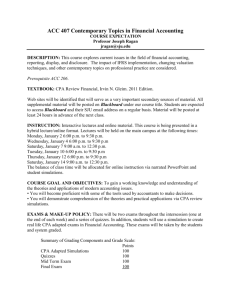

CPA Exam Basics Dribble Template

advertisement

CPA EXAM BASICS CONTENTS 03 INTRO: Let’s Get Started 04 CHAPTER 1: The Four Parts of the CPA Exam 08 CHAPTER 2: Types of Questions on the CPA Exam 11 CHAPTER 3: Pass Rates & Passing Score 13 CHAPTER 4: Educational Requirements & CPA Exam Checklist INTRODUCTION You’re close to completing your education in accounting or have already been working in the industry for a couple of years. Regardless of your situation, you’re ready to take the next big step toward your accounting career and become a CPA. Hurray! You’re in the right place! This eBook is designed to provide you with a basic overview of the CPA Exam. We’ll answer questions like what to expect on the exam, how to apply for the exam, and how to get started on the CPA Exam journey. And, as always, if you still have questions after reading through the material, our Customer Care Team is just a phone call away! They can be reached at 877-764-4272. CHAPTER 1 THE FOUR PARTS OF THE CPA EXAM EXAM STRUCTURE AUDITING & ATTESTATION (AUD) 4 hrs FINANCIAL ACCOUNTING & REPORTING (FAR) 4 hrs REGULATION (REG) 3 hrs BUSINESS ENVIRONMENT & CONCEPTS (BEC) 3 hrs The CPA Exam requires a total of 14 hours to complete and is administered by the American Institute of Certified Public Accountants (AICPA). CPA candidates must pass a total of four sections with a score of 75 or higher within an 18 month rolling window. The CPA Exam is broken down into the following sections: • 90 questions & 7 task-based simulations • Topics include: Standards, Planning & Evidence, Internal Controls, Reports, Compilations & Reviews • 90 questions & 7 task-based simulations • Topics include: Business Enterprises, Governmental Entities, Not-for-Profit Organizations • 72 questions & 6 task-based simulations • Topics include: Ethics, Professional & Legal Responsibilities, Business Law, Federal Taxation • 72 questions & 3 written communications • Topics include: Corporate Governance, Economic Concepts, Financial Risk Management, Information Systems, Strategic Planning, Operations Mgmt. CONTENT AUD 12-16%: Engagement Acceptance & Understanding the Assignment 16-20%: Understanding the Entity & its Environment (including internal control) 16-20%: Performing Audit Procedures & Evaluating Evidence FAR 17-23%: Conceptual Framework, Standards, Standard Setting, & Presentation of Financial Statements 27-33%: Financial Statement Accounts: Recognition, Measurement, Valuation, Calculation, Presentation, & Disclosures 16-20%: Evaluating Audit Findings, Communications, & Reporting 27-33%: Specific Transactions, Events & Disclosures: Recognition, Measurement, Valuation, Calculation, Presentation, & Disclosures 12-16%: Accounting & Review Services Engagements 8-12%: Governmental Accounting & Reporting 16-20%: Professional Responsibilities 8-12%: Not-for-Profit (Nongovernmental) Accounting & Reporting REG BEC 15-19%: Ethics, Professional, & Legal Responsibilities 16-20%: Corporate Governance 17-21%: Business Law 16-20%: Economic Concepts & Analysis 11-15%: Federal Tax Process, Procedures, Accounting, & Planning 15-19%: Information Systems & Communications 12-16%: Federal Taxation of Property Transactions 10-14%: Strategic Planning 13-19%: Federal Taxation of Individuals 12-16%: Operations Management 18-24%: Federal Taxation of Entities WHAT TO EXPECT ON AUD, FAR, & REG ON THE DAY OF THE EXAM START EXAM MULTIPLE CHOICE TESTLET #1 MULTIPLE CHOICE TESTLET #2 MULTIPLE CHOICE TESTLET #3 • Once you enter the Prometric Testing Center, you’ll register and then find a seat in front of an open computer. • After you log onto the computer and accept the terms and conditions, your testing time will begin. • Once you begin your exam, you will enter M/C Testlet #1. • The clock will begin counting down the minutes that you have left to take the exam. • Once you’ve finished answering all the questions, you’ll move to Testlet #2. • Keep in mind that once you’ve advanced a Testlet, you cannot go back to the previous Testlet. • You will have the ability to mark questions for review and move around within each Testlet. • Once you move forward into a new section, you cannot go back and change your answers. • When Testlet #3 is complete, you will move onto the Task-Based Simulations. • AUD & FAR have 7 Task-Based Simulations. TASKBASED SIMULATIONS • REG has 6 Task-Based Simulations. • 1 question will be pretested. • 1 Task-Based Simulation will be research based. • Each Task-Based Simulation is worth 6 to 7 points. WHAT TO EXPECT ON BEC THE DAY OF THE EXAM START EXAM MULTIPLE CHOICE TESTLET #1 MULTIPLE CHOICE TESTLET #2 MULTIPLE CHOICE TESTLET #3 WRITTEN COMMUNICATION • Once you enter the Prometric Testing Center, you’ll register and then find a seat in front of an empty computer. • After you log onto the computer and accept the terms and conditions, your testing time will begin. • Once you begin your exam, you will enter M/C Testlet #1. • The clock will begin counting down the minutes that you have left to take the exam. • Once you’re finished answering all of the questions, you’ll move to Testlet #2. • Keep in mind that once you’ve advanced a Testlet, you cannot go back to the previous Testlet. • You will have the ability to mark questions for review and move around within each Testlet. • Once you’re finished answering all of the questions, you’ll move to Testlet #3. • When Testlet #3 is complete, you will move on to the Written Communication section. • 3 questions total. • Written Communication tests you on your ability to explain a concept. CHAPTER 2 TYPES OF QUESTIONS ON THE CPA EXAM TYPES OF QUESTIONS ON THE CPA EXAM ? Multiple Choice Task-Based Simulations Task-based simulations (TBS) are case studies that allow candidates to demonstrate their knowledge and skills by generating responses to questions rather than simply selecting the correct answer. The majority of questions on the CPA Exam are Multiple Choice Questions (MCQs). • ANSWER ALL OF THE QUESTIONS, EVEN IF IT IS JUST A GUESS. THERE IS NO “GUESSING PENALTY,” MEANING YOU ARE NOT DOCKED FOR WRONG ANSWERS; ONLY REWARDED FOR CORRECT. • FAR AND AUD BOTH HAVE 90 MCQS. • REG AND BEC HAVE 72 MCQS. • TASK-BASED SIMULATIONS TYPICALLY REQUIRE CANDIDATES TO USE SPREADSHEETS AND/OR RESEARCH AUTHORITATIVE LITERATURE PROVIDED IN THE EXAM. • FAR AND AUD BOTH HAVE 7 TBS. REG HAS 6. BEC HAS 0. • REMEMBER THAT ONE OF THE TASKBASED SIMULATIONS ON EACH SECTION IS PRE-TESTED. THIS MEANS THAT IT WILL NOT COUNT TOWARD YOUR FINAL SCORE; HOWEVER, KEEP IN MIND THAT YOU WON’T KNOW WHICH QUESTIONS ARE PRE-TESTED, SO ANSWER ALL QUESTIONS ACCORDINGLY. Written Communication The written communication (WC) questions are designed to test your writing skills as well as your ability to understand and explain a concept. • YOUR ANSWERS WILL BE IN MEMO-STYLE FORMAT, WITH A BEGINNING, MIDDLE, AND END. • BE SURE TO CHECK FOR SPELLING AND GRAMMAR MISTAKES. • THERE ARE 3 QUESTIONS IN THE WRITTEN COMMUNICATION SECTION, ONE OF WHICH IS PRE-TESTED. HOW ARE THE QUESTIONS & SECTIONS WEIGHTED IN SCORING? 15% WC 40% TBS 60% MCQ 85% MCQ AUD, FAR, REG the taskFor AUD, FAR, & REG, tions based simulation questa hile the comprise 40% of the to nsl w comprise multiple choice questio n 60%. For BEC, the writte accounts communication portion le the for 15% of the total whi unt multiple choice questions acco for 85%. . BEC SAMPLE MULTIPLE CHOICE QUESTION Countdown clock Click on a number to see what question is ahead SAMPLE TASKBASED SIMULATION Customize your view You may be filling out a form Fill out the orange boxes SAMPLE TASKBASED SIMULATION Research question. Find your answers in the authoritative literature Fill in the appropriate answer SAMPLE TASKBASED SIMULATION Search by topic to find the information that you’re looking for within the literature Search terms are highlighted SAMPLE WRITTEN COMMUNICATION WC questions are checked for relevancy to the question asked WC questions are to be answered in a memostyle format Includes a spell checker, but not a grammar checker CHAPTER 3 PASS RATES & PASSING SCORE WHAT DOES IT TAKE TO PASS? DID YOU KNOW? 50% Less than of candidates taking the CPA Exam pass on their first try. The CPA Exam is 75 considered to be one of the most difficult of all professional licensing exams! THE GOOD NEWS IS... 88% OF ROGER STUDENTS PASS ON THEIR FIRST TRY! CHAPTER 4 EDUCATION & CPA EXAM CHECKLIST EDUCATIONAL REQUIREMENTS In order to sit for the CPA Exam, you must meet certain educational requirements. Requirements vary state-by-state, but typically, 150 semester hours/225 quarter units total. In many states, educational hours may be in business (24 semester hours) and accounting (24-36 semester hours). However, having an accounting degree isn’t always necessary or required. It’s important to contact your State Board of Accountancy for the most up-to-date CPA requirements. CPA EXAM CHECKLIST FOLLOW THIS ROADMAP For step-bystep guidance on how to qualify and sit for the CPA Exam. WHY CHOOSE ROGER CPA REVIEW At Roger CPA Review, our mission goes beyond seeing our students pass the CPA Exam— that’s a given. We believe the key to success is enjoying what you do, and are therefore dedicated to providing the most intuitive and engaging learning system that simultaneously delivers results and enjoyment. We motivate and inspire our students every step of the way, and continuously perfect our study tools to foster a preparation process that is Efficient, Effective, and–most importantly-Enjoyable. LEARN Plain and simple, we teach our students. Before diving into practice questions, it is essential that students first learn and understand the concepts. With the guidance of the industry’s top CPA Exam experts, we have created a proven system to help students learn and retain the concepts necessary to pass the CPA Exam. PRACTICE To solidify the concepts, it is important for students to apply what they’ve learned to actual AICPA questions via a system that simulates the computer-based CPA Exam. To help achieve this goal, each student has access to the Interactive Practice Questions from their online course. SUPPORT We provide support and guidance every step of the way to foster the most Efficient, Effective and— most importantly— Enjoyable learning process. LEARN Fully integrated Micro-Lessons Each of the four CPA Exam sections include a corresponding physical and online textbook. As the foundational curriculum for the entire course, textbooks are constructed by the editorial team, led by the profession’s top CPA Exam powerhouses, Roger Philipp, CPA, CGMA (Author, Instructor) and Mark Dauberman, CPA, EMBA (Senior Editor), pooling over 65 years of experience. Textbooks are written in a simplified format that gets straight to the point, eliminating any unnecessary theoretical jargon. We provide exactly what is needed to pass the CPA Exam, and never confuse students with optional chapters. The Most Focused, Dynamic Instructional Lectures The full course includes over 100 hours of lecture taught by the industry’s top CPA Exam instructor, Roger Philipp, CPA, CGMA. For over 25 years, Roger’s highly motivating teaching style has kept students engaged in their studies, and focused on exactly what they need to know to pass the CPA Exam. He is renowned for breaking down difficult CPA Exam topics into simplified concepts, and his memory aids and mnemonics help students retain this information in a fun and easy way. E-Textbooks & Physical Course Textbooks Written by CPA Exam Experts The course is broken down into lessons delivered with a micro-learning structure. Each lesson incorporates a 10-25 minute video lecture, a short section from the course textbook, and corresponding class questions. This efficient format allows for easier consumption and retention of concepts. Purposeful Online Learning Tools The entire course is delivered via an interactive system, integrating purposeful tools to enhance each student’s learning experience. For example, every student learns at their own pace. Therefore, we have included the ability to adjust the actual speed of the video lectures, along with the option to turn on Closed Captioning for increased comprehension. Furthermore, students can insert video bookmarks, take online notes and even highlight their E-textbooks. All learning tools have been tested and proven to help students retain more information with optimum efficiency. PRACTICE 4,000+ AICPA Released Multiple Choice Questions & Task-Based Simulations Practice makes perfect, and we provide students with a bank of over 4,000 questions to do so. Questions have been provided by the AICPA, the actual writers of the CPA Exam. This ensures students are testing themselves with questions that emulate real CPA Exam questions. Expert Written Solutions While the base questions come from the AICPA, our team of CPA Exam Experts provide full solutions. These solutions include thorough and easy to understand explanations to why each answer is correct or incorrect, helping the students get to the root of their topic comprehension. Practice by Chapter with Full Practice Exams The Interactive Practice Questions system is designed so that students can customize their practice by individual chapters, multiple chapters or full practice exams. This allows students to start with more focused sessions, and move into testing themselves over a broader spectrum as they approach their exam. Questions are delivered in a format that simulates the CPA Exam, so there are no surprises on exam day. Diagnostic Reports As students work through their Interactive Practice Questions, the system keeps track of their scores on individual quizzes, as well as within each chapter. This allows students to always have a firm understanding of their strengths and weaknesses, guiding the focus of their studies and their final review leading up to the exam. SUPPORT Customizable Study Planners Research shows that students who have a solid plan, and stick to it, are more likely to succeed on the exam. Therefore, each student will have access to 3, 6, 9 or 12 months study planners that can be customized to meet their individual scheduling needs. In these planners, the entire course is mapped out, including specific lectures, textbook chapters and practice question sessions. Also incorporated are days off, final review and suggested days for exam scheduling. This keeps students on track with their studies, and encourages overall accountability. Progress Assessment Tools Many students become overwhelmed by the sheer amount of information to learn for the CPA Exam. A great tip for these students is to always have a strong grasp of where they are in their studies. To help, we provide several Progress Assessment Tools. Students will always be able to monitor how far they have progressed in each course section, each chapter and each topic. They can furthermore countdown the days to their exam by simply plugging in their scheduled exam day. Personal Trainer The CPA Exam can be a daunting task….but it doesn’t have to be! The Personal Trainer delivers tips, tricks and motivational encouragement directly to each student’s inbox. Because this feature is tied directly to the individual student’s course, they will receive tailored information based on their own progress. For many students, this is the extra boost of motivation they need to reach the finish line! Homework Help Center At times, some students may find specific topics exceptionally difficult. This is understandable, as the CPA Exam is no easy task! For this reason, each student has free, unlimited access to the Homework Help Center. This 24/7 online forum is a platform for students to ask questions and receive guidance from expert CPAs as they progress through their studies. “IF YOU STUDY, YOU WILL PASS.”