ggp_pF 2003 - Foundation Center

advertisement

r

ggp_pF

Department of the treasury

Internal Revenue Service

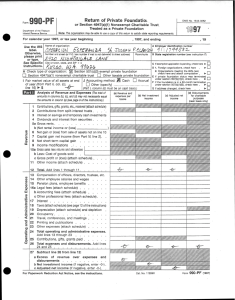

Return of Private Foundation

, 2003, and ending

Address change

Amended return

Final return

Name of organization

Name change

A Employer Identification number

Use the IRS

label .

Otherwise,

THE HAWKINS FOUNDATION

III

C / O WILLIAM M . HAWKINS

Number and street (or P .O . box number ii mail is not delivered to street address)

or type.

See Specific

Instructions .

8 BRITTANY MEADOWS COURT

City or town, state, and ZIP code

Room/suite

94-3347646

B Telephone number (seepage 10 of

the instructions)

650

210-5000

C it exemption application b

~~

I

pending, check here

D

TFiERTON

,545-005

2003

or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation

Note : The org anization ma be able to use a co of this return to satisfy state re ortin requirements

For calendar ear 2003 or tax ear beginning

Initial return

G Check all that apply:

print

OMB No

CA 94027

1 . Foreign organizations, check here

,

2. Foreign organizations meeting the

1 U

as% cep check here end attach

H Check type of organization : X Section 501 (c)(3) exempt private foundation

computation .

. 1

Other taxable p rivate foundation

Section 4947 ( a )( 1 ) nonexem p t charitable trust

E ,r private foundation status urea terminated

Accounting method . x Cash

Accrual

1 Fair market value of all assets at end

under section 507(b)(1)(A), check here .

of year (from Part fl, COI. (C), line

a Other (specify) - -- - -------- ------- p If the foundation Is In a so-month termination

(Part 1, column (d) must be on cash basis.)

under section 5o7(b)(1)(e), check here , 10~

16) t b

722 , 298 .

(d) Disbursements

FOMAnalysis of Revenue and Expenses

(a) Revenue and

(c) Adjusted net

b Net investment

for charitable

(The total of amounts in columns (b), (c), and

F

expenses per

books

(d) may not necessarily equal the amounts in

column a (see age 10 0l the instructions).

Contributions

Check ~

, , , ,

10 , 151 .

4 Dividends and Interest from securities , , , ,

b a Gross rents , , , , , , . . . . . . . . . . .

d

c

w

d

b (Net rental income or (loss)

)

6 a Net gam or (loss) from sale of assets not on line 10

b Gross sales price for all

10 a Gross sales less returns

and allowances

`~'¤S~f~'sF~i

't~

GrosM~~O9E~~ch sch ule) , ,

O her income (attach s-coed Ipa . . . ,

tai . Add lineal throw h 1

f~

~

stees, etc

Jm s

01M-employee salanerends , , ,

!

, , , ,

Pen~~~l~~ben.]

11

12

13

14

16

K 16a

W

dl

F

A

C

E

v

a

~c

A

X

c

17

L ega l l ees

a ac

,

, ,

,

20

21

22

23

18 , 417 .

6 , 150 .

3 , 075 .

NONE

3 , 075 .

25 .

, ,

, ,

10 .

Depreciation (attach schedule) and depletion

Occupancy , ,

Travel, conferences,andmeetings

"

"

, ,

Printing and publications . , , , , . . , , ,

Other expenses (attach schedule) $TMT, 3 ,

3 , 500 .

3 . 475 .

NONE

Add lines 13 through 23 , , . , , , , , . .

Contributions, gifts, grants paid . , , . , , ,

9 , 660 .

29 , 488 .

6 , 550 .

NONE

6 , 550 .

NONE

Total operating and administrative expenses .

25

Total ex penses and disbursements Add lines 24 and 25

26

Subtract line 26 from line 12'

27

8 Excess of revenue over expenses and disbursements

,

,

b Net investment income (if negative, enter -0-)

c Adjusted net income (ii negative, enter-0-). .

694102000

266 .

NO

Interest , , , , , , . . . . . . . . . . . . .

19

Sn'W #.

18 , 417 .

Taxes (attach schedule) (see page 13 of the Instructions)

18

10 , 151 .

8 , 266 .

. ,

b Accounting fees (attach schedule)STM;P 2 .

c Other professional fees (attach schedule), , ,

~ a`+ 24

a

p

8

176 , 128 .

assets on line 6a

(from

Part

IV, line 2) ,

Capital gain net income

Net short-term capital gain . . . . . . . . .

Income modifications "

7

B

9

purposes

cash basis only)

if the foundation is not required to

attach Sch B

Interest on savings and temporary cash investments

3

income

IRs, grants, ek , received (attach schedule)

Distributions from split-interest trusts

2

income

39

,

148 .

-20

,

731 .

For Paperwork Reduction Act Notice, see the instructions .

M03089

517R 03/08/2009

12 :43 :07

11 867 .

HAW001-03

-0-

3 , 100 .

29 , 488 a

32

~. .

,

588 .

Form 990-PF (2003)

4

Balance Sheets

Cash - non-Interest-bearing , , , , , , , , , , , , , , , , , ,

Savings and temporary cash investments , , , , , , , , , , ,

_______400_

Accounts receivable "

1

2

3

4

Less : allowance for doubtful accounts 01

Pledges receivable

Less . allowance for doubtful accounts

6

Grants receivable

6

Recervables due from officers, directors, trustees, and other

7

Other notes and loans receivable (attach schedule) 1

Less : allowance for doubtful accounts

,~

8

y

9

inning of ear

Book Value

Attached schedules and amounts in the

description column should be (or

94-3347646

b

Book Value

End

(c) Fair Market Value

9 , 679 .

9 , 469 .

9,469 .

1 .411 .

400 .

400 .

disqualified persons (attach schedule) (see page 15 of the instructions)

Inventories for sale or use

i

, , , , , , , , , , , , , , , . , ,

Prepaid expenses and deferred charges , , , , , , , , , , , ,

Q 10 a Investments - U S and state government obligations (attach schedule)

b Investments - corporate stock (attach schedule) , $TM .4 . ,

586

712 , 429 .

c Investments - corporate bonds (attach schedule) , , , , , , ,

1

11

Investments -land, buildings,

___________________

and equipment basis

Less accumulated depreciation 10.

(attach schedule)

------------------Investments - mortgage loans , , , , , , , , , , , , , , , ,

12

13

14

16

16

17

18

X 19

20

21

= 22

23

X 24

A 26

m26

Investments - other (attach schedule) , , , , , , , , , , , , ,

Land, buildings, and

equipment basis

___________________

Less accumulated depreciation 0,

(attach schedule)

-------------------Other assets (describe

Total assets (to be completed by all filers - see

the instructions Also see pa g e 1 item I

Accounts payable and accrued expenses , , ,

Grants payable , , , , , , , , , , , , , , ,

Deterred revenue page 16 of

, , , , , , , ,

, , , , , . , ,

Loans from officers, directors, trustees, and other disqualified persons

Mortgages and other notes payable (attach schedule) , , , , ,

Other liabilities (describe "

)

Total liabilities ( add lines i i mrou n cc

Organizations that follow SFAS 117, check here " U

and complete lines 24 through 26 and lines 30 and 31 .

Unrestricted , . , . . . . . . . . . . . . . . . . . . . . . .

Temporarily restricted . . . . . . . . . . . . . . . . . . . .

Permanently restricted """"""""""""""""""""

Organizations that do not follow SFAS 117,

check here and complete lines 27 through 31 .

,i

186

" Xa

o` 27

Capital stock, trust principal, or current funds . . , . . . . . .

y 29

Retained earnings, accumulated income, endowment, or other funds ,

28

GI

z

30

31

0.Mt

Paid-in or capital surplus, or land, bldg , and equipment fund

86

6

, , , ,

Total net assets or fund balances (see page 17 of the

455 .

instructions) , , , , , , . , . . . . . . , . . . . . . . . . .

Total liabilities and net assets/fund balances (see page 17 of

~ ~ ~ ~

~

~ ~ ~ the instructions

86

632,455 .

Analysis of Changes in Net Assets or Fund Balances

1 Total net assets or fund balances at beginning of year - Part II, column (a), line 30 (must agree with

end-of-year figure reported on prior year's return) , , , . , , . , , , , , . . . , . , . . . . . . . . . . . .

2 Enter amount from Part I, line 27a , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , . . . . . . .

3 Other increases not included in line 2 (itemize)

4 Add lines 1, 2, and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Decreases not included in line 2 (itemize)

s Total net assets or fund balances at end of year (line 4 minus line 5) - Part II, column (b), line 30 . .

653,186 .

-20,731 .

632,455 .

632,455 .

Form 990-PF (2oos)

JSA

3E 1420 1 000

M03089

517R 03/08/2004

12 :43 :07

HAW001-03

5

Form 990-PF 2003

'Ca p ital Gains and Losses for Tax on Investment Income

°"'

acquired

o moon

(a) List and describe the kind(s) of property sold (e g , real estate,

2-story brick warehouse, or common stock, 200 shs MLC Co.)

1a

b

c

Page 3

94-3347646

(c) Date

acquired

(mo , day, yr )

~d) Date sold

mo ., day, yr .)

SEE PART IV SCHEDULE

d

e

(f) Depreciation allowed

(or allowable)

(e) Gross sates price

(g) Cost or other basis

plus expense of sale

(h) Gain or (loss)

(e) plus (0 minus (g)

b

c

Com p lete onl y for assets showing gain in column h and owned b the foundation on 12131/69

(k) Excess of col . (i)

U) Adjusted basis

(i) F .M .V . as of 12/31/69

as of 12/31/69

over col . (j), if any

(1) Gains (Col . (h) gain minus

col . (k), but not less than -0-) or

Losses (from col . (h))

a

c

If gain, also enter in Part I, line 7

If (loss), enter -0- in Part I, line 7 } 2

3 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6):

If gain, also enter in Part I, line 8, column (c) (see pages 13 and 17 of the instructions).

If loss enter -0- in Part I line 8

FTNUR Qualification Under Section 4940 (e) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income .)

2 Capital gain net income or (net capital loss) " " " " ~ {

If section 4940(d)(2) applies, leave this part blank

Was the organization liable for the section 4942 tax on the distnbutable amount of any year m the base period? . . . . El Yes

If "Yes," the organization does not qualify under section 4940(e) . D o not complete this part.

1

x No

Enter the appropriate amount in each column for each year, see page 17 of the instructions before making any entries.

Base penod years Calendar year

or tax ear beg inning in

2002

2001

2000

1999

(b)

Adjusted qualifying distributions

43 , 165 .

25 , 750 .

7 , 786 .

NONE

(c)

Net value of nonchantable-use assets

682 ,

857 ,

1 , 019 ,

41 ,

d

I

Distribution ratio

0 .06326470192

0 .03004099575

0 .00763789361

292o

162o

391 .

480 .

NONE

1998

0 .10094359128

2

3

Total of line 1, column (d) . . . . . . . . . . . . . . . . . . . . . . . . . . .

Average distribution ratio for the 5-year base period - divide the total on line 2 by 5, or by

the number of years the foundation has been in existence d less than 5 years , , , , , , , , ,

3

4

Enter the net value of noncharitable-use assets for 2003 from Part X, line 5 , , , , , , , , . .

4

595 .057 .

5

Multiply line 4 by line 3 , , , , , . . . , , . , , . . . . . . . . , . . . . . . . . . . . . . . . .

6

Enter 1 % of net investment income (1 % of Part I, line 27b)

7

Add lines 5 and 6

7

15,136 .

0 .02523589782

. . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 8 1

32,588 .

Enter qualifying distributions from Part XII, line 4 . . . . . . ~ ~ ~ . . . " . " ~ ~ - " " ~ ~ ~ ~

If line 8 is equal to or greater than line 7, check the box in Part VI, line 1b, and complete that part using a 1% tax rate Seethe Part VI instructions on page 17

JsA

Form 990-PF (2003)

3E 1430 1 000

8

M03089

517R 03/08/2004

12 :43 :07

HAW001-03

6

94-3347646

-'orm990-13~ 2003

Excise Tax Based on Investment Income (Section 4940(a), 4 940(b), 4940(e), or 4948 - see pac

and enter "N/A" on line 1 .

1 a Exempt operating foundations described m section 4940(d)(2), check here 1

letter

if

necessary

see

instructions) , , , , , , , ,

Date of ruling letter _ _ _ - _ _ _ _ _ (attach copy of ruling

b Domestic or anizations that meet the section 4940(e) requirements in Part V, check

here " X and enter 1 % of Part I, line 27b , . , , , , , , , , . . . . . . . . . . . . . . . . . . . . . . . .

c All other domestic organizations enter 2°~ of line 27b . Exempt foreign organizations enter 4% of Part I, line 12, col . (b)

2

Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only . Others enter -0-) , , , , , , ,

Addlines land2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-), , , , , , ,

Tax based on investment income. Subtract line 4 from line 3 . If zero or less, enter -0- , , , , , , , , , , , , , , , ,

6

Credits/Payments :

6

6a

949 .

a 2003 estimated tax payments and 2002 overpayment credited to 2003 , , , , , , ,

6

b

NONE

tax

withheld

at

source

,

,

,

,

,

,

,

,

,

,

,

,

b Exempt foreign organizations 6c

NONE

c Tax paid with application for extension of time to file (Form 8868) , , , , , , , , , ,

6d

d Backup withholding erroneously withheld , , , , , , , , , , , , , , , , ,

3

4

. , . . . . . . . . . . .

Total credits and payments . Add lines 6a through 6d . . . . ,

Enter any penalty for underpayment of estimated tax. Check here Elif Form 2220 is attached

Tax due . It the total of lines 5 and 8 is more than line 7, enter amount owed , , , , , , , , , ,

Overpayment . It line 7 is more than the total of lines 5 and 8, enter the amount overpaid , , , ,

7

8

9

10

Enter the amount of line 10 to be : Credited to 2004 estimated tax "

11

Statements Re gard

17 of the ins

1

2

1

3

. . . . . . . . . .

, , , , , , , , , ,

, , , , , , , . . .

, , , , , , . , . ,

830 .

Refunded 1

During the tax year, did the organization attempt to influence any national, state, or local legislation or did

it participate or intervene in any political campaign? , , , , , , , , , , , , , , , , , . . . , , , . . , , . . . . . . . . . . . . . ,

b Did it spend more than $100 during the year (either directly or indirectly) for political purposes (see page

18 0( the instructions for definition)? , , , , , , , , , , , , , , , , , , , , , , . , , , , . . . . . . . , . . . . . . . . . . . . .

I( the answer is "Yes" to 1 a or 1b, attach a detailed description of the activities and copes of any materials

published or distributed by the organization in connection with the activities

c Did the organization file Form 1120-POL for this year? , , , , , , , , , , , , , , , , . , . . . , , , , , . . . . . . . . . . . .

d Enter the amount (it any) of tax on political expenditures (section 4955) imposed during the year'

1 a

e

2

3

(1) On the organization

1 $

(2) On organization managers

Has the organization made any changes, not previously reported to the IRS, in its governing instrument, articles

of incorporation, or bylaws, or other similar instruments? 1/ "Yes," attach a conformed copy of the changes , , , , , , , , , , , , , , ,

4 a Did the organization have unrelated business gross income of $1,000 or more during the year? , , , , , , , , , , , , , , , , , , ,

6

6

7

B

9

10

11

12

13

No

X

1b

X

1c

X

2

X

3

X

"$

Enter the reimbursement (if any) paid by the organization during the year for political expenditure tax imposed

on organization managers . lip. $

Has the organization engaged in any activities that have not previously been reported to the IRS? , , , , , , , , , , , , , , , , , , ,

If 'Yes,' attach a detailed description of the activities.

b If "Yes," has it filed a tax return on Form 990-T for this year?

Yes

1a

, , , , , , , , , , , , , , , , , , , , , . , , , , , , , , . . . . .

Was there a liquidation, termination, dissolution, or substantial contraction during the yeas? , , , , , , , , , , , , , , , , ,

ll'Yes,"attach the statement required by General Instruction T

Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either

By language in the governing instrument or

" By state legislation that effectively amends the governing instrument so that no mandatory directions

that conflict with the state law remain in the governing instrument? , , , , , , , , , , , , , , , . , . , , , , , , , .

Did the organization have at least $5,000 in assets at any time during the year? If "Yes,"complete Part fl, col. (c), and Part XV.

a Enter the states to which the foundation reports or with which it is registered (see page 19 of the

instructions) iii. CALIFORNIA

b If the answer is "Yes" to line 7, has the organization furnished a copy of Form 99aPF to the Attorney

General (or designate) of each state as required by General Instruction G? I( 'No," attach explanation , , , , , , , , , , , ,

Is the organization claiming status as a private operating foundation within the meaning of section 49420(3)

, , , , ,

4a

X

N A

4b

5

X

. . . ,

, , , , ,

6

7

X

X

, . , , .

8b

X

page 25)1 I/ "Yes,' complete Part XIV , , , , , , , , , , , , , , , , , , , , , , , , , , . , , . , , , . . . . . . . . . . . . . . .

Did any persons become substantial contributors during the tax year? It "Yes,' attach a schedule listing their names and addresses , , ,

10

or 49420(5) for calendar year 2003 or the taxable year beginning in 2003 (see instructions for Part XIV on

Did the organization comply with the public inspection requirements for its annual returns and exemption application? . . . . . . . . .

9

X

X

11

X

Web site address "

The books are in care of 1_DAVID_R__FENYON - - - - - - - - - - - - - - - - ----------- Telephone no . 1650_ 210-5000

Located at lio.1700 SEAPORT BLVD .- REDWOOD CITY .- CA ___-___________ ZIP+4 jo. ____ 94063 ___________

. , . . . . . . . . . 00

Section 4947(a)(1) nonexempt charitable trusts filing Form 990-PF in lieu of Form 1041 -Check here , , , . . . ,

. 1 I " 1.3 " I

and enter the amount of tax-exempt interest received or accrued during the year .

JSA

3 E 1440 1 000

M03089

Form 990-PF (2003)

517R 03/08/2004

12 :43 :07

HAW001-03

7

"

Form 990-PF

5

-3347646

Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the "Yes" column, unless an exception applies.

1 a During the year did the organization (either directly or indirectly) :

(1) Engage in the sale or exchange, or leasing of property with a disqualified person? . .

(2) Borrow money from, lend money to, or otherwise extend credit to (or accept it from)

a disqualified person? . . . . . . . . . . . . . " ~ ~ ~ ~ " ~ " " ~ " " ~ ~ ~ " " "

(3) Furnish goods, services, or facilities to (or accept them from) a disqualified person? .

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person? . .

(6) Transfer any income or assets to a disqualified person (or make any of either available

. . . . . .

1:1 Yes

aNo

. . . . . .

. . . . . .

. . . . . .

Yes

X No

X No

Yes

P Yes

X No

Yes

aX No

for the benefit or use of a disqualified person)? . . . . . . . . . . . " " " ~ ~ " " . . . . . . .

(6) Agree to pay money or property to a government official? (Exception. Check "No"

If the organization agreed to make a grant to or to employ the official for a period

Yes

EE No

after termination of government service, if terminating within 90 days.) . " " " " " " " " . . . .

in

Regulations

acts

fail

to

qualify

under

the

exceptions

described

b If any answer is "Yes" to 1a(1)-(6), did any of the

section 53 4941(d)-3 or in a current notice regarding disaster assistance (see page 19 of the instructions)? . . .

Organizations relying on a current notice regarding disaster assistance check here . . . . . . . . . . " " " ~ " 1J

e Did the organization engage in a prior year in any of the acts described in 1a, other than excepted acts,

that were not corrected before the first day of the tax year beginning in 2003? . . . . . . . . . . . . . .

2

Taxes on failure to distribute income (section 4942) (does not apply for years the organization was a private

operating foundation defined in section 49420(3) or 49420)(5))a At the end of tax year 2003, did the organization have any undistributed income (lines 6d

Yes

~X No

and 6e, Part XIII) for tax year(s) beginning before 2003? . . . . . . . . . " " " " " " " " . . . . .

1b

1c

If "Yes," list the years po.

b Are there any years listed in 2a (or which the organization is not applying the provisions of section 4942(a)(2)

(relating to incorrect valuation of assets) to the year's undistributed income? (If applying section 4942(a)(2)

to all years listed, answer "No" and attach statement - see page 19 of the instructions.) . . . . . . . . . . .

c I( the provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here

Did the organization hold more than a 2°.6 direct or indirect interest in any business

enterprise at any time during the year? , , , , , , , , , , , , , . , , , , . . , . . . . , . , , , ,

b If "Yes," did it have excess business holdings in 2003 as a result of (1) any purchase by the organization

3a

2b

Yes

~X No

or disqualified persons after May 26, 1969, (2) the lapse of the 5-year period (or longer period approved

by the Commissioner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequest, or (3)

the lapse of the 10-, 15-, or 20-year first phase holding period? (Use Schedule C, Form 4720, to determine

if the organization had excess business holdings in 2003 .) . . . . . . . " " " ~ " " ~ " ~ " " " ~ ~ ~ ~ ~

4 a Did the organization invest during the year any amount in a manner that would jeopardize its charitable purposes? . . . . . . .

b Did the organization make any investment in a prior year (but after December 31, 1969) that could jeopardize its charitable

purpose that had not been removed from jeopardy before the first day of the tax year beginning in 2003? . . . . .

6 a During the year did the organization pay or incur any amount to

(1) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))? , , , , , , EJYes

F

AI

(2) Influence the outcome of any specific public election (see section 4955) ; or to carry

Yes

X No

on, directly or indirectly, any voter registration drive? , , , , , , , , , , , , , , , , . . . . .

No

8

Yes

BX

travel,

study,

or

other

similar

purposes?

,

,

,

,

,

,

.

.

,

.

,

Provide

a

grant

to

an

individual

for

(3)

3b

4b

X

(4) Provide a grant to an organization other than a charitable, etc , organization described

~X No

in section 509(a)(1), (2), or (3), or section 4940(d)(2)? , , , , , , , , , . , , , . . . . . . . , a yes

other

than

religious,

charitable,

scientific,

literary,

or

(6) Provide for any purpose

educational purposes, or (or the prevention of cruelty to children or animals? , , , , , . , , , . El Yes

12 No

b If any answer is "Yes" to 5a(1)-(5), did any of the transactions fail to qualify under the exceptions described m

Regulations section 53 .4945 or in a current notice regarding disaster assistance (see page 20 of the instructions)? " ~

Organizations relying on a current notice regarding disaster assistance check here . . . . . . . . . . .

If the answer is "Yes" to question 5a(4), does the organization claim exemption from the

14/Z'+ 1 :1 Yes

E]No

tax because it maintained expenditure responsibility for the grant? . . . . . . . . . . . . . .

by

Regulations

section

53.49455(d).

attach

the

statement

required

I/ 'Yes,'

6 a Did the organization, during the year, receive any funds, directly or indirectly, to pay

Yes

F

AI

premiums on a personal benefit contracts , , , , , , . . . . . . . . . . . . . . . . . . . . . . .

b Did the organization, during the year, pay premiums, directly or indirectly, on a personal benefit contract? , , , , , , , , , , ,

1/ You answered 'Yes' to 66, also ale Form 8870.

c

6b

Form 990-PF (2003)

JSA

3E1450 1 000

M03089

5178 03/08/2004

12 :43 :07

HAW001-03

8

94-3347646

Form 990-PF (2003)

Page s

Inf ormation About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, and Contractors

1

List all officers, directors, trustees, foundation managers and their com p ensation see age 20 of the Instructions

(b) Title, and average

hours per week

(a) Name and address

devoted to

p osition

(c) Compensation

(11 not paid, enter

(d) Contributions to

employee benefit plans

41.-and deferred com p ensation

-------------------------------------SEE STATEMENT 5

NONE

(e) Expense account,

other allowances

NONE

NONE

---------------------------------------------------------------------------

2

Compensation of five hi g hest- p aid em plo y ees (other than those Included on fine 1 - see p a g e 20 of the instructions ) .

If none, enter "NONE."

-------------------------------------(a) Name and address of each employee paid more than $50,000

i

b Title and average

( hours Pper week

devoted to position

(e) Compensation

(d) Contributions to

employee benefit

plans and deferred

com p ensation

(e) Expense account,

other allowances

NONE

I

------------------------------------------ - - ---------------- - - ---- ---------------------------------------------

-------------------------------------Total number of other employees paid over $50,000

3

_T

. " NONE

Five highest-paid Independent contractors for professional services - (see page 20 of the Instructions) . If none, enter

"NONE ."

I

(b) Type of service

(a) Name and address of each person paid more than $50,000

(c) Compensation

NONE

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Total number of others receiving over $50,000 for professional services

~ ~

, , " NONE

Summary of Direct Charitable Activities

List the foundation's four largest direct charitable activities during the tax year Include relevant statistical information such as the number

of organizations and other beneficiaries served, conferences convened, research papers produced, etc

Expenses

----NLA------------------------------------------------------------------------------------------------------------------------------------------------

2----------------------------------------------------------------------------

----------------------------------------------------------------------------

3

---------------------------------------------------------------------------4

----------------------------------------------------------------------------

FoR 990-PF (2003)

I

JSA

3E 1460 2 000

M03089

517K 03/08/2004

12 :43 :07

HAW001-03

9

I

I

i

Page 7

Form 990-PF (2003)

94-3347646

utnmary of Program-Related Investments (see page 21 of the instructions)

Describe the two largest program-related investments made by the foundation during the tax year on lines 1 and 2

Amount

-------------------------------------------

- N-~A -

All

other program-related investments See page 21 of the instructions

--------------------------------------------------------------------------NONE

---------------------------------------------- ---------------------------------------------------------------------------Total . Add lines 1 throu gh 3

Minimum Investment Retum (All domestic ~foundations must complete this part . Foreign foundations,

see page 21 of the instructions .)

1

a

b

c

d

e

2

3

4

Fair market value of assets not used (or held for use) directly in carrying out charitable, etc .,

purposes.

Average monthly fair market value of securities . , . . . . . . , . . . . , . . . , . . . . . . . ,

Average of monthly cash balances .

Fair market value of all other assets (see page 22 of the instrucUons) . . , , , . . , , , , , , , ,

, , , , ,

Total (add lines 1 a, b, and c) . , , , , . . . , , , . , , , , , ,

Reduction claimed for blockage or other factors reported on lines 1 a and

1e

. . . . . . , . , ,

1c (attach detailed explanation)

to

line

1

assets

Acquisition indebtedness applicable

. . . . . . . . . . . . . . . . . . . . . . . .

Subtract line 2 from line 1d

Cash deemed held for charitable acUvities . Enter 1 1/2 ~/.' of line 3 (for greater amount, see page

,

, , , ,

. . . .

23

1a

1d

1a

7d

590 , 609 .

12 , 604 .

906 .

604 , 119 .

2

3

NONE

604 , 119 .

of the instructions)

. , . . . .

, , ,

, ,

4

5

Net value of noncharitable-use assets . Subtract line 4 from line 3 . Enter here and on Part V, line 4 . .

Minimum Investment return . Enter 5% of line 5

6

Distributable Amount (see page 23 of the instructions) (Section 49420(3) and 0)(5) private operating

foundations and certain foreign organizations check here p. a and do not complete this part .)

5

6

1

Minimum investment return from Part X, line 6 . . . . . . . . . . . . .

2a Tax on investment income for 2003 from Part VI, line 5 . . . . . , . .

b Income tax for 2003 . (This does not include the tax from Part VI .) . . .

c

3

4a

b

5

6

7

. .

2a

2b

9 , 062 .

595 , 057 .

29 , 753 .

. . . . . . . . . . . . . .

119

. .

,

Add lines 2a and 2b .

. . . . . . . . . . . . . .

Distributable amount before adjustments Subtract line 2c from line 1 . . .

NON]

Recoveries of amounts treated as qualifying distributions . , , , , , , 4a

4b

Income distributions from section 4947(a)(2) trusts . . , , . . . . . .

c Add lines 4a and 4b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Add lines 3 and 4c

. . . .

. . . ,

Deduction from distnbutable amount (see page 23 of the instructions)

Dlstrlbutable amount as adjusted Subtract line 6 from line 5 Enter here and on Part All, line 1

2c

4c

NONE

Qualifying Distributions (see page 23 of the instructions)

1

2

3

4

5

6

a

b

a

b

Amounts paid (including administrative expenses) to accomplish charitable, etc., purposes.

Expenses, contributions, gifts, etc . - total from Part I, column (d), line 26 . . , . . . , , , , , , , , , , ,

. . . . . .

Program-related investments - Total from Part IX-B . .

. . . ,

out

charitable,

etc.,

Amounts paid to acquire assets used (or held for use) directly in carrying

purposes ,

. . .

. . .

. .

. . . . . . . . . . . . . . . . . . . . .

Amounts set aside for specific charitable projects that satisfy the.

Suitability test (prior IRS approval required) . . . . . . , . . . . . . . . . . . . . , , , , , , , , , ,

Cash distribution test (attach the required schedule) . . . . . . . . , , . . , , , , , , , , , ,

Qualifying distributions . Add lines 1a through 3b . Enter here and on Part V, line 8, and Part XIII, line 4 , . . ,

Organizations that qualify under section 4940(e) for the reduced rate of tax on net investment

income . Enter 11% of Part I, line 27b (see page 24 of the instrucUons) . . . . . . . . . . . . . . . .

. . . . . . , .

. .

. .

Adjusted qualifying distributions . Subtract line 5 from line 4 . .

Note : The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating

qualifies for the section 4940(e) reduction of fax in those years.

JSA

3 E 7 470 1 000

M03089

517K 03/08/2004

12 :43 :07

, .

, .

1a

1 b

32 , 588 .

NONE

NONE

2

3a

3b

4

NONE

NONE

32 , 588 .

5

. .

6

.

whether the foundation

119 .

32 , 469 .

Form 990-PF (zoo3)

HAW001-03

10

Form 990-PF (2003)

Fla9e 8

94-3347646

Undistributed Income (see page 24 of the instructions)

2

(b)

Years prior to 2002

(a)

Corpus

Dlstributable amount for 2003 from Part XI,

1

29,876 .

, , , , , , , , ,

N02

b Total for pnoryears

Excess distributions car over, if any, to 2003 .

3

a

b

c

d

From 1998

NO

, , , , , ,

From 1999

From 2000 , , , , , ,

From 2001 , , , , , ,

e From 2002 , , , , , ,

t Total of lines 3a through e , , , , , , , ,

4

Qualifying distributions for 2003 from Part

32,588 .

X1 1, line 4: " $

a Applied to 2002, but not more than line 2a

NO

NO

NO

NO

, , ,

NONE

29 4 876 .

, , ,

b Applied to undistributed income of prior years

(Election required - see page 24 of the instructions)

NO]

, ,

c Treated as distributions out of corpus (Election

required - see page 24 of the instructions) , , ,

d Applied to 2003 distributable amount, , , . , ,

e Remaining amount distributed out of corpus , ,

6

Excess distributions carryover applied to 2003

(H an amount appears m column (d), the

s

same amount must be shown in column (a) .)

Enter the net total of each column as

Indicated below:

a Corpus . Add lines 3i, 4c, and 4e. Subtract line 5

NONE

NONE

NO]

income for which a notice of deficiency has

been issued, or on which the section 4942(a)

tax has been previously assessed , , , , , , ,

NO]

d Subtract line 6c from line 6b . Taxable

NO]

amount - see page 24 of the instructions , , , ,

e Undistributed income for 2002 Subtract line

4a from line 2a Taxable amount - see page

24 of the instructions . . . , , , , , , , ,

7

8

NONE

NONE

, , , ,

line 4b from line 2b

c Enter the amount of prior years' undistributed

i

2 , 712,

NONE

b Prior years' undistributed income . Subtract

Undistributed income for 2003 . Subtract

lines 4d and 5 from line 1 . This amount must

be distributed in 2004

Amounts treated as distributions out of

corpus to satisfy requirements imposed by

section 170(b)(1)(E) or 4942(8)(3) (see page

25 of the instructions) . . .

. . . .

Excess distributions carryover from 1998

not applied on line 5 or line 7 (see page 25

of the instructions) . . . . . . . . . . . . . . .

6,922 .

Excess distributions carryover to 2004.

9

10

(d)

2003

29 , 634 .

line 7 . . . . . . . . . . . . . . . . . . . . .

Undistributed income, d any, as of the end of 2002

a Enter amount for 2002 only

(c)

2002

Subtract lines 7 and 8 from line 6a . . . . . . .

Analysis of line 9.

Excess from 1999 . ,

NON

c

Excess from 2001 . ,

NON

d

Excess from 2002 . .

a

b Excess from 2000 . .

e

Excess from 2003 . . .

JSA

3 E 1480 1 000

M03089

5178 03/08/2004

NON

NON

NON

12 :43 :07

Form 990-PF (2oos)

HAW001-03

11

"

Form 990-PF

1a

b

2a

Private Operating Foundations (see page 15 of the instructions ana raR vii-H, question y)

If the foundation has received a ruling or determination letter that it is a private operating

foundation, and the ruling is effective for 2003, enter the date of the ruling , . , . . , , , , , ,

Check box to Indicate whether the organization is a private operating foundation described m section

Prior 3 years

Tax year

Enter the lesser of the

adjusted net income from

Part I or the minimum

investment return from Part

X for each year listed . . .

b

BS°h of line 2a

C

Qualifying distributions from Part

(a) 2003

(c) 2001

(b) 2002

9

NOT APPLICABLE

4942(j)(3) or

49420(5)

(e) Total

(d) 2000

. , , . .

XII, line 4 for each year listed

d

2

3

e

.

Amounts included In line 2c not

used directly for active conduct

of exempt activities ,

Qualifying distributions made

directly for active conduct of

exempt activities Subtract

line 2d from line 2c .

Complete 3a, b, or c for the

alternative test rolled upon

'Assab' eltemaWe test- enter

Value of all assets

b

C

(2) Value of assets qualifying

under section

4942U)(3)(B)(0 . . . . .

'EndowmenC alternative testEnter Z3 of minimum

Investment return shown In

Part X, line 8 for each year

listed . . .

'SupporCalternative test -enter

(1) Total support other than

prose Investment Income

(Interest, dividends, rents,

payments on securities

loans (section 512(a)(5)),

or royalties) .

(2) Support from general

public and 5 or more

exempt organizations

as provided In section

4942U)(3)(B)(III)

(3) Largest amount of support

from en exempt

organization

4

1

a

Gross investment income .

Supplementary Information (Complete this part only if the organization had $5,000 or more in

assets at any time during the year - see page 25 of the instructions .)

Information Regarding Foundation Managers'

List any managers of the foundation who have contributed more than 2°.6 of the total contributions received by the foundation

before the close of any tax year (but only ii they have contributed more than $5,000) . (See section 507(d)(2).)

WILLIAM M .

b

HAWRINS

6 LISA WARNES HAWRINS

List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the

ownership of a partnership or other entity) of which the foundation has a 10°.6 or greater interest.

NONE

2

Information Regarding Contribution, Grant, Gift, Loan, Scholarship, etc ., Programs :

1 X if the organization only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds

If the organization makes lifts grants etc (see page 25 of the instructions) to individuals or organizations under other conditions complete items 2a b, c, and d

a The name, address, and telephone number of the person to whom applications should be addressed:

Check here

b The form m which applications should be submitted and information and materials they should include :

c

Any submission deadlines

d

Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other

factors'

JSA

3 E 1490 1 000

M03089

517R 03/08/2004

12 :43 :07

HAW001-03

Form 990-PF (2003)

12

94-3347646

Form 990-PF (2003)

Supplementary Information (continued)

Form 990-PF (2003)

JSA

3E 1491 2 000

M03089

Page 10

517K 03/08/2004

12 :43 :07

HAW001-03

13

Form 990-PF (2003)

Page 11

94-3347646

Anal sis of Income-Producin Activities

Unrelated business income

Enter gross amounts unless otherwise indicated.

Business

code

1 Program service revenue :

a

Amount

Excluded b section 512, 513, or 514

(c)

(d)

Exclusion

Amount

code

Related or exempt

function income

(See page 26 of

the instructions

b

c

d

e

f

g

Fees and contracts from government agencies

2 Membership dues and assessments , , , , ,

3 Interest on savings and temporary cash investments

4 Dividends and interest from securities , , , ,

5 Net rental income or (loss) from real estate :

a

Debt-financed property

b

Not debt-financed property

14

10 , 151 .

18

8 , 266 .

, , , , , , , , ,

, , , , , , ,

6 Net rental income or (loss) from personal property

,

7 Other investment income

B Gain or (loss) from sales of assets other than inventory

9 Net income or (loss) from special events , , ,

10 Gross profit or (loss) from sales of inventory . .

11 Other revenue : a

c

d

e

18,417 . 1

12 Subtotal . Add columns (b), (d), and (e) , , , , E

......

(b),

(d),

and

(e)

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

.

.

,

,

.

.

.

.

.

.

.

.

. 13

13 Total . Add line 12, columns

on

26

to

veri

ty

calculations

See worksheet in line 13 instructions

page

.

dine No .

'

18,417 .

Relationship of Activities to the Accomp lishment of Exem pt Purposes

Explain below how each activity for which income is reported in column (e) of Part XVI-A contributed importantly to

the accomplishment of the organization's exempt purposes (other than by providing funds for such purposes). (See

page 26 of the instructions .)

Form 990-PF (2oos)

JSA

3E1492 1 000

M03089

5178 03/08/2004

12 :43 :07

HAW001-03

14

Form 990-PF 2003

Pace 12

94-3347646

Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Exem pt Or ganizations

Did the organization directly or indirectly engage in any of the following with any other organization described in section

501(c) of the Code (other than section 501(c)(3) organizations) or m section 527, relating to political organ¢ations'7

1

Yes

a Transfers from the reporting organization to a noncharrtable exempt organization of

No

(1)Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1a1

(2) Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a ( 2)

X

(1) Sales of assets to a nonchantable exempt organization , , , , , , , , , , , , , , , , , , , , , , , , . . . . . . . . . . 1 b(l )

(2) Purchases of assets from a nonchantable exempt organization , , , , , , , , , , , , , , , , , , , , . . , . . . . . . , 1 b(2)

X

(4) Reimbursement arrangements , , , , , , , , , , , , , , , , . , , , , . . . , . . . . . . . . . . . . . . . . . . . , , 1 b( 4)

(5) Loans or loan guarantees , , , , , , , , , , , , , , . . , . . . . . . . . . . . . . . . . . . . . . . . . . . . . . , , 1 b(S)

(6) Performance of services or membership or fundraising solicitations , , , , , , , , , , , , , , , , , . , , . . . . . . , , 1 b(6)

1c

c Sharing of facilities, equipment, mailing lists, other assets, or paid employees , , , , , , , , , , , , . . , , . . . . . . . . .

always

show

the

fair

market

complete

the

follovwng

schedule

Column

(b)

should

If

the

answer

to

any

of

the

above

is

"Yes,"

d

X

b Other transactions

(3) Rental of facilities, equipment, or other assets

, , , , , , , , , , , , , , , . , , , , , . . . , . . . . . . . . . . . . ,

1 b (3)

X

X

X

X

X

X

value of the goods, other assets, or services given by the reporting organization If the organization received less than fair

market value in any transaction or sharing arrangement, show in column (d) the value of the goods, other assets, or services

2 a

Is the organization directly or indirectly affiliated with, or related to, one or more tax-exempt organizations

described m section 501(c) of the Code (other than section 501(c)(3)) or m section 527

b If "Yes , " complete the followin g schedule

(b) Type of organization

(a) Name of organization

, , , , , , , , , , , , , , , , , .

El Yes DX

No

(c) Description of relationship

A

Under penalties of perjury, I declare that I

belief, it is true, correct, and complete Decl

`

ve examined this return, including accom

lion of preparer (other than taxpayer or fidu

Signature of officer or trustee

1

Gl

2

C

a

~n

~ ?~ Preparers

signature

~mo

a d H Firm's name (or yours if

self-employed), address,

and ZIP code

Jsn

3E 1493 1 000

M03089

517K

' HARRI S MYCF

1700

INC .

SEAPORT BLVD . ,

RE DWOOD CITY .

03/08/2004

-

12 :43'07

CA

ig schedules and statements, and to the best of my knowledge and

is based on all information of which preparer has any knowledge

THE HAWKINS FOUNDATION

FORM

990PF,

PART

I

94-3347646

- DIVIDENDS AND INTEREST FROM SECURITIES

DESCRIPTION

----------PAINEWEBBER VARIOUS

TOTAL

M03089 517K 03/08/2004

12 :43 :07

REVENUE

AND

EXPENSES

PER BOOKS

---------

NET

INVESTMENT

INCOME

------

10,151 .

-------------10,151 .

10,151 .

-------------10,151 .

HAW001-03

16

STATEMENT

1

94-3347646

THE HAWKINS FOUNDATION

FORM

990PF,

PART

I

- ACCOUNTING FEES

REVENUE

AND

EXPENSES

PER BOOKS

DESCRIPTION

ACCOUNTING FEES

TOTALS

M03089 517K 03/08/2004

12 :43 :07

6,150 .

-------------6,150 .

NET

INVESTMENT

INCOME

ADJUSTED

NET

INCOME

CHARITABLE

PURPOSES

3,075 .

-------------3,075 .

NONE

-------------NONE

3,075 .

-------------3,075 .

HAW001-03

17

STATEMENT

2

THE HAWKINS FOUNDATION

FORM 990PF,

PART

94-3347646

I - OTHER EXPENSES

REVENUE

AND

EXPENSES

PER BOOKS

---------

DESCRIPTION

FILING FEES

NET

INVESTMENT

INCOME

------

ADJUSTED

NET

INCOME

------

CHARITABLE

PURPOSES

--------

25 .

NONE

NONE

25 .

INVESTMENT FEES

150 .

150 .

NONE

NONE

MANAGEMENT FEES

3,139 .

3,139 .

NONE

NONE

186 .

--------------

186 .

--------------

NONE

--------------

NONE

--------------

FOREIGN TAX WITHHOLDING

TOTALS

M03089 517K 03/08/2004

12 :43 :07

3,500 .

HP.W001-03

3,475 .

NONE

18

25 .

STATEMENT

3

94-3347646

THE HAWKINS FOUNDATION

FORM

990PF,

PART

II

- CORPORATE STOCK

ENDING

BOOK VALUE

DESCRIPTION

MS ACCT 48800

TOTALS

M03089 517K 03/08/2004

12 :43 :07

ENDING

FMV

622,586 .

--------------622,586 .

HAW001-03

712,429 .

--------------712,429 .

19

STATEMENT

4

THE HAWKINS FOUNDATION

FORM

990PF,

PART VIII

94-3347646

- LIST OF OFFICERS,

DIRECTORS,

AND TRUSTEES

TITLE AND TIME

DEVOTED TO POSITION

-------------------

NAME AND ADDRESS

----------------

CONTRIBUTIONS

TO EMPLOYEE

BENEFIT PLANS

-------------

COMPENSATION

------------

EXPENSE ACCT

AND OTHER

ALLOWANCES

----------

WILLIAM M . HAWKINS

8 BRITTANY MEADOWS COURT

ATHEf2TON, CA

94027

PRESIDENT

AS NEEDED

NONE

NONE

NONE

LISA WARNES HAWKINS

8 BRITTANY MEADOWS COURT

ATHERTON, CA

94027

TREASURER

AS NEEDED

NONE

NONE

NONE

--------------

--------------

--------------

GRAND TOTALS

M03089 517K 03/08/2004

12 :43 :07

HAW001-03

NONE

20

NONE

STATEMENT

NONE

5

THE HAWfCINS FOUNDATION

94-3347646

FORM 990PF, PART XV - GRANTS AND CONTRIBUTIONS PAID DURING THE YEAR

-----------

----------------- ----- --

RELATIONSHIP TO SUBSTANTIAL CONTRIBUTOR

AND

RECIPIENT NAME AND ADDRESS

--------------------------

FOUNDATION STATUS OP RECIPIENT

------------------------------

THE NUEVA SCHOOL

NONE

6565 SKYLINE BLVD .

PUBLIC CHARITY

PURPOSE OF GRANT OR CONTRIBUTION

--------------------------------

AMOUNT

GENERAL CHARITABLE PURPOSE

15,729 .

GENERAL CHARITABLE PURPOSE

1,000 .

GENERAL CHARITABLE PURPOSE

500 .

GENERAL CHARITABLE PURPOSE

600.

GENERAL CHARITABLE PURPOSE

200 .

GENERAL CHARITABLE PURPOSE

75 .

GENERAL CHARITABLE PURPOSE

50

HILLSBOROUGH, CA 95010-6221

SAN JOSE FAMILY SHELTER

NONE

1590 LAS PLUMAS AVENUE

PUBLIC CHARITY

SAN JOSE, CA 95133-1667

THE AMERICAN VETERANS COUNCIL

NONE

2519 MARTIN LUTHER KING JR WAY

PUBLIC CHARITY

OAKLAND , CA 94612

THE SAN FRANCISCO ZOOLOGICAL SOCIETY

NONE

1 Z00 ROAD

PUBLIC CHARITY

SAN FRANCISCO, CA

94132

PENINSULA FAMILY YMCA

NONE

1877 SOUTH GRANT STREET

PUBLIC CHARITY

SAN MATEO, CA

94402

SMITHSONIAN INTITUTION

NONE

WASHINGTON, DC

PUBLIC CHARITY

FRIENDS OF MONTALVO

NONE

15400 MONTALVO ROAD

SARP.TOGA, CA

PUBLIC CHARITY

95071

THE GIRLS' MIDDLE SCHOOL

NONE

180 NORTH RENGSTROFF AVENUE

PUBLIC CHARITY

MOUNTAIN VIEW, CA

5,000.

GENERAL CHARITABLE PURPOSE

1,500

9403 .1

MENLO PRESBYTERIAN CHURCH

NONE

950 SANTA CRUZ AVENUE

PUBLIC CHARITY

MENLO PARK, CA 94025

M03089

GENERAL CHARITABLE PURPOSE

517K

03/08/2004

12 :43 :07

HAH001-03

21

STATEMENT

6

I

THE HAWKINS FOUNDATION

94-3347646

FORM 990PF, PART XV - GRANTS AND CONTRIBUTIONS PAID DURING THE YEAR

RELATIONSHIP TO SUBSTANTIAL CONTRIBUTOR

AND

RECIPIENT NAME AND ADDRESS

--------------------------

FOUNDATION STATUS OF RECIPIENT

------------------------------

STANFORD GRADUATE SCHOOL OF BUSINESS

NONE

518 MEMORIAL WAY, STANFORD UNIVERSITY

PULIC CHARITY

RING NURSERY SCHOOL

NONE

AMOUNT

PURPOSE OF GRANT OR CONTRIBUTION

--------------------------------

------

GENERAL CHARITABLE PURPOSE

1,000 .

GENERAL CHARITABLE PURPOSE

1,000 .

GENERAL CHARITABLE PURPOSE

300 .

GENERAL CHARITABLE PURPOSE

1,000 .

GENERAL CHARITABLE PURPOSE

34 .

GENERAL CHARITABLE PURPOSE

1,500.

STANFORD, CA 94305

850 ESCONDIDO ROAD

PUBLIC CHARITY

COLLEGE TRACK

NONE

1898C BAY ROAD

PUBLIC CHARITY

STANFORD, CA 94305

EAST PALO ALTO, CA 95303

BOYS SCOUTS OF AMERICA

NONE

PACIFIC SKYLINE COUNCIL

PUBLIC CHARITY

1300 S AMPHLETT BLVD, SAN MP,TEO, CA 94402-1907

NATIONAL GEOGRAPHIC SOCIETY

NONE

P .O .BOX 63001

PUBLIC CHARITY

TAMPA, FLORIDA 33663-3001

FOOTHILL AUXILIARY, FAMILY SERVICES AGENCY

NONE

24 2ND AVENUE

PUBLIC CHARITY

SAN MA,TEO, CA 94401

-----------TOTAL CONTRIBUTIONS PAID

M03089

517K

03/08/2004

12 :43 :07

HAW001-03

22

STATEMENT

29,488 .

7

Capital Gains and Losses

SCHEDULED

(Form 1041)

~oo

Attach to Form 1041, Form 5227, or Form 990-T . See the separate

structlons for Form 1041 also for Form 5227 or Form 990-T If a pp licable ) .

Employer identification number

Department of the Treasury

Internal Revenue Service

Name of estate or trust

THE HAWRINS FOUNDATION

C/O WILLIAM M .

HAWRINS,

" (a) Description of property

(Example, 100 shares 7%

preferred of 'T' Co )

3

4

6

94-3347646

III

Note : Form 5227 filers need to complete only Parts 1 and 1l.

Short-Term Ca pital Gains and Losses - Assets H

2

OMB No 1545-0092

(b) Date

acqwred

(mo , day, yr )

(c1 Date sold

(mo , day, yr )

(d)

One Year or Less

Sales price

e Cost or other basis

(see page 32)

I

Short-term capital gain or (loss) from Forms 4684, 6252, 6781, and 8824 , , , , , , , ,

Net short-term gain or (loss) from partnerships, S corporations, and other estates or trusts

Short-term capital loss carryover . Enter the amount, if any, from line 9 of the

2002 Capital Loss Carryover Worksheet , , , , , , , , , , , , , , , , , , , , , , , , . .

(n Gain or (Loss)

for the entire year

(col (d) less col (e)

(g) Post-May 5 gain

or (loss'

2

3

5a Combine lines 1 through 3 in column (g) 5a

b Net short-term gain or (loss) . Combine lines 1 through 4 in column (~ Enter

Sb

here and on line 14a below

~ ~ ~ ~ ~

~ ~ ~ ~ ~ ~ ~ ~

~ ~ ~ ~ - ~ ~

~ ~ ~ ~ ~ 10Long-Term Ca p ital Gains and Losses - Assets Held More Than One Year

(b) Date

. (a) Description of property

(e) Cost or other basis

(c) Date sold

ac cared

(Exam p le, 100 shares 7%

(d) Sales price

(see page 32)

4

(mo

,

day,

yr

)

Co

1

(mo,

day,

yr

)

preferred of'2"

~

Gain or (Loss)

the entire year

(d) less col (e)1

or (loss)'

8,266

7

8

9

10

11

12

Long-term capital gain or (loss) from Forms 2439, 4684, 6252, 6781, and 8824 , . . .

Net long-term gain or (loss) from partnerships, S corporations, and other estates or trusts

Capital gain distributions ,

Gain from Form 4797,Part l ,

Long-term capital loss carryover Enter the amount, if any, from line 14 of the

, , , , , ,

2002 Capital Loss Carryover Worksheet , , , , , , ,

Combine lines 6 through 10 in column (g) '--- 8,266 .

7

8

10

11

12

8 .266 .

Net long-term gain or (loss) . Combine lines 6 through 11 in column (f) Enter

here and on line 15a below

t I 13 I

8 , 266 .

"Include in col (g) all gams and losses from .col . (f) from sales, exchanges, .or conversions (including installment payments received) after

May 5, 2003 However, do not include gam attributable to unrecaptured section 1250 gam or 28% rate gain or loss (see mstr ).

13

Summary of Parts I and 11

Caution: Read the instructions before completing this part.

(1) Beneficiaries'

(see page 33)

14a Net short-term gain or (loss) (for the entire year) , , , , , , , , , , 14a

b(1) Net short-term gain (post-May 5, 2003) , , , , , , , , , , , , , , Lib D

b(2) Net short-term loss (post-May 5, 2003) . . . . . . . . . . . , , , 1 4b ( 2 )

15a Net long-term gain or (loss) (for the entire year) . , . , . , , , , , , Isa

b Net long-term gain (post-May 5, 2003) , , , , , , , , , , , , , , , , isn

c Qualified 5-year gam , , , , , , , , , , , , , , , , , , , , , , , , , ,

d Unrecaptured section 1250 gain (see line 18 of the worksheet on page 34) ,

e 28% rate gain or (loss) , , , , , , , , , , , , , , , , , , , , , , , , ,

16a Total net gain or (loss) . Combine lines 14a and 15a , , , , , , , t

b Combine lines 14b(2) and 15b If zero or less, enter -0- , , , , , , ,

(2) Estate's

or trust's

~

i5c

15d

use

1sa

1st

(3) Total

)

8 , 266 .

8 , 266 .

Note : 1I line 16a, column (3), is a net gam, enter the gain on Form 1041, line 4 If lines 15a and 16a, column (2), are net gams, go to Part V, and do

not complete Part IV !f line 16a, column (3), is a net loss, complete Part IV and the CaplFdl Loss Carryover Worksheet as necessary

Schedule D (Form 1041) 2003

For Paperwork Reduction Act Notice, see the Instructions for Form 1041 .

Jsn

3F1270 3 000

M03089

517K 03/08/2004

12 :43 :07

HAW001-03

23

s

Schedule D (Foitn 1041) 2003

I Loss

Enter here and enter as a (loss) on Form 1041, line 4, the smaller of

a The loss on line 16a, column (3) or

b $3,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

17

If the loss on line 16a, column (3), is more than $3,000, or if Form 1041, page 1, line 22, is a loss, complete the Capital Lass

Carryover Worksheet on page 36 of the instructions to determine your capital loss carryover

Tax Computation Using Maximum Capital Gains Rates (Complete this part only if both lines 15a and

16a in column (2) are gains, or an amount is entered in Part I or Part II and there is an entry on Form 1041,

line 2b(2), and Form 1041, line 22 is more than zero .)

Note : If line 15d, column (2) or line 15e, column (2) is more than zero, complete the worksheet on page 37 of the instructions

and skip Part V. Otherwise, go to line 18

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

Enter taxable income from Form 1041, line 22 . . . . . . . . . . . . . . .

Enter the smaller of line 15a or 16a in column

19

(2) but not less than zero . . . . . . . . . . . . .

Enter the estate's or trusts qualified dividends

from Form 1041, line 2b(2) . . . . . . . . . . . . 20

Add lines 19 and 20 , . . . . . . . . . . . . . . . 21

If the estate or trust is filing Form 4952, enter the

"

22

amount from line 4g ; otherwise, enter-0Subtract line 22 from line 21 If zero or less, enter-0- ,

Subtract line 23 from line 18 If zero or less, enter -0- ,

Enter the smaller of the amount on line 18 or $1,900 ,

If line 24 Is more than line 25, skip lines 26-36 and go

Enter the amount from line 24 , , , , , , , , , , , , , ,

, , , ,

, , , ,

, , , ,

to line

, , , .

. , , , , , . ,

, , , , , , , ,

, , , , , , , ,

37 .

. , . , , . . .

Subtract line 26 from line 25 . If zero or less, enter -0- and go to line 37

Add lines 16b, col . (2) and 20" . . . . . . . . . . . 1 28

Enter the smaller of line 27 or line 28 . . . . . . . . . . . . . . . . . . . . . .

Multiply line 29by5%(OS) ,

If lines 27 and 29 are the same, skip lines 31-36 and go to line 37 .

Subtract line 29 from line 27, . . . , , , , , , . .

Enter the amount, if any, from line 15c,

column (2) . . . . . . . . . . . . . . . . . . . . .

Enter the smaller of line 31 or line 32

Multiply line 33 by 8°/0 ( 08) . . . . .

Subtract line 33 from line 31 , , , ,

Multiply line 35 by 10% ( 10), , , . .

It the amounts on lines 23 and 27

18

23

24

25

26

27

29

,

31

32

33

, , , , , , , , , . . . , , . . , . . . . ,

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, . . , , , , , , , , , . . . . . , ,

, , , , . , . . . , . . . . . . , . . . . . . . . . . . . . . . . . . . .

are the same, skip lines 37 through 46 and go to line 47 .

Enter the smaller of line 18 or line 23 . . . . . . . . . . . . . . . . . . . . . .

Enter the amount, if any, from line 27 , , , , , , , , , , , , , , , , , , , , . .

Subtract line 38 from line 37

40

Add lines 16b, col (2) and 20',

Enter the amount from line 29 (if line 29 is blank,

enter -0-) . . . . . . . . . . . . . . . . . . . . . .

Subtract line 41 from line 40 , , . . . . . . . . .

41

42

Enter the smaller of line 39 or line 42 . . , . . . . . , , . . . . . . , , ,

Multiply line 43by15%(15) " . . . . . . . . . . . . . . . . . . . """

Subtract line 43 from line 39 . . . . . . . . . . . . . . . . . . . . . . .

Multiply line 45 by 20% ( .20) . . . . . . . . . . . . . . . . . . . . . . .

Figure the tax on the amount on line 24 Use the 2003 Tax Rate

instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Addlines 30,34,36,44,46,and47 .

Figure the tax on the amount on line 18 Use the 2003 Tax Rate

, , ,

38

39

43

. . . . . . . . . . . . . . . . . .

Schedule on page 21 of the

. . . . . . . . . . . . . . . . . .

., . ,

Schedule on page 21 of the

instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Tax on all taxable Income .

Enter the smaller of line 48 or line 49 here and on line 1 a of

Schedule G, Form 1041 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

JSA

3F1220 2 000

M03089 517R 03/08/2004

12 :43 :07

36

37

. . . . .

"

. . . 1 45 . 1

" If lines 20 and 22 are more than zero, see Lines 28 and 40 on page 36 for

the amount to enter

34

44

46

NONE

NONE

47

48

49

50

Schedule D (Form 1041) 2003

HAW001-03

24

THE HAWKINS FOUNDATION

94-3347696

Schedule D Detail of Long-term Capital Gains and Losses

Date

Ac q uired

Descri ption

P OST-MAY

5TH

CAPITAL

T OTAL

GAINS

POST-MAY

CAPITAL

SEE

-

GAINS

SEE

GAINS

HELD

Gross Sales

Price

Cost or Other

Basis

Long-term

Gam/Loss

LOSSES

STMT

CAPITAL

LOSSES

GAINS

CAPITAL

5TH

GAINS

CAPITAL

T OTAL

CAPITAL

Date

Sold

VAR

GAINS

LOSSES

FOR

CHARITABLE

STMT

LOSSES

FOR

176

128 .

167

862 .

8 , 266 .

176

128 .

167

862 .

8 1 266 .

176

128 .

167

862 .

8 , 266 .

176

128 .

167

862 .

8 , 266 .

167,862 .

8,266 .

PURPOSES

VAR

HELD

VAR

CHAR ITABLE

VAR

PURP OS ES

[ Totals

176,128 .

JSA

3F0970 1000

M03089 517K 03/08/2009

12 :43 :07

HAW001-03

25

STATEMENT

1

r

Investment Account

Account Number ; KP 48800 11

Your Financial Advisor

DUNCAN O . NAYLOR

650-233-0481/800-5"-6811

i

Statement Period : 2003 Year-End Summary

i zcA msae-x2s

. ooooot

2003 Realized gains and losses - continued

:/losses (first-In. /!w-out or FIFO

Estimated 200? palm end losses for transactions with trade dates through 12/J1/OJ have been Incorporated into this statement The oldest security lot !s liquidated first to calculate pain

accounting method) unless you specified which lot to close when you placed your order (a venue purchase or VSP order) An asterisk ("J indicates a UHS Financial Services adjustment to cost basis The number 'I' Indicates cost

bails information has been provided by a source other then U85 Financial Services See the back of the first page for additional information This information Is provided for informational purposes only end should not be relied

upon for tsR" IiIinO purposes Rely only on year-end far forms when preparing your far return Gains/losses may not be adjusted for X11 capital changes Cost basis for tax-exempt and ANT eligible coupon municipat securities has

been adjusted automatically for estimated amortization of bond premiums Estimates in fps "Uncletai/led section can not be classified as short-term or long-term due to missing information or the product Is one for which a

psinfloss calculation is not provided

Security description

Method

Short-term capital gains and losses :

FIFO

ALCON INC

AUTODESK INC

FIFO

FIFO

BOEING COMPANY

FIFO

DUKE ENERGY CORP

FIFO

GOLDMAN SACHS GROUP INC

KROGER COMPANY

FIFO

LUCENT TECHNOLOGIES INC

FIFO

FIFO

POSCO SPON ADR

RAYTHEON CO NEW

FIFO

STMICROELECTRONICS N V

VALERO ENERGY CORP NEW

WASH MUTUAL INC

FIFO

FIFO

FIFO

FIFO

FIFO

Total

Long-term capital gains and losses :

FIFO

ALCON INC

FIFO

CINN FINANCIAL CORP

FIFO

CONOCOPHILLIPS

FIFO

FIFO

CYTEC INDUSTRIES INC

GILLETTE COMPANY

FIFO

FIFO

GOLDMAN SACHS GROUP INC

FIFO

HONEYWELL INTL INC

FIFO

KROGER COMPANY

FIFO

--

-

OuanNtyl

face value

Purchase

dire

Sale

date

100 .000

100 .000

100 .000

700 000

100 000

350 .000

900 .000

400 .000

350 .000

03121/02

08/17103

04130/02

02/20103

10/16102

10/16/02

04/30/03

10/16/02

10/16!02

02!19103

11/20103

01106/03

10123/03

10109103

02/04/03

11/20/03

07111103

10109103

250.000

400.000

150 000

200 .000

150 .000

50 .000

100 000

100 .000

60 .000

70000

100 000

100 .000

50 .000

100 000

400 .000

09111/02

10/16/02

10116/02

05/22/02

10/16/02

03/21/02

03/21102

10/O6/00

07/26/01

08121101

09/18/00

06/28/02

08/28/02

09/18/00

09/18/00

Sale

amount

$

06/13103

06/13103

08127/03

02/t9103

03/14/03

10/23103

04/01/03

04/01/03

04/01/03

1tr20r03

04/01/03

10/09/03

07/15/03

04/01/03

02/04103

3,644 .89

1,978 .90

3,408 .89

12,809 68

8,709 .82

5,147 .54

2,735 .87

10,946 .32

9,638 .80

Purchase

amount

S

5,474.29

8,758.87

5,775.07

7,334.87

5,006 .14

Lost

3,388 .41

1,688 .83

4,471 .78

8,806 .23

6,841 .00

5,271 .00

1,640 .61

8,584.00

10,304 .00

3

-1,062 .89

S

91 ,367.55

3

80 522.55

$

2,655 .98

4,145 .80

3,569 .83

9,248.24

2,489 .48

3,165 .85

8,109.82

4,489.68

2,18489

5,882 .90

$

1,694 .21

3,388 .07

3,487 .32

3,818 .20

2,522 .18

2,793 .47

7,37345

3,686 .73

3,587 .50

8,800 .00

+"

812.84

2,814 .87

1,450.57

-1,011 .07

"2 E64.62

-569 .98

-52 .70

-1,402 .61

-2,917 .10

256.48

290.07

1,095 .26

2,382 .32

-867 .20

3

Not

peen/loss

3,003 .45

1,ggg,g2

-123 .48

4,861 .45

6,144.00

4,324.50

8,345.74

4,851 .00

Gain

155 .14

3

13709.82 3

$

981 .75

757 .73

$2 .51

372 .38

1,338 .17

802 .83

10 845 .00

Investment Account

Account Number: KP 48800 11

Your Financial Advisor

DUNCAN O. NAYLOR

650-233-0461/800-544-6611

2003 Realized gains and losses - continued

Secunry descnpbon

Method

Ourntity/

Face value

Purchase

dote

Sale

dot e-

FIFO

300 000

09/18/00

01/29/03

MOTOROLA INC

POSCO SPON ADR

VALERO ENERGY CORP NEW

WASH MUTUAL INC

FIFO

FIFO

FIFO

FIFO

250 .000

250 000

100 .000

150 .000

09/18/00

09/18/00

07102/02

09/18/00

11/20/03

03/12/03

08/27/03

03114!03

3M C0

Total

capital

pains/losses

:

Net

FIFO

60 000

09/18100

03/28/03

Gains/Losses

(RAYTHEON CO NEW

I Total

IZCA177649 "X26

Statement Period: 2003 Year-End Summary

Sale

amount

$

4,622 .86

3,327 .34

4,621 .41

3,850.05

5,006 .14

$

S

7,848 .63

72,072.55- $

Purchase

amovn ;

Loss

6,600 .00

-1,977 .14

8,390 .63

4,781 .25

3,724 .87

3,562.50

5,017 .50

75 .574 .65

-12,215 .52

Net

ga)nlloss

Gain

-5,063 .29

-159.84

S

. oooooa

125 .18

1,443 .64

$

2,831 .13

8 , 713 .42

$

$

50 000

2'50 .000

100 .000

10109/03

07/16/03

01106/03

$

5

1,376 .69

8,121 .41

3,189 .90

12,688 .00

" 3 502 10

7,342 .90

1,411

-7,353

.2,911

11 " 765 .

923

2003 Realized capital gain ./loss summary

Short-term gains/losses :

Long-term gains/losses :

Net year-to-date capital gains/losses

_

R ~y TH EoN

o-rAL

S

$

$

10,845 00

-3,502 10

7 .342 .90

91.3