Digital Pen and Paper

Adopting Innovation to Differentiate

the Indian Banking Customer Experience

Point of View

Digital pen and paper provides a cost-effective

way for traditional paper processes to enter the

digital world.

Making it’s mark

Digital pen and paper technology combines the

portability and social acceptance of traditional pen and

paper with a computer’s ability to store, share, and act

upon the information collected.

This technology innovation, while harnessing

process efficiencies, empowers banks to manage

the key business imperative – Customer Experience.

In India banks still rely heavily on

pen and paper. This is driven by

regulations and also by related issues

on cost of automation, varying level of

technology infrastructure across the

country, and the associated training

and change management. In the

current pen and paper process

therefore, handling forms, data capture

and ensuring data validity often slows

down essential processes and

generates costly bottlenecks. And at a

minimum, data is captured twice – on

paper and then re-entered into the

backend system, leading to additional

processing time and possibility of

manual errors.

The Digital Pen & Paper solution

provides banks an opportunity to

adopt a simple technology enabler

and streamline their existing pen and

paper processes. The inherent advantages

of this solution lies in the fact that it

is simple to implement, has minimal

operating costs, leverages the large

mobile infrastructure in the country,

uses common tools and is simple for

users to be acquainted with the

technology as no training is required.

At present times banks in India are

highly focused on innovative and

differentiated customer experience

for achieving High Performance.

Findings from Accenture’s Indian

Banking Customer Experience Survey

2010 reveal that quality of service (no

errors made) and speed of service (no

or less waiting time) are top priorities

for Indian banking customers.

Digital pen and paper which is

increasingly being adopted globally,

directly influences these two levers of

customer experience. One of the key

areas impacted is the foremost

relationship building activity, i.e.

account opening. The solution can

play a key role in streamlining the

current sourcing process – either in or

away from the branch – thereby

ensuring differentiated customer

experience. The solution has a digital

scanner with mobile phone

integration to effectively fulfill the

customer sourcing operations in the

field by relationship managers, i.e. by

feet on street. In case of customers

walking into the branch for account

opening, the digital pen and paper

can substantially reduce serving time

while improving the quality of service.

This technology can also be leveraged

for teller operations, such as cash

deposit slip, and service request forms.

Harnessing process efficiencies

through technology innovation can

thus enable banks to attain significant

competitive advantage in serving the

customer. The solution provides a

cost-effective way for traditional

paper processes to enter the digital

world by fusing the traditional means

of information-gathering with

electronic communications.

Accenture Technology Labs, the

technology research and development

organization within Accenture, has

developed in-depth experience of this

technology and believes that it can

make a radical difference at the bank.

The digital pen and paper is a key

component of Accenture’s Next

Generation Branch offering.

Digital pens are used like ordinary

pens – only they are embedded with

processor, infrared camera, memory

etc. capable of storing time-stamped

content. Users write on paper printed

with a faint irregular pattern of dots

similar to map coordinates, enabling

the pen to know which form is being

used, what is being written, where on

the form and when. For increased

security, each pen has a unique identifier

allowing all information recorded by

it to be traced back to the source. The

data stored in the pen is transmitted

through a computer or a Bluetooth

mobile phone to a central server for

storage, further processing and analysis,

or transmission to colleagues.

This technology is especially relevant

in situations requiring significant

amount of forms processing, and

when information such as signatures

and figures needs to be collected

(such as account opening and service

request forms) or a paper-based item

(such as a receipt) is provided – either

in or away from the branch. Digital

pen and paper technology can be easily

introduced to users who are unfamiliar

with or wary of new technologies.

Making ‘Customer-centricity’

cost efficient

Banks today are operating in a world

that is vastly different from just a few

years ago. Customer expectations too

have changed dramatically, with

increasingly high service levels and

speed being the stakes that could

make or break a bank’s relationship

with the customer.

Since access to customers is limited

within the branch and outside, banks

must view all interactions as being

high ‘relationship’ value. The relationship

manager of the bank is usually the

initial touch point for the customer.

Customer on-boarding is the first and

most critical step in ensuring a

satisfied and valuable client

relationship. However the concept of

once-only data capture at product

origination is still elusive for many

banks as revisits to complete/ validate

data are commonplace.

Today banks need to maximize their

interaction with the customer and

arrive at faster decisions based on

customer data and internal metrics.

The customer who has many options

today is looking for instant feedback

on his/her request.

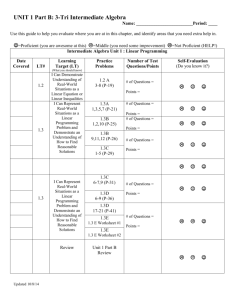

Benefits of using the Digital Pen and Paper – Account Opening Illustration

Frequently Asked Questions

Pen and Paper

How does the solution work?

Digital Pen and Paper

Process Flow using the Digital Pen and Paper Solution

Customer Experience

Long processing and end-to-end

turnaround time on account opening

Bank agent re-visits customer for Knowyour-customer (KYC) documentation due

to incomplete data or error on forms

80% + reduction in account opening time

Real-time data validation and processing

drastically reduces customer revisits

Eliminates data losses as data transmission

is always kept under control

Company location

1

USB

2a

http

Customer Experience

3

Digital pen and

paper server

Bluetooth

Digital Pen

and paper

Efficiency

Re-entry of data in CPCs (inhouse/outsourced) into backend systems

Lost sales opportunities and reduced

employee attention to revenue-generating

activities

25 – 30% of back-office staff optimized by

eliminating data re-entry in CPCs

Increases productivity, brings to high speed

of execution and refocuses revenue-generating

sales activites

Cost

Cost

Excess human capital performing non-value

added tasks which could otherwise be digitized

70-80% of data entry and archiving costs saved

Bluetooth connection

between pen and phone

2b

3

Bluetooth

3

Digital

scanner

2c

Bluethooth connection

between Pen and PC

XML file

5

PDF file

CRM system

GSM

http

Efficiency

4

Accenture

Mobility

Operated

Services

Digital archive

on document

managemant

system

GSM

Backend System

1 The digitized paper form is filled by

the relationship manager/

customer using digital pen KYC

documents/photographs can be

scanned through digital scanner or

captured using mobile camera

2 Data captured on digital pen is

transferred through an intermediate

mobile or laptop device– through

A case in point is a relationship

manager visiting an existing customer

for mortgage/credit related offerings.

The customer can fill the form with

digital pen and the data is instantly

transferred to a backend system.

Based on automated and integrated

core systems the initial qualification

can be done to generate credit score

(or through integrated automated

solutions) and share this information

through mobile channel with the

relationship manager. Based on this

important feedback, the relationship

manager can work with the customer

for an optimal solution and also

enable faster on boarding. This can

later also be leveraged for cross-sell

when it is integrated with the backend

Customer Relationship Management

(CRM) system.

Similarly, many banks face the challenge

of translating physical information

into system information. Rather, the

problem arises when backend data

entry operators do not capture all

content from the customer’s physical

form, or capture it incorrectly, into

the system. Through digital pen usage,

such a scenario will not arise as all

physical form data is instantly converted

and stored in the backend system.

Using the digital pen and paper solution,

the typical dissatisfaction factors for

the customer of long waiting times

and revisits for data validation are

addressed, and the relationship manager

is able to better focus efforts on

revenue-generating activities. Making

the ‘Paper-ridden’ process efficient

There are doubts as to whether a

bank can truly be paperless. Processes

are paper-ridden, and the branch

channel continues to be plagued by

inefficiencies leading to higher

turnaround time, increased overheads

and customer satisfaction challenges.

Today banks have centralized many

core operations in Centralised

Processing Centres (CPC) from branches.

Still parts of the processes remain

manual and dependent on multiple

handoffs. Expensive human resources

are spending an exorbitant amount of

time on manual tasks like routing

account opening paperwork on the

field, revisiting customers for error

rectifications in account opening

forms and then there is large scale

duplicate data entry in CPCs leading

to further cost overheads.

Using the digital pen and paper solution,

the data entry tasks are eliminated

and back-office staff time is optimized.

The solution can be adapted to

banks existing flow seamlessly, and

is not a difficult proposition to manage.

While the benefits of electronic processes

may not alleviate all of the pains, the

time and cost efficiencies realized can

help banks maximize returns from

each customer interaction.

The solution works on advanced Hand

Writing Recognition (HWR) that has

high conversion accuracy. Key points

that differentiate the digital pen and

paper technology include –

?

Complete solution for simultaneous

capture of customer data/ signature and

KYC documents including photographs

?

Data transmission is encrypted

?

Data can be electronically signed

by the relationship manager if

required by the bank’s internal policies

?

The form is automatically scanned

for archival needs

?

The form traceability is enforced

(each pen is identified, each

activity is timed)

?

Solution supports any storage

type: xls, csv, relational DB, etc.

?

The solution supports different

data sending methods (Bluetooth,

USB,GPRS/UMTS connection)

?

The solution has multiple validations

built-in and is integrated for

SMS/Fax/FTP/Web services delivery.

USB/bluetooth onto a laptop if at a

branch, or sent to phone via

Bluetooth, if in the field, by checking

the “pidget” on the paper

4 Validation of digitized data is done

on the backend platform and an

XML and/or PDF file version of the

form is created

3 Digital Pen Router runs in

background on the mobile phone

and transmits all the data received

from the pen/scanner to backend

web platform via secured https

5 Post acceptance, the XML and/or

PDF file is sent to the bank`s core

systems/archival system

How secure and reliable is it?

pre-set time). Once the remaining

data is filled in, the solution will

directly integrate the new data with

previously-stored data.

The digital pen is secure and is

securely coupled with a specific

mobile phone. Once the data has

moved to the mobile, the pen memory

is automatically erased. Data

transmission is encrypted and

happens over https for which a

complete audit trail is maintained. In

terms of data conversion accuracy, the

Hand Writing Recognition analyses

each pen stroke and identifies

patterns, then places the character.

Results from a pilot project show that

HWR can reach more than 90%

conversion accuracy. Since HWR is

based on pen strokes instead of the

entire object, it is far more accurate

than Optical Character Recognition.

Moreover, the solution ensures that

customer’s signature is the actual

image captured and cannot be

altered.

Can it support data entry in

draft stage?

Yes, the user can part-fill a form and

store the data under draft stage (for a

What are its running overheads?

The digital pen is rechargeable and its

ink is refillable. The paper used with

the digital pen is normal paper,

printed with a specific pattern.

Which phones/platforms does

it run on?

Accenture Digital Pen Router is a

simple J2ME based application

running on Nokia Smart Phones. A

wide range of mobile platforms are

supported: Symbian, Android and

Blackberry.

Starting with a comprehensive blueprint of existing

processes, the Accenture approach can help reveal

duplication and align strategy, business processes

and IT infrastructure on a wide scale.

Authors

Sanjay Tugnait, Managing Partner,

Financial Services, Accenture India,

Tel: +91 9920166700,

sanjay.tugnait@accenture.com

Mudeita Patrao, Lead Banking and

Capital Markets, Financial Services,

Accenture India, Tel: +91 98 2030

5179,

mudeita.patrao@accenture.com

Rajdeep Saha, Manager Financial

Services, Accenture India, Tel: +91

9769053527,

rajdeep.saha@accenture.com

Madhu Vazirani, Research Lead AsiaPacific Financial Services, Growth &

Strategy, Accenture, Tel: +91

9845817917,

madhu.vazirani@accenture.com

How can Accenture help?

Today banks must achieve the dual

objective of customer centricity and

process efficiency. Digitization holds

the key to simultaneously improving

customer experience and efficiencies.

However managing the interdependencies

between the business processes, the

customer touch points and back-end

systems can be deterring for the bank.

Accenture is helping banks to

understand these dependencies and

make smart decisions in automating

their processes.

Accenture’s Next Generation Branch

offering has many other innovations

which provide significant competitive

edge for the bank which chooses to

differentiate customer experience for

achieving High Performance.

The Digital Pen and Paper

can be demonstrated at

the Accenture Technology

Labs center in Bangalore

or offsite at a location of

your choice

Disclaimer

This Report has been published for

information and illustrative purposes

only and is not intended to serve as

advice of any nature whatsoever. The

information contained and the

references made in this Report is in

good faith, neither Accenture nor any

of its directors, agents or employees

give any warranty of accuracy nor

accepts any liability as a result of

reliance upon the information, advice,

statement or opinion contained in

this Report. This Report also contains

certain information available in public

domain, created and maintained by

private and public organizations.

Accenture does not control or

guarantee the accuracy, relevance,

timelines or completeness of such

information. The reader bears

responsibility for his/her own research

and decisions and should seek

appropriate advice. This report is not

intended to provide specific advice on

any given circumstances. While care

and attention has been exercised in

the preparation of this document, all

warranties and liability, whether

express or implied by statute, law or

otherwise in whatsoever it name it

may be called are hereby disclaimed

and excluded. This Report constitutes

a view as on the date of publication

and is subject to change. Accenture

does not warrant or solicit any kind of

act or omission based on this Report.

Accenture’s role is to integrate the

respective components of the digital

pen and paper solution, implement,

customize, support and manage this

offering as a service and any reference

to the product coincidental.

About Accenture Technology Labs

Accenture Technology Labs, the

technology research and development

(R&D) organization within Accenture,

has turned technology innovation

into business results for over 20 years.

The Labs create a vision of how

technology will shape the future and

invent the next wave of cutting-edge

business solutions. Working closely

with Accenture's global network of

specialists, Accenture Technology Labs

helps clients innovate for competitive

advantage. Labs are located in the

heart of Silicon Valley in San Jose, CA,

with additional offices in Chicago,

Illinois; Washington, D.C.; Sophia

Antipolis, France; Beijing, China and

Bangalore, India. For more

information, please visit our website

at www.accenture.com/accenturetechlabs

Copyright © 2011 Accenture

All rights reserved.

Accenture, its logo, and

High Performance Delivered

are trademarks of Accenture.

About Accenture

Accenture is a global management

consulting, technology services

and outsourcing company, with

more than 215,000 people serving

clients in more than 120 countries.

Combining unparalleled experience,

comprehensive capabilities across

all industries and business functions,

and extensive research on the

world’s most successful companies,

Accenture collaborates with clients

to help them become high-performance

businesses and governments. The

company generated net revenues

of US$21.6 billion for the fiscal

year ended Aug. 31, 2010. Its

home page is www.accenture.com