Growing the Snow Sports Industry

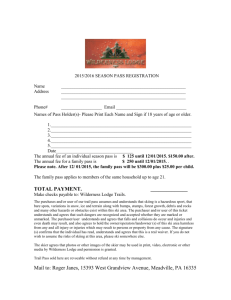

advertisement