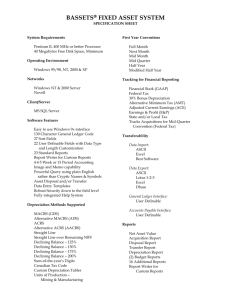

Operating Assets: Property, Plant, and Equipment

advertisement