OPERATIONS RESEARCH METHODS:

advertisement

OPERATIONS RESEARCH METHODS:

RELATED PRODUCTION, DISTRIBUTION, AND

INVENTORY MANAGEMENT APPLICATIONS

B. D. CRAVEN

University of Melbourne

S. M. N. ISLAM

Victoria University

March 2005

ii

PREFACE

Business managements make daily decisions on many issues, such

as how much and where to produce, for which market, what prices to

set, and how much stock to keep. Mathematical models can help to

make the best decisions, among the possible alternatives.

The objective of this book is to present a survey of selected

Operations Research methods, and some of their applications to

managerial decision making, concerning production, inventory,

distribution, and integrated supply chain modelling. Also included are

listing of some computer programs to compute operations research

models.1

Operations Research (O.R.) has been termed The Science of

Better. A problem in the real world is modelled, usually in mathematical

terms, then mathematical techniques, together with data analysis and

computational algorithms, are applied, in order to find ways to do the

job better. The word Operations derives from the many successful

applications of O.R. to military operations in the 1940s. But, since

then, most O.R. applications have been to peaceful activities, especially

to business management, of which planning industrial production, and

scheduling airlines, and other transportation, have been prominent. The

name Management Science denotes the same discipline, with some

emphasis on business management. Practitioners of Operations

Management will find many of these techniques relevant. The areas of

Logistics, Supply Chain Management, Decision Sciences, and

Manufacturing Management deal with similar applications.2

This book is concerned with O.R. methods. The commencing chapter

(numbered chapter 0 - computers count up from zero) gives a general

discussion of model building, various examples of their applications, and

some discussion of the limitations of some models. It is suggested that

an O.R. practitioner should understand the models and the techniques,

and, while using computers and computer packages extensively, should

not depend on them to decide a model (possibly inappropriate) to use.

Chapter 1 discusses linear programming . As well as the

mathematics, section 1.16 on cost data discusses when such models

are appropriate, and what sort of data must be sought.

Chapter 2 discusses dynamic programming, and several of its many

applications, to capital budgetting and to a rental problem. The effect

of random elements is also considered.

Chapter 3 discusses the critical path method.

Chapter 4 discusses planning over time. This includes discussion of

interest rates and present value, effect of inflation, risk-averse utility,

decision trees and planning over time, and forecasting. A concise

introduction to the use of spreadsheets for such planning and

calculations is given in chapter 9.

Chapter 5 discusses inventory, presenting various versions of

1

Some programs written in FORTRAN AND GAMS are included.

2

See Ragsdale (2001), and Gass and Harris (2001), for various such applications.

iii

economic order quantity, with applications including seasonal demand,

discounting, and the issues that arise when inventory and production

must be managed together, as especially in supply chain management.

Chapter 6 outlines the topic of networks, which often arise in

planning models.

Chapter 7 discusses various methods for nonlinear optimization ,

and lists some of their applications. Although many models are

described by linear equations, nonlinear models are also often needed.

Chapter 8 discusses simulation techniques, with applications to

queue, inventory and storage models, and also to networks models.

Often simulation can obtain results, when no exact formulas are

possible. The discussion of simulation methods, both those based on

events and those planned on a time scale, should enable a user to

understand what a computer package for simulation should be doing,

and perhaps write his own simulation program.

In chapter 9, a number of related computer programs are listed.

For these various methods and applications, the basic methods and

primary applications are presented, together with some reviews of

recent developments.

In comparison with some other books on the methods of Operations

Research, the present book gives a concise account of the methods and

applications. A moderate mathematical background is assumed (some

calculus and matrix algebra). A reader is assumed to want to

understand the methods, and the modelling assumptions made, rather

than leave it all to a computer package. Some aspects that may be

innovative include the following:

• A detailed discussion (in chapter 0) of O.R. modelling, including the

difficulties involved, and various areas of application to real problems.

• A discussion (section 1.16) of cost data, replacing the common

(inadequate) assumption that everything is linear.

• Various topics (in chapter 4) concerning planning over time, i

including discussion of riak-averse utility, and stability analysis.

• Some critical discussion (sections 5.11 and 5.12) of supply chain

models.

• Some critical discussion (sections 7.19 and 7.20) of multiobjective

optimization, and of optimization when the usual convexity

assumptions fail.

This book presents phases and aspects of applied operations

research studies with the emphasis on business, logistics, and operation

management applications. This book includes many examples of

applications of operations research methods in those areas. It can be

used as a text or a reference for a course on operations management

and logistics/supply chain management at the Masters or Doctoral level

and a text for undergraduate students in operations research. It will also

be of importance to corporate executives, academics, practitioners,

and business consultants.

iv

TABLE OF CONTENTS

Chapter 0

Introduction to Operations Research and Applications

0.1 Mathematical models for management

0.2 Some reference books

0.3 Initial example

0.4 Check-list, when setting up an Operations Research model

0.5 Some other examples of Operations Research models

in business

0.6 Importance of model building, and limitations of computers

0.7 Why the name?

0.8 The usefulness of spreadsheets

0.9 Presentation of conclusions and recommendations

6

11

12

12

12

Chapter 1 Linear Programming

1.1 Introduction - management models

1.2 Standard form for a linear program

1.3 Idea of simplex method

1.4 Simplex tableaus

1.5 Information from tableau

1.6 Two-phase method

1.7 Unsigned variables

1.8 Revised simplex method

1.9 Dual linear program

1.10 Dual properties

1.11 Sensitivity

1.12 Dual simplex method

1.13 Jumps in shadow costs

1.14 Integer linear programming

1.15 Transportation problem

1.16 Cost data (piecewise linear cost function)

1.17 Some exercises on linear programming

1.18 Computer input/output for linear programming

1.19 A note on interior-point methods

Appendix: Some theory of linear programming

14

16

16

17

18

19

20

20

22

23

25

25

26

27

29

33

36

40

43

44

Chapter 2

Dynamic Programming

2.1 Introduction

2.2 A routing problem

2.3 Why does this work?

2.4 Forward analysis

2.5 An investment (or capital budgetting) problem

2.6 A model for inventory and production

2.7 A rental problem

2.8 Stochastic inventory

2.9 Some exercises and examples

46

46

47

48

48

49

51

52

53

v

1

2

3

3

Chapter 3

Critical Path Method

3.1 Introduction

3.2 Example of CPM

3.3 Method of calculation

3.4 Example of computer output

3.5 Alternative presentation

3.6 Random variation in time durations

3.7 Exercises

55

55

56

57

58

59

59

Chapter 4

Planning over Time, Uncertainty and Forecasting

4.1 Present value

4.2 Annual cost and rate of return

4.3 Allowing for inflation?

4.4 Different interest rates

4.5 Decision trees

4.6 Risk-averse utility

4.7 Decision tree examples and exercises

4.8 Stability over time

4.9 Indifference curves

4.10 Forecasting and exponential smoothing

61

62

62

63

64

68

69

70

71

72

Chapter 5

Inventory Management

5.1 What is inventory?

5.2 Economic order quantity

5.3 Inventory model for constant sales rates

5.4 Inventory model for variable demand

5.5 Sequencing a number of products

5.6 What stock to carry of a critical component?

5.7 Managing inventory and production together

5.8 Seasonal demand

5.9 Discounted and floor prices

5.10 The newsboy problem

5.11 Supply chain management

5.12 Examples of supply chain models

5.13 Some exercises

74

74

75

76

77

78

78

80

80

81

81

83

85

Chapter 6

Network Planning

6.1 Why networks?

6.2 Idea of out-of-kilter algorithm

6.3 Idea of a shortest-path algorithm

6.4 Idea of Ford-Fulkerson transportation method

6.5 Branch and bound

6.6 Remarks on mixed-integer linear programming

6.7 Job-shop scheduling

6.8 Examples

86

87

88

88

89

92

92

94

Chapter 7

Nonlinear Optimization Methods

7.1 Introduction

95

vi

7.2

7.3

7.4

7.5

7.6

7.7

7.8

7.9

7.10

7.11

7.12

7.13

7.14

7.15

7.16

7.17

7.18

7.19

7.20

Separable programming

Convergence and convergence rate

Lagrange multipliers

Sensitivity

Computing an iterative algorithm

Descent methods

Fletcher-Reeves algorithm

Davidon-Fletcher-Powell (DFP) algorithm

Example

Linesearch

Descent methods and stability

Constrained minimization

Sequential unconstrained minimization technique (SUMT)

Projected gr5dient

Quadratic programming by Wolfe's method

Further comments on constrained mimimization

Multiobjective optimization

Invexity

Some applications of nonlinear programming

95

96

97

99

99

100

101

101

102

103

105

106

107

107

108

109

112

113

114

Chapter 8 Simulation

8.1 Idea of simulation

8.2 Queue and storage models

8.3 Examples of simulation

8.4 Getting pseudorandom numbers

8.5 Some simulation models

8.6 Some other methods and models

115

115

118

120

122

122

Chapter 9 Some Computer Programs

9.1 Remarks on computer programs for O. R. problems

9.2 Using spreadsheets

9.3 Using Excel Solver

9.4 An example of a GAMS package for capital budgetting

125

126

129

131

9.5

9.6

9.7

9.8

9.9

9.10

Introduction to the FORTRAN programming language

A linear programming package lpZSq

Documentation for the linear programming package lpZSq

A FORTRAN program for critical path

A program for one application of dynamic programming

FORTRAN programs to illustrate methods for unconstrained

optimization

Bibliography

133

138

144

147

151

153

160

vii

Chapter 0

INTRODUCTION TO OPERATIONS RESEARCH

AND APPLICATIONS

0.1

Mathematical models for management

A business firm must make decisions on many issues relating to

production, distribution, consumers, shareholders, information

processing, employees, society, pricing etc..These decisions typically

concern production and inventory planning, sales forecasting, capital

budgeting, investment planning, materials requirement planning,

locational decisions, personnel management and planning, pricing,

distribution, management and planning, integrated supply chain or

logistics management and planning, as they affect the several parts of

the firm. These questions are sometimes considered under the heading

of Operations Management.

Business decision making requires the choice of the best decision

among alternatives, or at any rate a decision that gives a substantial

improvement. The objectives may be revenue maximisation, cost

minimisation, satisfactory performance regarding social responsibility,

shareholder value maximisation, etc., or sometimes the survival of the

firm in adverse circumstances. The decisions are constrained by

requirements such as budget and resource constraints. Methods of

Operations Research (O.R.) are well adapted to such decision making in

business. Applications of OR to business management have been

discussed in different disciplines such as Management Science,

Operations Management, Logistics Management, Supply Chain

Management, and Decision Sciences.

In Operations Research, we set up and use mathematical models,

usually related to questions of planning in business, industry, or

management. Any model of a real-life situation must simplify it greatly,

by picking out those factors we think important for our purpose, and

neglecting the rest. Otherwise, we can't calculate, or predict. (Newton

approximated the sun and earth by masses concentrated at points.

This approximation succeeded). We must consider whether we have

we made a right selection. What check or validation is possible?

To put our model in mathematical terms makes us formulate our

ideas precisely - what exactly are we assuming? - and so we are less

likely to make hidden assumptions without knowing it. Moreover, once

we have a model in mathematical terms, we can manipulate it

effectively using concise mathematical language. Also calculations,

using a computer, are more readily set up. The model results provide

useful information for making business decisions.

The factors we recognize, as affecting the situation, consist of (i)

external factors ("exogenous factors"), which we regard as inputs to

the system, and whose effects we shall study, (ii) factors the model

1

tries to explain ("output", "dependent", or "endogenous" factors), and

(iii) factors we shall neglect. For example, if we are hired by a firm to

determine the level of production that will maximize profits, then profit

becomes an "output" for the system, and market factors become the

"inputs". But, for an economist who wants to explain production levels,

profit could be an internal variable (internal to the system being

studied, neither an input nor an output). We should be clear what is the

aim of our investigation. It often falls to the O.R. investigator to clarify

the objective. This involves much discussion with the propounder of the

problem, to find out "where the shoe is really pinching". For example, it

could be irrelevant to optimize a production schedule, if the real

problem is labor relations.

We can fall on our face by neglecting some essential factors. A

century ago, some mathematicians proved that aeroplanes were

impossible; they had neglected the essential "boundary layer", where

viscosity of the air plays an essential role. Likewise, in a business

model, it is possible to omit an essential factor - for example there

may be an upper bound on certain resources, which must not be

forgotten. This course has to present examples from books; however, in

a real-world situation, always go and see for yourself (the factory floor,

or the airport, or whatever) if you possibly can - it is usually different

from what was supposed.

0.2 Some reference books (a few out of the many published.)

The codes <DG> etc. are here for cross-referencing.

Note that a book such as <DG>, which includes discussion of

building suitable models, is of more value to an O.R. practitioner than a

book that mainly presents the computational algorithms. In practice,

the calculations are done on computers; however, one needs some

understanding of the algorithms, otherwise one never knows whether

the computer is producing sense or nonsense.

<DG> H.C. Daellenbach, J.A. George, D.C.. McNickle, 1984 (1st. ed.)

or 1978 (2nd. ed.). Introduction to Operations Research (Allyn &

Bacon).

<a good balance between model building and the mathematics>

<HW> R. Hesse and E. Woolsey, 1980. Applied Management Science

(a quick and dirty approach), (Science Research Associates).

<good for practical " real-world" details of application>

<B+> K.H. Bradshaw and others, 1982. An Operations Research

Casebook (Longman Cheshire).

<the source of many miniproject topics for an O. R. course>

J.C. Ecker and M. Kupferschmid, 1988.Introduction to Operations

Research (Wiley).

<MD> M.J.C. Martin and R.A. Denison, 1971. Case Exercises in

Operations Research ,(Wiley-Interscience)

2

<a good source of many project topics>

E.A. Bender, 1970. An introduction to mathematical modelling

(Wiley/Interscience).

H.A. Taha, 1982. Operations Research (Macmillan).

<better on calculation examples than model building>

B. Srinavasan and C.L. Sandblom, 1989, Quantitative Analysis for

Business Decisions (McGraw-Hill).

<includes some useful examples of decision trees>

<SDK> M. Syslo, N. Deo, J. Kowalik,1983. Discrete Optimization

Algorithms with Pascal Programs, (Prentice-Hall).

<See especially chapter 3: Optimization on Networks>

<WS> R.E.D.Woolsey and H. Swanson, 1969, 1975.Operations

Research for Immediate Application A Quick and Dirty Manual, (Harper &

Row).

<see especially chapters 6 and 7>

<MW> S. Makridakis and S. C. Wheelwright, 1989. Forecasting

Methods for Management (Wiley).

This list is not meant to exclude other, and more recent, textbooks.

Reference may be made to Thompson and Thore (1992), Ragsdale

(2001), and Vollman et al. (2005), listed in the bibliography, for more

examples of O. R. models in management. But it is not recommended

to use a text that is mainly a manual for a particular computer package

(see section 0.6).

0.3 Initial example

Think of a factory, whose running cost (which is to be minimized)

is a function of various production variables (how much do we make of

which product on which machine for which market?), subject to

constraints (limits on material resources, labor, time available, market

requirements). This may (but need not always) reduce to a linear

programming model). Note that we must, later, be specific as to what

we mean by cost. The following check-list (in 0.4) applies specifically

to linear programming models, but also gives general guidance in

setting up other kinds of O.R. models.

0.4 Check-list, when setting up an Operations Research model

The stages of an applied operations research study have been listed

as follows (following Taha, 1992):

a. defining the research or the policy problem

b. developing the operations research model for the relevant

system

c. implementing/solving the model numerically by some suitable

algorithms and computer programs

d. undertaking validation tests of the model and its results

e. analysing the implications of the model results for actions or

decisions related to the issues under the study.

3

A more detailed check-list is as follows:

(1). Find out what the problem really is! It won't come to you packages

in mathematical terms. Ask simple, relevant questions. Go and see for

yourself. "Obvious" assumptions can be wrong.

(2) What are the variables of the problem? What, in fact, can you

vary? If you seek to optimize, what is the objective function? Or are

there several ? Check that the variables relate to the decisions that

must be made. Would they give us enough information to act on? Many

variables cannot be negative. What alternatives are possible?

(3) List the constraints. They often include: input constraints

(restrictions or requirements on raw materials), capacity constraints

(e.g. available machine time, pipeline capacity, storage available, rate

at which a product can be made), materials balance ("what goes in

must come out", e.g. old inventory + production - part used to make

new product = new inventory + deliveries to customers), output

constraints (requirements, or limits, on sales, production, or rate of

return). Check that units of measurement are consistent, or make

them so. (A factory once measured its storage tank capacities in cubic

feet, but its flow rates - inconsistently - in gallons per minute. For

mathematical modelling, the flow rates were converted to cubic feet

per hour - to avoid hopeless confusion. Today, SI units (metres,

kilograms,. etc.) would be preferred).

(4) What data are needed? You may need all your tact to get it! Exact

figures may be unobtainable, or make little sense; maybe get upper and

lower estimates instead. Are the cost figures you get relevant ? If you

are planning production schedules, then likely costs of raw materials

and energy enter; wages may or may not, depending on the time scale

of planning.

(5) Check out a simplified example! So, find any blunders in your

model, or your computer program, before you risk your reputation. And

get quickly a "ballpark estimate" to please the boss ! (Don't be

frightened of a rough "back of envelope" calculation for this limited

purpose - if you can do it quickly !) Do the results make practical

sense? Are the computations, perhaps, only telling you what everyone

in tbe industry has known for twenty years ?

(6) Compute the full model. Often it is better to start from present

operating conditions, and try to improve them, rather than start from

scratch. What can be recommended for action (expressed in practical

4

terms, not mathematical symbols) ? Note the importance of writing a

report, intelligible to management. Don't expect managers to cope with

a schedule of how much to make of which product, if it is expressed as:

x⁄ = 17.5

x‹ = 29.7

and so on !

Instead, tell the, in their language ! Something like:

Daily production schedule

Dinguses

17.5 tonnes

Whatsits

29.7 tonnes

and so on.

(7) Model Validation and Verification.

In Gass and Harris (2001, p. 865), model validation is defined as

the process of determining how well the outputs of a mathematical

model of real-world problem conform to reality. Model validation is

often synonymously used with other terms such as model verification

and model testing. Model validation is one of the important steps of an

O.R. study. In an applied O.R. study, the reliability of the O.R. model and

its results need to be tested. For this purpose, the usual model

validation criteria can be adopted. According to Hazell and Norton

(1986, p. 269) model validation and its purposes are as follows

“"Validation of model is a process that leads to (1) a numerical report

of the models fidelity to the historical data, (2) improvements of the

model as a consequence of imperfect validation, (3) a qualitative

judgment on how reliable the model is for its stated purposes, and (4) a

conclusion (preferably explicit) for the kinds of uses it should not be

used for"

Several criteria can be used to test the validation of a model (see

Gass and Harris, 2001; Labys, 1982; Taha, 1992; Hazell and Norton,

1986) at three levels of validation tests: descriptive, analytical and

experimental. Three different types of validation criteria are applied to

these three levels of validation tests (although 2 types of validations

are suggested in Gass and Harris (2001) which are face validity and

predictive validity) (see Kresge 1980 for further details):

(i) Descriptive validation criteria:

The attainment of the objectives of the model.

The appropriateness of the model structure and the plausibility of

results.

(ii) Analytical validation criteria:

The plausibility and characteristics of models and their results.

The robustness of the results.

(iii) Experimental validation criteria:

Methodological tests of model documentation.

Cost and efficiency in model, storage, transfer and extension.

Tests for accuracy and efficiency of implementation as well as cost

of and efficiency in the software transfer, storage and extension.

5

The above is a detailed set of model validation criteria for O.R.

models. In a real life O.R. study often some simple validation tests are

used (Hazell and Norton, 1986): plausibility of results, and comparisons

of model results with actual or historical results, and other model

results. Also, it is important to compare the model predictions with an

independent set of observations. Those may be observations from a

different time period, from the period whose data were used to

estimate the parameters of the model.

(8) What happens if something changes?

Murphy's law makes sure it does ! How sensitive are your

conclusions to small changes in the data ? (The jargon phrases are

"post-optimality analysis" for linear programming, or (more generally)

"sensitivity analysis".) If your recommendation is very sensitive to a

particular item of data, or a particular assumption, find this out before

it finds you out!

If you calculate a linear programming model, it is seldom good

enough to just present an optimum schedule! Consider also what

happens if some likely things change. For example, a sales target for

some product may have been set; but would it be profitable to increase

it by a few percent, even though the distribution costs would then also

increase ? Also, there may (quite often) be several other schedules,

alternative to the calculated optimum schedule, which are nearly as

good; and sometimes these alternatives should be presented to a

management. They may want to take additional factors into account such as qualitative factors, that could not be included in the

mathematical model.

(9) Try to persuade the management to put your recommendations into

effect. This can be the hardest part ! If they do, observe carefully

what happens. Get some feedback of information. Should your model

then be altered ?

0.5 Some other examples of Operations Research models in business

There will be many such in later chapters. Chapter 1 discusses

various linear programming examples. For the present, consider without going into details - the following additional examples of

Operations Research models in business, including supply chain

questions.

(a ) A management must choose between several plans for future

action. For example, do they start at once to produce their new product

line ? Or do they conduct a market survey first ? That gives them,

hopefully, better information, but runs the risk of letting a competitor

6

get in first. The various possibilities may be shown on a diagram called

a decision tree. In this diagram, a branch divides into two or more

branches whenever the management must take some decision (go

ahead, or not? how much to make?), or whether the external world

decides it for them (the new product sells like hot cakes, or only a few

people want to buy it?) Based on this diagram, some evaluation of

alternative courses of action can be made. Of course, one is

estimating uncertain things (how likely is it that the sales will go up by

50% for the new product?), and such estimates have to be rough. But

one is better off analysing even rough information in a systematic and

quantitative way, than just relying on intuition - or optimism - to put

the picture together. (See Chapter 4)

(b) Planning industrial operations over months or years, as well as

comparing alternatives as in a, needs to be done systematically. A

dollar now is worth more than a dollar at some future date. (Even

without inflation, money can still earn interest.) So one has to discount

future payments or receipts, to an extent depending on the time

interval, to allow for this. One may thus calculate a present value of

operations that will happen gradually over time. A variant of this is to

calculate a (percentage) rate of return - a measuring stick for how

profitable or productive the planned operations will be (see Chapter 4).

Such calculations are often, and usefully, done using a spreadsheet

program on a desktop computer, so that all the relevant figures are

handily displayed, say with years as columns and various kinds of

payments or receipts as rows. This makes it easy to vary some

parameter, such as some interest rate, and see what will happen. Such

a presentation also allows another important aspect, called cash flow,

to be checked. A business must have enough money coming in, from

somewhere, to meet its essential obligations in each year. (A firm may

go bankrupt now, for lack of cash flow this year, even though its

prospects for future years appear bright.)

(c) Network models are often useful. This may describe some actual

network, of pipelines for oil or water, or an electrical or telephone

network, or a network of routes for road transport, whose performance

(and bottlenecks !) must be analysed. However, scheduling problems

can often be described by networks. If a number of tasks have to be

done in a suitable order (you can't put the roof on the building until you

have built some walls !), then a network can describe the scheduling.

Thus, each line (or "pipe", or arc) of the network could represent a

task, and each dot (or "junction", or node) of the network represents a

time of completion. One may then calculate how soon the whole

project could be completed, and which are the "bottlenecks" (see

Chapters 3 and 6).

7

(d) Inventory means things kept in store - whether raw materials, or

products partly made ("in-process inventory"), or completed products.

If the firm has no inventory of raw materials, then an interruption to

supply will stop production - and starting and stopping is expensive

(even, sometimes, disastrous !). If there is no inventory of finished

products, then the customers can't get the products when they need

them (and then do they buy them from another firm ?), or the firm's

production is further disrupted by starting and stopping to match

varying demand for the products. But carrying inventory costs money;

not only do storage facilities, and wages of people to run them, cost

money, but (often, most importantly) the cost of the materials held in

stock has to be borrowed from the bank, and costs bank charges. How

should these conflicting requirements be balanced ? Guesswork usually

gets it wrong ! (Many firms have spent far too much in connection with

inventory, keeping far too much, or far too little.) However,

mathematical models are available, and these things can be calculated

(see Chapter 5).

(e) Rail trucks, carrying raw materials for a factory, come to a goods

yard to be unloaded. Their rate of arrival is somewhat variable; and the

rate at which they can be handled is also somewhat variable. The usual

result is that some queue builds up of trucks, waiting to be unloaded.

That costs money - and the situation is even worse, if the materials are

perishable ! Similar queues arise in many other situations, including

(for example):

Passengers, and baggage, arriving at airline counters;

Telephone calls coming into a telephone exchange;

Waiting to use specialized machines in a factory.

Mathematical models are available for various kinds of queues, if

something is known (or can be measured) about variabilities, as well as

average rates. It is these quantities that make the differences, not

whether the queue is of people or rail trucks or telephone calls. The

mathematics is very close to that for inventories (see Section 8.1).

(f) Many scheduling problems, including some questions of inventory

management, scheduling production and employment, budgetting for

capital expenditure between several projects, have the common (and

awkward) feature that the number of possibilities is very great, far too

many to make a list of them to compare. Suppose that the scheduling

can be put on a time scale (weeks or months, say), or at any rate put in

order (number off the alternative investment projects 1,2,3,...).

Suppose also that the "cost" (maybe actual cost, or some other

quantity such as waste product, to be minimized), adds up over the

different "times". Then a technique called dynamic programming can

8

often be used, to avoid listing an impossible number of possibilities.

Under the "adds up" assumption, one may calculate from each "time"

to the next, instead of listing all possible schedules. Roughly stated, the

production (or whatever) for "today" depends on past history, only to

the extent that it is summed up in the production (or whatever) for

"yesterday" (see Chapter 3).

(g ) The property just stated (not needing to look further back than

"yesterday") may be thought of as a "short memory" property.

(Technically, it is called the Markovian property). This property

happens, quite often, with stochastic systems - those including some

random elements - in particular with many queues, and inventory

systems where (as usual) there is some variability in demand for the

products. Of course, it does not always happen; but, when it does, it

usually makes some calculations possible.

(h) The order of scheduling tasks in a workshop - say, when various

jobs must be scheduled on successive machines - often leads to job

shop scheduling problems, involving integers (in which order should a

list of jobs be done), rather than continuous variables. For some of

these practical problems, there are good techniques; for some others,

there are only rough approximations (see Chapter 6).

(i)

Suppose the yield (ratio of useful output to raw material input)

for some industrial process must be maximized, subject to some

constraints (it is no use blowing up the factory, or making the reaction

vessel freeze solid !). Usually, the functions here are nonlinear, so that

linear programming does not apply. Sometimes, such a problem can be

reformulated, using different variables, to allow linear programming to

be used as an approximation. But, quite often, there is too much

nonlinearity in the problem to allow this simplification. There are a

diversity of methods for calculating such nonlinear problems. Questions

of sensitivity to changes in the data are also important (see Chapter 7).

(j) Optimization is not only about maximizing profit or minimizing cost,

but can, and often should, consider environmental variables as well. For

example, a model may include a constraint which sets an upper bound

to air or water pollution. Or an environmental variable may be

assigned a cost, and included in the cost function that is to be

minimized.

(k) A model for optimal waste management was given by Sahoo, Kim,

Kim, Kraas, and Popov (2005). If only vehicle travel time is minimized,

the model is a mixed integer linear program (MILP). Thus (see Chapter

1 and Section 6.6), the model is described by linear equations, but

9

some of them may only take integer values. A more complicated

version of the model also seeks to minimize the number of vehicles, and

balance the workload. Of course, there must be some compromise

between these different objectives. While there are various computer

programs for MILP, they may not be suitable for this specialized

problem. The authors use several heuristic (approximate) methods,

including a clustering algorithm to generate the initial routes, related to

the travelling salesman problem, and also a simulated annealing method

(see Section 8.4) to improve the result.

(l) Various models for supply chain have been given recently. One, by

de Kok, Janssen, van Donemalen, van Wachem, Clerkx and Peeters

(2005) is cited in section 5.12. The variability of demand increases as

one moves back through the stages of the production process. The

authors propose a model, with linear equations describing inventory.

However, their main concern is to reduce time lags in the planning

process.

Another supply chain model, by Troyer, Smith, Marshall, Yaniv,

Tayur, Barkman, Kaya and Liu (2005), seeks to improve the proportion

of deliveries that are on time, over a network of factories and dealers,

while reducing inventories. Here, inventories must be held at various

places in the network, with appropriate levels of safety stock (see

chapter 5 for what this means for a single inventory). But the demands

must be propagated down the network (see Section 5.11.)

(m) Metty, Harlan, Samelson, Moore, Schnweur, Raskina, Schneur,

Kanner, Potts and Robbins (2005) gave a model for a supplier

negotiation process in the telecommunications industry. This led again

to a MILP model.

Hicks, Madrid, Milligan, Pruneau, Kanaley, Dumas, Lacroix,

Desrisoers and Soumis (2005) gave a MILP model for scheduling the use

of aircraft which are shared between several firms. This model

contained many zero-one variables (taking value 1 when the aircraft is

used for a particular journey, and 0 otherwise). The (heavy)

computational requirement was reduced by partitioning the MILP into

smaller subprograms, having only a few variables in common. So the

problem was handled by optimizing the subprograms, then

improving the values of the common variables, then repeating the

process.

Kuchta, Newman and Topal (2005) gave a MILP model for

scheduling production at an iron mine, to meet demands from the mills

that process it. Here, zero-one variables occur, taking value 1 if a

particular block is mined at a particular time, and otherwise zero.

LeBlanc, Hill, Greenwell and Czesnat (2005) developed a

distribution model, involving different warehouses and shipping

distances, to minimize the total shipping, holding and handling costs,

using a linear programming model.

10

0.6 Importance of model building, and limitations of computers

Any course on Operations Research must detail various standard

models, and methods to analyse and calculate with them. But one must

not impose a standard model on a real-world situation, if it does not fit.

It may well happen that no standard model is of any relevance, to a

particular real situation. One must learn, and be prepared, to set up a

model, to fit the real situation. To practice this, one should also

undertake project work on specific problems.

Most Operations Research investigations involve serious

computation, and many computer packages are available, e.g. for linear

programming. But it is important not to allow an available package to

determine the model to be used. The computer output may be very

misleading if you do not know what model, or assumptions, are built

into the package, or if you do not know, even in outline, what

computational method is being used. Indeed, if a very rough, quick,

pencil-and-paper calculation can be done, it may provide a useful check

(are we out by a factor of ten?), as well as giving some answer to an

impatient boss or client.

One instance of misuse of a computer package was cited by

Greenberg (1987). A factory had a two-year supply of unsaleable red

widgets in its warehouse, and more being made, because the

computer-based production and inventory control system said they

should be made. The system was not documented, to they did not

understand it. Eventually, it was found that an order for blue widgets

had been received, but it was entered by mistake as a large order for

red widgets. This caused a special production order to replenish the

stock of red widgets, and a spurious forecast demand for red widgets,

so even more were called for. The mistaken order was corrected, but

the system did not recover from the mistake.

One source of projects (of moderate size) is An Operations

Research Casebook, by K. H. Bradshaw, D. N. Foster, B. R. Smith, and G.

A. Vignaux (Longman Cheshire, Melbourne, 1982). Many actual

applications of operations research may be found in journals, especially

Journal of the Operational Research Society and Interfaces. However

those in Interfaces are often large models, involving large sets of data

and heavy computation. A student is advised to start on some smaller

models, found in the older literature. A few examples are the following:

K. Kolesar, 1975, Determining the relation between fire engine travel times and

travel distances in New York city, Operations Research 23 (4), 614.

W. T. Ziemba, C. Parkan and R. B rooks-Hill, 1974. Calculation of investment

portfolio with risk-free borrowing and lending, Management Science 21, 209-222.

R. Juseret, Long term optimization of electrical system generation by convex

programming, 1978. Mathematical Programming Study 9, 186-195.

A. Prékopa and T. Szántai, Flood control reservoir system design using stochastic

programming, 1978. Mathematical Programming Study 9, 138-151.

B. D. Craven, Mathematical Programming and Control Theory, 1978. Chapman & Hall,

11

London.

S. K. Singh, A function for size distribution of incomes, 1976. Econometrica 44, 963970.

R. P. O'Neill, M. Williard, B. Wilkins and R. Pike, 1979. A mathematical

programming model for allocation of natural gas, Operations Research 27, 857.

0.7 Why the name ?

Operations Research takes its name from the application of

scientific methods to the planning of military operations, by Britain and

U.S.A., during the 1939-1945 war. However, the ideas and methods

have long since been applied to the arts of peace.

Other names, such as Management Science and Industrial

Engineering, describe very similar disciplines.

0.8 The usefulness of spreadsheets

A spreadsheet program is often useful for data input (e.g. to a

linear programming package, see section 1.18 for an example), or for

data output for presentation, from the computation of an O. R. model.

The basic principles of a spreadsheet are quite simple (see section 9.2),

and the complications (especially graphical presentations) can be

learned later, as and when required.

However, the computational features of spreadsheet programs have

serious limitations, and often more specialized computer programs are

preferable (e.g. programs for linear programming or nonlinear

optimization.)

Moreover, a model that is easy to set up on a spreadsheet may be an

inadequate model. Nothing substitutes for the pencil-and-paper

modelling, before going near the computer.

0.9 Presentation of conclusions and recommendations

It is the responsibility of an Operations Research consultant

(whatever label he/she wears) to present the results intelligibly to the

client, without assuming the client is already familiar with the

technicalities. (It is always the job of a mathematician to explain

himself/herself to the client, rather than the other way about.)

Usually, both a written report and an oral presentation are required.

The following notes relate to a written report, what it should contain,

and how it should be arranged, so as to be acceptable to a business

management.

The layout of a report should be something like the following:

SUMMARY (or OVERVIEW (on a single page; no math

symbols!)

Introduction and objectives

Summary of findings and conclusions

Summary of recommendations (perhaps cross-referenced to

main report)

12

MAIN REPORT

(maximum nine pages)

Problem definition

Method (but relegate math. technicalities to an appendix)

Assumptions made (list assumptions - so that your work is

checkable)

Analysis of data

Findings and conclusions

(some graphical, or

spreadsheet, presentation may be useful)

Recommendations

(some specific things to do)

APPENDICES

(as the problem requires; put here such

things as extensive tables of data, computer output,

mathematical formulation, e.g. of a linear programming

model.)

The stated limitation on the size of the Summary (one page, for

the big boss), and the Main Report (maximum 9 pages), are important.

Do not expect managers to read masses of material! Don't expect them

to read mathematical symbols, when these are not essential! For

example, do not present the results of a linear programming optimization

as x1 = 123.45

, x2 = 17.4 , etc. .

Instead present some table of recommended quantities, with names that

the management will be familiar with, for example:

PRODUCTION SCHEDULE

123.5 tons of Wotsernames,

17.4 tons of Gizmos,

etc (putting in whatever the names of the products really are).

Do not present spurious precision in the conclusions - consider how

accurate the data are! Also, a spreadsheet presentation is often

persuasive.

The names given for headings are not set in concrete; vary them to

suit the topic.

There must be (usually in an appendix) enough relevant mathematical

detail to enable the calculations to be checked, or repeated with some

changes. For example, for a linear programming model, there must be a

list of variables, and the problem description in some form - a data

matrix, maybe on a spreadsheet, can be better than pages of equations.

Note carefully that the data for a real-world problem is often

inadequate (then, often, you must make assumptions, and state clearly

what you have assumed), and may contain items that are irrelevant, or

misleading (you must use some judgement !)

A report must be typed, using any available word processor. You don't

have to use a computer program to do diagrams; graphs can be pasted

in the report. However, spreadsheet programs, such as Excel, have some

useful graphics capability. And the added neatness of graphs done with a

computer program is a selling point, as well as a requirement by journal

editors.

13

Chapter 1

LINEAR PROGRAMMING

1.1 Introduction : management models

To introduce linear programming, consider the following two models.

Model A Allocation of production to machines Six products can be

made on each of two machines.The following tables show, for each

combination of product and machine, the production rate (expressed as

hours per ton) and the cost ($ per ton); also the demand in tons for

each product. Also shown are the variables, x⁄, x¤, ..., chosen to

denote the amount (tons) of each product to be made on each

machine. The hours available are 780 hours on machine 1, and 3077

hours on machine 2. A schedule is required, by which the requirements

can be met at minimum total cost.

Production rate

Product

Product

Product

Product

Product

Product

1

2

3

4

5

6

Cost

Demand

($/ton)

(tons)

Mach.1 Mach.2 Mach.1

.228 .119

36.0

.228 .119

42.4

.231 .132

34.5

.231 .132

41.0

.182 .112

22.1

.182 .112

28.5

Variables (hours/ton)

Mach.2

44.2

36.2

38.4

30.2

21.4

13.4

2929

9420

1655

8978

2989

2977

x⁄

x¤

x‹

x›

xfi

xfl

x‡

x°

x·

x⁄‚

x⁄⁄

x⁄¤

There is a constraint for each product (x⁄ + x‡ = 2929 for the first

product), and a constraint for each machine

(.228x⁄+.228x¤+.231x‹+.231x›+.182xfi+.182xflˆ780 for machine 1);

and all the variables xj are nonnegative. The constraints need to be laid

out tidily in rows and columns (thus as a matrix) - or there will be

confusion, especially when entering data into a computer program.

The use of dots for zeros is unconventional, but helps the eye

considerably. The objective function to be minimized is

36.0x⁄ + 42.4x¤ + ... + 13.4x⁄¤ .

14

x⁄ x¤

1 1

2 .

3 .

4 .

5 .

6 .

7

8

x‹

.

1

.

.

.

.

x›

.

.

1

.

.

.

xfi

.

.

.

1

.

.

xfl

.

.

.

.

1

.

x‡

.

.

.

.

.

1

.228 .228 .231 .231 .182 .182

.

.

.

.

.

.

x°

1

.

.

.

.

.

x· x⁄‚ x⁄⁄ x⁄¤

.

.

.

.

.

1 .

.

.

.

.

1

.

.

.

.

.

1

.

.

.

.

.

1

.

.

.

.

.

1

=2929

=9420

=1655

=8978

=2989

=2977

.

.

.

.

.

.

ˆ 780

.119 .119.132 .132 .112 .112 ˆ3077

Model B The Novelty Company makes Thingos, Dinguses and Whatsits.

Each Thingo takes 1.5 hours to make, and requires 4.5 kg of raw

material I and 950 g of raw material II. Each Dingus takes 4.6 hours to

make, and requires 2.0 kg of raw material I and 100 g of raw material

II. Each Whatsit takes 2.1 hours to make, and requires 11.0 kg of raw

material I and 240 g of raw material II. The net profit (= sale price

minus costs) for each Thingo is $220, for each Dingus is $150, for

each Whatsit is $270. The Company has available 25 hours, 130 kg of

raw material I, and 26 kg of raw material II. What is the maximum

profit they can make, and how do they do it ?

Suppose they make x⁄ Thingos, x¤ Dinguses, and x‹ Thingos.

Then x⁄ ˜ 0, x¤ ˜ 0 and x‹ ˜ 0, since negative amounts have no meaning

here. The restrictions on time, raw material I, and raw material II,

require the following constraints to be satisfied:

1.5x⁄ + 4.6x¤ + 2.1x‹

ˆ 25,

4.5x⁄ + 2.0x¤ + 11.0x‹ ˆ 130,

950x⁄ +100x¤ +240x‹

ˆ26000.

Subject to these constraints, the objective function

220x⁄ + 150x¤ + 270x‹

is to be maximized. So there is a linear programming problem:

Maximize 220x⁄ + 150x¤ + 270x‹

subject to x⁄ ˜ 0, x¤ ˜ 0, x‹ ˜ 0,

1.5x⁄ + 4.6x¤ + 2.1x‹

ˆ 25 ,

.45x⁄ + .20x¤ + 1.10x‹ ˆ 13.0 ,

.95x⁄ +.10x¤ + .24x‹ ˆ 26.0

.

Observe that, in a linear program, the objective function and the

constraint functions are linear, and the veariables are nonnegative .

The constraints may be equalities, ˆ inequalities, or ˜ inequalities.

[Note also , in Model B, that the second and third constraints have been

scaled (multiplying by 0.1 and 0.001 respectively), so as to make the

largest coefficient in each constraint not too far from 1 is absolute

value; this helps the accuracy of computation.]

Linear programming applies to many other situations; other

examples are given in later sections.

15

1.2

Standard form for a linear program

The inequalities are converted to equalities by putting in extra

variables. Thus, in Model B, the inequality1.5x⁄ + 4.6x¤ + 2.1x‹ ˆ 25

becomes 1.5x⁄ + 4.6x¤ + 2.1x‹ + x› = 25,

where x› is a nonnegative slack variable . Thus Model B becomes:

Minimize 220x⁄ + 150x¤ + 270x‹ + 0x› + 0xfi + 0xfl

subject to x⁄, x¤, x‹, x›, xfi, xfl ˜ 0,

1.5x⁄ + 4.6x¤ + 2.1x‹

+ x›

= 25.0 ,

.45x⁄+ .20x¤ + 1.10x‹

+ xfi

= 13.0 ,

.95x⁄ + .10x¤ + .24x‹

+ xfl = 26.0 .

Note that each constraint now has a variable with coefficient 1, that

occurs nowhere else (thus, x› in the first constraint). Thus there is an

initial feasible solution (feasible means satisfying the constraints) x› =

25.0, x› = 13.0, xfl = 26.0, all other xj = 0. (Notice that there are here

just as many nonzero xj (three) as there are constraints.) If the

coefficients in these constraInts are laid out as a matrix, thus

x⁄

1.5

.45

.95

x¤

4.6

.20

.10

x‹

2.1

1.10

.24

x›

1

.

.

xfi

.

1

.

xfl

.

.

1

25

13

26

then this matrix contains a unit matrix (here, columns 4,5,6). This is

necessary in order to start the simplex method - see Section 1.3).

If a model has a ˜ constraint, for example 3x⁄ + 4x¤ ˜ 12, then a

negative slack variable is introduced, to convert to an equality, thus

3x⁄ + 4x¤ - xnegslack = 12. But this is not enough, since a term

with coefficient +1 is needed, to provide the unit matrix. So an

artificial variable is added; thus,

3x⁄ + 4x¤ - xnegslack + xartificial=12.

But xartificial is not part of the original problem; so a penalty cost term

+Mxartificial must be added to the objective function (to be minimized).

Here, M is a large enough positive number, so that minimizing the

objective function will get rid of the artificial variable. Consider now an

equality constraint, say 3x⁄ + 4x¤ = 12. This still needs an artificial

variable (though not a slack variable), thus 3x⁄+4x¤ + xartificial= 12,

with +Mxartificial in the objective function.

This account standardizes on Minimization problems. Maximization

(as in many textbooks) is equally good. Note that MAX 2x⁄ - 3x¤ + 5x‹

is equivalent to MIN -2x⁄ + 2x¤ -+ 5x‹ .Thus, the profit coefficients

-2, 2, -5 are the negatives of the cost coefficients 2, -3, 5 ; and the

z j-cj (see Section 1.4) have opposite sign; and -Mxartificial is added to the

objective being maximized. [Also some books have a different

definition of standard form.]

1.3 Idea of simplex method

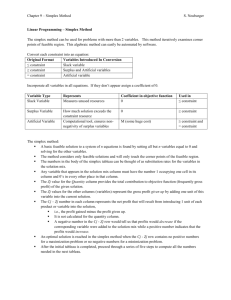

The simplex method is the most widely used algorithm for

computing linear programs. (See also Section 1.19.)

16

Consider the linear program:

C: Minimize 3x⁄ + 4x¤ subject to x⁄˜0, x¤˜0, 2x⁄ + x¤ ˆ 7, x⁄ + x¤ ˜ 5.

Putting this into standard form gives the (initial) tableau :

3

x⁄

2

1

7

Cost coeffts

zj -cj

4

x¤

1

1

6

0

x‹

.

-1

-10

0

x›

1

.

0

10

xfi

.

1

0

Requirement

7

5

50

Multiplier

-.5

-3.5

Note that the cost coefficients (c⁄=3, c¤=4, etc.) are not part of

the tableau; but we need to refer to them. Multiplier and zj-cj are

explained below. Here, x› is a slack variable, x‹ is a negative slack, and

xfi is an artificial variable; M is taken here as 10, for simplicity. (Usually

a much larger number is required, like 10000, to be large enough,

compared to all the other costs in the problem). Columns 4 and 5 give

the required unit matrix.

The constraints solve immediately to give x›=7-2x⁄-2x¤-0x‹ and

xfi=5-x⁄-x¤+x‹. (The variables x› and xfi form the initial basis. Initially

x›=7 and xfi=5, so the objective function f = 0(7)+10(5)=50. ) Now

the objective function equals

f = 3x⁄+4x¤+0x‹+0x›+10xfi = 3x⁄+4x¤+0x‹+10(5-x⁄-x¤+x‹)

= 50 - [ 10(1) -3]x⁄ - [10(1) - 4]x¤ - [10(-1)-0]x‹

= 50 - 7x⁄ - 6x¤ + 10x‹.

[The numbers 7, 6, -10 are zj -cj in the tableau.]

Initially x⁄=x¤=x‹=0 (nonbasic variables). Consider increasing one of

them from zero. The fastest rate of decrease of f is obtained by

increasing x⁄ from zero. How far can x⁄ increase ? From x›=7-2x⁄

˜0and xfi=5-x⁄˜0, there follows x⁄ˆ3.5 and x⁄ˆ5, hence x⁄ is taken as

3.5. The new basis variables are x⁄ (replacing x›) and xfi. [The order

of the basis variables matters.] [Here, the pivot is the element in

column 1 (new basis variable) and row 1 (the first constraint here tells

which variable leaves the basis. Row 1 is here the pivot row.]

It is now required to solve for x⁄ and xfi. Add 0.5 (equation 1) to

equation 2; add -3,5(equation 1) to the zj-cj row); divide the pivot row

(here, row 1) by the 2 (the pivot element). This gives

x⁄ +.5x¤ +.5x› = 3.5 and .5x¤-x‹-.5x›+xfi=1.5.

Solving for the new basis variables, x⁄=3.5-.5x¤-.5x› and

xfi=1.5-.5x¤+x‹+.5x›.

Therefore f = 3x⁄+4x¤+10xfi

=25.5 -[ 3(.5)+10(.5)-4]x¤ -[3(0)+10(-1)-0]x‹ - [3(.5)+10(-.5)-0]x›

=25.5 - 2.5x¤ +10x‹ + 3.5x› ;

so x¤ enters the basis. Then x⁄=3.5-.5x¤˜0 and xfi=1.5-.5x¤˜0, require

that x¤ˆ3.5/.5=7.0 and x¤ˆ1.5/.5=3; so take x¤=3; the pivot is the

second element in column 2. And so on.

1.4 Simplex tableaus

The above calculations are done systematically, using arrays of

numbers, called tableaus. The step from each tableau to the next is

17

called an iteration.

3

x⁄

Tabl.1 2

1

zj -cj 7

Cost coeffts

Tabl.2 1

.

0

Tabl.3 1

.

0

4

x¤

1

1

6

0

x‹

.

-1

-10

0

x›

1

.

0

.5

.5

2.5

.

-1

-10

.5

-.5

-3.5

.

1

0

1

-2

-5

1

-1

-1

10

xfi

.

1

0

Requirement

5

50

.

1

0

3.5

1.5

25.5

-1

2

-5

2

3

18 .

Multiplier

7

-.5

-3.5

-1

-5

In tableau 1, the basis columns are 4 and 5; the cost coefficients are

[c› cfi] = [0 10]. Calculate z⁄-c⁄ =[0 10] ã2õ-3=7;

z¤-c¤=[0 10] ã1õ-4=6;

and so on; note basic zj-cj=0.

Ã1Õ

The largest positive zj-cj is z⁄-c⁄=7; so x⁄ enters the basis. Choose

the smallest nonnegative ratio among 7/2 and 5/1 [look at

requirements column and pivot column; ignore negative ratios, if

present, since they don't stop the variable going positive]. The first

ratio is the smallest, so the first basis variable (x›) is replaced by x⁄.

The pivot is shown in bold.

For rows other than the pivot row, the

multiplier = - (element in pivot column)/(pivot element).

[Thus the multiplier for second row is -(1)/(2). ]

To update the tableau, for rows other than the pivot row:

new element = old element +(row multiplier)(element in same

column and pivot row)

Thus, for row 2 and column 1, 1 ü 1 + (-.5)(1) = .6. The zj-cj row is

updated like any other row. Finally, the pivot row is divided by the

pivot.Thus tableau 2 is obtained. The largest positive zj-cj is z¤-c¤=2.5;

so x¤ enters the basis. The second basis element (xfi) leaves the basis

(consider ratios 3.5/.5 and 1.5/.5).

In the third tableau, all zj-cj are ˆ 0; so an optimum has been

reached. (The numbers zj-cj are called reduced costs.)

1.5 Information from tableau

The optimal solution is x⁄ = 2, x¤ = 3, other xj = 0. Observe that

the unit matrix in the initial tableau consists of columns 4 and 5 (in that

order). The optimal inverse basis matrix then consists of columns 4

and 5 in the optimal tableau. From z›-c›=-1 and zfi-cfi=-5, with c›=0

and cfi=10, obtain z›=-1 and zfi=5. In the optimal tableau, columns 1

and 2 form the unit matrix; columns 1 and 2 in the initial tableau from

18

the optimal basis.

Check that: ã 1 -1õã2 1õ =ã1

0õ and [3 4]ã -1õ = [-1 5]

Ã-1 2ÕÃ1 1Õ Ã0

1Õ

Ã-1 2Õ

i.b.m.

b.m.

Here, [3 4] is the vector of cost coefficients for the optimal basic

variables; and the shadow costs are [z›, zfi] = [-1 5] (see below).

What happens if some requirement is perturbed a little? If the

second requirement 5 is changed to 5+h, then (using the inverse basis

matrix)

ãx⁄ õ =

ã1

-1õã7 õ =ã2- h õ ˜ ã0õ provided hˆ2

Ãx¤ Õ

Ã-1

2ÕÃ5+hÕ Ã3+2hÕ

Ã0Õ

h˜-1.5

So the basic variables x⁄, x¤ stay basic when h varies between -1.5 and

2, although the values change. Within that range, the optimal objective

function equals 3(2-h)+4(3+2h)=18+5h. The number 18 is already

given in the optimal tableau; and 5 is the second shadow cost.

1.6 Two-phase method

So far, a numerical value was given for M. If, instead, M is left as a

symbol, then the zj-cj for the initial tableau for example C (in 1.3) are

M-3, M-4, -M, 0,0, and the initial objective is 5M (instead of 50), with

multiplier -(M-3)/2. The second tableau obtains 0, (M-5)/2,-M, -(M3)/2,0; objective =(3M+21)/2, and multiplier = -(M-5). The third

tableau has

zj-cj as 0, 0, -5, -1, -M+5, and objective 18. This is the

big M method, sometimes used for hand calculation.

An alternative, often used in computer programs for LP, is the

two-phase method. In phase I, M is taken as the unit of cost, and other

numbers considered negligible, so that the cost coefficients become 0,

0, 0, 0, 1, and the initial objective value is 5.

Phase I

Cost coeffts 0

0

0

0

1

x⁄

x¤

x‹

x›

xfi

Requirement Multiplier

Tabl.1 2

1

.

1

.

7

1

1

-1

.

1

5 -.5

zj -cj

1

1

-1

0

0

5 -.5

Tabl.2 1

.

0

.5

.5

.5

.

-1

-1

.5

-.5

- .5

Tabl.3 1

.

z j - cj

0

New zj - cj 0

.

1

0

0

1

-2

0

-5

1

-1

0

-1

.

1

0

3.5

1.5

1.5

-1

2

-1

5

2

3

0

-1

-1

At the end of phase I, the zj-cj are all zero, except artificial columns.

They must be recalculated, using the original costs, for example

19

z‹-c‹= [3

4] ã 1 õ -0 = -5 (using costs 3, 4 for basic x⁄,x¤

Ã-2 Õ

and zero now instead of M )

Here, by coincidence and unusually, all the (new) zj-cj happen to be ˆ 0,

so the optimum has been reached. But usually some (new) zj-cj is > 0,

so a phase II must follow, consisting of one or more simplex iterations.

If the objective function in example C (in 1.3) is changed to x⁄ - x¤,

then the tableaus become

x⁄

x¤ x‹

x› xfi

Requirement

2

1

.

1

.

7

1

1 -1

.

1

5

1

1

-1

.

.

5

1

1

0

-2

.

1

0

.

1

-1

0

1

1

.

0

.

-1

1

-1

X

2

5

0

-5 öRecalculated

After the end of Phase I, the zj - cj row and objective value are

recalculated as shown above, for example

z⁄-c⁄ = [c‹ c¤]

[1] - c⁄ =

[0 -1

[1] -1 = -3 .

[2]

[2]

[Here X is no longer relevant, since the artificial column will ot be put back into the basis.

For comparison, X would be -M-1 for the big M method.] An iteration of Phase II

gives:

1

2

-3

.

1

.

1

.

.

1

1

-1

-1

.

X

2

7

-7

which happens to be optimal, with x⁄=0, x¤=7, and (slack) x‹=2. (Again,

X is not relevant here - although its matrix column is part if the inverse

basis natrix.)

1.7 Unsigned variables

A variable (z say) that is not required to be nonnegative can occur

in a linear program - usually representing the change (up or down) of

a variable from its usual level. To make the simplex method work, z

must be written as z = z⁄ - z¤ with z⁄˜0 and z¤˜0. But z⁄ and z¤ must

not both occur in a basis (3 = 3-0 and -3 = 0-3 okay, not 3 = 4-1).

1.8 Revised simplex method

Usually (see model A for an example) the matrix of coefficients in a

linear program is sparse, meaning that there is a high proportion of

zeros. It then becomes computationally useful to not work with the

whole simplex tableau, but only with part of it - the inverse basis

matrix, with an extra row and column. The revised simplex method thus

saves both data storage and computing time (multiplying uselessly by

zero). But it is then necessary to record separately which variables are

20

in the basis; the whole simplex tableau is no longer available to show it.

Req

Matrix

Col

Mult

Req

50 | 0 10 | 7 | -3.5

7 | 1 . |2 |

5 | .

1 |1 | -.5

Basis x›,xfi

zj - cj =7,6,-10,0,0 ; col 1

Matrix

Col

Mult

25.5 | -3.5 10 | 2.5 | -5

3.5 | 0.5 . | .5 |-1

1.5 | -.5 1 | .5 |

Basis x⁄,xfi

zj - cj =0,2.5,-10,-3.5,0 ; col 2

Req

18

2

3

Matrix

.

| -1 5|

| 1 -1|

| -1 2|

Basis x⁄,x¤

zj - cj =0,0,-5,-1,[-5] ;optimal.

In this calculation, M is taken as 10. The initial objective value,

50, is obtained as in the simplex method; it is convenient here to put

the requirements column at the left. The matrix tabulated is the

inverse basis matrix , so starts with a unit matrix. The top row starts

with the cost coefficients for the initial basis columns.

The revised simplex (unlike the simplex) regularly refers back to

the original data matrix:

x⁄

x¤

x‹

x›

xfi

Requirement

2

1

.

1

.

7

1

1

-1

.

1

5

The cost coefficients are 3,4,0,0,10. To obtain the zj-cj for the first

revised-simplex tableau, use the top row with the columns of the

data matrix. Thus z⁄-c⁄ = [0 10]

ã2 õ - 3 = 7; others are

Ã1 Õ

similar.This shows that column 1 should enter the basis. To

reconstruct column 1 of the simplex, use the inverse basis matrixwith

column 1 of the data matrix :

ã1 0 õã2õ = ã2õ

Ã0 1ÕÃ1Õ Ã1Õ

This column is marked Cols in the above revised-simplex tableau; the 7

at the top is z⁄-c⁄. The pivot is chosen, in this column, as for the

simplex; and the update (of the whole matrix) is done, just as for the

simplex (except that it is a smaller matrix). [For example, 0-(3.5)(1)=-3.5]

In the second revised-simplex tableau, z¤-c¤=[-3.5 10]ã1õ-4= 2.5;

others are similar. Thus x¤ enters the basis.

Ã1Õ

Column 2 of the simplex is reconstructed as ã.5 0õ ã1õ=ã.5õ;note that

the column is got from the data matrix

Ã-.5 1Õ Ã1Õ Ã.5Õ

Considering the ratios 3.5/.5 and 1.5/.5, the first basis variable (x›)

leaves the basis, being replaced by x¤. In the update (for example) the

matrix element 0.5 ü 0.5+(-1)(-.5)=1.

The third tableau is optimal, since all zj-cj are ˆ 0; zfi-cfi (for the

artificial column) is put in [ ], to remind that an artificial column is not

considered for putting back in the basis.

Computer programs for linear programming use the revised simplex

(or some development of it that saves space by storing, not the inverse

matrix itself, but other information from which it can be constructed, or

some other form that is more numerically stable for large LPs), not the

simplex, to save both storage space and time. (Only integer

21

programming needs the full simplex tableau).

Normally, one uses decimals, rather than vulgar fractions otherwise denominators soon get unmanageably large. Note that the

change from simplex to revised simplex, and the change from big M to

two-phase, are separate things; the revised simplex example here used

big M (with M=10 for convenient presentation), but could have used

two-phase instead. Observe also that the calculations work down

columns rather than across rows. For this reason, some computer

programs for linear programming (e.g. Craven's program - see Section

1.19, and the Minos package) enter the matrix data going down

columns (thus not across rows, like equations), and enter only nonzero

matrix elements (and which row they are in). Alternatively, some

programs accept the data in spreadsheet format (see section 4.10);

here also, only nonzero data need be entered.

1.9 Dual linear program

Consider the following linear programs:

Primal program

in matrix language

MIN 3x⁄+4x¤+Mxfi subject to

MIN cTx = [3 4 0 0 M] x

2x⁄+x¤+x› = 7,

(where x = [x⁄, x¤, x‹, x›, xfi]T )

x⁄+x¤-x‹+xfi=5,

ü

subject to

x ˜ 0,

x⁄,x¤,x‹,x›.xfi ˜0

Ax = b,

[Optimum x⁄=2, x¤=3]

where A = ã2 1 . 1 .õ, b=ã7õ .

ï

Ã1 1 -1 . 1Õ

Ã5Õ

ï (rearrange the pieces)

Dual program

ö MAX bTw subject to ATw ˆ cT,

MAX 7w⁄ + 5w¤ subject to

2w⁄+w¤ˆ3, w⁄+w¤ˆ4,

thus MAX [7 5]ãw⁄õ subject to

0w⁄ -1w¤ˆ 0 [so w¤˜0]

à w¤Õ

1w⁄+0w¤ ˆ M, [so w¤ˆM]

[w⁄ w¤]ã2 1 . 1 .õ ˆ [3 4 0 0 M]

ï [Optimum w⁄=-1,w¤=5

Ã1 1 -1 . 1Õ

set z⁄=-w⁄, z¤=w¤

Note that the dual does not

MAX -7z⁄+5z¤ subject to

include a constraint w ˜ 0.

-2z⁄+z¤ˆ3, -z⁄+z¤ˆ4, z⁄˜0, z¤˜0.

Thus, a dual problem can sometimes be usefully rearranged. Note that,

if M is very large, a constraint w¤ ˆ M has no effect.

1.10 Dual properties

I Weak duality If x is feasible for the primal, and w is feasible for the

dual, then cTx ˜ bTw.

Proof cTx - bTw = cTx - wTb = cTx - wTAb = (cT-wTA)x ˜ 0

since each vector has components ˜ 0.

Remark The range of values that the primal objective takes lies

entirely above the range of values that the dual objective takes

(assuming x and w feasible). Suppose that the primal is minimized

as x=x*, and the dual is maximized at w=w*; then cTx* ˜ bTw*.

22

II Zero Duality Gap (ZDG) cTx* = bTw* ; and w* is the vector of

shadow costs for the primal.

Proof In the optimal simplex tableau, denote by Q the inverse

basis matrix, u the vector of basic variables, q the vector of cost

coefficients for them. Then u = Qb; the matrix in the optimal tableau

is QA; the vector of the zj-cj is cTQA-cT, which is ˆ 0 by the

optimality condition. So the vector qTQ of shadow costs is feasible

for the dual. Since (qTQ)b = qTu = cTx*, and no w feasible for the

dual can (by I) have wTb>cTx*, it follows that w*=qTb is optimal for

the dual, and cTx* = bTw*.

III Karush-Kuhn-Tucker conditions (see chapter 7). Necessary

conditions for x* to minimize the primal are that, for Lagrange

multipliers r* ˜ 0 and w*, there hold cT=w*TA + r* and r*Tx* = 0.

Proof In the optimal tableau, xj>0 only for basic xj, and then r*j=cj-zj =0.

So r*j = cj-zj = 0; so r*Tx = 0.

1.11 Sensitivity

It is usually not enough to calculate an optimum to a linear

program; it is also necessary to consider how sensitive the optimum is

to small changes of the data. (Requirements are not all "set in

concrete"; and there can be last-minute changes to data.)

•a

In 1.5, a small change to one requirement is considered; over a

sufficiently small right hand side range (in the example, if the second

requirement lies between 5-1.5 and 5+2), then optimal objective =

original value+(shadow cost)(change in requirement); and the same

basic variables stay optimal. (If more than one requirement changes,

the shadow costs still apply, but the RHS ranges are reduced.)

•b

Consider a change to a cost coefficient.

(a) Change c‹ away from 0. Since x‹ is not in the optimal basis, the

z j are unchanged. So all the zj-cj remain ˆ 0 (still optimal), provided that

z‹-c‹ stays ˆ0. From c‹=0 and z‹-c‹=-5 follows z‹=-5, so now z‹-c‹=5-c‹ˆ0 provided c‹˜-5.

(b) Change c⁄ away from 3. Since x⁄ is basic, the zj are changed; it

is necessary to check all nonbasic zj-cj (except artificials). Thus,

z‹-c‹= [c⁄ 4] ã 1 õ-0=c⁄-8ˆ0 provided c⁄ˆ8. (Hereã 1õ is column 3 of

Ã-2Õ

Ã-2Õ

the optimal tableau in 1.4.) Similarly z›-c›=c⁄-4ˆ0 provided c⁄ˆ4. So

the tableau is still optimal when c⁄ˆ4. (If c⁄ increases above 4, a

further simplex iteration is needed.)

(c) Suppose that both c⁄ and c‹ are both functions of some

parameter r. For a simple example, suppose c⁄=3+r and c¤=4-2r. Then

z‹-c‹ = [3+r 4-2r]ã 1õ-0 = 5-4r ˆ 0 provided r˜5/4; z›-c› = ... .

Ã-2Õ

Such a situation may arise in a profit-maximizing problem, with profit

23

coefficients p⁄ = 30-20 (thus, revenue - variable cost) and p¤ = 85-45

(representing products manufactured) in the objective being

maximized. Suppose that a unit of the first product requires 0.1 kg of a

certain ingredient, and a unit of the second product requires 0.2 kg,

where this ingredient costs $q per kg (currently q = $50, but may

vary). Then

p⁄ = 30 - [.1q+15] and p¤ = 85 - [.2q + 35].

•c Consider the example of 1.4, with requirements changed to 7 and

3.5. (The latter is on a boundary of its RHS range.). The optimal tableau

now becomes:

Tabl.3

1

.

0

.

1

0

1

-2

-5

1

-1

-1

-1

2

-5

3.5

0

25.5

(Note one basic xj is zero.) But there is also another optimal tableau

(got using dual simplex, see 1.12) :

Tabl.3 1

(new) .

0

1

-1

0

-1

2

-3

.

1

0

1

-2

-7

3.5

0

25.5

The shadow costs are different: -1 and 5 for the first tableau, 0 and 3

for the second.

But also the RHS ranges are different, when the

second requirement (b¤) varies: from 3.5 to 5.0 for the first tableau,

from 0 to 3.5 for the second.

If the optimal objective value is

considered as a function of b¤, then this function is piecewise linear

(thus, made up of a finite number of linear pieces), and the slope

changes when b¤=3.5 .

•d Consider adding a new column to the problem . Suppose the

example of 1.3 is modified to:

Minimize 3x⁄+4x¤ (+10xfi)-7xfl subject to all xj˜0, and

2x⁄+x¤+x› +xfl = 7, x⁄+x¤-x‹+xfi -xfl = 5.

(Including slacks x3, x4 and artificial x5).

What would zfl-cfl be for tableau 3 in 1.4 (which was optimal without xfl) ?

This is calculated using the shadow costs, as

zfl-cfl= [-1 5]ã 1õ-(-7) =+1, so no longer optimal. Then the new

Ã-1Õ

column 6 must be calculated, applying the inverse basis matrix,to the

new column, as

ã1 -1õ ã 1õ = ã 2õ . A simplex iteration would then follow.

Ã-1 2Õ Ã-1Õ