Economics 313 SAMPLE FINAL EXAMINATION J. Wissink Cornell

advertisement

Economics 313

SAMPLE FINAL EXAMINATION

J. Wissink

Cornell University

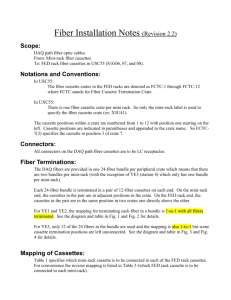

Directions: Answer all questions. Write legibly, concisely, and coherently. Be sure to

label all axes, functions, and variables you use. READ QUESTIONS CAREFULLY.

Draw pictures whenever possible.

Total time for the test is 120 minutes. The point score for each question is equal to

TWICE the amount of time allotted for the question. Maximum points available = 240.

Part I. Short essay: 48 minutes, 12 minutes each; Answer all four.

Answer the question OR do the stated problem OR critically evaluate the following

statements and explain why or in what way the statements are true, false, or uncertain.

1. Recall Abe and Betty and suppose: uAbe = min{2F, 1C} and uBetty = min{1F, 1C}.

Assume there is no production in this "economy" and that Abe and Betty each have 20

units of food and 10 units of clothing.

a. What allocations of food and clothing to Abe and Betty lie on the

contract curve? Illustrate on a carefully labeled Edgeworth box diagram.

b. Represent/transcribe the allocations on the contract curve in/into a

carefully labeled and numbered utility possibility frontier (u.p.f.) diagram.

2. Prove that a profit maximizing simple monopolist would never choose to operate on

the inelastic portion of his/her demand curve.

3. Derive the long-run total cost function for widgets assuming that widgets are produced

with the technology: x = LK assuming the w = price of labor per unit and r = the price of

capital per unit.

4. Derive the price consumption curve for changes in the price of "y" for the utility

function: u = x + y.

Part II. Problems: 72 minutes; 24 minutes each; Answer all three.

1. Mr. Ithaca Video (IV) sells blank video cassettes to Mr. Smith and his kid Ima Brat

Smith. Suppose Mr. Smith's and Ima's demands for cassettes are as follows:

Mr. Smith: xS = 10 - P; Ima: xI = 5 - (½)P.

Suppose IV is a monopolist and his marginal cost is constant and equal to $2 regardless

of who he sells a cassette to and regardless of how many cassettes he sells. He has no

fixed costs. (Notice this implies his total cost function is quite simple: tc = 2X)

a. If IV behaves as a simple profit maximizing monopolist, what price will

he charge per cassette? How many cassettes in total will he sell? How

many cassettes does Mr. Smith buy? How many cassettes does Ima buy?

(Note: graphs are nice, algebra is nice, graphs and algebra are even nicer!)

b. Suppose IV decides to practice third degree price discrimination. How

many cassettes are sold in total? How many cassettes will Mr. Smith buy?

What will he be charged per cassette? How many cassettes will Ima buy?

What will Ima be charged per cassette? (Note: graphs are nice, algebra is

nice, graphs and algebra are even nicer!)

c . Does it pay for IV to price discriminate in this way? Why or why not?

What seems to be true about the own-price elasticities of demand for Ima

and Mr. Smith?

d. Suppose all of a sudden Ms. Cornell Video shows up on the scene so it

is no longer possible for IV to price discriminate. She, too, can produce

cassettes at a constant marginal cost of $2. Find the Cournot-Nash

equilibrium solution; i.e., price (pCN), and quantities (XCN, x1CN, x2CN).

e. Repeat part (d) assuming CV and IV are Bertrand-Nash duopolists.

2. Suppose the following game in matrix form represents a game of profit for Coke and

Jolt colas. They can either charge high or low prices and the payoffs in terms of

profitability are as indicated below.

COKE

JOLT

low

high

low

profit Jolt = 2 , profit Coke = 2

profit Jolt = 5 , profit Coke = 5

high

profit Jolt = 3 , profit Coke = 8

profit Jolt = 4, profit Coke = 7

a. Write down each firm's best response function.

b. Do there exist any dominant strategy equilibria to this game? If so, what

are they? What are the dominant strategy equilibrium outcomes? (That is,

what are the payoffs to the two firms in each of the dominant strategy

equilibria you found?)

c. Do there exist any Nash equilibria to this game? If so, what are they?

What are the Nash equilibrium outcomes? (That is, what are the payoffs to

the two firms in each of the Nash equilibria you found?)

d. Suppose the game were played sequentially, instead of simultaneously.

You are Jolt and can choose whether you would like to "go first" or would

like to be able to observe Coke's decision before moving, i.e., "go second."

Which would you choose and why? Explain explicitly.

3. Loosely speaking, we can say that the three basic questions of Microeconomics What?

How? and For Whom? are answered efficiently by the operation of a market economy.

a. Write down the 1st Fundamental Theorem of Welfare Economics - the

theorem to which the above statement is implicitly referring.

b. Write down the definition of Pareto efficiency.

c. Write down the three conditions that characterize Pareto efficiency in a

2-person; 2-output; 2-input model of an economy.

d. Does the point "E" and allocation "e" in the graph below accurately

depict an efficient allocation in an economy with only 2 factors of

production (K and L), 2 goods (F and C), and two people (A and B)?

Which of the your conditions in part "c" above characterizing efficiency

have or have not been met? Support your answers briefly.

e. Explain how an economy might find itself in such a situation.

Key

PP=Production Possibilities Frontier

UA=A's indifference curve UB=B's indifference curve

OU=A's consumption of F UV=B's consumption of F

OS=A's consumption of C ST=B's consumption of C