(Microsoft PowerPoint - INVESTOR_FACT_SHEET_EN

advertisement

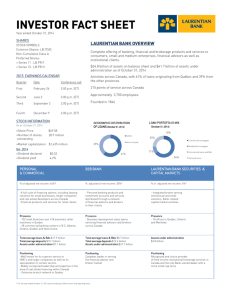

INVESTOR FACT SHEET First quarter ended January 31, 2015 BUSINESS SEGMENTS LAURENTIAN BANK OVERVIEW Complete offering of banking, financial and brokerage products and services to consumers, small and medium-enterprises, financial advisors as well as institutional clients $37.4 billion of assets on balance sheet and $42.6 billion of assets under administration as of January 31, 2015 Activities across Canada, with 215 points of service across Canada Approximitely 3,700 employees OUR PAN-CANADIAN PRESENCE Personal and commercial Business Services Recognized for its unparalleled expertise, rapid execution and innovative approach within all of our market niches and segments, the group concentrates on serving the needs of small cap companies and medium-sized enterprises and real estate promoters across Canada. Retail Services With longstanding roots in Québec, the distinctiveness of our Retail Services sector rests on the climate of client confidence it has established through its authentic relational approach fuelled by its commitment to simplicity and accessibility. B2B Bank As a leader dedicated exclusively to serving Canadian financial advisors and brokers, B2B Bank offers a range of products designed specifically to enable them to build theirs client’s wealth Laurentian Bank Securities and Capital Markets Recognized in the field of institutional brokerage in Canada, the business segment is specialized in serving small cap companies and in the fixed income sector. DIVERSIFICATION BY LOAN CATEGORIES GEOGRAPHIC DIVERSIFICATION BY BUSINESS SEGMENTS Retail Services residential mortgage loans (33%) 7% B2B Bank residential mortgage loans (16%) 33% 9% Commercial mortgage loans (10%) 12% Commercial and other loans (12%) 5% 40% Business Services residential mortgages loans (5%) 15% 10% 30% 16% 100% 60% 53% Retail Services personal loans (9%) B2B Bank investment loans (15%) 10% Retail Services Loans Québec Ontario B2B Bank loans Business Services loans Western Canada and Eastern Canada FINANCIAL OBJECTIVES FOR FISCAL 2015 Indicators 2015 Objectives** Q1-2015 Results Adjusted diluted earnings per share* 5% to 8% growth + 2% Adjusted efficiency ratio* < 71.0% 71.4% Adjusted operating leverage* Positive 0.5% Adjusted return on comon shareholder’s equity* ≥ 12% 11.3% Common Equity Tier 1 capital ratio >7.0% 7.8% FINANCIAL HIGHLIGHTS ADJUSTED NET INCOME ADJUSTED DILUTED EARNINGS PER SHARE *ǂ *ǂ (in millions of $) 140.7 155.4 (in dollars) 5.07 4.98 163.6 5.31 2013 2014 Q1-2015 (non-interest expenses as a percentage of total revenue) 73.1% 72.8% 71.0% *ǂ 71.4% 1.32 40.5 2012 ADJUSTED EFFICIENCY RATIO 2012 2013 TOTAL REVENUE TOTAL ASSETS‡‡ (in millions of $) 865.3 796.6 (in billions of $) 2014 2012 2013 2014 Q1-2015 DECLARED DIVIDEND HISTORY ($ per share) 874.1 34.9 Q1-2015 36.5 33.9 37.4 218.2 1,84 1,98 2,06 0,54 2012 2013 2014 Q1-2015 2012 2013 2014 Q1-2015 2012 2013 2014 *Excluding adjusting items (items related to business combinations, restructuring charges and retirement compensation charge) **Refer to the caution regarding forward-looking statements on page 17 of the Bank’s 2014 Annual Report ǂResults prior to 2013 have not been restated to reflect the adoption of amendments to IAS 19, Employee Benefits ‡‡ Results prior to 2014 have not been restated to reflect adoption of admendments to IAS 32, Financial Instruments:Presentation SHARES STOCK SYMBOLS Common Shares: LB (TSX) Non-Cumulative Class A preferred shares: » Series 11 : LB.PR.F » Series 13 : LB.PR. 2015 EARNINGS CALENDAR STOCK INFORMATION As at January 31, 2015 »Share Price »Number of shares outstanding $46.81 28.9 million »Market capitalization Q1- 2015 »Dividend declared »Dividend yield $1,355 million $0.54 4.6% Q1 February 26 Q2 June 3 Q3 September 2 Q4 December 9 CONTACT INFORMATION Public Affairs, Communications and Investor Relations Tel.: 514-284-4500, ext. 7511 Fax: 514-284-3916 Email: gladys.caron@banquelaurentienne.ca www.laurentianbank.ca Head Office Tour Banque Laurentienne 1981 McGill College Avenue, 20th floor, Montréal, Québec H3A 3K3 Transfer Agent Computershare Investor Services Inc. 1500 University Street, Suite 700 Montréal, Québec H3A 3S8 Tel.: 1-800-564-6253 Q1-2015