adjusting entry

advertisement

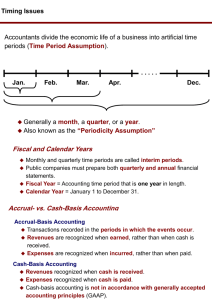

Chapter 5 Accrual Adjustments and Financial Statement Preparation Revenue recognition Matching expenses to revenues Expenses related to periods 1 The Measurement of Income z z z major function of accounting Ö to monitor business performance one important way of doing it – measuring and reporting a company‘s net income Net income = revenues – expenses Revenues: Value retrieved in exchange for goods sold or services rendered to customers Expenses: cost of goods and services used in the process of obtaining revenues 2 Impact of Basic Accounting Principles on Income Measurement z Periodicity assumption z Going-concern assumption z Businesses need regular progress reports, so accountants prepare financial statements for specific periods and at regular intervals. • yearly - twelve-month accounting period is called a fiscal year • quarterly / monthly - reporting periods are called interim periods allows cost allocation over several periods Revenue Recognition and Matching Principle Recognize revenues when earned and let cost follow the revenues 3 Realization Principle z Revenues of a transaction are realized when each of the following conditions hold: 1. 2. z the company is expected to receive economic benefits from the transaction the benefits and the costs from the transaction can reliably be measured In the case of sales of goods: economic ownership of the object has been transferred to the customer • „economic ownership“ means that the customer has acquired all the property rights that have to be transferred according to the contract and has taken over all the respective risks Revenue realization usually is documented by sending an invoice to the customer when the customer remains silent after a due time, (s)he has accepted that (s)he is in charge of the return; that‘s when the revenue is realized Long-term contracts: percentage of completion method: realisation is assumed pro rata based on conditions 1. and 2. 4 Recognition of expenses z Production costs are attributed to revenue z Nonproduction costs are to be matched to an indefinite set of future revenues z they are matched with the revenue they were sacrificed for they are recognized in the period in which they occurred Modifying principle: Prudence (Conservatism) expected losses are anticipated; they are recognized in the period in which they come to be known example: a construction company has to deliver a project at a fixed price, but it turns out that the costs will exceed the price because of unexpected difficulties with the underground; then the uncovered part of cost is expensed as soon as possible: it is considered as a loss actually obtained when the contract was signed 5 Accrual basis versus cash basis z Instead of accrual basis accounting cash basis could be used z i.e. Revenues and Expenses are recognized when the corresponding cash flows occur Cash basis Accounting is less informative as a basis for assessing regular performance and may be outright misleading cash flows occur far from the basic economic processes e.g. • purchasing durable equipment • provisions of pension liabilities • provisions for closing down a nuclear power plant • revenues from long-term contracts 6 Trial Balance as the Starting Point of the Adjustment Process Trial Balance ZiscoSys Magdeburg Trial Balance September 30, 2003 Cash Accounts Receivable Equipment Supplies Prepaid Insurance Accounts Payable Unearned Revenue Owner's Investment Owner's Withdrawal Revenues Rent Expense Utility Expense 6.500 2.000 4.000 500 1.200 300 2.400 8.000 800 5000 500 200 15.700 15.700 7 The Adjustment Process z adjusting entries to apply accrual accounting to transactions that span more than one accounting period z adjusting entries required whenever financial statements are prepared z Deferral: postponement of the recognition of an expense already paid for or of a revenue already received z examples: prepaid expenses, unearned revenues Accrual: recognition of an expense or revenue that has arisen but has not yet caused an expenditure (or receipt, respectively) examples: accrued expenses, accrued revenues 8 Adjusting entries accomplish four things: z Deferrals Apportion recorded costs among two or more accounting periods • prepaid expenses – e.g. cost of machinery, prepaid rent Apportion recorded revenues among two or more accounting periods • unearned revenues – e.g. sale of a one-year contract for wireless phone service z Accruals Record unrecorded expenses • accrued expenses – e.g. interest payable on a loan Record unrecorded revenues • accrued revenues – e.g. fees earned but not yet billed to customers 9 How do we make the adjustment(s)? (1) (2) record the transaction in the journal Ö journalizing transfer the journal entry to the ledger account Ö posting ... we basically run through the accounting cycle again! ... that‘s why we need a „new“ trial balance, the adjusted trial balance! 10 Adjusting Entries for Deferrals z deferral – expiry-of-asset / liability adjustment required to record the portion of the prepayment (deferral) that represents the expense incurred or the revenue earned in the current accounting period decrease a balance sheet account increase an income statement account Prepaid expenses: adjusting entry Ö increase an expense account, decrease an asset account Unearned revenues: adjusting entry Ö increase a revenue account, decrease a liability account 11 Prepaid Expense z ... refers to expenses paid in cash and recorded as assets before they are used or consumed z initial account entry: debit an asset account prepaid expenses expire in two ways: with passage of time (e.g. prepaid rent and insurance) through use or consumption (e.g. equipment, supplies) z if used or expired Ö record the expenses that apply to the current period & prepare adjusting entry 12 Asset Account Unadjusted Balance Expense Account Adjusting Entry Credit Adjusting Entry Debit Amount equals cost of goods or services used up or expired Note: asset Æ expense relation 13 Adjustments for Supplies Used Up z supplies used – difference between balance in the supplies account and cost of supplies still in store ZiscoSys had bought supplies for € 500 at the beginning of September. At the end of September, supplies still on hand are counted and valued at historical cost. Amount: € 300. Hence, € 200 must be recorded as an expense. Journal entry Sept. 30 Supplies expense Supplies 200 200 14 z now we can transfer the journal entry toSupplies the ledger Supplies Expense Sept. 8 500 Sept. 30 Bal. 300 Sept. 30 Adj. 200 Sept. 30 Adj. 200 adjustment without adjusting entries: (1) September expenses will be underand net income overstated by € 200 (2) both assets and owner‘s equity will be overstated by € 200. 15 Adjustment for Insurance Expired z insurance expired – equal to the insurance premium times the length of the accounting period over the entire term of coverage ZiscoSys bought a one-year insurance policy. At the end of September € 100 have expired (€ 1.200 * 1 month / 12 months). Journal entry Sept. 30 Insurance expense Prepaid insurance 100 100 16 Prepaid Insurance Sept. 2 1.200 Sept. 30 Bal. 1.100 Sept. 30 Adj. Insurance Expense 100 Sept. 30 Adj. 100 adjustment z without adjusting entries: (1) September expenses will be under- and net income overstated by € 100 (2) both assets and owner‘s equity will be overstated by € 100 17 Adjustment for Depreciation z z depreciation – allocation of the cost of an asset to expense over its useful life in a rational and systematic manner amount of depreciation is an estimate and not a factual measurement ZiscoSys invested € 4.000 in office equipment which will provide service for four years, that means monthly depreciation will be appr. € 84. (€ 4.000 / 48 months = € 84 per month) Office Equipment Sept. 2 4.000 Accumulated Depreciation Office Equipment Sept. 30 Adj. Depreciation Expense 84 Sept. 30 Adj. 84 18 contra accounts z „accumulated depreciation – office equipment“ is a contra-asset account z Why not credit the asset account directly? z z a valuation account that is paired with and deducted from a related account in the financial statements Because ... ... depreciation is an estimate, and ... to preserve original cost of the asset separate „Accumulated depreciation“ accounts for each long-lived asset difference between cost of asset and accumulated depreciation is called carrying value or book value 19 Balance sheet presentation of accumulated depreciation Plant and Equipment Office Equipment Less Accumulated Depreciation Total Plant and Equipment z € 4.000 84 € 3.916 the entries show: original cost of € 4.000, cost that have expired to date (€ 84), and the balance left to be depreciated (€ 3.916) 20 Unearned Revenue z ... is an obligation arising from receiving cash before providing a service initial account entry: debit a liability account if a fraction of the service is rendered or goods are delivered, the adjusting entry recognizes this revenue Liability Account Adjusting Entry Debit Revenue Account Unadjusted Balance Adjusting Entry Credit Amount equals price of services performed or goods delivered Note: liability Æ revenue relation 21 z ZiscoSys received € 2.400 for maintenance work that should be performed over the course of a year. At month-end of September, € 200 were earned. Unearned Revenue Sept. 30 Adj. z 200 Service Revenue Sept. 4 2.400 Sept. 30 Bal. 2.200 Sept. 10 Sept. 30 Adj. 5.000 200 without adjusting entries: (1) September revenues and net income would be understated by € 200 in the income statement (2) liabilities would be over- and owner‘s equity will be understated by € 200 on the balance sheet. 22 Adjusting Entries for Accruals z accrual – passage of time adjustment z accrued revenues: z adjusting entry Ö increase an asset account, -increase a revenue account accrued expenses: z required to record revenues earned and expenses incurred in the current period that have not been recognized or recorded adjusting entry for accruals will increase both a balance sheet and an income statement account. adjusting entry Ö increase an expense account, increase a liability account Note: The following examples do not pertain to the ZiscoSys example and, thus, will not affect the adjusted trial balance. 23 Accrued Revenues z revenues for which services have been performed or goods delivered but are unrecorded so far may accumulate with passing of time (interest, rent etc.) or from services that are neither billed nor collected Asset Receivable Account Revenue Account Adjusting Entry Debit Adjusting Entry Credit Amount equals price of services performed 24 z let‘s assume a company has provided a service worth € 750 to a client that hasn‘t been billed to him/her. the following adjusting entry would be made at month-end Accounts Receivable 10/31 Adj. z 750 Service Revenue 10/31 31 31 Adj. 10/31 Bal. 5.000 400 750 6.150 without adjustment Æ assets, owner‘s equity, revenues and net income would all be understated 25 Accrued Expenses z expenses that have been incurred but not yet recorded in the accounts accrue from the same sources as accrued revenues Expense Account Liability Account Adjusting Entry Debit Adjusting Entry Credit Amount equals cost of expense incurred Cisco Sysems Inc. reported accrued compensation of $ 1.3 billion and other accrued liabilities of $ 1.5 billion on its 2000 balance sheet. Explain the meaning of the numbers. 26 z let‘s assume we have borrowed money for which € 100 interest accrues every month Interest Expense 10/31 Adj. z 100 Interest Payable 10/31 Adj. 100 without adjusting entries: (1) expenses and liabilities will be understated by € 100 (2) net income and owner‘s equity will be overstated by € 100 27 Summary of the adjusting entries Type of Adjustment Reason for Adjustment Accounts before Adjustment Adjusting Entry 1. Prepaid expenses Prepaid expenses originally recorded in asset accounts have been used Assets overstated Expenses understated Dr. Expenses Cr. Assets 2. Unearned revenues Unearned revenues initially recorded in liability accounts have been earned Liabilities overstated Revenues understated Dr. Liabilities Cr. Revenues 3. Accrued revenues Revenues have been earned but not yet received in cash or recorded Assets understated Revenues understated Dr. Assets Cr. Revenues 4. Accrued expenses Expenses have been incurred but not yet paid in cash or recorded Expenses understated Liabilities understated Dr. Expenses Cr. Liabilities 28 Summary of Adjusting Entries for ZiscoSys General Journal Date 2003 Account Titles and Explanation Adjusting Entries Sept. 30 30 30 30 Supplies Expense Supplies (to record supplies used) Insurance Expense Prepaid Insurance (to record insurance expired) Depreciation Expense Accumulated Depreciation - Office Equipment (to record monthly depreciation) Unearned Revenue Service Revenue (to record revenue for service provided) J2 Ref. Debit a c c o u n t Credit 200 200 100 100 n u m b e r s 84 84 200 200 29 z Adjusted Trial Balance The Adjusted Trial Balance ZiscoSys Magdeburg Adjusted Trial Balance September 30, 2003 Cash Accounts Receivable Equipment Supplies Prepaid Insurance Accumulated Depreciation - Office Equipement Accounts Payable Unearned Revenue Owner's Investment Owner's Withdrawal Revenues Supplies Expense Rent Expense Utility Expense Insurance Expense Depreciation Expense 6.500 2.000 4.000 300 1.100 84 300 2.200 8.000 800 5.200 200 500 200 100 84 15.784 Entries affected by adjustments are in bold numbers. The financial statements can be prepared directly from the adjusted trial balance. 15.784 30 Income Statement and Owner‘s Equity Statement ZiscoSys Magdeburg Income Statement For the Month Ended September 2003 Revenues Service Revenues 5.200 Expenses Rental Expense Utility Expense Supplies Expense Insurance Expense Depreciation Expense Total Expenses 500 200 200 100 84 1.084 € 4.116 Net Income ZiscoSys Magdeburg Statement of Owner's Equity For the Month Ended September 2003 ZiscoSys Capital, September 1, 2003 Add: Owner's Investment Net Income for the Month Subtotal Less: Withdrawal ZiscoSys Capital, September 30, 2003 Recall the „unadjusted“ numbers: 0 8.000 4.116 12.116 12.116 800 € 11.316 Net income: € 4.300 ZiscoSys Capital: €11.500 31 z The Balance Sheet ZiscoSys Magdeburg Balance Sheet September 30, 2003 Assets Cash Accounts Receivable Supplies Prepaid Insurance Equipment Less: Accumulated Depreciation Total Assets Liabilities 6.500 2.000 300 1.100 4.000 84 Accounts Payable Unearned Revenue 300 2.200 Owner's Equity ZiscoSys, Capital 11.316 3.916 € 13.816 Total Liabilities and Owner's Equity € 13.816 32 Alternative Treatment of Deferrals z Prepaid expenses, usual treatment: debit an asset account (initially) z alternative treatment: debit an expense account (initially) z Why? Because we expect to use up, say, the supplies completely before the next financial statement date. z Advantage: We do not need to make adjusting entries (provided that we in fact use up the supplies completely)! If, however, we do not completely use up the supplies, we make the following adjustments (numbers taken from our example): Supplies Sept. 30 Adj. 300 Supplies Expense Sept. 8 500 Sept. 30 Bal. 200 Sept. 30 Adj. 300 33 Alternative treatment of Unearned Revenues z Instead of crediting a liability account, we can alternatively credit a revenue account. Why? Because we expect to earn the revenue, e.g. perform the service, until the next financial statement date. Advantage: If we do earn the revenue until the next financial statement date, no adjusting entry is needed. z If, however, we do not fully earn the revenue until the next financial statement day, we make the following adjustment (numbers taken from our example): Unearned Revenue Sept. 30 Adj. Service Revenue 2.200 Sept. 30 Adj. 2.200 Sept. 4 Sept. 30 Bal. 2.400 200 34