ACC 407 Contemporary Topics in Financial Accounting

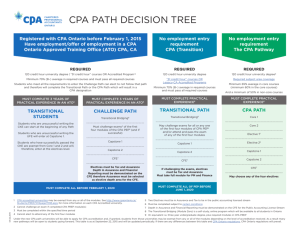

advertisement

ACC 407 Contemporary Topics in Financial Accounting COURSE EXPECTATION Professor Joseph Ragan jragan@sju.edu DESCRIPTION: This course explores current issues in the field of financial accounting, reporting, display, and disclosure. The impact of IFRS implementation, changing valuation techniques, and other contemporary topics on professional practice are considered. Prerequisite ACC 206. TEXTBOOK: CPA Review Financial, Irvin N. Gleim. 2011 Edition. Web sites will be identified that will serve as a very important secondary sources of material. All supplemental material will be posted on Blackboard under our course title. Students are expected to access Blackboard and their SJU email address on a regular basis. Material will be posted at least 24 hours in advance of the next class. INSTRUCTION: Interactive lectures and online material. This course is being presented in a hybrid lecture/online format. Lectures will be held on the main campus at the following times: Monday, January 2 6:00 p.m. to 9:30 p.m. Wednesday, January 4 6:00 p.m. to 9:30 p.m Saturday, January 7 9:00 a.m. to 12:30 p.m. Tuesday, January 10 6:00 p.m. to 9:30 p.m Thursday, January 12 6:00 p.m. to 9:30 p.m Saturday, January 14 9:00 a.m. to 12:30 p.m. The balance of class time will be allocated for online instruction via narrated PowerPoint and student simulations. COURSE GOAL AND OBJECTIVES: To gain a working knowledge and understanding of the theories and applications of modern accounting issues. • You will become proficient with some of the tools used by accountants to make decisions. • You will demonstrate comprehension of the theories and practical applications via CPA review simulations. EXAMS & MAKE-UP POLICY: There will be two exams throughout the intersession (one at the end of each week) and a series of quizzes. In addition, students will use a simulation to create real life CPA adapted exams in Financial Accounting. These exams will be taken by the students and system graded. Summary of Grading Components and Grade Scale: Points CPA Adapted Simulations 100 Quizzes 100 Mid Term Exam 100 Final Exam 100 Total Points 400 Final letter grades will be determined on a standard scale where: A AB+ B BC+ C CD+ D DF = = = = = = = = = = = 372 to 400 points 360 to 371 points 348 to 359 points 332 to 347 points 320 to 331 points 308 to 319 points 292 to 307 points 280 to 291 points 268 to 279 points 252 to 267 points 240 to 251 points Below 240 points WHAT WILL I LEARN? In addition to its many topics, this will teach you a lot about professional judgments in accounting. It is specifically designed around topics that have significant profile on the CPA Exam. We look not only at those topics but also in efficient solutions using technology. Please note that I will be willing to give you any extra help throughout the semester, as you may need. Plan to spend 2-3 hours of study between each class. I mean about 2-3 legitimate hours between each class. The biggest problem creating low grades in this class is inadequate preparation before class. Participation in class is also important. Students should come to class having read material to be covered during class. Class attendance will be taken. ACADEMIC INTEGRITY: Examinations: All examinations must be the exclusive work of the individual student. Penalty for academic integrity violations: University-recommended sanctions for academic integrity violations will be imposed. All academic integrity violations will be reported to the Office for Student Life. Cheating or plagiarism will result in failure in the course. STUDENTS WITH DISSABILITIES: In accordance with state and federal laws, the University will make reasonable accommodations for students with documented disabilities. For those who have or think that you may have a disability requiring an accommodation (learning, physical, psychological) should contact Services for Students with Disabilities, Room G10, Bellarmine, 610-660-1774 (voice) or 610660-1620 (TTY) as early as possible in the semester for additional information and so that an accommodation, if appropriate, can be made in a timely manner. You will be required to provide current (within 3 years) documentation of the disability. For a more detailed explanation of the University’s accommodation process, as well as the programs and services offered to students with disabilities, please go to www.sju.edu/studentlife/studentresources/sess/ssd. If you have any difficulty accessing the information on-line, please contact Services for Students with Disabilities at the telephone numbers above. TOPICS COVERED WITHIN THIS COURSE: I. II. III. IV. V. VI. VII. VIII. IX. X. XI. XII. Financial reporting environment Financial statements Income statement items Financial statement disclosure Cash and investments Receivables Inventories Property, plant, equipment, & intangible assets Payables Stockholders equity & business combinations Governmental accounting Non-for-profit accounting & reporting