1H2015 - Banif

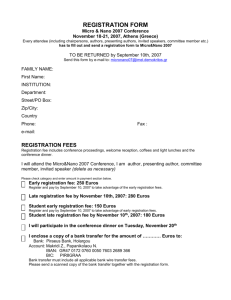

advertisement

Reuters: BANIF.LS Bloomberg: BANIF PL ISIN: PTBAF0AM0002 www.banif.pt/investidores 2015 1H2015 CONSOLIDATED RESULTS Lisbon, 7 August 2015 Unaudited information CONSOLIDATED RESULTS: January to June 2015 Highlights: Positive growth Significant improvement in business performance has in net profits... resulted in a net consolidated profit. Net profits for the first half of 2015 came to 16.1 million euros. This compares extremely favourably with the loss of 97.7 million euros recorded for the same period of the previous year. Significant Improvement in net interest income, which rose 25.1% recovery in net year-on-year in the first half of 2015, to stand at 55.9 million interest income euros. This was largely the result of lower funding costs, and commissions particularly as regards deposits. Compared to the previous quarter, net interest income went up by 24.5% to 31.0 million euros. Improvement in net commissions, which increased by 22.0% year-on-year over the first half of 2015, to 34.9 million euros. This performance reflects a business approach focused on the core segments, the ongoing implementation of greater commercial assertiveness and is also the result of the amortization of Government guaranteed bonds. Structural Reduction in operating costs, which fell by 24.5% streamlining with compared to the first half of 2014. This reduction was a positive impact achieved across the range of structural costs. Staff costs in terms of cost came down by 22.3%, general and administrative costs by savings 27.3% and amortisations also fell by 29.0%. Lower level of Reduction in impairments of 62.6%, year-on-year, to impairment over 54.0 million euros. Despite this improvement, impairments the semester were affected by the provisions for real estate assets classified as Non-Current Assets Held for Sale. 2 Consolidated Results - 1H2015 Net profits of Consolidated 16.1 million compares favourably with the loss of 97.7 million euros euros recorded for improvement net the profits first in net half of of 16.1 million 2014 interest and euros that reflects the and net income commissions, the significant reduction in structural costs and in impairments and provisions, as well as the positive performance of the discontinued operational units (that includes the capital gain of 49.1 million euros on the sale of the holding in Banif Mais SGPS, S.A.). However, it should be noted that, despite this positive growth, net profits were adversely affected, in year-on-year terms, by the significant fall in capital gains made on the disposal of Portuguese public debt securities (90.7 million euros in the first half of 2014, compared to 44.7 million euros in the first half of 2015), and was also penalized by the higher capital losses on the sale of real estate assets, and the higher provisions for real estate assets (-17.8 million euros in the first half of 2014, compared to -45.9 million euros in the first half of 2015). Furthermore, net profits in the 1H2014 had been positively influenced by the 38 million euros in capital gains made on the disposal of the write-offs portfolio. Liquidity at Stable commercial gap, compared to December 2014, with comfortable levels the loans-to-deposits ratio standing at 105.8% (as opposed to 105.5% as at December 2014 and 106.7% for the first quarter of 2015). ECB funding rose by some 175.6 million euros between December 2014 and June 2015. However, since December 2014 until today the exposure to ECB decreased by around 410 million to 1,259 million euros. Capital ratio above As at 30 June 2015, the Common Equity Tier 1 ratio, regulatory calculated in accordance with the CRD IV/CRR rules (phasing requirements in) stood at 8,4% and the total solvency ratio at 9,4%, above the minimum levels required by the regulatory authorities. 3 Consolidated Results - 1H2015 Key Indicators Jun-15 Jun-14 D 116.8 189.1 -38.2% -81.2 -107.5 -24.5% -29.1 -120.2 -75.8% -1.4 -17.1 - -24.6 -8.0 - 36.4 -27.0 - 16.1 -97.7 116.5% Jun-15 Dec-14 D 105.8% 105.5% 0.3pp 8.4% 8.4% - Results Operating revenues Operating costs Loans impairment net of reversals and recovery Impairment of other financial assets net of reversals and recovery Impairment of other assets net of reversals and recovery Income from discontinued operations Net income Liquidity Loans-to-deposits ratio Capital Common Equity Tier 1 ratio CRD IV/CRR (phasing in) Amounts in millions of euros. 4 Consolidated Results - 1H2015 Highlights - 1H2015 Net profit of 16.1 million euros, compared to the 97.7 million euro loss of 1H2014. Results Operating income: 116.8 million euros, -38.2%, year-onyear(yoy); Net Interest Income: 55.9 million euros, +25.1% yoy; Net Commissions: 34.9 million euros, +22.0% yoy; Gains on Financial Operations: 44.5 million euros, 45.5%, year-on-year(yoy); Other operating income: -18.9 million euros, which compares favourably to the 33.4 million euros of the 1st half of 2014. Operating costs: 81.2 million euros, -24.5%, (yoy); Net provisions and impairments: 54.0 million euros, 62.6% yoy. Loan book (net): 6.6 thousand million euros. Balance Sheet Total customer resources on the balance sheet: 6.5 thousand million euros. Loan-to-deposit ratio: 105.8%. Liquidity Common Equity Tier 1 ratio As at 30 June 2015 the Capital Common Equity Tier 1 ratio, calculated in accordance with the CRD IV/CRR rules (phasing in), and the total solvency ratio stood at 8.4% and 9.4%, respectively. 5 Consolidated Results - 1H2015 Balance Sheet (millions of euros) Jun-15 Cash and balances at central banks Dec-14 120.1 113.8 Deposits with banks 76.9 102.9 Financial assets held for trading 35.9 65.1 Financial assets at fair value through profit or loss 49.4 48.8 1,968.0 1,960.8 248.6 250.8 6,637.3 6,855.0 5.6 5.5 Available-for-sale financial assets Loans and advances to banks Loans and advances to customers Held-to-maturity investment securities Financial assets with repurchase agreements 36.1 26.9 1,502.6 2,154.7 Investment property 712.5 736.5 Other tangible assets 184.7 207.3 Non-current assets held for sale Intangible assets 12.0 13.4 Investments in associates, affiliates and joint ventures 55.5 146.3 Current tax assets 0.8 1.6 Deferred tax assets 287.2 266.2 Other assets 176.9 169.9 Total Assets 12,110.1 13,125.5 1,669.3 1,493.7 34.4 30.4 Deposits from central banks Financial liabilities helding for trading Financial liabilities at fair value through profit or loss 12.8 12.8 359.8 882.5 Customer accounts and other loans 6,270.7 6,499.3 Financial liabilities 1,467.7 1,645.6 892.2 1,130.0 9.7 10.9 Deposits from banks Non-current liabilities held for sale Provisions Current tax liabilities 19.5 3.9 Deferred tax liabilities 50.0 66.2 Instruments representing capital 130.3 130.2 Other subordinated liabilities 268.8 181.6 Other liabilities 228.5 234.9 11,413.7 12,322.0 1,720.7 1,720.7 Issue premiums 199.8 199.8 Revaluation reserves -11.1 61.4 -1,245.9 -952.2 16.1 -295.4 Total Liabilities Share capital Other reserves and retained earnings Profit for the period Minority interests Total Equity Total Equity + Liabilities 16.8 69.2 696.4 803.5 12,110.1 13,125.5 6 Consolidated Results - 1H2015 Profit and Loss Account (millions of euros) Jun/15 Jun/14 Restated D 15/14 (*) Interest and similar income 147.8 197.0 -25.0% Interest and similar expense -91.9 -152.3 -39.7% 55.9 44.7 25.1% 0.4 0.8 -50.0% 34.9 28.6 22.0% Net interest income Dividend income Net fees and commissions Gains and losses in financial operations 44.5 81.6 -45.5% -18.9 33.4 - 116.8 189.1 -38.2% Personnel costs -49.6 -63.8 -22.3% Selling and General Administrative costs -24.5 -33.7 -27.3% -7.1 -10.0 -29.0% 35.6 81.6 -56.4% 1.1 0.8 37.5% -29.1 -120.2 -75.8% -1.4 -17.1 -91.8% -24.6 -8.0 - 1.9 -5.9 - -16.5 -68.8 76.0% Other operating income Operating revenue Depreciation and amortisation Operating Income Provisions net of reinstatement and write-offs Loans impairment net of reversals and recovery Impairment of other financial assets net of reversals and recovery Impairment on other assets net of reversals Equity accounted earnings Profits before tax Taxes Profits after tax Income from discontinued operations (*) Minority interests Net income for the period -3.0 -0.7 - -19.5 -69.5 71.9% 36.4 -27.0 - -0.8 -1.2 33.3% 16.1 -97.7 116.5% (*) Group entities Banif - Banco Internacional do Funchal (Brasil), SA, Banif Bank (Malta), PLC, Banco Caboverdiano de Negócios (BCN) and Banif Mais SGPS are classified as discontinued operational units in the consolidated profit and loss accounts, as at 30 June 2015 and 2014. In June 30, 2015 Açoreana Seguros was classified in this category. 7 Consolidated Results - 1H2015 Business Summary Results In the first half of 2015, Banif made a net profit of 16.1 million euros. This reflects the measures being implemented under the bank's restructuring programme, which is designed to completely reshape the business plan and ensure the bank's viability in a highly challenging economic and regulatory environment. Over this period, banking income came to 116.8 million euros. This income was affected by a number of factors, including: The 25.1% rise in net interest income, to 55.9 million euros. Despite the positive effect of the policy of reducing deposit cost (currently at 1%), which has improved significantly over recent quarters, due to changes made to the fundraising policy. However, net interest income was negatively affected by the following: (i) the effect of the fall in loan volumes, a consequence of the deleveraging of the non-financial sectors of the economy and the lowering of spreads on loans; (ii) reference interest rates that have remained historically low; and (iii) the cost of the interest on the CoCos, which totalled 6.1 million euros in the first half of 2015. An increase of 22.0% in commissions (net), to 34.9 million euros. This positive performance reflects a business approach focused on core segments, the ongoing implementation of the operational efficiency drive and is also the result of the amortization of Government guaranteed bonds. There was a 45.5% fall in profits from financial operations, which came to 44.5 million euros. This compares with 81.6 million euros in the first half of 2014. The decrease is largely explained by the lower capital gains made on the sale of fixed yield Portuguese public debt securities (44.7 million euros in the first half of 2015, compared to 90.7 million euros over the same period of 2014). Other operating losses,which came to 18.9 million euros, compared to profits of 33.4 million euros in 1H2014. The losses recorded for the first half of 2015 are largely the result of the capital losses sustained on the disposal of real estate assets. The profits made in the same period of the previous year were mostly explained by the capital gains made on the disposal of the write-offs portfolio. 8 Consolidated Results - 1H2015 Banking Income: Structure 17.7% 38.1% 43.2% 29.9% 0.3% 15.1% 0.4% 47.9% 23.6% -16.2% Jun-14 (*) Jun-15 Net interest margin Dividend income Net fees and comissions Gains and losses in financial operations Other operating income (millions of euros) (*) Restated Structural costs totalled 81.2 million euros for the first half of 2015. This is 24.5% lower than in the same period of the previous year and can be attributed to the benefits accruing from the restructuring process, particularly as regards the accelerated schedule for branch closures and the staff reorganisation programme. This reduction was achieved across the full range of structural costs. Staff costs came down by 22.3%, general and administrative costs by 27.3%. Over the period, amortisations also fell by 29.0%. Staff costs stood at 49.6 million euros for 1H2015 (that is, 22.3% lower than in 1H2014). Excluding the impact of non-recurring costs arising from the voluntary redundancy programme, staff costs fell by 15.1% year-on-year. General administrative costs totalled 24.5 million euros for the first half of 2015, a year-on-year fall of 27.3%. Excluding the costs associated with the recapitalisation process, general administrative costs fall by 26.4%, year-on-year. This decrease can be attributed to the gains in efficiency resulting from the rationalisation and optimisation strategy being applied to operating procedures and also to the renegotiation of contracts, the resizing of the distribution network and the reduction in staffing levels. Amortisations for the period totalled 7.1 million euros at the end of the first half of the year, 29.0% less than in the previous year. This partly reflects the downsizing of the bank’s structure and the rationalisation of our investment policy to provide a better fit to the reshaped business model. 9 Consolidated Results - 1H2015 Net provisions and impairments for the first half of 2015 came to 54.0 million euros, against the 144.5 million euros recorded for the same period in 2014, a year-on-year fall of 62.6%. This figure reflects the extra provisions made for real estate assets classified as held for sale, in the amount of 13.3 million euros (impairment of other assets). The figures for loans impairment were much better in this half, compared to the same period of 2014, falling by 91.1 million euros (or -75.8% yoy). This significant YoY reduction is largely due to the extraordinary impairment related with GES exposure booked in the 1H2014. Profits from the discontinued operating units totalled 36.4 million euros as at the end of the first half of 2015. This figure includes the capital gain, of 49.1 million euros, made on the sale of the holding in Banif Mais SGPS, S.A. In the first half of 2014, this item stood at -27 million euros. The group still has the following discontinued operational units: Banco Banif Brasil, Banif Bank (Malta), Banco Caboverdiano de Negócios and Banif Mais SGPS, S.A. (which was sold in 2Q2015). On 30 June, Açoreana Seguros was classified to this category. Net profits for the first half of 2015 came to 16.1 million euros. These compare favourably with the loss of 97.7 million euros recorded for the first half of 2014 and reflect the improvement in net interest income and net commissions, the significant reduction in structural costs and in impairments and provisions as well as the positive performance of the discontinued operational units. However, it should be noted that, despite this positive growth, net profits were adversely affected, in year-on-year terms, by the significant fall in capital gains made on the disposal of Portuguese public debt securities (90.7 million euros in the first half of 2014, compared to 44.7 million euros in the first half of 2015), the increased capital losses on the sale of real estate assets and the higher provisions for real estate assets (-17.8 million euros in the first half of 2014, compared to -45.9 million euros in the first half of 2015). Net profits in the first half of 2014 had been positively influenced by the 38 million euros in capital gains made on the disposal of the write-offs portfolio. 10 Consolidated Results - 1H2015 Balance Sheet Net assets stood at 12,110.1 million euros, as at 30 June 2015, 7.7% lower than at the end of 1H2014. Gross lending to clients came to 7,658 million euros, as at 30 June 2015, down around 3.1% compared to 31 December 2014. This fall reflects not only the lower demand for loans in a Portuguese economy that is deleveraging but also the bank's lower exposure to non-strategic sectors. It is also the result of an increasingly closer scrutiny of client credit risk, with priority being given to loans to lower risk operations, as a way of improving the quality of the balance sheet assets. Nevertheless, it is important to note, in the context of Banif's support for Portuguese businesses, that the bank is developing a repositioning strategy that will allow it to focus more closely on the corporate sector (Micro and SME). Moreover, during the first half of the year Banif focused on strengthening: i) its positioning in the foreign trade and non-resident businesses, so that it can play an increasingly important role in the internationalisation of Portuguese companies, particularly those in the small and medium enterprise categories, the main drivers of development in the Portuguese economy, and ii) its relationship with Portuguese communities abroad, by taking advantage of its foreign network, particularly the offices / incorporated companies in the USA, Canada, Venezuela and South Africa. 11 Consolidated Results - 1H2015 Gross Lending to Customers (million euros) Jun-15 Dec-14 Corporate 3,154 3,292 -4.2% Individuals 3,345 3,635 -8.0% Mortgage Loans 2,642 2,740 -3.6% Consumer Loans 163 338 -51.8% Other Loans 540 557 -3.1% D Others 1,159 979 18.4% Total 7,658 7,906 -3.1% 679 1,444 -53.0% 8,337 9,350 -10.8% Discontinued units (*) The Others item includes loans more than 30 days overdue Deposits in the first half of 2015 totalled 6,271 million euros, a decrease of 3.5% compared to December 2014. This can be attributed to the accelerated branch closure programme (41 branch closures in the first semester). Banif has continued to follow a funding cost reduction strategy that has focused the offer on standardised savings products, rather than on term deposits with negotiated rates. During this period, and in line with the current strategic plan, the bank is continuing to implement a differentiated support strategy for high value private clients in the private and affluent segments and continue its commercial support for mass market customers, particularly in the autonomous regions. This includes a tight focus on customers in the emigration segment. “Off-balance sheet” resources totalled 1,748 million euros, as at 30 June 2015. 12 Consolidated Results - 1H2015 Total Customer Resources (millions of euros) Total on-balance sheet customer resources Jun-15 Dec-14 6,492 6,866 -5.4% 6,271 6,499 -3.5% 221 367 -39.8% 1,748 1,718 1.7% 8,240 8,584 -4.0% 642 692 -7.2% 8,882 9,276 -4.2% Deposits Other liabilities Total off-balance sheet customer resources Total Discontinued units Total D Loan-to-Deposit Ratio 118.8% 2T14 113.9% 3T14 105.5% 106.7% 105.8% 4T14 1T15 2T15 Excluding discontinued operational units. As at 30 June 2015, the loan-to-deposit ratio (net credit/deposits) stood at 105.8%. Equity, before minority interests, fell by 7.4%, compared to December 2014, to stand at 679.6 million euros at the end of June 2015. This fall is largely attributable to the fall, of 72.5 million euros, in revaluation reserves (broadly attributable to the devaluation of Portuguese public debt securities) and the net profit for the period of 16.1 million euros. Liquidity Management The Banif Group’s funding plan for 2015 is based on diversifying its sources of funding, building longer average maturities for its liabilities and reducing the group’s funding costs, namely the deposit cost currently stands at 1%. 13 Consolidated Results - 1H2015 A number of transactions took place in the first half of 2015, namely: an issue of subordinated Tier 2 bonds, in the amount of 80 million euros and with a maturity of 10 years, fully placed with the bank’s own clients in January. a senior debt issue, with a maturity of 3 years and paying a fixed rate of 2.5%, in the amount of 30 million dollars, placed with clients in February. the placement, in March, of 336 million euros in securities (demand for which came to 467 million euros) in relation to a securitisation operation called Atlantes Mortgage 3, comprising mortgage loans made by Banif in Portugal. This issue has a maturity of approximately 8 years and was placed at a cost of Euribor 3M + 1.20%. The bank also repaid two treasury bond issues that matured on 31 May, in a total amount of 57 million euros. The disposal of Banif Mais SGPS, S.A., on 4 June, had a positive impact on liquidity of 540 million euros. Since December 2014 until today the exposure to ECB decreased by around 410 million to 1,259 million euros. In June 2015, the value of the free assets in the ECB pool stood at 539 million euros. 30 June 2014 Total resources: 31 December 2014 6% 9% 9% 6% 5% 50% Recursos de clientes Bancos centrais 15% 8% 15% 52% Dívida própria 11% Recursos de unidades descontinuadas 14% Capitais próprios Outros recursos 14 Consolidated Results - 1H2015 Solvency As at 30 June 2015, the Common Equity Tier 1 ratio, calculated in accordance with the CRD IV/CRR rules (phasing in) stood at 8,4% and the total solvency ratio at 9,4%, above the minimum levels required by the regulatory authorities. 15 Consolidated Results - 1H2015 Commercial network and Staffing There were 41 fewer bank branches in Portugal in June 2015 than there were in December 2014. As regards staffing numbers, 2,267 people were employed by the group, as at June 2015. This compares with a staff complement of 2,733 as at December 2014, a reduction of 17.1% (or -24% less than at the end of 1H2014, when the group had 2,980 employees). Banif S.A. (domestic business), ended the first half of 2015 with 1,802 employees which compares to 1,935 employees it had in December 2014 and 2,147 it had at the end of the 1H2014. This translates into a fall of 7% and 16.1%, respectively. 16 Consolidated Results - 1H2015 Key Events in 2015 12 January 2015: Public offering of subscription and listing for trading of up to 80 million euros in subordinated bonds, under the basic prospectus for public offerings for the distribution and/or listing for trading of debt securities. 30 January 2015: Announcement regarding the full early repayment of the issue of 45 million euros of Senior Fixed Yield EUR 2014/2017 Bonds and the issue of 44.4 million dollars in Senior Fixed Yield USD 2014/2017 Bonds. 3 February 2015: Public offering of subscription of up to 30,000 senior bonds, worth up to a total of 30,000,000 USD, under the basic prospectus for public offerings for the distribution and/or listing for trading of debt securities. 5 March 2015: Placement on the international market of an issue of 336 million euros in securities (demand for which came to 467 million euros) in relation to a securitisation operation called Atlantes Mortgage 3, comprising mortgage loans made by Banif in Portugal. The issue, with a maturity of approximately 8 years, was placed at a cost of Euribor 3M + 1.2%. Ratings of “A”, “A+” and “AA” were attributed to the issue, by Standard & Poor’s, Fitch and DBRS, respectively. 7 May 2015: Publication of the call to the general shareholders meeting, to be held on 29 May 2015. 25 May 2015: Announcement regarding the full early repayment of the issue of 50,000 Senior Fixed Yield USD 2013/2016 Bonds. 4 June 2015: Announcement regarding the completion of the sale of the Banif – Banco Internacional do Funchal, S.A. holding in Banif Mais SGPS, S.A. 6 July 2015: Placement on the international market of an issue of 440 million euros in securities (for which demand came to 543 million euros), issued by Banif’s subsidiary Gamma – Sociedade de Titularização de Créditos, S.A. This issue related to a securitisation operation called Atlantes SME 5, comprising mortgage loans made by Banif in Portugal. The issue was placed at a cost of Euribor 3M + 1.2% and was attributed an “A-” rating by Standard & Poor’s and an “A3” rating by Moody’s. 17 Consolidated Results - 1H2015 24 July 2015: The European Commission announced the opening of an in-depth investigation into the compatibility between the support provided by the state to Banif and European rules on state support. 4 August 2015: Publication of the call to the continuation of the general shareholders meeting of 29 May 2015, to be held on 29 August 2015. The Board of Directors Banif – Banco Internacional do Funchal, SA Limited Liability Company Registered Office: Rua de João Tavira, 30 – 9004-509 Funchal Share Capital: 1,720,700,000 euros Single Registration and Corporate Taxpayer Number 511 202 008 18 Consolidated Results - 1H2015