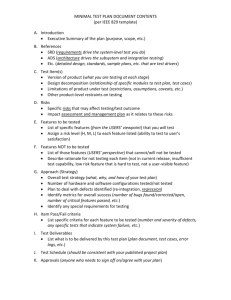

Understanding Movements in Aggregate and Product

advertisement