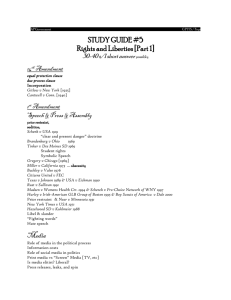

Granholm v. Heald: Wine In, Wit Out

advertisement