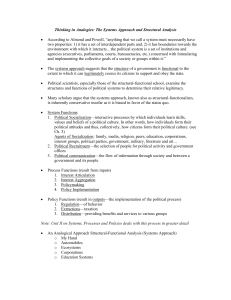

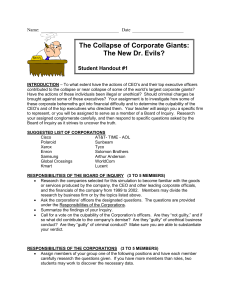

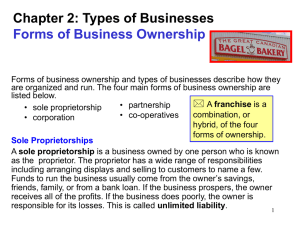

Business Ethics and Stakeholder Theory

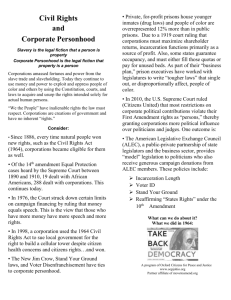

advertisement