income Tax (in terms of South African Legislation) 3.3 To have passed Company Law (in terms of South African Legislation) 3.4 To have passed Auditing (i) or Internal Auditing (i and ii) Practical Experience (per the Regulations to the Close Corporations Act) 3.5.1 3.5.2 To have gained a Minimum of three (3) years, articled or learner-ship training, under the guidance of a registered Accounting Officer OR To have gained a Minimum of six (6) years relevant, practical accounting experience at a management or supervisory level (under the guidance of a qualified accountant as mentioned above). The application must be supported by an affidavit, stamped and signed by a Commissioner of Oaths, verifying the applicant's practical experience, as well as a comprehensive job description. Evaluation 3.6 The applicant must do an up to 5 hour written and oral evaluation based on a pre-determined questionnaire covering the following: 1. 2. 3. 4. 5. 6. Accounting Auditing Taxation Company Law Management Accounting Practice Management The applicant will need to travel to the Assessor (at the applicant’s own expense) or if agreeable by both parties, the Assessor will travel to the applicant, and an additional travelling charge will be levied. Once an Evaluator has signed off the above criteria, the Board (in its sole discretion) may issue the applicant with a practice certificate and membership of the Institute. NB: IAC designation for Accounting Officer = Financial Accountant in Practice (FAP) 3 What an Accounting Officer is allowed to do. - - - - Note: Under no circumstances is any designation in the membership of the IAC allowed to conduct an Audit unless the member is registered with IRBA (Independent Regulatory Body for Accountants) as an auditor. The member of IAC who is registered as an Accounting Officer with the Institute CAN: Prepare Financial Statements and sign off for Close Corporations. Do an independent compilation of Financial Statement for Companies and Incorporates (SME’s) who’s PIS score is under 100. The Financial Statements for both Companies and CC needs to comply with IFRS or IFRS for SME’s. Prepare Financial Statements and sign off for NPO’s and PBO’s – as long as the organization’s constitution allows it. Can prepare Financial Statements and sign off for a Body Corporate under the Sectional Titles Act 95 of 1986 as long as the number of units is below 10 units, and if there are 10 or more units, the rules must be amended. Can prepare Financial Statement and sign off for Trusts if the trust deed allows it. Can prepare Financial Statements and sign off for a Sole Proprietor and Partnership. Be allowed to accept the audits of Schools, but this needs to be understood in terms of the School’s Act 84 of 1996 as well as the requirements of the Schools Act in the various Provinces. The member of IAC who is registered as an Accounting Officer with the Institute CANNOT: Do Review Engagements in terms of ISRE 2400 and ISRE 4400, unless they have done the course on Review Engagement and are registered as a Reviewer with IAC. CPD Requirement for the Accounting Officer: 40 CPD hours / annum (20 structured + 20 unstructured dispersed into the 4 categories, namely, Accounting (i.e. IFRS), Taxation, Company Law, Auditing & Review Engagements, and if any of these members carry Tax Practitioner status they will need to complete 9 structured + 6 unstructured tax hours. 4. Independent Accounting Professional (Reviewer) (IAP – FULL MEMBER) 1. The Independent Accounting Professional ( Reviewer) is defined in section 26 (d) (i) (cc) of the Regulations to the Companies Act no.71 of 2008. 2. Only registered Accounting Officers, who completed and passed an approved Reviewer’s course, may apply for registration as an Independent Accounting Professional. CPD Requirement for the IAP: Same as Accounting Officer above. 4 (Form MEM0001) 5. Financial Accountant in Commerce (FAC – FULL MEMBER) • A person who has completed a degree or diploma in Accounting with a minimum (SAQA rated NQF Level 6 as per the old grid, post 2009 = NQF 7 - New Grid) • The applicant needs to have a minimum of 3 years practical Accounting experience under the guidance of a qualified Accountant, which must include the preparation of Financial Statements (i.e. balance sheet, income statement, cash flow and notes). • A Financial Accountant in Commerce should be allowed to write up books of prime entry for all types of business entities but will not be allowed to act as an Accounting Officer in terms of section 60 of the Close Corporation Act or as a reviewer as defined in section 26 (1) (d) of the Regulations to the Companies Act No 71 of 2008. Body Corporate is also excluded. • Financial Accountant in Commerce may apply to be registered as an Accounting Officer but would have to meet the entry requirements prevailing at the time. CPD Requirement: Same as Accounting Officer above. 6. Technical Accountant (IAC designation) – TA (ASSOCIATE MEMBER) To be registered as a Technical Accountant, an applicant must meet the following criteria: Completed a two-year learner ship registered with the Institute, ICB and FASSET and successfully completed 10 of the 14 IAC accredited subjects or the equivalent. OR A person who does not have a formal qualification, but has been working as a senior bookkeeper or accountant for a period of 5(five) years or more, be allowed to be admitted to Technical Accountant status, even though they may not have any formal qualifications. (This would be the Institute’s RPL process). A Technical Accountant shall not be allowed to vote at general meetings. CPD Requirement: 20 CPD hours / annum (10 structured + 10 unstructured dispersed into the 4 categories, namely, Accounting (i.e. IFRS), Taxation, Company Law, Auditing & Review Engagements. 5 (Form MEM0001) 7. Student on Leaner-ship 1. 8. A student studying accounting at a university or a university of technology and has signed an accounting officer leaner ship can be registered as a student on learner ship. Students 1. Other students wishing to enter the accounting profession may also register as a student. Upon signing this application form, applicants acknowledge and agree to the following: a. The Board of Directors of the Institute of Accounting and Commerce in its sole discretion may issue the applicant with a practice certificate and membership of the Institute b. Membership certificates are and remain the property of the Institute. Should membership be terminated (for whatever reason), the certificates must be returned to the IAC. Please attach certified copies of the following documents with your application form and post to: P.O. Box 36477 Glosderry 7702 Phone: (021) 7616211 1. 2. 3. 4. 5. 6. I.D. document Proof of residence Matric certificate Degree \ Diploma Academic transcript A detailed affidavit of working experience or contract of articles 6 (Form MEM0001) Application for Membership Category of membership applying for:- 1. Personal Details Prof [ ] Dr [ ] Mr [ ] Mrs [ ] Miss [ ] (Please TICK or specify other) ________ Surname First names Date of birth ID.No. Home Address Postal Code Postal Address Postal code Tel: Area Code ( ) (B) _________________ (H) ____________________ Fax: Area Code ( ) (B) _________________ (H) ___________________ Cell phone E-mail Address for Correspondence: Private [ ] Business Income Tax Reference Number Tax Clearance Certificate Number Approved Date Expiry Date 7 [ ] (Form MEM0001) 2. Present Employment Organisation/Company name Business telephone number Area Code: ( ) Fax Number (if available) Area Code: ( ) Business address Postal Code 3. Present Position Position title Date appointed _________________ To be completed by Members Applying for Fellow, Accounting Officer and Accountant in Commerce Management Level in Organization Position in Company Senior Middle Number of employees reporting to you? To whom do you report? His/her position in organisation 8 (Form MEM0001) 4. Previous Employment (in the last ten years) Year From Year To Position held Name of organization Number of employees reporting to you Please attach a separate list if the above space is insufficient). Primary responsibilities in your most recent position: * TO BE COMPLETED IN THE FORM OF A COMPREHENSIVE AFFIDAVIT * 5. Academic, Technical and Professional Education Year From Note: Year To Institution Degrees, Diplomas You are required to submit certified copies of your post-matric qualifications in support of your application. The actual subjects passed, must be listed and certified. 9 (Form MEM0001) 6. 1. 3. Declaration Do you qualify in terms of the criteria set out on Pages 2 and 3? Yes [ ] No [ ] Are you currently, or have you been in the past, a member of any Recognised Controlling Body or Accounting Body? If so, kindly state names of Institute/Association. Yes [ ] No [ ] 3. If you are no longer a member, please explain briefly the circumstances of your membership ceasing 4. Have you ever been convicted of an offence under the Companies Act, the Close Corporation Act, the Insolvency Act or the Tax or been found guilty of a criminal offence in terms of section 234 to 237 of the Tax Administration Act of 2011. (If yes, please state details.) Yes [ ] No [ ] ____________________________________________________________________________ ____________________________________________________________________________ 5. Have you ever been convicted of a criminal offence? (If yes, please state details.) 6. Have you ever been insolvent, or assigned your estate? (If yes, please state details.) Yes [ ] No [ ] Yes [ ] No [ ] __________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________ 10 (Form MEM0001) 7. Referees Please have your application signed by two persons who will act as referees. The proposer should be your immediate superior who should be able to support your application by actual knowledge of your responsibilities. If you are the head of your organisation, please name two business / professional associates. If possible, your application should be proposed or seconded by a member of the Institute who is willing to act as your referee. Proposer : Name: Seconder : Name: Position title Position title Qualifications Qualifications Organisation Organisation Address Address Postal Code Postal Code Telephone Telephone IAC member [ ] YES [ ] NO IAC member [ ] YES IAC membership grade IAC membership grade Signature Signature 8. This section to be completed by IAC Diplomats only 1.6 What is your IAC registration number? When did you complete your IAC diploma(s)? / / Which IAC diploma(s) did you complete? 11 (month and year) [ ] NO (Form MEM0001) 9. Declaration I hereby certify that the above particulars are correct. Should it be necessary, I hereby authorize the Institute of Accounting and Commerce to make any enquiries it considers relevant to its acceptance of this application. If admitted as a member, I agree to abide by the rules, regulations and bye-laws of the Institute of Accounting and Commerce as they now exist and as they may hereafter be altered, and to use my status as a member of the Institute in an honourable manner. I understand that the "Diploma of Membership" issued to me remains the property of the Institute. I undertake to return same should I resign, or cease to be a member through whatever cause. Signature of applicant _________________________________________ Signed at ________________________________________ Date ___________/____________/________________ IAC Banks with: Branch: Branch Code: Account Number: Account Type: FNB Adderley Street Cape Town 201409 62190124645 Current Account Please note: It is very important that you write your IAC membership number or name and surname in the reference section on the deposit slip. Enquiries can be directed to: Tel: (021) 761-6211 or Fax: (021) 761-5089 / 086 637 6989 12 (Form MEM0001) For Office Use Only: Grade of Membership Recommended: Fellow Member [ ] Independent Accounting Professional [ ] Financial Accountant in Practice [ ] CC as an Accounting Officer [ ] Financial Accountant in Commerce [ ] Technical Accountant [ ] Tax Practitioner [ ] Technical Tax Practitioner [ ] Students [ ] Students on Learnership [ ] Action to be taken: Signature of Membership Officer Date Approved as ____________________ _______________ Member Not Approved ____________________________________ Application for Membership Approved by EXCO Meeting on ________________ Application for Membership Approved by Board Meeting on _________________ Signature of President or Chief Executive Officer Date 13