BP Energy Outlook 2030

advertisement

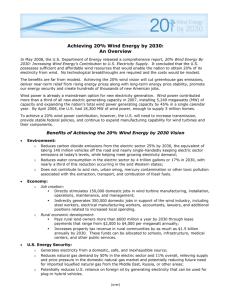

BP Energy Outlook 2030 London, January 2012 Disclaimer This presentation contains forward-looking statements, particularly those regarding global economic growth, population growth, energy consumption, policy support for renewable energies and sources of energy supply. Forward-looking statements involve risks and uncertainties because they relate to events, and depend on circumstances, that will or may occur in the future. Actual results may differ depending on a variety of factors, including product supply, demand and pricing; political stability; general economic conditions; legal and regulatory developments; availability of new technologies; natural disasters and adverse weather conditions; wars and acts of terrorism or sabotage; and other factors discussed elsewhere in this presentation. Energy Outlook 2030 2 © BP 2012 Contents Page Introduction 4 Global energy trends 7 Outlook 2030: Fuel by fuel 21 Key determinants 43 Risks and unknowns 73 Appendix 83 Energy Outlook 2030 3 © BP 2012 Welcome to the 2012 edition of BP’s Energy Outlook 2030. This is the second year in which BP has made our outlook for global energy available to the public. I am glad to see this decision was endorsed by the response we received to last year’s edition, which was downloaded over 36,000 times from BP’s website. I was particularly pleased at this response because I strongly believe that sharing the data and analysis of the Energy Outlook – and of our annual Statistical Review of World Energy – is part of our responsibility to inform the discussions on energy that are occurring in companies, governments, and over dinner tables worldwide. This Energy Outlook contains our projections of future energy trends and key uncertainties, based on our views of the evolution of the world economy, of policy, and technology. This is our view of the most likely outcome for world energy supply and demand to 2030; it is not necessarily the energy world we at BP wish to see. This year we examine in more detail several important facets of the global energy story: the pathways for economic development and energy demand in China and India; the factors affecting the energy export prospects of the Middle East; and the “drivers” of energy consumption in road transportation. As always, the numbers that make up this outlook point to long term trends and highlight potential decision points or “fault lines” in the system; in short, their job is to convey the underlying challenges and opportunities we all face in producing and consuming energy. 4 © BP 2012 Our job is to unlock this story from the numbers. For example, this outlook highlights the critical role that fossil fuels will continue to play in the world’s energy mix, even as renewable energy sources continue their rapid growth. While this has inescapable implications for the likely path of carbon emissions, the outlook also highlights the opportunities for improving energy efficiency and “lightening the carbon load” by switching to less carbon-intensive fuels such as natural gas. The outlook also challenges some long-held beliefs. Significant changes in US supply and demand prospects, for example, highlight the likelihood that import dependence (in what is today’s largest energy importer) will decline substantially. Perhaps most important to me is how the outlook reminds us that we are all connected. Global energy trade continues to grow rapidly, linking the world’s economies and driving a remarkable convergence of the relationship between energy use and economic activity in countries around the world. These are changes for the better. They are market driven, and while they need the support of well-designed policies, they represent a key reason why I feel optimistic about the world’s ability to meet the challenge of providing energy that is affordable, secure, sustainable and of course safe. We hope you find the 2012 edition of the BP Energy Outlook 2030 a useful addition to the global energy discussion. Bob Dudley Group Chief Executive Energy Outlook 2030 5 © BP 2012 Note on method and assumptions This edition updates our view of the likely path of global energy markets to 2030, taking account of developments over the past year. The underlying methodology remains unchanged – we make assumptions on changes in policy, technology and the economy, based on extensive internal and external consultations, and use a range of analytical tools to build a “to the best of our knowledge” view. We focus on the “most likely” base case numbers, to provide a basis for discussion. Of course the future is uncertain, and in the process of building the Outlook we explore the impact of alternative assumptions. While we do touch on some of the key uncertainties, the treatment of energy market risks here is by no means exhaustive. Unless noted otherwise, data definitions are based on the BP Statistical Review of World Energy, and historical energy data through 2010 is consistent with the 2011 edition of the Review . Gross Domestic Product (GDP) is expressed in real Purchasing Power Parity (PPP) terms. All data sources are listed on page 88. Energy Outlook 2030 6 © BP 2012 Contents Page Introduction 4 Global energy trends 7 Outlook 2030: Fuel by fuel 21 Key determinants 43 Risks and unknowns 73 Appendix 83 Energy Outlook 2030 7 © BP 2012 Key assumptions are population and GDP growth… Global growth rates % p.a. 4% GDP 3% Population 2% Energy Energy per capita 1% Energy per GDP 0% -1% -2% 1970-1990 Energy Outlook 2030 1990-2010 2010-2030 8 © BP 2012 …and a key outcome is accelerating energy efficiency Population and income remain the key drivers of energy demand. Over the last 20 years the global population has increased by 1.6 billion people, but the growth rate is trending down. We project population growth of 1.4 billion over the next 20 years (or 0.9% p.a.). Global GDP growth is likely to accelerate, driven by low and medium income economies. We project GDP growth to rise over the next 20 years, to 3.7% p.a. from 3.2% p.a. between 1990 and 2010. This implies accelerating growth of income per capita. Energy efficiency – measured broadly as energy per unit of GDP – will continue to improve globally, at an accelerating rate of 2.0% p.a., vs. 1.2% p.a. over the past 20 years. This acceleration restrains the overall growth of primary energy consumption. Primary energy consumption growth to 2030 decelerates to 1.6% p.a. (compared to 2.0% p.a. the last 20 years); energy consumption per capita grows at 0.7% p.a., about the same rate as it has since 1970. Energy Outlook 2030 9 © BP 2012 Non-OECD economies drive energy consumption growth… Billion toe Billion toe 18 18 15 15 12 12 9 9 6 3 Non-OECD Non-OECD OECD OECD 0 1990 2000 2010 2020 2030 Energy Outlook 2030 Renewables* Hydro Nuclear Coal 6 Gas Oil 3 0 1990 2000 2010 2020 2030 *Includes biofuels 10 © BP 2012 …as the fuel mix gradually shifts away from oil and coal World primary energy consumption is projected to grow by 1.6% p.a. over the period 2010 to 2030, adding 39% to global consumption by 2030. The growth rate declines, from 2.5% p.a. over the past decade, to 2.0% p.a. over the next decade, and 1.3% p.a. from 2020 to 2030. Almost all (96%) of the growth is in non-OECD countries. By 2030 non-OECD energy consumption is 69% above the 2010 level, with growth averaging 2.7% p.a. (or 1.6% p.a. per capita), and it accounts for 65% of world consumption (compared to 54% in 2010). OECD energy consumption in 2030 is just 4% higher than in 2010, with growth averaging 0.2% p.a. to 2030. OECD energy consumption per capita is on a declining trend (-0.2% p.a. 2010-30). The fuel mix changes slowly, due to long gestation periods and asset lifetimes. Gas and non-fossil fuels gain share at the expense of coal and oil. The fastest growing fuels are renewables (including biofuels) which are expected to grow at 8.2% p.a. 2010-30; among fossil fuels, gas grows the fastest (2.1% p.a.), oil the slowest (0.7% p.a.). Energy Outlook 2030 11 © BP 2012 Fuel substitution is the main story in the OECD… By fuel and country grouping Change 2010 to 2030, Billion toe 5 Contributions to global growth % p.a. 2.5% Renewables* 4 2.0% 3 Hydro Nuclear 1.5% Coal 2 1.0% Gas 1 0.5% Oil 0 0.0% -1 OECD Energy Outlook 2030 1970- 1990- 20101990 2010 2030 Non-OECD 12 * Includes biofuels © BP 2012 …while the non-OECD sees all fuels expanding OECD total energy consumption is virtually flat, but there are significant shifts in the fuel mix. Renewables displace oil in transport and coal in power generation; gas gains at the expense of coal in power. These shifts are driven by a combination of relative fuel prices, technological innovation and policy interventions. The economic development of non-OECD countries creates an appetite for energy that can only be met by expanding all fuels. For many developing countries the imperative remains securing affordable energy to underpin economic development. The growth of global energy consumption is increasingly being met by non-fossil fuels. Renewables, nuclear and hydro together account for 34% of the growth; this aggregate non-fossil contribution is, for the first time, larger than the contribution of any single fossil fuel. Renewables on their own contribute more to world energy growth than oil. The largest single fuel contribution comes from gas, which meets 31% of the projected growth in global energy. Energy Outlook 2030 13 © BP 2012 The growth of energy consumption by sector… By sector and region to 2030 By sector and fuel to 2030 Billion toe Billion toe 3.0 3.0 RoW Middle East 0.5 OECD Other Industry -0.5 Transport 0.0 Final energy use Energy Outlook 2030 Renew. Electricity 1.5 China & India 1.0 2.0 Gas 1.0 Biofuels 0.5 Oil 0.0 Coal -0.5 Other 1.5 Nuclear Industry 2.0 2.5 Transport 2.5 Hydro Final energy use Inputs to power 14 Inputs to power © BP 2012 …is dominated by power generation and industry Energy used to generate electricity remains the fastest growing sector, accounting for 57% of the projected growth in primary energy consumption to 2030 (compared to 54% for 1990-2010). The power sector is also the main driver of diversification of the fuel mix; non-fossil fuels, led by renewables, account for more than half of the growth. Industry leads the growth of final energy consumption, particularly in rapidly developing economies. The industrial sector accounts for 60% of the projected growth of final energy demand to 2030. The transport sector shows the weakest growth, with OECD transport sector demand projected to decline. In transport, we are starting to see diversification: driven by policy and enabled by technology, biofuels account for 23% of transport energy demand growth (with gas contributing 13% and electricity 2%). Energy Outlook 2030 15 © BP 2012 Strong growth in power generation continues… World power generation Growth of fuel inputs to power Thousand TWh 40 Billion toe 1.6 Renewables 30 Hydro 1.2 Nuclear 20 0.8 Coal Gas 10 0.4 Oil 0.0 0 1990 2000 2010 2020 2030 Energy Outlook 2030 19902000 16 -0.4 20002010 20102020 20202030 © BP 2012 …with lower carbon fuels gaining market share World electricity demand (2.6% p.a.) is projected to grow more rapidly than total energy over the next 20 years, although not as rapidly as GDP (3.7% p.a.). Efficiency gains in power generation mean that the fuel inputs grow less rapidly than power output, averaging 2.1% p.a. 2010-30. Over the next decade coal is still the largest contributor to the growth of power fuels, accounting for 39%, but non-fossil fuels are rapidly catching up. In aggregate nuclear, hydro and other renewables contribute as much as coal. The growing role of non-fossil fuels becomes even clearer in the following decade to 2030, with 75% of the growth coming from these sources and very little from coal. Meanwhile the contribution of gas remains relatively steady at around 31% through the decades. Energy Outlook 2030 17 © BP 2012 Convergence of energy intensity and fuel shares… Energy intensity Shares of world primary energy Toe per thousand $2010 GDP 0.4 50% 40% 0.3 China US 0.2 Oil 30% World 20% Gas 0.1 0 1970 Coal India 1990 2010 10% 2030 Hydro 0% 1970 Nuclear 1990 Renewables* 2010 2030 * Includes biofuels Energy Outlook 2030 18 © BP 2012 …will be dominant trends Energy intensity continues its long term trend of convergence across countries, to a lower and lower global level – a process we have discussed in more detail in the 2011 edition of the Energy Outlook. As a result, economic growth will become significantly less energy intensive, especially in non-OECD economies. Convergence is driven by energy trade, the diffusion of technology, and the standardization of consumption baskets. Fossil fuels are converging on a market share of 26-28% each and non-fossil fuel groups on a market share of 6-7% each. Oil follows a long run trend of decline in its market share, while gas continues to gain. Coal’s recent gain in market share will start to reverse soon, with a trend decline evident by 2020. The rate at which renewables penetrate global energy markets bears remarkable similarity to the emergence of nuclear power in the 1970s and 1980s. Energy Outlook 2030 19 © BP 2012 Energy Outlook 2030 20 © BP 2012 Contents Page Introduction 4 Global energy trends 7 21 Outlook 2030: Fuel by fuel Liquid fuels 22 Natural gas 30 Coal 36 Non-fossil fuels 38 Key determinants 43 Risks and unknowns 73 Appendix 83 Energy Outlook 2030 21 © BP 2012 Liquids demand growth from non-OECD countries… Demand Mb/d Supply 105 2030 level Other 100 Iraq S&C Am 95 Saudi Mid East Oil Sands NGLs Biofuels India 90 Other Brazil US China 85 80 2010 OECD Declines Energy Outlook 2030 NonOECD Growth 2010 22 NonNonOPEC OPEC OPEC Growth Growth Declines © BP 2012 …will be met by supply growth from OPEC and the Americas Oil is expected to be the slowest-growing fuel over the next 20 years. Global liquids demand (oil, biofuels, and other liquids) nonetheless is likely to rise by 16 Mb/d, exceeding 103 Mb/d by 2030. Growth comes exclusively from rapidly-growing non-OECD economies. China (+8 Mb/d), India (+3.5 Mb/d) and the Middle East (+4 Mb/d) together account for nearly all of the net global increase. OECD demand has likely peaked (in 2005), and consumption is expected to decline by 6 Mb/d. Rising supply to meet expected demand growth should come primarily from OPEC, where output is projected to rise by nearly 12 Mb/d. The largest increments of new OPEC supply will come from NGLs, as well as conventional crude in Iraq and Saudi Arabia. Non-OPEC supply will continue to rise, growing by 5 Mb/d, due to strong growth in the Americas from US and Brazilian biofuels, Canadian oil sands, Brazilian deepwater, and US shale oil, offsetting continued declines in a number of mature provinces. Energy Outlook 2030 23 © BP 2012 Liquids demand growth is driven by non-OECD transport… Liquids demand by sector Mb/d 105 Liquids demand by product group Non-OECD Ind. & Other 90 Non-OECD Transport 75 60 OECD Ind. & Other 45 OECD Transport 30 15 0 2010 Energy Outlook 2030 Biofuels 90 Light distillates 75 60 45 Middle distillates 30 Other 15 Power 1990 Mb/d 105 0 1990 2030 24 Fuel Oil 2010 2030 © BP 2012 …while OECD demand falls across all sectors Global liquids consumption growth is projected to slow to 0.8% p.a. (from 1.4% p.a. in 1990-2010); oil will slow to 0.6% p.a.. OECD consumption will fall to 40.5 Mb/d, 1 Mb/d below the 1990 level. NonOECD consumption is likely to overtake the OECD by 2014, and reach 63 Mb/d by 2030 – 2½ times the 1990 level. Overall consumption growth will be constrained by stronger crude oil prices seen in recent years, technological advances, a range of new policies, and the continued, gradual reduction of non-OECD subsidies. By sector, liquids demand growth to 2030 comes from non-OECD transport (nearly 14 Mb/d), with non-OECD industry also contributing (6.5 Mb/d, largely for petrochemicals). Expected OECD declines are initially concentrated outside the transport sector, where oil can be more easily displaced by gas and renewables; post-2015, improved engine efficiency will drive declines in OECD transport demand. Demand growth is expected to be weighted towards middle distillates while fuel oil consumption declines. This will continue to put pressure on those refineries with limited upgrading capacity. Energy Outlook 2030 25 © BP 2012 OPEC’s critical position in the oil market grows... Liquids supply by type Mb/d 105 90 Growth from 2010 to 2030 Mb/d 12 45% Other OPEC share (rhs) 75 60 45 30 15 OPEC NGLs OPEC crude Biofuels 6 Saudi Arabia Iraq Oil Sands Other nonOPEC Non-OPEC conventional Brazil US Shale Oil Biofuels 3 NGLs 0 OPEC 0 30% 1990 2000 2010 2020 2030 Energy Outlook 2030 9 Canadian Oil Sands Other Americas RoW -3 26 © BP 2012 …while the Americas also play an expanding role Global liquids supply growth will match expected growth in demand with OPEC accounting for 70% of incremental supply; the group’s market share will approach 45%, a level not reached since the 1970s. OPEC NGLs will grow by more than 4 Mb/d – driven in part by rapid growth of natural gas production. Crude oil output from Iraq is projected to double to nearly 6 Mb/d, while Saudi output expands by nearly 3 Mb/d. Saudi Arabia is assumed to add new capacity as and when required to maintain a cushion of spare capacity. Supply from the Americas will also expand, by 8 Mb/d, as advances in drilling technologies unlock additional resources in the Canadian oil sands (+2.2 Mb/d), Brazilian deepwater (+2 Mb/d), and US shale oil (+2.2 Mb/d). In addition, the US and Brazil contribute over half of total biofuels production growth (of +3.5 Mb/d) expected by 2030. Overall, non-OPEC output is projected to rise by over 5 Mb/d as these growth areas more than offset declining conventional output elsewhere. Energy Outlook 2030 27 © BP 2012 The implications for refining are stark… Global liquids supply and demand Mb/d 105 Global liquids demand Total liquids 16 Mb/d Other Other liquids:1 NGLs Non-refined NGLs: 3 90 Bio 75 Crude 60 Supply growth 2010-30 1 Biofuels: 3 => Refined crude: 9 China crude runs:2 7 => Runs ex-China 2 OECD 1 includes 45 2010 2015 Energy Outlook 2030 2020 2025 2030 28 2 if processing gains self-sufficient in products © BP 2012 …with refinery throughputs likely to grow only modestly Growth in the call on refinery throughput to 2030 will be constrained by the growth of liquids which do not need refining: biofuels (+3.5 Mb/d) and non-refined NGLs (+3 Mb/d). Increases in processing gains and growth in supplies of liquids derived from gas and coal are likely to add another 1 Mb/d to product supplies. All of these supply sources will compete directly with refineries to meet total liquids demand growth of 16 Mb/d from 2010, limiting the growth in the call on refinery throughput to only 9 Mb/d over the next 20 years. Existing spare capacity will accommodate some of the future growth in refinery throughput. More than half of global liquids demand growth is in China, and that country’s refinery expansion plans will affect product balances globally. A continuation of its stated strategy to be self-sufficient in refined products would severely curtail crude run increases for refiners outside of China. Energy Outlook 2030 29 © BP 2012 Natural gas demand growth is concentrated in the non-OECD… Demand Bcf/d Supply 470 2030 level Other 420 Other India N. America FSU China 370 Mid East Mid East Other Africa Australia Mid East Other N. America 320 270 2010 Energy Outlook 2030 OECD Non-OECD 30 2010 LNG Pipeline © BP 2012 …with LNG playing a growing role in supply Natural gas is projected to be the fastest growing fossil fuel globally (2.1% p.a.). The non-OECD accounts for 80% of global gas demand growth, averaging 2.9% p.a. growth to 2030. Demand grows fastest in non-OECD Asia (4.6% p.a.) and the Middle East (3.7% p.a.). Gas grows rapidly in China (7.6% p.a.) to a level of gas use in 2030 (46 Bcf/d) equal to that of the European Union in 2010. China contributes 23% to the global demand increase. The share of gas in China’s primary energy consumption expands from 4.0% to 9.5%. On the supply side the main regional contributors to growth are the Middle East (26% of global growth) and FSU (19%). Significant incremental supply (11-12% of global growth each) is also expected from Australia, China, and the US. LNG represents a growing share of gas supply. Global LNG supply is projected to grow 4.5% p.a. to 2030, more than twice as fast as total global gas production (2.1% p.a.) and faster than inter-regional pipeline trade (3.0% p.a.). LNG contributes 25% of global supply growth 2010-30, compared to 19% for 1990-2010. Energy Outlook 2030 31 © BP 2012 Natural gas demand growth is supported by fuel substitution… Gas demand growth 2010-30 Demand by sector Bcf/d Bcf/d 60 500 Transport 50 400 Non-OECD Power 300 Non-OECD Ind. & Other 200 OECD Power 100 0 1990 2010 Energy Outlook 2030 2030 40 30 Growth at constant fuel shares Effect of changing fuel mix 20 10 OECD Ind. & Other 0 -10 Power Industry Power Industry OECD 32 Non-OECD © BP 2012 …as gas gains market share against coal and oil Of the major sectors globally, growth is fastest in power (2.4% p.a.) and industry (2.1% p.a.) – consistent with historical patterns. Natural gas use in transport is confined to 2% of global gas demand in 2030, despite growing four times from today’s level. In the OECD, growth is concentrated in the power sector (1.6% p.a.). Efficiency gains and low population growth keep industrial (0.9% p.a.) and other sector (<0.1% p.a.) gas growth low. Non-OECD gas use is driven by industrialisation, the power sector and the development of domestic resources. Gas consumption expands most strongly in power (2.9% p.a.) and industry (2.8% p.a.). Growth in gas demand is supported by fuel substitution, especially in the OECD, triggered by regulatory changes and lower relative prices. About half of all incremental gas demand in the OECD power sector and 75% of incremental demand in OECD industry is substitution for other fuels. Substitution is much less pronounced in the non-OECD, where rapidly expanding energy demand creates room for all fuels to grow. Energy Outlook 2030 33 © BP 2012 Unconventional gas will play a growing role… Sources of gas supply, by region North America Bcf/d Europe China 100 Bcf/d 100 100 80 80 80 60 60 60 40 40 40 20 20 20 0 0 0 1990 2010 2030 Energy Outlook 2030 Bcf/d 1990 2010 2030 34 Net pipeline imports Net LNG imports Syngas from coal Shale gas and CBM Conventional (inc. tight gas) Domestic production 1990 2010 2030 © BP 2012 …especially in North America and Asia The world had 6,609 Tcf of proved gas reserves in 2010, sufficient for 59 years of production at current levels. Unconventionals remain to be appraised in detail globally, but current estimates suggest they could double this R/P ratio. Shale gas and coal bed methane (CBM) will account for 63% of North American production by 2030. Sustained growth of shale gas raises the prospect of LNG exports from North America by 2030 (5 Bcf/d). Outside North America, unconventionals are in their infancy, but likely to play a growing role in the long term as current technical and regulatory hurdles recede. In Europe we do not expect major unconventional production before 2020. The decline in conventional supply implies a growing import requirement for Europe, up by more than 60%, from 26 Bcf/d in 2010 to 42 Bcf/d in 2030. In China gas production is expected to grow at 6.1% p.a.. CBM and shale gas are likely to contribute 46% to growth, but still leave a rising need for imports, which are met by expansion of LNG and pipeline projects. Energy Outlook 2030 35 © BP 2012 Coal consumption levels off after 2020… Coal demand by region Coal demand by sector Billion toe Billion toe 5 5 4 4 Oil Other Industry China 3 3 2 2 India Power Other Non-OECD 1 1 OECD 0 1990 Energy Outlook 2030 2010 0 1990 2030 36 2010 2030 © BP 2012 …as China shifts to a less coal-intensive economy Coal consumption declines in the OECD (-1.1% p.a. 2010-30), offset by growth in the non-OECD (2.1% p.a.). In China, rapid coal consumption growth ends after 2020. This will bend the global trend: Growth is set to decline from 4.0% p.a. in 2000-2010 to just 0.5% p.a. in 2020-2030. Efficiency gains and structural shifts dramatically reduce coal intensity in China – coal consumed per unit of GDP is almost 60% lower in 2030 than today. Still, China accounts for 67% of global coal growth to 2030 and remains the largest coal consumer, increasing its share of global consumption from 48% to 53%. India’s continuing growth only partially offsets the slow-down of coal in China. India contributes 33% of global growth to 2030, and its share of global coal consumption climbs from today's 8% to 14% in 2030. India and China together account for all the global net growth to 2030. Both China and India face challenges in growing domestic production fast enough to keep up with demand. Their growing import requirements drive further expansion and integration of the global coal trade. Energy Outlook 2030 37 © BP 2012 Non-fossil fuels growth is led by renewables in the OECD… OECD Non-OECD Billion toe 2.0 Billion toe 2.0 Renewables 1.5 Biofuels 1.5 Hydro Nuclear 1.0 1.0 Renewables in power 0.5 0.5 Biofuels 0.0 1990 2000 Energy Outlook 2030 2010 2020 2030 38 0.0 1990 2000 2010 2020 2030 © BP 2012 …while all sources grow rapidly in the non-OECD Non-fossil fuels grow strongly in both the OECD (2.0% p.a.) and non-OECD (5.1% p.a.). OECD growth is concentrated in renewable power. Nuclear output is restored to pre-Fukushima levels by 2020, but thereafter shows only modest growth. Hydro continues to grow slowly, constrained by the availability of suitable sites. In the non-OECD growth is more evenly split between renewables, nuclear and hydro, as rapidly growing economies call on all available sources of energy supply. Nuclear output grows rapidly, averaging 7.8% p.a. 2010-30, as China, India and Russia pursue ambitious expansion programmes. Renewables growth is initially led by the EU, but from 2020 the US and China are the largest sources of growth. Over the 2020-30 period the non-OECD adds more renewable power than the OECD. The non-OECD increases its share of renewable power from 22% today to 43% by 2030. Energy Outlook 2030 39 © BP 2012 The increasing share of renewables in power and transport… Share of power generation Share of transport sector 30% 30% 25% 25% EU 20% 20% Other OECD 15% 10% 15% World 10% 5% 5% Non-OECD 0% 1990 2000 Energy Outlook 2030 2010 2020 0% 1990 2030 40 2000 2010 2020 2030 © BP 2012 …is constrained primarily by the cost of scaling up Renewables are generally more costly than other energy sources, although in some cases they are competitive already (e.g. Brazilian biofuels, US onshore wind in the best locations). Policy support is assumed to remain in place to help the industry deploy new technologies and drive down costs. A key constraint on the pace of renewables penetration is the willingness and ability to meet the rapidly expanding cost of policy support as renewables scale up. By 2030 renewables supply 11% of world electricity. The EU leads the way, with 26% of power coming from renewables by 2030. The rest of the OECD follows with a lag, and then the non-OECD also starts ramping up the share of renewables in power. Renewables face a tougher challenge penetrating the transport fuels market. By 2030, 7% of world transport fuels come from renewable sources. Brazil has the highest penetration of biofuels (21% in 2010, rising to 39% by 2030), while the US leads the OECD in incentivising biofuels (4% in 2010 to 15% by 2030). Energy Outlook 2030 41 © BP 2012 Energy Outlook 2030 42 © BP 2012 Contents Page Introduction 4 Global energy trends 7 21 Outlook 2030: Fuel by fuel Key determinants China and India 43 Middle East 53 Transport 63 Risks and unknowns 73 Appendix 83 Energy Outlook 2030 43 © BP 2012 The pace and scale of development in India and China… Population Energy GDP Billion Billion toe Trillion, $2010 PPP 9 18 180 15 150 12 120 9 90 Rest of World 6 60 India 3 30 8 7 6 5 4 3 2 1 0 1970 China 1990 Energy Outlook 2030 2010 0 2030 1970 1990 44 2010 2030 0 1970 1990 2010 2030 © BP 2012 …play a major role in shaping the global outlook By 2030 China and India will be the world’s largest and 3rd largest economies and energy consumers, jointly accounting for about 35% of global population, GDP and energy demand. Rapid economic development means industrialisation, urbanisation and motorisation. Over the next 20 years China and India combined account for all the net increase in global coal demand, 94% of net oil demand growth, 30% of gas, and 48% of the net growth in non-fossil fuels. The development paths of China and India represent a major source of uncertainty for any global outlook, posing two key questions: Will China’s energy demand continue to grow as rapidly as in the past decade, or will it slow? Will India replicate China’s pattern of a rapid acceleration of energy consumption growth as GDP rises, or will it follow a different pattern of development? Energy Outlook 2030 45 © BP 2012 The surge in China’s energy consumption slows… India China Billion toe 5 Renewables* 4 Billion toe 5 Hydro 4 Nuclear 3 Coal 3 Gas 2 Oil 2 1 1 0 1990 0 1990 2000 2010 2020 2030 2000 2010 2020 2030 *Includes biofuels Energy Outlook 2030 46 © BP 2012 …and is not repeated in India China’s energy demand growth is projected to decelerate to 3.0% p.a. over the forecasting period (vs. 6.6% p.a. 1990-2010) due to slowing GDP growth and rapid improvement in energy intensity. India does not follow China’s path; there is no surge in energy demand as India industrialises. Demand growth slows to 4.5% p.a. (vs. 5.5% p.a. 1990-2010) as improvements in energy efficiency partly offset the energy needs of industrialisation and infrastructure expansion. India remains on a lower path of energy intensity; by 2030 it consumes only about half the energy that China consumes today, at a similar income per capita level as in China today. Coal remains the main commercial fuel, but its share falls from 70% to 55% in China as a result of maturing industrial structure, and from 53% to 50% in India due to domestic resource constraints. Oil’s share is flat at 18% in China and falls to 26% in India, constrained by prices and growing import dependency. Gas gains market share along with nuclear and renewables in both countries. Energy Outlook 2030 47 © BP 2012 China and India follow a historical pattern of development… Historical industrialisation Energy intensity Industry as %GDP Toe per thousand $2010 GDP 50 0.4 China 40 0.3 30 0.2 20 20 major countries 1820-2010 China 1970-2010 India 1945-2010 10 0.1 0 0 10 20 30 40 $2010 GDP per capita (000s) Energy Outlook 2030 50 48 0 1970 India 1990 2010 2030 © BP 2012 …but from different starting points A stylised pattern of economic development shows energy intensity rising as the economic structure shifts from low energy intensive agriculture to intensive activities in industry, and then falling again as the economy shifts to the less energy intensive service sector (see the 2011 edition of the Energy Outlook). We see this pattern at work in both, China and India, although they start from different places. As China matures, its share of industry in GDP will decline. The composition of industry also shifts away from heavily energy intensive sub-sectors as the need for infrastructure and urbanisation projects declines. The rate of decline in energy intensity accelerates, constraining the growth of energy demand. In India, the share of industry continues to grow, as infrastructure development catches up and manufacturing expands to absorb a growing labour force, but it never reaches the Chinese level. India therefore remains significantly less energy intensive, with a relatively high share of the service sector in GDP. Energy Outlook 2030 49 © BP 2012 Industry causes energy demand to decelerate… China: final energy demand by sector Primary energy growth by fuel Billion toe Billion toe 3.5 1.4 3.0 2.5 Other Transport 1.2 Industry 0.8 1.5 0.6 1.0 0.4 0.5 0.2 0.0 1990 0.0 2010 2020 2030 Energy Outlook 2030 Hydro Nuclear Coal Gas Oil 90- 00- 10- 2000 10 20 30 *Includes biofuels 50 India Renewables* 1.0 2.0 2000 China 90- 00- 10- 2000 10 20 30 © BP 2012 …as the fuel mix diversifies away from coal Our Outlook assumes structural economic transformation in China will significantly slow industry’s energy demand growth, especially post 2020. Industrial energy consumption grew by 9.9% p.a. in the last decade and accounted for about 80% of the final energy demand growth. The fuel mix implications of this slowdown are most notable for coal, the principal fuel in power and heavy industry. The contribution of coal to primary energy growth drops from 48% between 2010-2020 to 13% in 2020-2030. Its use in power generation declines between 2020 and 2030. India’s fuel mix changes more gradually, with coal remaining the main source of primary energy growth (48%) in the next 20 years. Non-fossil fuels account for an increasing share of energy growth in both countries (44% and 16% in China and India respectively over the 2020-2030 period), driven by rising dependence on fossil-fuel imports and environmental challenges related to heavy coal use. Energy Outlook 2030 51 © BP 2012 Energy Outlook 2030 52 © BP 2012 Contents Page Introduction 4 Global energy trends 7 21 Outlook 2030: Fuel by fuel Key determinants China and India 43 Middle East 53 Transport 63 Risks and unknowns 73 Appendix 83 Energy Outlook 2030 53 © BP 2012 Resource availability shapes the Middle East... GDP per capita Index (1970=100) 600 500 400 Energy per capita 500 Non-OECD Mid East * Energy intensity 300 Other non-OECD 400 OECD 240 300 180 200 120 100 60 300 200 100 0 1970 1990 2010 2030 0 1970 1990 2010 2030 0 1970 1990 2010 2030 *Non-OECD Middle East includes Arabian Peninsula, Iran, Iraq, Jordan, Lebanon, Syria Energy Outlook 2030 54 © BP 2012 ...though gradual adjustments are expected Per capita income growth in the Middle East has lagged other regions and is likely to continue to do so. Energy consumption, in contrast, has soared. In 1970, energy use per capita was roughly twice the rest of the non-OECD; by 2010, it was more than 3 times as high. Energy intensity in 1970 was less than half the level of other nonOECD; by 2010, it was 50% higher. With the trend in other countries pointing toward continuous improvement, the Middle East region by 2030 is likely to be more than twice as energy intensive as the rest of the non-OECD. The Middle East, enjoying a comparative advantage in access to cheap energy, will remain energy intensive. However, modest improvements are likely, reversing the long run upward trend. We expect energy intensity to start declining before 2020, due to a slowdown in the expansion of energy intensive industries (especially petrochemicals), a gradual reduction in subsidies and other policies to improve efficiency, as well as gas for oil substitution. Energy Outlook 2030 55 © BP 2012 Gas will play a key role in domestic demand... Regional demand by fuel 2010-30 growth by sector and fuel Billion toe 0.3 Billion toe 1.5 Hydro Renewables Nuclear Hydro 1.0 0.2 Nuclear Renew. Electricity Coal Gas Gas 0.1 Oil Oil 0.5 1990 Energy Outlook 2030 2010 2030 Other Industry 0.0 Transport 0.0 1970 Coal Final energy use 56 Inputs to power © BP 2012 ...in power generation and industry The region continues to rely on oil and natural gas for nearly all of its energy demand. The continuation of long-standing efforts to displace oil consumption with gas (to sustain oil exports) will continue to boost gas’ market share from 21% in 1970, to 48% in 2010, and 55% in 2030. Energy consumption growth slows to 3.0% p.a. for 2010-30, from 5.9% 1970-2010; oil demand growth is expected to slow to 2.0% p.a. and gas to 3.8% p.a. (compared to 4.8% and 8.1% in 1970-10). Energy growth is driven by industry and power generation. The industrial sector needs oil and gas for petrochemicals and the expansion in energy-intensive LNG production. The power sector increasingly replaces oil with gas, with oil’s share dropping from 41% in 1990, to 33% in 2010, and 20% in 2030. The pace of oil displacement and the associated efficiency improvement is predicated on regional gas supply growth. If the development of gas resources fails to materialise, additional oil will be required to fill the void. Energy Outlook 2030 57 © BP 2012 High subsidies contribute to elevated energy intensity... Oil intensity vs prices Retail gasoline prices (Nov 2010) $/litre 2.0 Toe per thousand $2010 GDP subsidy tax 0.4 Iran 1.6 0.3 1.2 2011 increase 0.8 Saudi 0.2 tax Kuwait subsidy UAE 0.4 India 0.1 China Energy Outlook 2030 Germany Brazil India China US UAE Kuwait Saudi Iran 0.0 US Brazil Germany 0.0 0.0 58 0.5 1.0 1.5 2.0 Gasoline price (Nov 2010), $/litre 2.5 © BP 2012 ...but policy changes should drive gradual improvement Many Middle Eastern countries heavily subsidise oil products and natural gas, contributing to the region’s high energy intensity. Our outlook assumes that the region’s governments slowly introduce measures to improve energy efficiency. A number of countries have already reduced subsidies and there is widespread interest in other measures to boost fuel efficiency. Iran substantially increased fuel prices last year in the face of international sanctions – and oil consumption fell. Iraq has reduced oil subsidies under an agreement with the IMF, and Saudi Arabia committed to a G20 agreement in 2010 to end fossil fuel subsidies. The region’s energy intensity gradually improves (-1.0% p.a.) after 2020 due to eventual subsidy reduction and other efficiency measures. A lack of progress and/or delays on the assumed new policies is a key risk to this outlook: If oil intensity did not decline, for example, oil demand would be 3 Mb/d higher in 2030. Energy Outlook 2030 59 © BP 2012 The region’s role in global oil markets is set to continue... Mid East Oil and Gas Supply Exports as share of global demand (excl. Mid East) Billion toe 2.5 2.0 40% Gas Oil Gas Oil 30% 1.5 20% 1.0 10% 0.5 0.0 1970 0% 1990 Energy Outlook 2030 2010 2030 1970 60 1990 2010 2030 © BP 2012 ...as gas supply growth meets domestic needs Oil constitutes 74% of the region’s energy production, but will drop to 67% by 2030 as gas production expands. Nonetheless, from 2010 to 2030 oil supply is expected to expand by 10 Mb/d and gas production by 41 Bcf/d, both higher increments than over the past two decades. Saudi Arabia (+3.7 Mb/d) and Iraq (+3.5 Mb/d) will dominate oil supply growth while Qatar (+11 Bcf/d), Iran (+9 Bcf/d), and Saudi Arabia (+9 Bcf/d) drive gas production. The region’s share of global supply will increase to 34% for oil and to 18% for gas (from 29% and 14% today). While there are large supply increases in both oil and gas, the impact on the region’s exports differs between the two fuels. Middle East oil exports currently supply 22% of global demand (excl. Middle East), rising to 25% by 2030. Gas exports, only 2% of global demand today, rise to just 3% in 2030, as incremental growth is consumed locally. Failure to develop gas resources and/or to improve oil intensity will weigh on the region’s ability to deliver the expected supplies to global oil markets. Energy Outlook 2030 61 © BP 2012 Energy Outlook 2030 62 © BP 2012 Contents Page Introduction 4 Global energy trends 7 21 Outlook 2030: Fuel by fuel Key determinants China and India 43 Middle East 53 Transport 63 Risks and unknowns 73 Appendix 83 Energy Outlook 2030 63 © BP 2012 Vehicle numbers are set to grow rapidly in the Non-OECD… Total number of vehicles Vehicles per thousand people (1970-2030) Millions Vehicles 800 1,600 US Germany 1,200 600 Japan 800 Non-OECD 400 400 200 China OECD 0 1930 1950 1970 1990 2010 2030 Energy Outlook 2030 0 1970 64 India 2000 2030 © BP 2012 …while OECD growth slows due to saturation The global vehicle fleet (commercial vehicles and passenger cars) grows rapidly – by 60% from around 1 billion today to 1.6 billion by 2030. Most of the growth is in the developing world with some mature markets at saturation levels. More than three quarters of the total fleet growth occurs in the nonOECD, where the vehicle population rise from 340 million to 840 million over the next 20 years – a 2 ½ fold increase. Between 2010 and 2030, vehicle density per 1000 population grows from approximately 50 to 140 in China (5.7% p.a.) and from 20 to 65 in India (6.7% p.a.). China is expected to follow a slower path to vehicle ownership than seen historically in other countries. This reflects the impact of current and assumed future policies, designed to limit oil import dependency and congestion, including rising fuel taxation, widespread mass transportation options and relatively uneven income distribution. Energy Outlook 2030 65 © BP 2012 Transport fuel demand is met predominantly by oil… By energy type Projected car efficiency Billion toe 3 Litres per 100 km 10 US light vehicles Electricity 8 China Gas 2 Coal 6 Biofuels 1 Oil - road Oil - non-road 0 1990 EU 2010 Energy Outlook 2030 4 2 2030 66 2000 2010 2020 2030 © BP 2012 …with fuel growth slowing as vehicle efficiency improves Transport fuel in 2030 remains dominated by oil (87%) and biofuels (7%). Other fuels gain share, such as natural gas and electricity (4% and 1% respectively in 2030) are constrained by limited policy support combined with a general lack of infrastructure in all but a handful of markets. Despite the projected 60% increase in vehicles over the next 20 years, energy consumption in total transport is forecast to grow only 26% (1.2% p.a. – down from 1.9% p.a. between 1990 and 2010). The growth rate of energy used for transport declines due to accelerating improvements in fuel economy and the impact of high oil prices on driving behaviour. Vehicle saturation in the OECD and likely increases in taxation (or subsidy reduction) and development of mass transportation in the non-OECD are other factors. Vehicle fuel economy improvements are driven by tightening policy (CO2 emissions limits in Europe and CAFE standards in the US) and enabled by improving technology. Prices also play a role, since high fuel costs provide an additional incentive to improve vehicle efficiency. Energy Outlook 2030 67 © BP 2012 Policy and technology enable efficiency improvements… Passenger car sales by type Global vehicle fleet in 2030 100% Plug-ins incl. BEVs 80% 4% 11% Full hybrid 60% 16% Mild hybrid 40% 69% Conventional incl. stop-start 20% 0% 2010 Energy Outlook 2030 2020 2030 68 © BP 2012 …as the vehicle fleet gradually shifts to hybrids The efficiency of the internal combustion engine is likely to double over the next 20 years. The improvement come initially from engine stop-start technologies, downsizing, boosting and lower vehicle weight followed by the gradual penetration of the vehicle fleet by hybrid cars. By 2030, sales of conventional passenger vehicles (accounting for nearly 100% today) fall to a third of total sales, while hybrids dominate (full hybrids 22%, mild hybrids 34%). Sales of plug-in vehicles, including full battery electric vehicle (BEVs), are forecast to be 8% of sales in 2030. Plug-in vehicles, with the capability to switch to oil for longer distances, are likely to be preferred to BEVs, based on current economics and consumer attitudes towards range limitations. Hybridisation of the total vehicle fleet takes much longer because of relatively long vehicle lifetimes and because we assume that heavy commercial vehicles are unlikely to use this technology. By 2030 our outlook shows that approximately 30% of conventional vehicles have been replaced by advanced technologies. Energy Outlook 2030 69 © BP 2012 Efficiency gains have the biggest impact on oil demand… Mb/d Oil demand in road transport 60 Non-OECD 50 Non-OECD OECD Biofuels Other* 40 OECD 30 2010 Increased number of vehicles Reduced average usage Improved vehicle efficiency Increased use of alternatives 2030 * Includes GTL, CTL, CNG, LNG and electricity Energy Outlook 2030 70 © BP 2012 …but alternative fuels may play a greater role post 2030 Assuming no changes to vehicle usage, efficiency and the use of alternatives, oil demand in road transport would increase by a massive 23 Mb/d over the next 20 years, more than our total projected oil demand growth (16 Mb/d), due mostly to more vehicles in the non-OECD. Instead we project oil demand growth for road transport to be 6 Mb/d. Vehicle fuel economy is forecast to improve by 1.1% p.a. in both the OECD and non-OECD. These efficiency gains are equivalent to 11 Mb/d by 2030 – saving approximately half of the incremental oil demand that would otherwise be required under the above “no change” case. Average miles driven per vehicle is expected to fall (saving 2.4 Mb/d) as high fuel prices (partly due to rising taxes or reduced subsidies), congestion and mass transit outweigh the impact of rising incomes. Biofuels make up more than half of the incremental demand for alternative fuels in transport. Use of electric vehicles and CNG/LNG is growing, but there are still barriers delaying the scale-up. Alternative fuels therefore are not expected to have a material impact by 2030. Energy Outlook 2030 71 © BP 2012 Energy Outlook 2030 72 © BP 2012 Contents Page Introduction 4 Global energy trends 7 Outlook 2030: Fuel by fuel 21 Key determinants 43 Risks and unknowns 73 Appendix 83 Energy Outlook 2030 73 © BP 2012 Quantifying and benchmarking “business as usual” trends… Implications of business as usual trends ...for China, and its global fuel impact Billion toe 7 6 Business as usual (at trend intensity) % of world demand in 2030 30% 25% 4 20% 3 15% 2 Base case 8 6 4 10% 1 5% 0 1970 1990 2010 2030 0% Energy Outlook 2030 Mb/d in 2030 10 35% 5 …and in oil markets 2 0 Coal Oil Gas CO2 74 China Trans. M.East © BP 2012 …helps to illustrate the uncertainties around any outlook One way to explore the range of uncertainty around any energy outlook is to extrapolate past trends to examine the implications of “business as usual”. We illustrate this here for China (the market with the greatest potential to change the global outlook), by assuming that energy intensity will continue to decline at the same trend rate as over the last 10 years (less than half the decline rate in our base case projection) to 2030. Compared to our base case, the resulting higher Chinese demand would increase global coal demand in 2030 by 32%, oil by 8% and gas by 2%. Global CO2 emissions would also be 18% higher in 2030. Inevitably, this would trigger repercussions elsewhere in the system. The implications of the Chinese “business as usual” case on oil markets are roughly on par with two similar illustrations: Keeping oil exports from the Middle East flat 2010-30, and benchmarking the improvement of fuel efficiency in transport to the rate achieved over the past ten years. Energy Outlook 2030 75 © BP 2012 Energy imbalances improve in the Americas… Europe FSU N. America Mid-East China India Key: Billion toe 1 0 Gas Oil Coal Africa S. & C. America Other Asia Pacific 1990 2010 2030 -1 Net importers Net exporters Energy Outlook 2030 76 © BP 2012 …but worsen in Europe and in Asia Pacific Europe’s energy deficit remains roughly at today’s levels for oil and coal but increases by 65% for natural gas. This is matched by gas production growth in the FSU and trade. Among energy importing regions, North America is an exception, with growth in biofuel supplies and unconventional oil and gas turning today’s energy deficit (mainly oil) into a small surplus by 2030. In aggregate, today’s energy importers will need to import 40% more in 2030 than they do today, with deficits in Europe and Asia Pacific met by supply growth in the Middle East, the FSU, Africa and S & C America. China’s energy deficit increases by 0.8 Btoe (spread across all fuels) while India’s import requirement grows by 0.4 Btoe (mainly oil and coal). The rest of Asia Pacific remains a big oil importer at similar levels to today. Asian energy requirements are partially met by increased Middle East and African production but the rebalancing of global energy trade as a result of the improved net position in the Americas is also a key factor. Energy Outlook 2030 77 © BP 2012 Import dependency rises in Asia and Europe… India China EU27 US Billion toe Gas 1.2 Oil 1.0 Import share of respective fuel Coal 0.8 0.6 47% 0.4 91% 42% 80% 80% 94% 0.2 6% 40% 0.0 32% 57% -0.2 1990 2010 2030 Energy Outlook 2030 1990 2010 2030 78 1990 2010 2030 1990 2010 2030 © BP 2012 …and falls in the US Import dependency, measured as the share of demand met by net imports, increases for most major energy importers except the US. The import share of oil demand and the volume of oil imports in the US will fall below 1990s levels, largely due to rising domestic shale oil production and ethanol displacing crude imports. The US also becomes a net exporter of natural gas. In China, imports of oil and natural gas rise sharply as demand growth outpaces domestic supply. Oil continues to dominate China's energy imports, although gas imports increase by a factor of sixteen. China also becomes a major importer of coal. India will increasingly have to rely on imports of all three – oil, coal and natural gas – to supply its growing energy needs. European net imports (and imports as a share of consumption) rise significantly due to declining domestic oil and gas production and rising gas consumption. Virtually all of the growth in net imports is from natural gas. Energy Outlook 2030 79 © BP 2012 Carbon emission growth slows, but more action is needed… Global CO2 emissions from energy use Billion tonnes CO2 Billion tonnes CO2 40 Base Case 40 Non-OECD 30 Policy Case 30 Coal 20 IEA “450 Scenario” 20 Gas 10 0 1990 Energy Outlook 2030 10 OECD 2010 Oil 0 2000 2030 80 2010 2020 2030 © BP 2012 …to get emissions falling by 2030 We assume continued tightening in policies to address climate change. Carbon abatement policies in the OECD, including carbon pricing, succeeds in reducing emissions in 2030 (by 10% versus 2010). Non-OECD countries do make significant progress in reducing the carbon intensity of their economies, but this is outweighed by carbon increases due to rapid economic growth. The net result is a projected increase in global emissions of 28% by 2030. This leaves the world well above the required emissions path to stabilise the concentration of greenhouse gases at the level recommended by scientists (around 450 ppm). Our “Policy Case” (discussed in more detail in last year’s Outlook) assumes a step-change in the political commitment to action on carbon emissions. Even in this case, the path to reach 450 ppm remains elusive. However, a declining emissions path by 2030 is achievable, given the political will to shoulder the cost. Energy Outlook 2030 81 © BP 2012 Conclusion GDP, Energy and CO2 Index (1970=100) Energy can be available and affordable 800 700 GDP 600 Coal Competition Innovation 500 400 Gas Energy CO2 emissions not on track CO2 Oil 200 Regulation harnessing market forces Energy security will remain an issue 300 100 1970 OECD 1990 Energy Outlook 2030 2010 2030 82 © BP 2012 Contents Page Introduction 4 Global energy trends 7 Outlook 2030: Fuel by fuel 21 Key determinants 43 Risks and unknowns 73 Appendix 83 Energy Outlook 2030 83 © BP 2012 Key changes versus last year’s Outlook... Changes in 2030 levels versus the 2011 Outlook Revised up Revised down Nuclear output Biofuels supply Renewables in power Biofuels India total energy demand N. America oil & gas supply -100 Gas Oil -50 0 50 100 150 Mtoe Energy Outlook 2030 84 © BP 2012 …result in little net change in total energy Our projection for world energy demand and supply is little changed since our last outlook (up about 1% by 2030). A slightly higher base year, due to strong global consumption growth in 2010, has been offset by a slightly slower annual growth rate. Nuclear prospects have been revised down after Fukushima and the resulting policy changes in Japan and Europe. Biofuels growth (while still very robust) has been reduced due to more modest expectations of penetration of next generation fuels. Renewables in power generation have been revised higher due to improved prospects for cost reductions. They also play a part in replacing the lost nuclear output in Japan and Europe. Indian energy consumption has been revised upwards on a reassessment of the country’s economic development path. North American oil and natural gas supply outlooks have been revised higher due to evolving expectations for shale plays. Energy Outlook 2030 85 © BP 2012 Differences with other outlooks are mostly due to… Growth of energy consumption 2010-2030 World energy consumption Billion toe Billion toe 20 6 External range Non-OECD BP 5 OECD 15 4 3 10 2 5 1 0 1990 0 2000 Energy Outlook 2030 2010 2020 2030 86 IEA EIA XOM IEA NPS NPS BP OPEC IEA BP CPS © BP 2012 …differing views on OECD vs. non-OECD prospects Our outlook is within the range of publicly-available forecasts, initially lying near the upper end of the range but moving toward the centre by 2030. Many forecasters expect higher growth in OECD energy demand than we do, while our projections for non-OECD growth are stronger than most. Our outlook lies between the IEA’s “New Policies Scenario”, which assesses demand prospects on the assumption that announced national policy objectives are fully implemented, and their “Current Policies Scenario”, which assumes current policies remain in place through 2030. In contrast to the IEA scenarios, our outlook does not take policies as given but makes judgments about the likelihood of future policy developments and their impacts. Energy Outlook 2030 87 © BP 2012 Data sources BP p.l.c., BP Statistical Review of World Energy, London, United Kingdom, June 2011 Cedigaz, Paris, France Center for International Comparisons of Production, Income and Prices at the University of Pennsylvania, Heston, A., Summers, R., Aten, B., Penn World Table Version 7.0, May 2011. Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH, Eschborn, Germany Energy Information Administration, International Energy Outlook , Washington, D.C., United States, September 2011 Energy Information Administration, World Shale Gas Resources: An Initial Assessment of 14 Regions outside the United States, Washington, D.C., United States, April 2011 International Energy Agency, CO2 Emissions from Fuel Combustion, Paris, France, 2011 International Energy Agency, Energy Balances of Non-OECD Countries, Paris, France, 2011 International Energy Agency, Energy Balances of OECD Countries, Paris, France, 2011 International Energy Agency, World Energy Outlook 2011, Paris, France, 2011 Mitchell, B.R., International Historical Statistics 1750-2005, Palgrave Macmillan, New York, United States, 2007 Oxford Economics Ltd, Oxford, UK United Nations Population Division, World Population Prospects: The 2008 Revision, New York, United States, 2009 United Nations Statistics Division, National Accounts Statistics, New York, United States, 2011 Waterborne Energy, Inc., Houston, Texas, United States Plus various official sources Energy Outlook 2030 88 © BP 2012