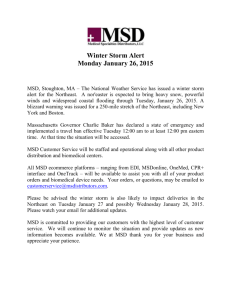

IU Health Plans - MSD of Wayne Township

advertisement