Job Order Costing

advertisement

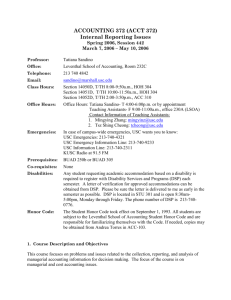

Master Budget and Responsibility Accounting Cost Accounting Horngreen, Datar, Foster Budgeting Cycle Performance planning Providing a frame of reference Investigating variations Corrective action Planning again Cost Accounting Horngreen, Datar, Foster The Master Budget Master Master Budget Budget Operating Operating Decisions Decisions Cost Accounting based on one expected scenario Financial Financial Decisions Decisions Horngreen, Datar, Foster Why Budgets? Conveys strategy to employees and managers Provides a framework for judging performance Motivates employees and managers Promotes coordination and communication Cost Accounting Horngreen, Datar, Foster Strategy, Planning, and Budgets Long-run Planning Long-run Budgets Short-run Planning Short-run Budgets Strategy Analysis Cost Accounting Horngreen, Datar, Foster Time Coverage of Budgets Budgets typically have a set time period (month, quarter, year). This time period can itself be broken into subperiods. The most frequently used budget period is one year. Businesses are increasingly using rolling budgets. Cost Accounting Horngreen, Datar, Foster Operating Budget Materials Inventory B. Sales Budget Production B. Procurement B. Requirements Budget: - Materials - Labor - Capacities Finished Goods Inventory B. Production Cost B. Revenue B. Non-Production Cost B. Cost Accounting -direct - overhead Horngreen, Datar, Foster Operating Budget Example Hawaii Diving expects 1,100 units to be sold during the month of August 2004. Selling price is expected to be $240 per unit. How much are budgeted revenues for the month? 1,100 × $240 = $264,000 Cost Accounting Horngreen, Datar, Foster Operating Budget Example Two pounds of direct materials are budgeted per unit at a cost of $2.00 per pound, $4.00 per unit. Three direct labor-hours are budgeted per unit at $7.00 per hour, $21.00 per unit. Variable overhead is budgeted at $8.00 per direct laborhour, $24.00 per unit. Fixed overhead is budgeted at $5,400 per month. Variable nonmanufacturing costs are expected to be $0.14 per revenue dollar. Fixed nonmanufacturing costs are $7,800 per month. Cost Accounting Horngreen, Datar, Foster Production Budget Example Budgeted sales (units) + – = Target ending finished goods inventory (units) Beginning finished goods inventory (units) Budgeted production (units) Cost Accounting Horngreen, Datar, Foster Production Budget Example Assume that target ending finished goods inventory is 80 units. Beginning finished goods inventory is 100 units. How many units need to be produced? Units required for sales Add ending inv. of finished units Total finished units required Less beg. inv. of finished units Units to be produced Cost Accounting 1,100 80 1,180 100 1,080 Horngreen, Datar, Foster Direct Materials Usage Budget Each finished unit requires 2 pounds of direct materials at a cost of $2.00 per pound. Desired ending inventory equals 15% of the materials required to produce next month’s sales. September sales are forecasted to be 1,600 units. What is the ending inventory in August? 480 pounds Cost Accounting Horngreen, Datar, Foster Direct Materials Usage Budget September sales: 1,600 × 2 pounds per unit = 3,200 pounds 3,200 × 15% = 480 pounds (the desired ending inventory) What is the beginning inventory in August? 1,100 units × 2 × 15% = 330 units How many pounds are needed to produce 1,080 units in August? 1,080 × 2 = 2,160 pounds Cost Accounting Horngreen, Datar, Foster Material Purchases Budget Hawaii Diving Direct Material Purchases Budget for the Month of August 2004 Units needed for production Target ending inventory Total material to provide for Less beginning inventory Units to be purchased Unit purchase price Total purchase cost Cost Accounting Horngreen, Datar, Foster 2,160 480 2,640 330 2,310 $ 2.00 $4,620 Direct Manufacturing Labor Budget Each unit requires 3 direct labor-hours at $7.00 per hour. Hawaii Diving Direct Labor Budget for the Month of August 2004 Units produced: Direct labor-hours/unit Total direct labor-hours: Total budget at $7.00/hour: Cost Accounting Horngreen, Datar, Foster 1,080 3 3,240 $22,680 Manufacturing Overhead Budget Variable overhead is budgeted at $8.00 per direct laborhour. Fixed overhead is budgeted at $5,400 per month. Hawaii Diving Manufacturing Overhead Budget for the Month of August 2004: Variable Overhead: (3,240 × $8.00) $25,920 Fixed Overhead 5,400 Total $31,320 Cost Accounting Horngreen, Datar, Foster Ending Inventory Budget Cost per finished unit: • • • • • Materials Labor Variable manufacturing overhead Fixed manufacturing overhead Total $ 4 21 24 5* $54 » *$5,400 ÷ 1,080 = $5 What is the cost of the target ending inventory for materials? • 480 × $2 = $960 What is the cost of the target finished goods inventory? • 80 × $54 = $4,320 Cost Accounting Horngreen, Datar, Foster Cost of Goods Sold Budget • • • • Direct materials used 2,160 × $2.00 Direct labor Total overhead Cost of goods manufactured 4,320 22,680 31,320 $58,320 Assume that the beginning finished goods inventory is $5,400. Ending finished goods inventory is $4,320. What is the cost of goods sold? Cost Accounting Horngreen, Datar, Foster Cost of Goods Sold Budget Beginning finished goods inventory + Cost of goods manufactured = Goods available for sale – Ending finished goods inventory = Cost of goods sold Cost Accounting Horngreen, Datar, Foster $ 5,400 $58,320 $63,720 $ 4,320 $59,400 Nonmanufacturing Costs Budget Hawaii Diving Other Expenses Budget for the Month of August 2004 Variable Expenses: Fixed expenses Total Cost Accounting ($0.14 × $264,000) Horngreen, Datar, Foster $36,960 7,800 $44,760 Cost of Goods Sold Budget Hawaii Diving has budgeted sales of $264,000 for the month of August. Cost of goods sold are budgeted at $59,400. What is the budgeted gross margin? Hawaii Diving Budgeted Income Statement for the Month ending August 31, 2004 Sales Less cost of sales Gross margin Other expenses Operating income Cost Accounting $264,000 59,400 $204,600 44,760 $159,840 Horngreen, Datar, Foster 100% 22% 78% 17% 61% Financial Planning Models Financial planning models are mathematical representations of the interrelationships among operating activities, financial activities, and other factors that affect the master budget. Cost Accounting Horngreen, Datar, Foster Example: Cash Budget Depends on collection pattern: In the month of sale: In the month following sale: In the second month following sale: Uncollectible: Cost Accounting Horngreen, Datar, Foster 50% 27% 20% 3% Cash Budget Budgeted charge sales are as follows: • • • • June July August September $200,000 $250,000 $264,000 $260,000 What are the expected cash collections in August? Cost Accounting Horngreen, Datar, Foster Cash Budget Budgeted Cash Receipts for the Month Ending August 31, 2004 August sales: July sales: June sales: $264,000 × 50% $250,000 × 27% $200,000 × 20% Total $132,000 $67,500 $40,000 $239,500 Cost Accounting Horngreen, Datar, Foster Cash Budget Budgeted Cash Disbursements for the Month Ending August 31, 2004 August purchases Direct labor Total overhead Other expenses Total *Other expenses exclude depreciation Cost Accounting Horngreen, Datar, Foster $ 4,620 $22,680 $31,320 $9,760* $68,380 Cash Budget Cash Budget for the Month Ending August 31, 2004 Budgeted receipts Budgeted disbursements Net increase in cash Cost Accounting $239,500 68,380 $171,120 Horngreen, Datar, Foster Exercise: Prepare a purchases budget in pounds for July, August, and September, and give total purchases in both pounds and dollars for each month. Lubriderm Corporation has the following budgeted sales for the next six-month period: Month June July August September October November Unit Sales 90,000 120,000 210,000 150,000 180,000 120,000 There were 30,000 units of finished goods in inventory at the beginning of June. Plans are to have an inventory of finished products that equal 20% of the unit sales for the next month. Five pounds of materials are required for each unit produced. Each pound of material costs $8. Inventory levels for materials are equal to 30% of the needs for the next month. Materials inventory on June 1 was 15,000 pounds Cost Accounting Horngreen, Datar, Foster What is Kaizen? The Japanese use the term “kaizen” for continuous improvement. Kaizen budgeting is an approach that explicitly incorporates continuous improvement during the budget period into the budget numbers. Cost Accounting Horngreen, Datar, Foster Kaizen Budgeting A kaizen budgeting approach would incorporate future improvements. Budgeted Hours/Item January – March 2004 April – June 2004 July – September 2004 October – December 2004 Cost Accounting Horngreen, Datar, Foster 3.00 2.95 2.90 2.85 Activity-Based Budgeting Activity-based costing reports and analyzes past and current costs. Activity-based budgeting (ABB) focuses on the budgeted cost of activities necessary to produce and sell products and services. Cost Accounting Horngreen, Datar, Foster Activity-Based Budgeting Product A Product B Units produced: 880 200 Labor-hours per unit: 3 3 Budgeted setup-hours: 5 5 Total budgeted machine setup related cost is $25,920 per month. Total budgeted labor-hours are: Product A: 880 × 3 Product B: 200 × 3 Total What is the allocation rate per labor-hour? 2,640 600 3,240 • $25,920 ÷ 3,240 = $8.00 Cost Accounting Horngreen, Datar, Foster Activity-Based Budgeting Total cost allocated to each product line: Product A: $8.00 × 2,640 = $21,120 Product B: $8.00 × 600 = $ 4,800 Under ABB, the number of setups is the cost driver. $25,920 budgeted machine setup cost ÷ 10 budgeted machine setup-hours = $2,592 allocation rate per machine setup-hour. How much machine setup related costs are allocated to each product line? Cost Accounting Horngreen, Datar, Foster Activity-Based Budgeting Product A $12,960 $2,592 × 5 Product B $12,960 $2,592 × 5 Setup-related cost per unit: Product A: $12,960 ÷ 880 $14.73 Product B: $12,960 ÷ 200 $64.80 Cost Accounting Horngreen, Datar, Foster What is a Responsibility Center? It is any part, segment, or subunit of a business that needs control. – production – service Cost Accounting Horngreen, Datar, Foster Types of Responsibility Centers Cost Center Profit Center Investment Center Cost Accounting Horngreen, Datar, Foster What is Controllability? It is the degree of influence that a specific manager has over costs, revenues, or other items in question. A controllable cost is any cost that is primarily subject to the influence of a given responsibility center manager for a given time period. Cost Accounting Horngreen, Datar, Foster Controllability Responsibility accounting focuses on information and knowledge, not control. A responsibility accounting system could exclude all uncontrollable costs from a manager’s performance report. In practice, controllability is difficult to pinpoint. Cost Accounting Horngreen, Datar, Foster Human aspects of Budgeting Budgeting should not be considered as a „mechanical tool“ Quality of the budget depends on the information that is fed into the process There are incentives for dishonest reports • Budgetary slack • Empire building Management aims to ensure honest reporting by lower level management • Via appropriate performance measures • Monitoring Cost Accounting Horngreen, Datar, Foster True or False ??? A budget that covers the financial aspects is a qualitative expression of a proposed plan of action by management for a specified period. The master budget reflects the impact of only operating decisions. Feedback in the budgeting process may cause a firm to alter its strategies and plans. Statistical analysis should be the only input used to forecast sales. Sensitivity analysis allows managers to see how results will change if predicted data are not achieved or an underlying assumption changes. Cost Accounting Horngreen, Datar, Foster Pick your Choice I: When a budget is administered wisely, it will • discourage strategic planning. • provide a framework for performance evaluation. • discourage managers and employees. • eliminate coordination and communication between subunits. If a firm is using activity-based budgeting, the firm would use this in place of which of the following budgets? • • • • Direct materials budget Revenue budget Direct labor budget Manufacturing overhead budget Cost Accounting Horngreen, Datar, Foster Pick your Choice II: BDH Corporation, which makes only one product, Kisty, has the following information available for the coming year. BDH expects sales to be 30,000 units at $50 per unit. The current inventory of Kisty is 3,000 units. BDH wants an ending inventory of 3,500 units. Each unit of Kisty takes two units of component L. Component L is budgeted to cost $12 per unit. Current inventory of L is 4,000 units. BDH wants 6,000 units of L on hand at the end of the next year. How much will the direct materials budget show as the cost of materials to be purchased? • $330,000 • $390,000 • $684,000 • $756,000 Cost Accounting Horngreen, Datar, Foster Who Gets the Money? New York Post, April 29, 2001 In the above-cited article, ABC and its parent company, Walt Disney Company, say that the show "Who Wants to be a Millionaire," is the most profitable television show ever - generating almost $1 billion in revenue in a little less than two years on the air. Each individual show costs about $700,000 to produce, including prize money and host Regis Philbin's salary. Each show earns $2 million in advertising revenue. The rights to air Millionaire are also sold to Canada for $250,000 per episode. The Millionaire show also sells a CD-ROM game for $20. About 4 million of these games have been sold. There is also an on-line version of the game that Millionaire fans can play. Users of the game don't pay, but each "hit" is noted when advertising space is sold for the site. The article also points out that Disney also sells hats and t-shirts of the game, and markets a special version of "Millionaire" to corporations that can be played at conventions by employees and clients. Cost Accounting Horngreen, Datar, Foster “Who Gets the Money?“ - Questions 1. The Millionaire show itself generates about $1.3 million per episode in net income ($2 million in revenue, $700,000 in expenses.) Give a reason why this should be considered a profit center for evaluating a manager's performance. 2. Do you think that one manager has responsibility for the Millionaire show, as a profit center, or is it divided as a cost center and as a revenue center? 3. Should the ancillaries of the show (the t-shirts, CD-ROM, etc.) be evaluated as a profit center, cost center or revenue center? Why? Cost Accounting Horngreen, Datar, Foster