Syllabus Corporate Finance - CATÓLICA

advertisement

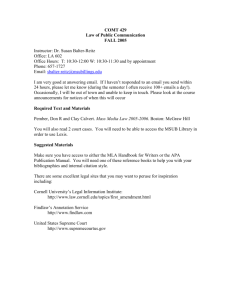

International MSc in Business Administration Corporate Finance Fall 2013 Guilherme Almeida e Brito, Mário Meira Syllabus Instructors: Guilherme Almeida e Brito holds a Ph.D. in Finance from New York University, a MBA from NYU and a Licenciatura in Business Administration from FCEE-Católica. He is Senior Associate Dean at Católica-Lisbon and the MSc Academic Director. He was the MBA Academic Director 1999-2008. His main areas of academic activity include capital budgeting, financing decisions and security design. He has presented his research at several international Finance conferences. He is a consultant for the Center of Applied Studies and he has developed some entrepreneurial activities. Mário Meira holds a M.Sc in Economics from Católica-Lisbon Shcool of Business and Economics and a Undergraduate degree in Economics from Católica-Porto School of Business and Economics. He is currently enrolled in the Ph.D. program in Economics in Nova School of Business and Economics. In his previous professional experience he has worked as a consultant for institutions like the Portuguese Banking Association and Maksen. Contacts: gbrito@ucp.pt, mhm@clsbe.lisboa.ucp.pt COURSE AIMS The main goal of the Finanças Empresariais course is to engage you in a journey to discover the main financial concepts and methods. We adopt the perspective of a financial manager of a non-financial firm. This course contributes to understand financial markets, financial investments and corporate finance decisions. LEARNING OBJECTIVES At the end of the course you should be able to: Value investment projects. Understand basic valuation of bonds, stocks and options. Understand the relationship between risk and return. Understand the relationship between capital structure and the cost of capital. TEACHING AND LEARNING METHODS This is a demanding quantitative course. You are expected to acquire a clear understanding of financial concepts and great familiarity with financial techniques. The course requires careful reading of the textbook and extensive time for exercises. Please do so every week and your experience will be greatly enhanced. ASSESSMENT Mini-test: 10%, Midterm Exam: 40%, Final Exam: 45%, Written Assignments + Class Participation: 5% COURSE CONTENT Week Subject Mandatory reading 1, 2 Present Values. BMM chap. 1, 2, 5; BMA, chap. 1, 2 2, 3 Asset Valuation: Bonds. BMM chap. 6; BMA, chap. 3 4, 5 Asset Valuation: Stocks. BMM chap. 7; BMA, chap. 4 6, 7 Project Valuation. BMM chap. 8, 9, 10; BMA, chap. 5, 6 8 Risk and Return. Portfolio Theory. BMM chap. 11, 12; BMA, chap. 7, 8 9 Risk and Return. CAPM. BMM chap. 111, 12; BMA, chap. 7, 8, 9 10 Cost of Capital: Financial Leverage, MM. BMM chap. 16; BMA, chap. 9, 10, 17 11 Cost of Capital: WACC. BMM chap. 13; BMA, chap. 19 12 Asset Valuation: Derivatives. BMM chap. 23; BMA, chap. 20, 21 BIBLIOGRAPHY Required textbook: Brealey, Myers & Allen (BMA), “Principles of Corporate Finance”, 10th edition, McGraw-Hill (previous editions are also acceptable). You may use instead an alternative textbook:, Ross, Westerfield, Jaffe & Jordan, “Modern Financial Management”, or Ross, Westerfield and Jaffe, “Corporate Finance”. Students with weaker analytical skills may prefer to use instead a more introductory textbook: Brealey, Myers & Marcus (BMM), “Fundamentals of Corporate Finance”, 7th edition, McGraw-Hill, 2012 (previous editions are also acceptable).