Handouts-2014UTC Lesson - Magnetar Youth Investment Academy

advertisement

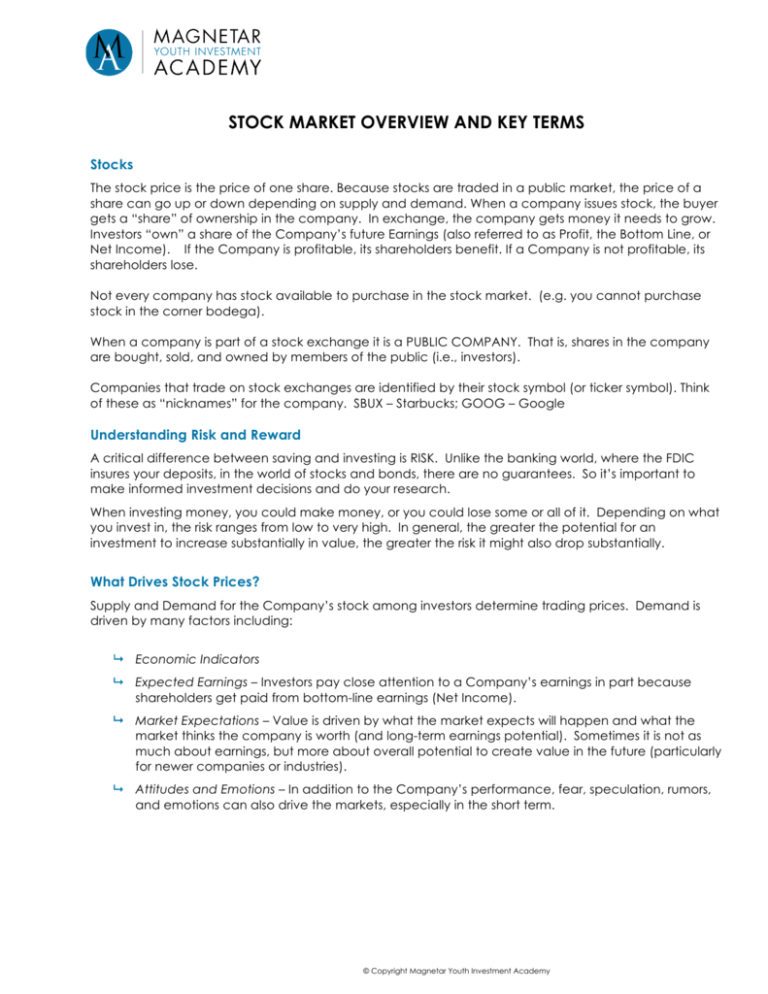

STOCK MARKET OVERVIEW AND KEY TERMS Stocks The stock price is the price of one share. Because stocks are traded in a public market, the price of a share can go up or down depending on supply and demand. When a company issues stock, the buyer gets a “share” of ownership in the company. In exchange, the company gets money it needs to grow. Investors “own” a share of the Company’s future Earnings (also referred to as Profit, the Bottom Line, or Net Income). If the Company is profitable, its shareholders benefit. If a Company is not profitable, its shareholders lose. Not every company has stock available to purchase in the stock market. (e.g. you cannot purchase stock in the corner bodega). When a company is part of a stock exchange it is a PUBLIC COMPANY. That is, shares in the company are bought, sold, and owned by members of the public (i.e., investors). Companies that trade on stock exchanges are identified by their stock symbol (or ticker symbol). Think of these as “nicknames” for the company. SBUX – Starbucks; GOOG – Google Understanding Risk and Reward A critical difference between saving and investing is RISK. Unlike the banking world, where the FDIC insures your deposits, in the world of stocks and bonds, there are no guarantees. So it’s important to make informed investment decisions and do your research. When investing money, you could make money, or you could lose some or all of it. Depending on what you invest in, the risk ranges from low to very high. In general, the greater the potential for an investment to increase substantially in value, the greater the risk it might also drop substantially. What Drives Stock Prices? Supply and Demand for the Company’s stock among investors determine trading prices. Demand is driven by many factors including: 9 Economic Indicators 9 Expected Earnings – Investors pay close attention to a Company’s earnings in part because shareholders get paid from bottom-line earnings (Net Income). 9 Market Expectations – Value is driven by what the market expects will happen and what the market thinks the company is worth (and long-term earnings potential). Sometimes it is not as much about earnings, but more about overall potential to create value in the future (particularly for newer companies or industries). 9 Attitudes and Emotions – In addition to the Company’s performance, fear, speculation, rumors, and emotions can also drive the markets, especially in the short term. © Copyright Magnetar Youth Investment Academy Diversification Diversification means ensuring that you have a mix of different kinds of investments in your portfolio. Diversification is a primary way to reduce risk and maximize profit in a portfolio. Diversification can lower the risk of an investment portfolio because not all industries or stocks move together. For example, within your stock portfolio, it is important to own multiple stocks that are very different from one another. (e.g., investing in Pepsi and Coca-Cola stocks do not achieve optimum diversification. Their businesses are too similar, and their stocks likely move in the same direction at the same time.) Owning multiple investments does not, in itself, mean a portfolio is fully diversified. For example, if you own 20 different technology stocks (even if they are from 20 different tech companies), your portfolio is not necessarily diversified. Other Key Terms Sector Stocks that are grouped into the same sector share many common characteristics. For example, stocks in the Technology sector are characterized by high growth and high volatility (risk). By contrast, the Utility sector is characterized by low growth, and low volatility. Ticker or Stock Symbol Publicly traded companies are assigned an abbreviated form of their name. The reason why these abbreviated names are often referred to as “ticker symbols” is because years ago, it was easier to abbreviate the company name when communicating trades on the hectic trading floor. Stock Portfolio A stock portfolio is a collection of stocks owned by an individual or group. Stocks or Shares Stocks are also commonly referred to as “Shares”. A share is a unit of ownership in a publicly-traded company, a claim on the company’s assets and future earnings. Stock Market & Stock Exchange The stock market is a broad term to describe where stocks are bought and sold. A stock exchange is a regulated marketplace where individuals can trade stocks. In the US, the most dominant stock exchange is the New York Stock Exchange (NYSE) followed closely by the NASDAQ. Portfolio Manager Portfolio Managers “PM” work at a financial services firm and oversee a portfolio of investments for an institution or an individual. © Copyright Magnetar Youth Investment Academy P/E Ratio The Price/Earnings ratio reflects the price of the stock relative to its earnings. A high P/E ratio indicates an “expensive” stock, and a low P/E indicates a “cheaper” stock. The average P/E ratio for the overall market over time has been around 15. Beta Measure of a stock’s risk to the overall market. A beta of one (1) means the stock is as risky as the market, a beta greater than one means it is riskier that the market, and a beta less than one means it is less risky than the overall market. Investors combine high-beta and low-beta stocks to build a diversified portfolio. Earnings Per Share (EPS) The amount of Earnings (Net Income) the company made over the past 12 months, divided by the number of shares the company has outstanding. Volume/Average Volume Trading volume is the total number of shares of that stock that have been traded throughout the day. Average volume is measured over the last 30 days. Market Cap “Market capitalization,” is another way of measuring how much a company is worth. (Calculated by the current value of all its outstanding shares of stock) 52 Week High/Low The highest and lowest prices at which a stock has traded over the past 12 months. Stock Index A stock index is a group or “basket” of selected stocks that are considered to represent a particular sector of the US stock market or the economy. Instead of having to follow the rise and fall of every stock in that particular sector, you can do it almost as effectively by watching the rise and fall of the stock index that represents the sector. Examples of these are the Dow Jones Industrial Average (the DOW) and Standard & Poor’s (S&P) 500 Composite Index. Cyclical Stocks The prices of cyclical stocks tend to move in the same direction as the overall economy. They increase in good times and decrease in recessionary times. When times get tough, consumers tend to pull back on their spending with these companies. When times are good, consumers spend more with these firms. (i.e. cars, travel, clothing) Defensive Stocks The prices of defensive stocks tend not to change dramatically compared to the business cycle. They are steady and reliable even in economic downturns. They are typically companies who sell goods and services that are basic necessities that people cannot go without. (i.e. utilities, food) © Copyright Magnetar Youth Investment Academy