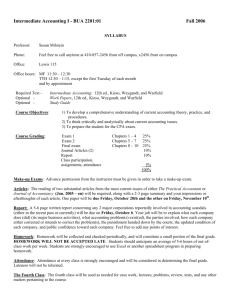

Accounting: Goodwill & Intangible Assets Assignment Table

advertisement