Matching Concept & Adjusting Process in Accounting

advertisement

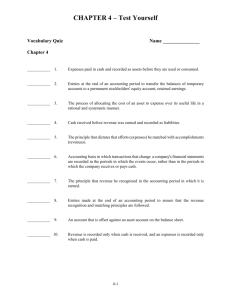

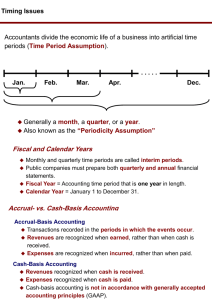

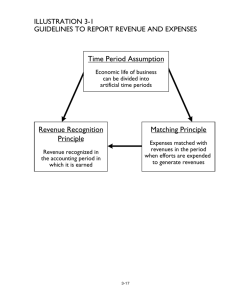

Chapter 3: The Matching Concept and the Adjusting Process I. Matching Concept • Reporting revenues and expenses incurred to create the revenue are reported in the same accounting period. Question • If rent for May is paid on June 1, in which month will be reported as rent expense? – May? – June? Answer: • It depends on whether the business is run in a “cash basis” or an “accrual basis” – Accrual basis: May – Cash basis: June • Accrual basis: revenues reported as earned; expenses reported when incurred, e.g., matching the expenses to the revenues recorded. • Cash basis: revenues reported when received; expenses reported when paid. Accrual Basis Business Applies for Loan and Required to Provide List of Monthly Expenses • • • • • • • Checkbook shows the following checks: $375: rent $110: utilities $200: car payment $480: ½ year of car insurance $120: 1 year of life insurance $20: paying for credit purchases last year How to Report? • • • • • • Rent: ? Utilities: ? Car Payment: ? Car insurance: ? Life insurance: ? Credit Card: ? Answer: • • • • • • • Rent: Same as check Utilities: Same as check Car Payment: Same as check Car insurance: 480/6 months = $80/month Life insurance: $120/12 = $10/month Credit Card: Same as check Note: If entire insurance payments are reported as monthly expenses, monthly expenses will be overstated. – Illustration of the “matching” concept. Similar problem: • What if the business had received $10,000 loan, with principal and interest of 12% to be paid 12 months after receipt of funds? • Issue? Issue: • Not all business expenses for the month are paid monthly. • The business must consider all expenses incurred for the month: – $10000(.12)= $1200/year = $120/month Similar problem: • What if the business made $100 in sales to customers but payment not received until 2 months later? • Must show $200 revenue earned for the period even though unpaid. • GAAP: Net Income: Revenues earned from sale of services during the period – expenses incurred in providing those services. – Match expenses against revenues they generate Accrual basis accounting requires adjusting entries • How much of the Accounts Receivables earned during the month? • How much of the Supplies were used during the month? Exercise: Net Income for Brick Layers Inc. for the month of June • $1200: Fees earned for a brick patio. • $400: Bricks purchased on account to be paid in July. • $20: 2 cement bags purchased and paid in June • $200: laborers’ pay at the end of the work. • $600/moth: Other monthly expenses paid for rent, utilities, insurance, etc. NET INCOME • Revenues: ? • Expenses: – Bricks:? – Cement: ? – Wages: ? – Other expenses: ? • Net Profit: ? NET INCOME • Revenues: ? • Expenses: – Bricks:? – Cement: ? – Wages: ? – Other expenses: ? • Net Profit: ? Net Income • Revenues: • Expenses: 1200 – Bricks: 400 – Cement: 20 – Wages: 200 – Other expenses: ¼ of $600: $150 – Total Expenses 770 • Net Profit: 430 II. Adjusting Entries • Why? – Accrual basis requires that we update accounting records so that all revenues earned and all expenses incurred are properly recorded. Types of adjusting entries: • Deferral = cash transfers hands in current period in payment for performance in future periods. – Deferred cash today for future performance • Accruals = Performance in current period and cash transfers hands in future periods. – Accrue performance today for future cash Deferrals: • Deferred Expense: – When you pay for an item in advance (before it is actually used), e.g., a prepaid expense. – 1st recorded as an asset. – As the asset is used, adjusting entries reflect a transfer from the asset to an expense: • Supplies • Prepaid insurance Supplies: Recorded as an asset when purchased. • As supplies are used each month, an adjusting entry is required to transfer the cost of supplies from an asset account to an expense account. Example • On December 5, the business purchased $250 in supplies. On 12/31 the ending inventory in supplies was $50. • Original entry – Supplies…………………………250 – Cash…………………………..250 • Adjusting entry – Supplies expense…………….. 200 – Supplies…………………...….200 Prepaid insurance: Recorded as an asset when purchased. • As the policy expires, each month the asset is being used up. • So an adjusting entry is required to transfer the cost of insurance from an asset account to an expense account Example • On December 1, the business purchased a 6-month insurance policy. On December 31, how do you record insurance? • Original entry – Prepaid insurance………. 600 – Cash…………………….. 600 • Adjusting entry – Insurance Expense……….. 100 – Prepaid Insurance………100 Deferred revenue: • Occurs when you get paid before you earn it, e.g., unearned revenues. – Cash has been received for goods but as goods have not been delivered, the cash has not being earned. • Records receipt of cash against a liability that reflects unearned revenues, e.g., a promise to deliver goods or services in the future. • After delivery, revenues are earned, so a corresponding portion of the liability is transferred to revenue, e.g., revenue is recognized. Example • On 11/2 the business received 3 months rent in advance or $2400. What is the entry at EOY? • Original entry – Cash …………………... 2400 – Unearned rent ……………..2400 • Adjusting entry • Unearned rent……………1600 • Rent income 1600 • Note: “unearned” = liability in Balance Sheet; “earned” = revenue in Income Statement Accruals • Accrued expense: expenses incurred before payment. – Assume electricity is paid on the 15th of the following month: A daily utility expense is incurred but not paid. Others: Accrued wages, accrued interest. • Accrued revenues: revenues are earned but not recorded. A business is not paid for services rendered during the month until the 10th of the following month. Other: accrued interest on notes receivable. Example • On Wednesday 12/31, the business owes $500 in wages. Payroll is Friday. • Original entry: None • Adjusting entry: • Wages Expense….............…500 • Wages Payable……………….500 Example • At EOY the business is owed $80 in interest. • Original entry: None • Adjusting entry: – Interest receivable ……………80 – Interest Income…………………..80 Depreciation • Applicable only to assets with a long life, e.g., fixed assets • While use of supplies is reflected by the quantity used, e.g., total supplies decreases as used, one building continues to be one building. However, as the equipment gets older, performance decreases. • The decrease in performance or usefulness is known as “depreciation”. • Decrease for the period is a function of “useful life”. – Useful life is an artificially created # of years the asset is expected to be useful. Recording Depreciation • Depreciation expense reflects the periodic decrease in the building usefulness for the period being reported. – Debit Depreciation Expense – Credit Accumulated Depreciation • Contra asset account – Asset increases are denoted with debits – Contra asset increases are denoted with credits – Do not credit the original asset. Prices are reflected at their original cost. An analogy • You need 4 tires. One set costs $200 with a life estimate of 20,000 miles. The other set costs $300 with a life estimate of 40,000 miles. If you drive 10,000 miles/year and are keeping the car for at least 4 years, which is the best buy? Estimating Cost • $200 set is estimated to last 20,000 miles or 2 years. Thus, cost = $100/year • $300 set is estimated to last 40,000 miles or 4 years. Thus cost = $75/year. • Upon purchase of $300 set, it is recorded as an asset. Every year, $75 is transferred to an expense account. • Original entry – Tires……………………………….300 – Cash………………………………..……300 • Adjusting entry at EOY: – Depreciation expense…………..…75 – Accumulated Depreciation…………….75 Exercise: • An accrual business buys a building in an area where real estate is increasing at 6%/year. You record depreciation. • Why record depreciation when values are going up? Answer • Depreciation is not related to the value of the asset. • Depreciation is an estimate of the asset’s usefulness that has expired during the period. • The original cost and the accumulated depreciation are reported in the Balance Sheet. Two separate accounts. Exercise: Prepare journal entries from trial balances • Unadjusted/Adjusted: – Supplies 200/140 – Prepaid insurance 400/210 – Wages Payable 0/130 – Unearned revenue 100/30 – Fees earned: 7200/7330 – Supplies expense 0/60 – Insurance expense 0/190 Answer • Supplies expense…………60 • Supplies………………………60 – Expl: Supplies at BOY=200; EOY=140 • Insurance expense……….190 • Prepaid insurance…………….190 – Expl: Prepaid insurance BOY:400; EOY 210 • Wages Expense……………….130 • Wages Payable………………130 – Expl: $130 wages accrued but not paid at EOY • Unearned Revenue……………70 • Fees earned ……………………..70 – Expln: Unearned fees at EOY