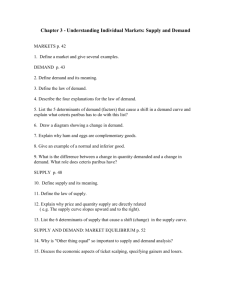

economics

advertisement