Far-western University Faculty of Management Course No. MGT

advertisement

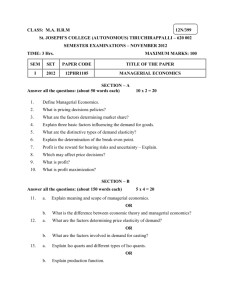

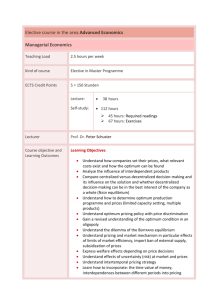

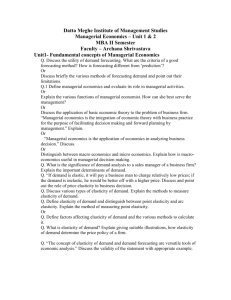

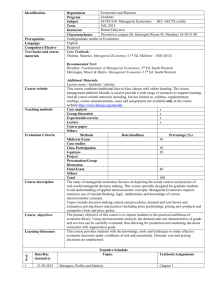

Far-western University Faculty of Management Course No. MGT ECO 511 Course: Managerial Economics Nature of the course: Theory Year: First Level: Graduate Full marks: 100 Pass marks: 45 Total periods: 45 Time per period: 1 hr Program: MBM 1. Course Introduction The main objective of the study is to provide comprehensive knowledge of microeconomics to the MBM students. The course is designed to enhance the capabilities of the students to take economic decisions and make economic predictions. The course also provides a deep foundation for different subjects in management like general management, accounting, finance, and marketing. The course emphasizes on real-world application of economics. It considers case studies, current economic trends and developments from Nepalese and global perspectives. The course intends to develop economic way of thinking in dealing with practical business problems and challenges. The first chapter of the course includes introduction of managerial economics, the second chapter deals with demand analysis, business and economic forecasting while the third one covers the theory of production. The fourth chapter considers costs theory and estimation and fifth one comprises market structures and product pricing. The sixth chapter contains survey of theories of firm and finally the seventh chapter consists of profit, investment and risk analysis. 2. General Objectives To acquaint the learners to build a perspective essential for the application of modern economic concepts precepts, tool and techniques in evaluating business decision. To acquaint the learners of managerial economics and models and their uses to take business decisions. To enable the students to know demand analysis and economic forecasting. To familiarize students with production theories. To enable students to know the cost theories and estimation. To emphasize on market structures and product pricing. To acquaint the learners with profit, investment and risk analysis 3. Specific Objectives and Course Contents Specific Objective Contents Explain about managerial economics. Unit I: Introduction to Managerial Economics (3) Discuss the role of managerial 1.1 Concept, nature and scope of managerial economics economics and economist in 1.2 Role of managerial economists 1.3 Role of managerial economics in business decision business decision making. making Explain and analyze the basic 1.4 Concept of economic models and their uses in concept of economic models and its business decision making uses in business decision making. Define demand function, its meaning and types. Discuss the determinants of demand. Explain and analyze the methods for measurement of elasticity of demand. Discuss the use of elasticity concepts in business decision making. Discuss and explain relationship between revenues and price elasticity of demand. Explain the purpose, steps and significance of forecasting. Discuss and analyze different methods of forecasting. Discuss and explain production function (short run and long run). Explain and analyze optimal employment with one and two variable inputs. Discuss the law of returns to scale. Explain production Possibility curve. Discuss and analyze optimum product mix of a multi –product. Explain and discuss innovation and global competitiveness. Discuss economies of scope Explain the concept of output elasticity. Define explicit and implicit costs, opportunity cost. Discuss and explain short and long run cost function. Derive short-run and long-run cost curve. Derive learning curve. Discuss empirical estimation of cost functions. Explain basic concepts of different market structure. Explain and discuss cartel, price leadership and derive kinked demand curve. Explain cost plus pricing, Unit II: Demand Analysis, Business and Economic Forecasting (8) 2.1.Demand function: Meaning and types 2.2.Determinants of demand 2.3.Elasticity of demand: Measurement and determinants of price, income, cross and sales elasticity's and their uses in business decision making 2.4.Relationship between revenues and price elasticity of demand 2.5.Purpose, steps and significance of forecasting 2.6.Methods of forecasting 2.6.1 Qualitative forecasts: Survey techniques 2.6.2 Quantitative forecasts: Time series analysis, trend projection method and seasonal variation 2.6.3 Smoothing techniques: Moving averages and exponential smoothing 2.6.4 Simple regression model, input-output model (Simple numerical examples) Unit III: Theory of Production (7) 3.1.Production Function (Short run and long run), Cobb Douglas production function 3.2.Optimal employment of one variable input 3.3.Optimal employment of two variable input 3.4.Returns to scale 3.5.Production possibility curve 3.6.Optimum product mix of a multi-product 3.7.Economies of Scale: Innovations and global competitiveness 3.8.Economies of scope 3.9.Concept of output elasticity ( Simple numerical examples) Unit IV: Cost Theory and Estimation (8) 4.1. Nature of costs: Explicit and implicit costs, opportunity cost 4.2. Cost functions: Short run and long run 4.3. Derivation of short run cost curves 4.4. Derivation of long run cost curves 4.5. Derivation of learning curve/empirical cost curve 4.6. Empirical estimation of short and long term cost functions (Simple numerical examples) Unit V: Market Structures and Product Pricing (9) 5.1. Concept of different market structures (Perfect competition, monopoly, monopolistic competition, oligopoly) 5.2. Pricing under oligopoly: Cartel, price leadership and kinked demand curve model Incremental cost pricing, multiple 5.3. Pricing strategies and policies: Cost plus pricing, product pricing, transfer pricing, incremental cost pricing, multiple product pricing, peak-load pricing, skimming pricing, transfer pricing, peak-load pricing, skimming penetration pricing. pricing, penetration pricing 5.4. Strategic behavior and game theory: Nash Discuss and explain basic elements equilibrium, Prisoner's dilemma of game theory. (Simple numerical examples) (7) Discuss and explain profit Unit VI: Survey of Theories of Firm 6.1. Profit maximization model maximization, value maximization 6.2. Value maximization model and sales maximization model. Explain theory of Satisfying, 6.3. Sales maximization model Williamson's model, Marris model, 6.4. Theory of satisfying Cyert and March Behavioral theory. 6.5. Williamson's model of managerial discretion 6.6. Marris model of managerial enterprise 6.7. Cyert and March behavioral theory (Simple numerical examples) Discuss and compare accounting and Unit VII: Profit, Investment and Risk Analysis (8) 7.1. Accounting profit vs. economic profit economic profit. Analyze cost-volume profit and 7.2. Cost-volume profit analysis and operating leverage 7.3. Meaning and factors influencing investment operating leverage. decision Explain and discuss the meaning and 7.4. Risk Analysis: Risk and uncertainty in managerial factors influencing investment decision making, measuring risk with probability decision. distributions, utility and risk aversion Discuss risk and uncertainty in 7.5. Information and risk: Asymmetric information and managerial decision making. markets for lemons, insurance market and adverse Analyze and measure risk with selection, problem of moral hazard probability distributions, utility and (Simple numerical examples) risk aversion. Explain asymmetric information, markets for lemons, insurance market and adverse selection. Discuss the problem of moral hazard. 6. Prescribed Books Text books Dwivedi, D. N. (2008). Managerial Economics, 7th Edition, Vikash Publishing House PVT LTD. Hirschey, Mark (2009). Fundamentals of Managerial Economics, 9th Edition, Cengage Learning Salvatore, D. (2012). Managerial Economics Principles and Worldwide Application, 7th Edition, Oxford University Press. Petersen, Craig H., Lewis, W Cris, Jain, Sudhir K. (2009). Managerial Economics, 4th Edition, Indian Institute of Technology, Delhi. Reference books Mankiw, N. G. (2011), Principles of Microeconomics. Sixth Edition, USA: South Western College publication. P. Robert S., R. Daniel L., M. Prem L. (2012). Microeconomics, 7th Edition, Published by Dorling Kindersley (India) Pvt. Ltd. Dwivedi, D. N. (2012 ). Microeconomics, Theory and Application, 2nd Edition, Dorling Kindersley (India) Pvt. Ltd. Chandra, P. (2002), Project Planning, Analysis Financing, Implementation and Review, New Delhi, Tata McGraw- Hill Publishing Company Limited.